Santa Rally Failed?

January 12, 2026

Market Roundup for the Week

Based on the market data from the last two weeks, the short answer is no – a classic "Santa Claus Rally" did not happen this year. In fact, for the first time in history, the market has now failed to produce a Santa Rally for three consecutive years (2023, 2024, and 2025).

Here is a breakdown of why this year's performance was rated poorly by analysts:

- The Numbers (Quantity)

A "Santa Claus Rally" is technically defined as the final five trading days of December plus the first two trading days of January.

- Performance: The S&P 500 finished this seven-day window down 0.11%.

- The Comparison: Historically, this period averages a +1.3% gain and is positive 79% of the time. This year, the index drifted lower on light volume, completely missing the seasonal tailwind.

- The Quality Rating: Low

Market strategists generally rate the quality of this period as "Low" for a few reasons:

- Momentum Stall: The market entered late December with a lot of "oomph", but hit a wall of uncertainty regarding 2026 interest rate cuts and the upcoming Supreme Court ruling on tariffs.

- Narrow Participation: While some big names like Costco and certain AI tech stocks held up, the broader market saw a "tax-loss harvesting" sell-off in the final days of 2025 that was heavier than usual.

- Broken Streak: Historically, the market has never missed a Santa Rally three years in a row until now. This "triple miss" has led to the old adage: "If Santa Claus should fail to call, bears may come to Broad and Wall."

- The Silver Lining

Despite the technical failure of the "rally window," the broader context is actually quite strong.

- The S&P 500 finished 2025 with an impressive 17.9% gain.

- Even though the "official" 7-day window was negative, the market has already rebounded in the second week of January, hitting new record highs on January 9.

- The Result: The S&P 500 finished the first full week of 2026 (ending Friday, Jan 9) up 1.76%.

- The Milestone: On Friday, January 9, the S&P 500 hit a new all-time record high of 6,966.28.

- The Interpretation: Historically, when the first week of January is positive, the full year is positive roughly 80% of the time, with an average gain of about 14%.

