Chop and Indecision

December 8, 2025

Market Roundup for the Week

Wednesday's are called "hump day" for a reason, and for basically the whole week, stocks struggled to get over recent hurdles.

The problem? The market appears trapped in a tug-of-war between AI bubble fears and hopes of a Fed rate cut next week. A classic case of mixed messages came from the payroll processor ADP that private employers cut 32,000 jobs in November, more than economists anticipated. That ups the odds that the Federal Reserve will slash interest rates at its next meeting on December 9 and 10, giving stocks a boost.

On the other hand, worries rippled through Wall Street after a report surfaced that Microsoft lowered sales growth targets for certain artificial intelligence products. Although Microsoft denied these allegations as inaccurate, its stock swung wildly, finishing down 2.5% for the day and spooking investors that the AI trade may still be unsteady.

This heady mix of AI exuberance and job market jitters had everyone scratching their heads and wondering. In a nutshell, the market advanced but appeared to lack expansion of range. Which way will this cookie crumble?

Although the stock market's been a hot mess lately, there was hope that the markets would pull themselves together with the Fed's favorite inflation gauge, the PCE report. Higher inflation would mean that the Fed hesitates to cut interest rates, but the market seemed to think that Jerome Powell & Co. will pull the trigger regardless: Fedwatch odds hovered at 89% that the FOMC will cut rates next week.

Finally, the bulls got another bit of good news on Friday, courtesy of an investing philosophy first touted over 100 years ago.

The Dow Theory, established by Charles Dow himself in the 1890s, states that the Dow Jones Industrial Average and the Dow Jones Transportation Average (IYT) must move in tandem in order to confirm a market uptrend. While the Dow has been doing well this year, the Dow Transports has lagged—until now. The transport index just clinched its 10th straight daily gain, its longest streak since 2021 and only the fifth time in the last 100 years that it has strung together this many wins in a row.

While bears might worry that the market had gotten ahead of itself, IYT is currently at its highest level in a year—and good ol' Chuck Dow would indicate that there are more gains ahead.

After a five-week delay courtesy of the government shutdown, a solid stack of economic reports landed in trader laps. The latest numbers suggest that all systems are a go for the Fed to cut rates next week...but what happens after that? Is this the start of an early Santa Claus Rally, or are we still hearing more noise than sleigh bells?

December is far from over, and there's still a lot more coming down the pike. On December 16, the Bureau of Labor Statistics will release its next jobs report shedding new light on the state of employment. Meanwhile, uncertainty swirls around Fed Chair Jerome Powell's replacement, which is slated to be announced in early January. And on top of all that, the Supreme Court will be mulling President Trump's use of emergency powers to pass sweeping tariffs—a decision with billions in tariff revenue at stake.

Bottom line: Today's inflation data may be looking merry and bright, but don't count on the market bringing you a gift until everything's unwrapped.

Strategy Corner

Based on last week's market movements, here are some trading ideas and option strategies for the readers' consideration. The strategies can be scaled bigger (or smaller), according to individual account size.

