Last Week’s Highlights at IVolLive:

- Register HERE for our next live webinar on Tuesday, November 14th where we will cover how to use the Options Pricing and Probability Calculators within IVolLive.

- Get a free IVolLive Trial HERE.

Retracement...

November 10, 2023

Retracement. This happens when an asset climbs higher, only to fall back again to its starting point.

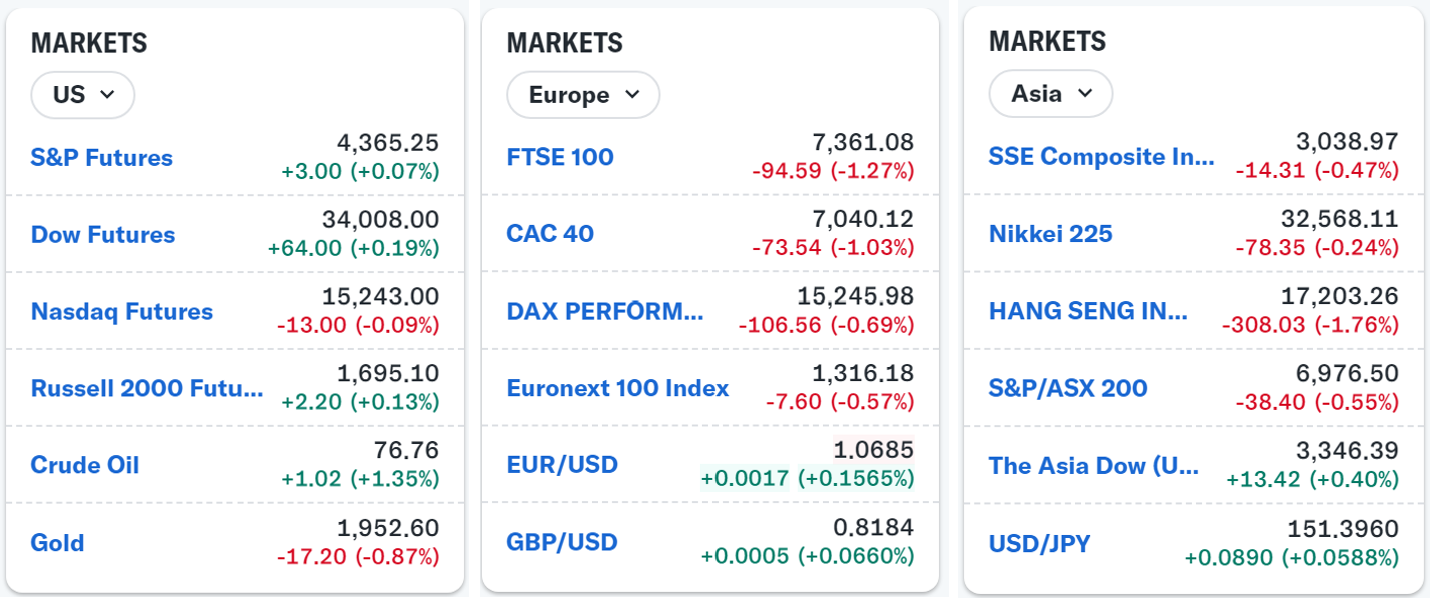

And that's exactly what we have with the S&P 500. Check out this one-month chart:

As you can see, price (in blue), dropped throughout October, rose at the beginning of this month, and has since fallen back down. The result? We're essentially back where we started.

Now, this isn't necessarily a bad thing...

As you can see, as price moved higher, Implied Volatility (in green) moved lower. This means option prices (in general) have also moved lower. This also means it's cheaper to enter an options position.

(Check out how to design option spread trades in our recent Real Time Spread Scanner demo HERE.)

How to Play It

If you would prefer to strike on individual names rather than the S&P 500, you could look at individual companies that have fallen hard in the recent earnings season:

• Spirits giant Diageo PLC fell as much as 16% after earnings

• Digital advertising leader Trade Desk Inc. dropped 27% after issuing weak sales guidance

• Groupon plummeted 37% after announcing earnings and a new equity offering

(Finally, we evaluated Apple using five different bullish spread strategies. You can review that demo HERE.)

Previous issues are located under the News tab on our website.