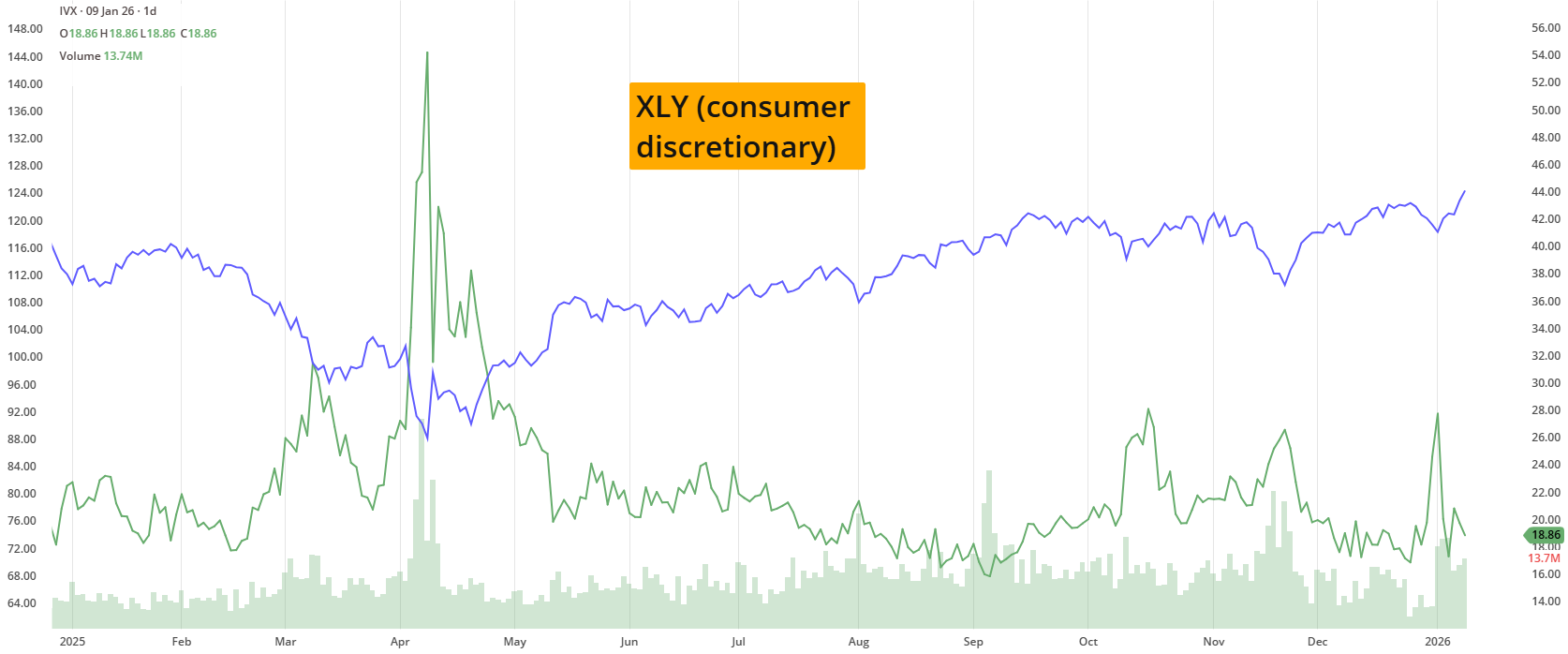

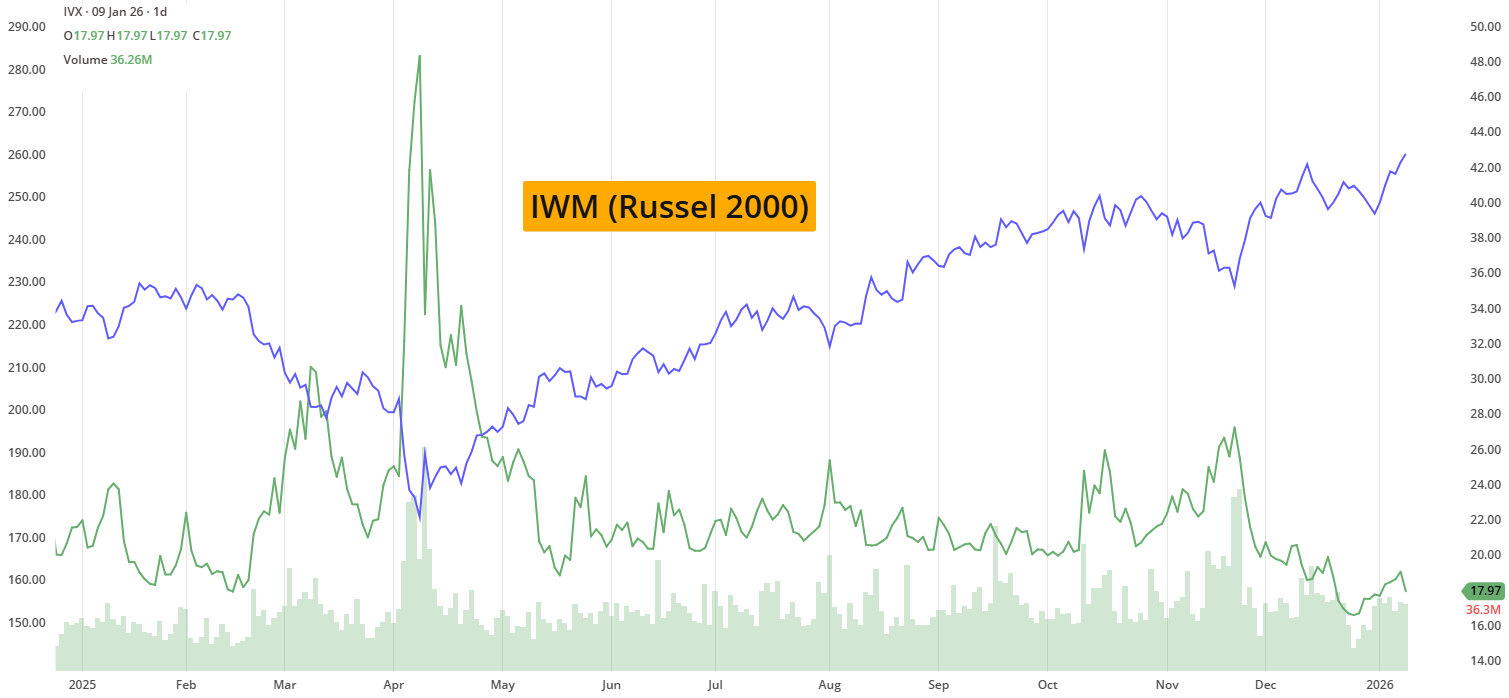

The most encouraging thing about this week's data isn't just that the market went up—it's how it went up. While the standard S&P 500 (dominated by Tech) is up 1.76%, the Equal Weight S&P 500 is up an impressive 3.14%. This suggests that the rally is "broadening." Instead of just 5 or 6 giant tech companies carrying the market, thousands of mid-sized and smaller companies are starting to participate. This is usually considered a "high-quality" signal for a sustainable bull market.