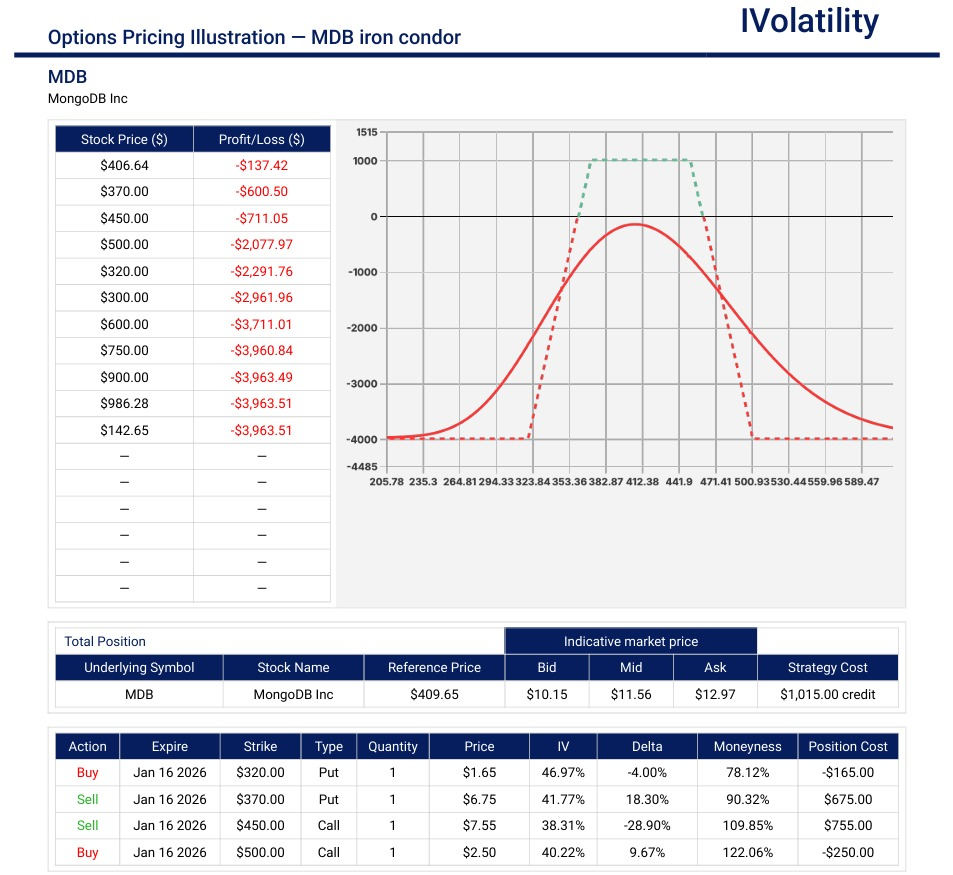

- MDB (closed at 409.47 on Friday, Dec 5th)

If a trader would like to take a neutral position in this underlying, an iron condor strategy for Jan 16 expiration could be considered

Sell the 370put and 450call at the expected move

Buy longs 50points away at 320 and 500 to establish a buying power requirement of around $3800

Probability of profit is about 65%

Premium collected is about $1150 (about a 30% return on capital)

