Option Volume and Open Interest

Option Volume is the total actual number of contracts traded on the day. A high level of options trading often indicates excessive speculative activity.

Open Interest is the total number of outstanding contracts that are held by the market participants at the end of the day. Open interest is the number of outstanding contracts held by the longs or the shots, not the total of both, because we're dealing with trading contracts, and for every long there must be a short.

Open interest is one of many measures that are used in the formation of Contrarian Opinion. In general, the higher the open interest figures are, the better chance that the contrarian positions will prove profitable. A contrarian position should not be taken, however, while open interest is still increasing. A continued rise in open interest numbers increases the odds that the present trends will continue. Wait for the open interest numbers to begin to flatten out or to decline before taking action.

Open interest shown on the site refers to all open positions on a contract. The greater the value, the greater liquidity and trading activity associated with option contract.

The charts with open interest and option volume can be found in Services & Tools->Advanced Historical Data-> Implied Volatility Index.

Example

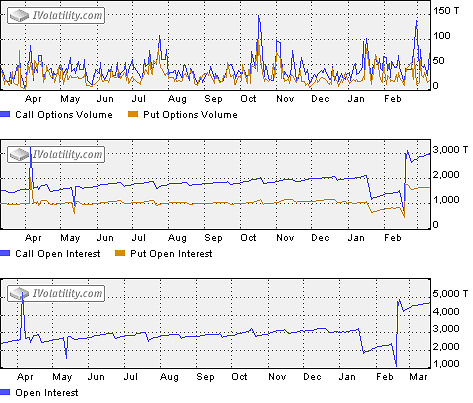

The following charts show call and put open interests and option volumes for MSFT. As you can see on the charts, on the whole, call activity exceeds put activity. It means that the market participants expect prices to rise.

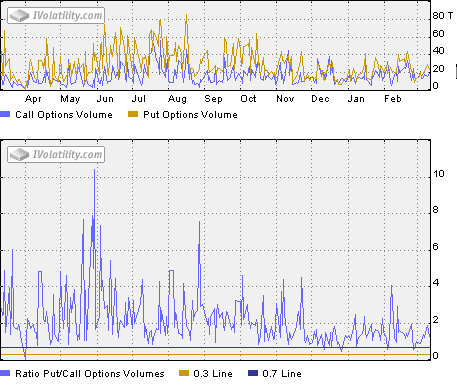

The following charts show call and put options volumes and put-to-call ratio for DJX. As you can see, historically, put option volume essentially exceeds call option volume over last year. It means that market is bearish or pessimistic and expects price to move lower. Thus, put-to-call ration is very high, because investors buy put options for downside protection.