Despite the strong start, there are a few reasons why analysts are still cautious about the full-year Barometer:

- Tariff Uncertainty: Investors are closely watching the Supreme Court and administrative trade policies. If tariffs lead to "sticky inflation," the Fed might stop cutting interest rates, which could derail the January momentum.

- Valuations: The market is currently trading at a high price-to-earnings multiple. Essentially, stocks are "expensive," meaning they need to show very strong earnings in Q1 to justify these new record highs.

The "First Five Days" signal has technically overridden the negative "Santa" signal. If the S&P 500 can hold these gains through January 31, the Barometer will officially point to a "Green Year."

Strategy Corner

Based on last week's market movements, here are some trading ideas and option strategies for the readers' consideration. The strategies can be scaled bigger (or smaller), according to individual account size.

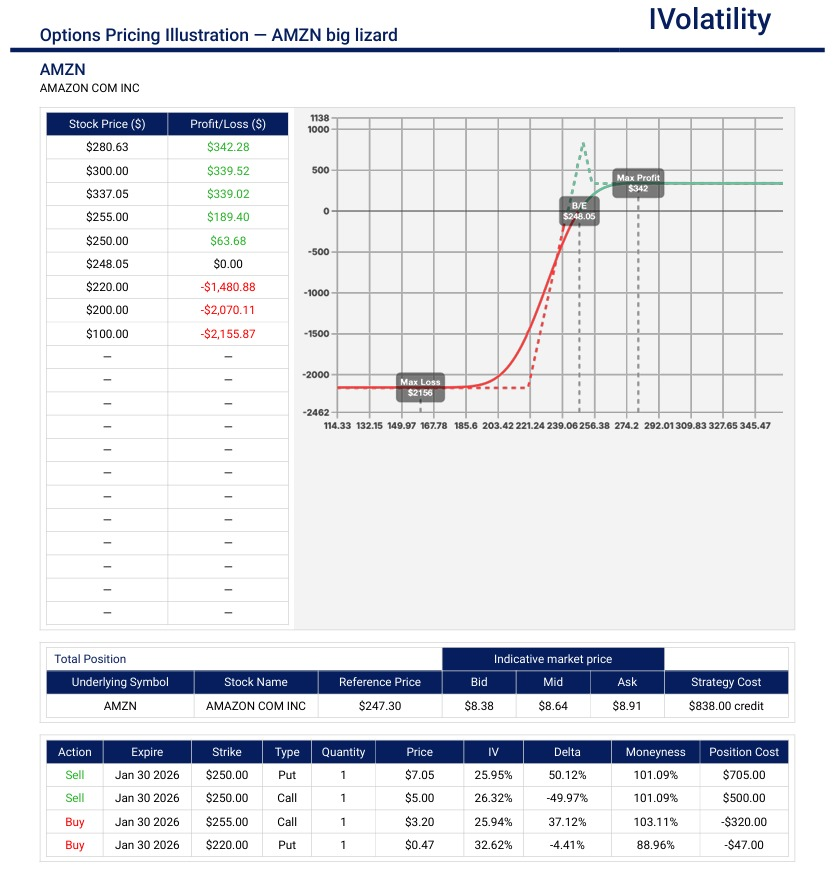

- AMZN (closed at 247.35 on Friday, Jan 9th)

If a trader believes that AMZN might make a run upwards in the week before earnings, then a big lizard strategy could be something to consider.

For the Jan30th expiration, sell the ATM 250 straddle, buy the 255 call to remove any risk to the upside and buy the 220 put to limit the buying power requirement.

BP required is about $2150

Credit collected is about $865

No risk to the upside (since the 250/255 call spread is covered by the credit collected) and downside breakeven is around 247 (255put less the credit collected).

PnL Calculator from the IVolLive Web - SOFI (closed at 27.39 on Friday, Jan 9th)

This underlying is often referred to as "amazon in the making" of online banks. If a trader would like to get bullish over the long haul, then a call diagonal might be considered. The diagonal can be financed by the sale of staggered puts as well to reduce the cost basis and increase the long delta of the position.

Call diagonal: buy Jan15th ITM 15 call / sell the Jan30th 31call

Sell the feb20th 27put AND sell the Mar20th 25put

Cost of trade about $1000

Max potential profit could be $600 or more since the short puts/call can be rolled forward for several months.