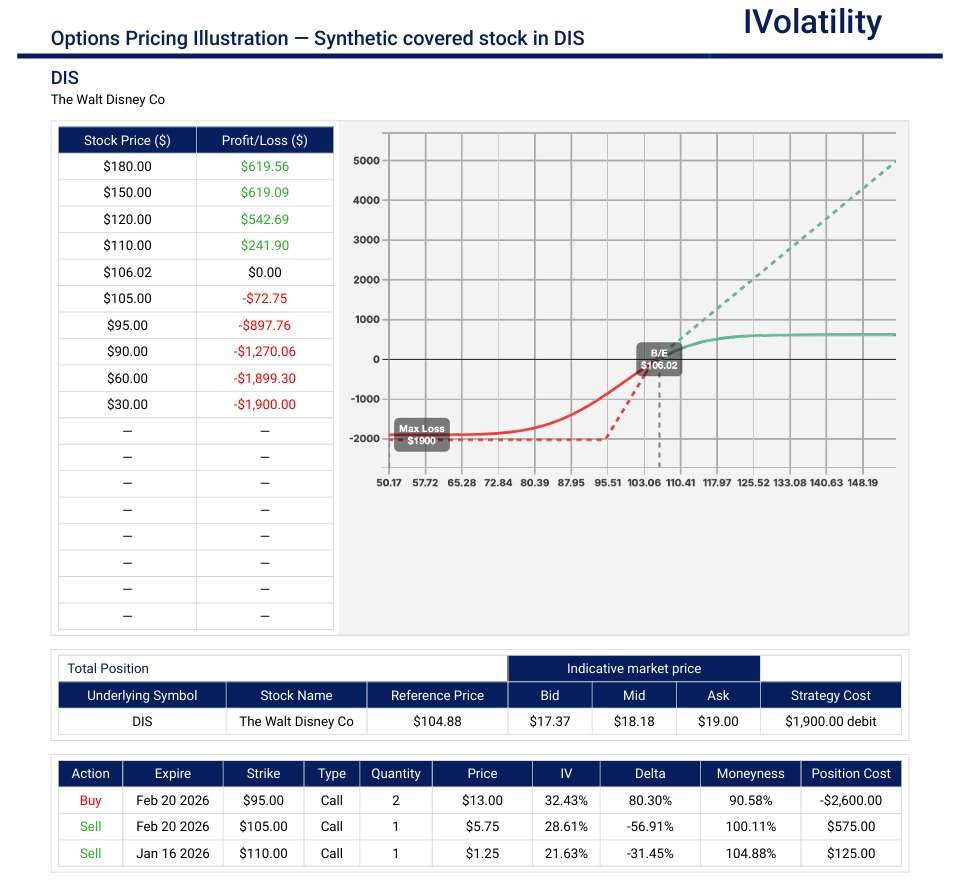

PnL Calculator from the IVolLive Web - DIS (closed at 105.23 on Friday, Dec 5th)

If a trader would like to establish a covered stock position in this underlying, a synthetic position can be opened. In the Feb20 expiration, buy TWO 95calls and sell ONE 105call. This position is about 100 deltas (or a synthetic long stock position).

In the Jan16 expiration, cover the synthetic long stock position by selling the 110call.

The trader is now net long 70deltas at a cost of about $1800

Maximum potential value is over $2500.

Notice that this synthetic position will cost a fraction of a static covered stock position where 100 shares of the underlying need to be purchased.

PnL Calculator from the IVolLive Web

Movement of the Major Indices:

These numbers are reporting the tradable activity from the opening on Monday, Dec 1st to the closing on Friday, Dec 5th (any gaps over the weekend are not included).

| INDEX | UP | DOWN |

| SPY | 0.85% | |

| QQQ | 1.82% | |

| IWM | 1.58% | |

| DIA | 0.6% | |

| GLD | -0.66% | |

| BTC/USD | -2.14% | |

| TLT | -0.77% | |

| Crude Oil | 1.95% | |

| VIX | -14.79% |

Movement of the Major Sectors:

| SECTOR | UP | DOWN |

| XLK | 3.34% | |

| XLF | 1.15% | |

| XLV | -2.41% | |

| XLY | 1.76% | |

| XLI | 1.34% | |

| XLP | -1.01% | |

| XLE | 1.39% | |

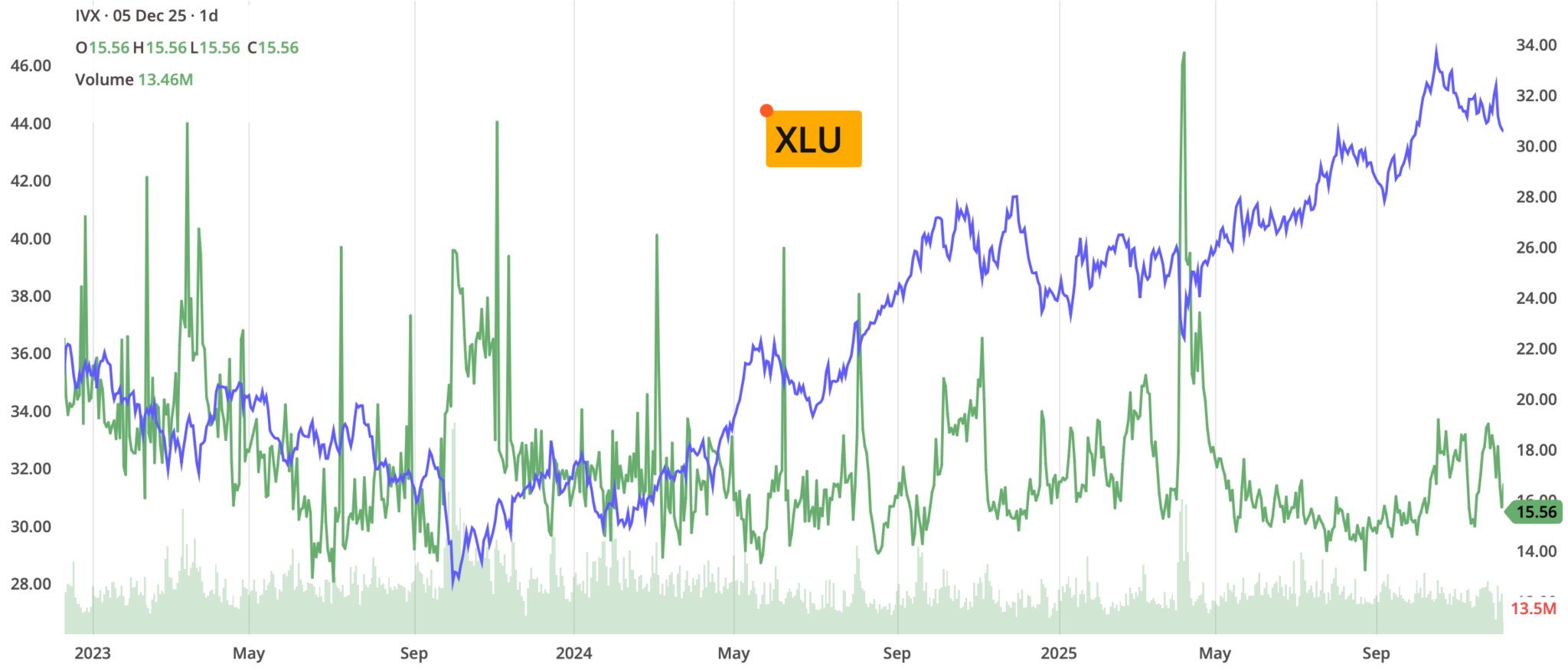

| XLU | -3.91% | |

| XLB | -1.23% | |

| XLRE | -0.58% |

Notable S&P gainers for the week of Dec 1st - 5th:

The week saw strong gains in specific retail, data infrastructure, and semiconductor stocks, primarily driven by better-than-expected corporate earnings and M&A activity.

MongoDB (MDB) jumped over 23% with gains driven by continued positive sentiment in the high-growth data and AI infrastructure space.

Microchip Technology (MCHP) jumped nearly 23% benefiting from overall strength in the chip sector and strong demand signals for industrial chips.

Dollar General (DG), the discount retailer surged nearly 21% after beating quarterly earnings and raising its full-year guidance, reflecting resilient demand from value-seeking consumers across all income levels.

Ulta Beauty (ULTA) rose over 13%. Stock hit a record high after reporting strong quarterly earnings and boosting its outlook, confirming resilient consumer spending in the beauty category.

Warner Bros. Discovery (WBD) climbed over 6% on news that Netflix had agreed to buy the majority of WBD's studio and streaming operations in an $83 billion deal, offering a clear valuation floor for the entertainment giant's assets.

Moderna (MRNA) jumped 9% after a long-term study was released in France indicating its COVID-19 vaccine was safe and effective, bolstering confidence in its core product and technology platform.

Salesforce (CRM) gained over 13% after after posting better-than-expected quarterly profit and raising its outlook, driven by growth in its data products and AI offerings.

Albemarle (ALB) rose over 8% after a major analyst upgrade that cited higher energy storage demand and a projected lithium market deficit in 2026.

Notable S&P losers for the week of Dec 1st - 5th:

Several high-profile stocks suffered sharp losses due to disappointing earnings, negative corporate news, and sector-specific selling pressure.

Snowflake (SNOW) dropped 11% after the cloud data warehousing company saw a sharp drop after its post-earnings call included a disappointing revenue outlook and management commentary that failed to reassure investors about future growth deceleration.

Paramount Skydance (PSKY) dropped over 10% after Netflix announced it had acquired a major portion of Warner Bros. Discovery (WBD), effectively ending PSKY's rumored bid for WBD and leaving it without a clear strategic path forward.

Intel (INTC) shed 8% after reports indicated the chipmaker would hold onto its networking and communications unit, disappointing investors who had hoped for a clear divestiture or spin-off of non-core businesses.

Shopify (SHOP) dropped 6% after the company reported merchants were experiencing technical issues with accessing Admin and POS systems, directly impacting a crucial holiday sales period.

Kroger (KR) lost 5% after reporting lower-than-expected revenue for the quarter and disclosing a large net loss due to a significant impairment charge related to the closure of three automated delivery fulfillment facilities.

The week also saw continued volatility and weakness in two specific sectors:

Cryptocurrency-Tied Stocks: Coinbase (COIN), MicroStrategy (MSTR), Riot Platforms (RIOT). These stocks saw multiple days of selling pressure as Bitcoin fell below the $90,000 level from its recent highs, renewing general risk-off sentiment in the crypto space.

"Magnificent Seven" Tech: the group slipped as investors continued to debate the high valuations of big tech and concerns about the pace of future AI spending growth.

Review selected market indices below:

Daily Notable Market Action

Monday's Markets and News:

Markets were redder than Rudolph's nose today as December kicked off on a sour note, with investors fretting that the Fed may not cut rates this month after all.

Bitcoin celebrated Thanksgiving by climbing above $90,000, but the comeback was short-lived as investors took a risk-off stance.

Oil was buoyed by several geopolitical tailwinds, including Ukrainian drone attacks on Russia's shadow fleet, the closure of Venezuelan airspace by the US, and OPEC's decision to leave crude output levels where they are next quarter.

But even with parts of the holiday economy looking strong, investors seemed unsure of getting their usual Santa Claus rally.

The market's unpredictable mood powered both sudden rallies and abrupt pullbacks, leaving investors guessing. Rate-cut expectations have been just as volatile, markets now see an 83% chance the Fed will cut rates at its December meeting, up from about 30% just last week.

With sentiment shifting so quickly, the Fed's decision on Dec.10 has become the next major catalyst, and could determine whether Santa Claus will leave investors with a gift or a stocking full of coal.

Monday's Movers to the Upside:

- Disney got a boost from "Zootopia 2" with a strong Thanksgiving debut, pulling in $156 million domestically. Shares rose over 2%.

- DoorDash climbed nearly 4% after Sequoia partner Alfred Lin bought about $100 million worth of shares.

- Chip design company Synopsys jumped nearly 5% on news that Nvidia invested $2 billion in its common stock as part of a new strategic partnership.

- Bedding product manufacturer Leggett & Platt popped over 16% following Somnigroup's proposal to acquire the company in an all-stock deal at a 30.3% premium.

- New Fortress Energy surged 7.38% after winning tentative approval for a $3.2 billion LNG deal in Puerto Rico.

Monday's Movers to the Downside:

- Strategy, Robinhood and Coinbase slid between 3-5% after bitcoin tumbled sharply over a 24-hour period.

- Korean e-commerce company Coupang dropped over 5% after a massive data breach exposed customer emails, phone numbers, and shipping addresses.

- Moderna fell over 7% following reports that an FDA director suggested COVID shots may have been linked to at least 10 child deaths between 2021 and 2024.

- Chinese electric vehicle manufacturers Xpeng and Nio slipped about 5% each despite strong November deliveries and expectations for record December volumes.

- Electric aircraft maker Joby Aviation declined over 6% after Goldman Sachs initiated coverage with a sell rating, citing valuation concerns.

- Shopify fell nearly 6% after a Cyber Monday outage left some merchants unable to process transactions during one of the year's busiest online shopping days.

Tuesday's Markets and News:

Markets recuperated after getting dragged by a crypto selloff yesterday (more on that later), with tech and industrial stocks powering the recovery.

Crude sank, but one bit of good news greeted Americans at the pump: Gasoline prices fell below an average of $3 per gallon this week, their lowest level since 2021.

Tuesday's Movers to the Upside:

- Intel popped nearly 9% following reports that it will begin supplying chips for Apple's MacBook Air and iPad Pro as early as 2027.

- Software company MongoDB climbed over 22% on a Q3 beat-and-raise report, with investors cheering accelerating AI-driven demand and continued momentum from its Atlas cloud database platform.

- Aerospace manufacturer Beta Technologies rose over 8% after Eve Air Mobility inked a 10-year deal worth up to $1 billion to buy its electric motors.

- Bayer jumped nearly 12% after the Trump administration urged the US Supreme Court to take up the pharmaceutical and biotech company's Roundup appeal, a rare boost for the firm amid years of bruising litigation.

- Boeing gained over 10% following guidance that deliveries of both the 737 and 787 jets are expected to increase next year.

- Credo Technology surged over 10% on a strong fiscal Q2 and a bullish long-term forecast, with the company projecting 50% annual revenue growth and 70% earnings growth through 2028.

Tuesday's Movers to the Downside:

- Ford slipped over 1.5% as November sales declined 1% year over year, including a 10% drop in F-Series trucks and a 61% collapse in EV sales.

- Biopharmaceutical company Janux Therapeutics plunged over 50% despite releasing positive early-stage prostate cancer trial data, as analysts cut price targets over limited data and concerns about its competitiveness against Novartis's Pluvicto.

- Signet Jewelers fell nearly 7% even though it beat Q3 earnings, with investors focusing on the company's warning of a challenging holiday season ahead.

- XPO dropped over 5.5% after the freight company reported weakening operating metrics in its North American LTL business for November.

- Biotech company MetaVia slid over 20% following news of a 1-for-11 reverse stock split, which consolidates every 11 outstanding shares into a single share.

Wednesday's Markets and News:

Did MSFT lower AI software sales quotas? Yes, according to an outfit called The Information. ... a few hours later, the headline was retracted!!!

Stocks sank to start the day, but quickly recovered as investors bet on the Fed cutting interest rates (more on that below). Bond yields fell on rising rate-cut hopes, while the CBOE Volatility Index tumbled.

Silver hit yet another new all-time high, while crude climbed as talks between the US and Russia about peace in Ukraine ended without a breakthrough.

Bitcoin hit a two-week high as the crypto market continues to recover from its recent downturn.

Forget the AI bubble—BlackRock and Bank of America say it's more of an "air pocket."

Harvard bet $500 million on bitcoin last quarter, just ahead of its brutal selloff.

President Trump plans to roll back Biden-era fuel economy standards, which would be a boon for US automakers.

Nvidia is desperately trying to keep new requirements that US customers get first dibs on its most advanced chips out of the latest defense spending bill.

Anthropic is racing toward an IPO as it tries to stay one step ahead of OpenAI.

Wednesday's Movers to the Upside:

- Bristol Myers Squibb rose over 5.5% after the company said it will expand enrollment in a late-stage trial for Cobenfy, its experimental treatment for Alzheimer's-related psychosis.

- Marvell Technology jumped nearly 8% thanks to strong Q3 results and projections that data-center revenue will grow over 25% by 2027, well above prior expectations of 16%.

- Dollar Tree gained over 3.5% on strong earnings and a beat in comparable-store sales.

- Microchip Technology climbed over 12% after raising its fiscal Q3 revenue and profit guidance.

- Delta Air Lines jumped over 3.5% despite flagging a $200 million hit to Q4 pretax profit tied to the government shutdown, as the airline said demand and early-2026 bookings remain healthy.

- Eric Trump's American Bitcoin Corp. recovered 9.13% today after plummeting over 50% in just 30 minutes on Tuesday.

Wednesday's Movers to the Downside:

- Netflix fell nearly 5% while Paramount slid nearly 8% as investors weighed the costly reality that either company could end up mounting a multibillion-dollar bid for Warner Bros. Discovery.

- Acadia Healthcare dropped nearly 11% as the behavioral healthcare service provider trimmed its earnings guidance thanks to mounting legal expenses.

- Micron slipped over 2% on news that it will wind down its consumer products unit to concentrate on AI-grade memory chips.

- GitLab fell nearly 13% after posting a Q3 loss, with ongoing softness in its public-sector business weighing on results.

- Alexandria Real Estate Equities sank over 10% on a 45% dividend cut that rattled investors.

- Pure Storage plummeted over 27% despite strong Q3 results as investors focused on its plan to funnel AI hyperscaler revenue back into R&D and sales efforts, a strategy that could leave 2027 margins looking slimmer.

Thursday's Markets and News:

Investors tried to parse through mixed labor market data today, as initial jobless claims fell to their lowest level since 2022, but employers also reported the most layoffs for the month of November since 2022. Markets looked above and failed.

All eyes were on Japan, where 10-year bond yields rose to their highest level since 2007 as traders worry that the Bank of Japan may raise rates later this month.

Bitcoin briefly returned to positive territory for the year, despite an over-30% decline between October and November. The rally could have legs: one JPMorgan strategist thinks bitcoin might climb to $170,000.

The Elon Musk—Sam Altman rivalry continues to heat up, with reports that Altman has explored building a competitor to Musk's SpaceX.

Paramount is challenging the fairness of Warner Bros. Discovery's sale process, setting the stage for a shareholder battle.

Amazon pays the USPS $6 billion per year to help deliver packages, but the e-commerce titan is reportedly considering expanding its own delivery network.

Americans are on track to spend a record $20 billion using buy-now-pay-later this holiday season, raising concerns they're borrowing their way into financial trouble.

Thursday's Movers to the Upside:

- AST SpaceMobile popped over 18% after announcing that its upgraded BlueBird 6 satellite, featuring an antenna array more than three times larger than earlier models, will be launched Dec. 15.

- Salesforce rose over 3.5% after reporting 9% year-over-year revenue growth.

- UiPath jumped over 24% as the automation software company posted a third-quarter profit, swinging from a loss a year ago.

- Science Applications International gained over 16% after beating Q3 EPSestimates by 26% and raising earnings guidance for 2026 and 2027.

- Hormel Foods edged up nearly 4% following mixed quarterly results but a strong outlook for 2026.

- Blockchain lending company Figure Technology climbed over 10% after unveiling a new consortium focused on real-world asset tokenization.

Thursday's Movers to the Downside:

- Kroger slipped over 4.5% after reporting a $1.5 billion operating loss in Q3 and missing sales expectations.

- PVH Corp fell nearly 12% despite an earnings beat as margins tightened under tariff pressure.

- Snowflake fell over 11% as investors focused on product revenue growing 29%, slower than last quarter’s 32% pace.

- Genesco plunged over 30% after its adjusted earnings came in below expectations and the footwear company cut its full-year profit outlook.

- Pattern Group sank over 13% following a cautious report from Bear Cave's Edwin Dorsey.

- Symbiotic tumbled over 17% after announcing a share offering yesterday, adding pressure just a week after the warehouse automation company delivered a mixed fourth-quarter report.

Friday's Markets and News:

Light inflation and rising consumer sentiment combined to propel the S&P 500 higher for a fourth straight day, leaving it inches from its record high. NFLX wins bid for WBD merger. Stocks rally but then fail... regulation concerns?

US Treasurys wrapped up their worst week in six months as investors wonder who will take the reins from Jerome Powell, and what monetary policy will look like next year.

Bitcoin's rebound stalled once again today, while BlackRock's iShares Bitcoin Trust ETF, the largest bitcoin ETF by assets, concluded its sixth straight week of outflows. Apple just hit an all-time high—and the AI crown may be within reach.

Chinese chipmaker Moore Threads skyrocketed 425% in its trading debut, though its nearly $40 billion valuation still pales in comparison to Nvidia's multitrillion-dollar scale.

The New York Times has been busy: it filed a copyright lawsuit against Perplexity, accusing the AI startup of illegally using its content, a day after suing the Department of Defense over the Pentagon's tightened limits on press access.

SoftBank CEO Masayoshi Son is pitching "Trump Industrial Parks" to build US AI infrastructure with Japanese funding.

Wall Street has been shaken by fears of a yen carry-trade blowup, but some strategists think the worries are overblown.

Friday's Movers to the Upside:

- DigitalBridge popped over 45% on reports that SoftBank is exploring a potential acquisition of the digital-infrastructure giant.

- Victoria's Secret jumped nearly 18% after reporting a 9% increase in third-quarter sales and lifting its full-year outlook, underscoring success in its beauty product segment.

- Ulta Beauty jumped nearly 13% after topping estimates and lifting its annual sales forecast.

- Rubrik skyrocketed over 22% following a strong Q3 report, putting the stock on track for one of its best days of trading ever.

- Southwest Airlines ticked over 5.5% higher despite trimming its earnings forecast to account for a $200 million hit from the federal government shutdown, with the carrier noting demand remains robust heading into 2026.

- Praxis Precision Medicines soared over 30% after its experimental epilepsy drug delivered positive trial results.

Friday's Movers to the Downside:

- Parsons fell over 20% after the government chose another contractor for a major air-traffic control upgrade, undercutting investor expectations.

- SoFi Technologies slid over 6% after announcing a $1.5 billion stock offering.

- Cloudflare dropped over 1.5% following a Friday outage that briefly disrupted access to major platforms such as Coinbase—the company's second outage in three weeks.

- Docusign dipped nearly 8% despite posting strong earnings and raising its full-year sales outlook.

- SentinelOne declined nearly 14.5% after analysts highlighted a weak fourth-quarter revenue outlook in the company's latest results.

Notable Earnings for week of Dec 8th - 12th:

The actual day may vary, so do consult with your broker to confirm the actual date. Also, if an options trader wishes to open positions to participate in earnings announcements, it's important to check whether the earnings are released BEFORE or AFTER the date of earnings.

This is a heavy-hitter week for earnings, acting as a crucial barometer for both the "AI Trade" and the health of the US consumer heading into the holidays.

Monday: TOL

Tuesday: AZO / GME / CASY / CPB

Wednesday: ORCL / ADBE / SNPS / CHWY / MTN

Thursday: CIEN / AVGO / COST / LULU

Friday: no notable company earnings are to be released

Notable Economic Data for week of Dec 8th-12th:

Wall Street's focus will be on the Federal Reserve's final interest rate decision of the year. It will also be the penultimate full trading week of the year, and markets will hope to ride recent momentum into a strong year-end Santa Claus rally.

Traders widely expect the Fed on Wednesday to cut its key rate by another 25 basis points for a third straight monetary policy committee meeting. December rate cut odds have been on a bit of a roller-coaster ride since last month, but recent economic data has reinforced the chances.

Here is the schedule of notable economic data releases:

Monday, December 8:

NY Fed 1-Year Consumer Inflation Expectations: This gauges where consumers think inflation is going. The Fed watches this closely to ensure inflation psychology isn't becoming "unanchored."

Tuesday, December 9:

JOLTS Job Openings (Oct/Sep Delayed Release): Due to previous government shutdown delays, we are getting a catch-up release. The ratio of job openings to unemployed workers is a key metric the Fed uses to gauge labor market tightness.

Wednesday, December 10:

FOMC Interest Rate Decision: Markets are pricing in a high probability of a 25 basis point rate cut, bringing the target range down to 3.50% – 3.75%. Investors will be scrutinizing the "Dot Plot" (Summary of Economic Projections) released alongside the statement to see where Fed officials expect interest rates to settle in 2026.

The rate cut is mostly "baked in." The market volatility will come from the future projections. If the Fed signals fewer cuts in 2026 than the market expects, stocks could pull back.

Thursday, December 11:

US November PPI (Producer Price Index: This measures inflation at the wholesale level. It is a leading indicator for consumer inflation (CPI).

Closing Thoughts

Stuffing wasn't the only item that Americans over-consumed this Thanksgiving.

Holiday weekend spending smashed forecasts: shoppers spent $6.4 billion on Thanksgiving, $11.8 billion on Black Friday, and $14.25 billion on Cyber Monday—all record highs. Tech played a surprisingly large role this year. AI-driven traffic to US retail sites jumped 805% on Black Friday compared to last year, helping steer shoppers toward deals and boosting conversion. Total online sales hit $44.2 billion per Adobe Analytics, beating expectations.

At first glance the numbers look strong, but a closer look tells a different story: Americans are spending more but walking away with less.

Revenue from online Black Friday sales rose 3%, but only because the average selling price jumped 7%, according to Salesforce. It might have seemed like everything was on sale, but average Cyber Week prices actually rose 7%, outpacing last year's 5% climb. And Americans bought less overall on Black Friday, with shopping carts 2% smaller than they were a year earlier.

One major culprit could be the tariffs. The rising price of imported goods has pushed producers to pass along higher costs to customers stateside. Typically, the US leads global holiday spending growth—but this year, global Black Friday spending grew twice as fast as US sales. And Cyber Monday sales growth in the US lagged behind Europe for the first time, a reversal fueled by US tariffs and aggressive ECB rate cuts, according to Bloomberg.

All this plays out as consumers confront mounting economic anxiety. Alongside tariff-driven costs, households are facing job insecurity and stubborn inflation. Consumer spending makes up 70% of US GDP, but the foundation of the US economy is wobbling, as illustrated by the Consumer Confidence Index recently falling to its lowest level since April.

The holiday sales strength we're seeing today may reflect a divergence between haves and have-nots, rather than broad consumer health. A chief economist at Navy Federal Credit Union, called this season "a K-shaped economy on steroids", with Americans earning more than $170,000 driving double-digit spending growth this year.

The question now might be whether this small base of big spenders can sustain momentum through the rest of the season, and into next year.

Questions / Comments

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use support@ivolatility.com.

Previous issues are located under the News tab on our website.