PnL Calculator from the IVolLive Web

Movement of the Major Market Indices:

| INDEX | UP | DOWN |

| SPY | 1.59% | |

| QQQ | 2.21% | |

| IWM | 4.6% | |

| DIA | 1.14% | |

| GLD | 0.88% | |

| BTC/USD | -0.99% | |

| TLT | -0.24% | |

| Crude Oil | 3.14% | |

| VIX | -0.14% |

Movement of the Major Sectors:

| SECTOR | UP | DOWN |

| TECH (XLK) | 0.1% | |

| FINANCIALS (XL) | 1.8% | |

| INDUSTRIALS (XLI) | 2.5% | |

| ENERGY XLE | 2.1% | |

| HEALTHCARE (XLV) | 1.6% | |

| UTILITIES (XLU) | -1.6% | |

| MATERIALS (XLB) | 4.8% | |

| REAL ESTATE (XLRE) | 0.4% | |

| CONSUMER STAPLES (XLP) | 2.0% | |

| CONSUMER DISCRETIONARY (XLY) | 5.8% |

Notable gainers for the week of January 5th – 9th:

The first full trading week of 2026 was marked by a shift away from high-flying mega-cap tech and toward "cyclical" stocks—companies that benefit from government policy and physical infrastructure. The week's top gainers were concentrated in the homebuilding, materials, and specialized technology sectors.

Century Communities (CCS) rose 11% after the administration proposed a $200B mortgage bond purchase plan to lower interest rates.

Intel Corp (INTC) jumped nearly 11% after a high-profile "great meeting" between the CEO and President Trump fueled hopes for domestic chip subsidies.

Vistra Corp (VST) popped 10.0% after signed a power deal with META with Vistra providing nuclear power for its massive AI data centers.

Lennar Corp (LEN) rose nearly 9% from the same $200B mortgage bond news that lifted the entire residential construction sector.

Albemarle (ALB) popped nearly 8% following the rise of Lithium carbonate prices (nearly 40% in one month and a UBS upgrade to a "Buy" citing a looming 2026 supply deficit.

Applied Digital (APLD) zoomed nearly 18% higher as news of "Big Tech" capital expenditure expansion on AI data center infrastructure.

Notable losers for the week of January 5th – 9th:

First Solar (FSLR) dropped 13% amidst tariff and policy uncertainty. Investors pulled back amid fears that upcoming administration policies could reduce renewable energy subsidies.

NRG Energy (NRG) shed over 10% when multiple top insiders were reported to have sold tens of millions in stock simultaneously.

Western Digital (WDC) dropped 9% after a massive 17% surge on Tuesday, the stock saw a sharp "correction" as traders locked in gains.

Equifax (EFX) shed 7.5% when FHFA Director Bill Pulte publicly criticized credit bureau pricing, signaling an intent to "protect consumers" from high fees.

Chevron (CVX) dropped over 5% after the company faced specific selling pressure after its initial "Venezuela rally" cooled off.

Review selected market indices below:

Daily Notable Market Action

Monday's Markets and News:

The Dow cracked 49,000 for the first time ever, and while it fell short of that impressive milestone at the end of the day, it closed at a new record high.

10-year Treasury yields fell thanks to a report that US manufacturing activity shrank in December by its most since 2024.

Bitcoin began 2026 on a high note, continuing to rally as investors seek out safe havens as geopolitical risks mount.

2026 was kicked off by the abduction of President Maduro of Venezuela (and his wife) by the US government. The world was shocked by the dramatic turn of events and the long-term geopolitical implications are still shaking out.

However, the stock market largely shrugged off the news. Part of the reason why investors didn't freak out is the historical record. According to UBS, the S&P 500 only fell an average of 0.3% in the week following the last 11 major geopolitical events, and rose 7.7% over the next year. With the administration walking back President Trump's earlier comments about how the US will "run" Venezuela, investors seemed confident that the storm had largely passed, and that markets will quickly recover from the drama.

On one hand, geopolitical shocks usually give oil a boost. Then again, traders are also weighing the fact that the US has pledged to increase oil production in Venezuela, which would sink prices. For now, the oil market looks stable—Venezuela produces roughly 1% of global oil supply, and its oil infrastructure remains operational, so traders are taking a wait-and-see approach.

Energy companies, however, are seeing green. Oil companies (such as Chevron), oil refiners (such as Valero Energy and Marathon Petroleum) and oilfield service providers (such as Schlumberger and Halliburton) all rose in response to the US overtaking of Venezuela oil assets.

In other commodity news, gold, silver, and copper all surged, as traders sought to hedge their bets given the obvious geopolitical risk.

US defense stocks rose as well with Lockheed Martin, Northrop Grumman and General Dynamics showing substantial gains.

The threat of a new world order based on "hard power" also sent Asian defense companies soaring, including names like IHI Corp, Mitsubishi Heavy Industries, and Kawasaki Heavy Industries.

Monday's Movers to the Upside:

- Foxconn rose nearly 2% after the world's largest contract electronics maker reported its Q4 revenue climbed 22% year over year, driven by strong AI-server demand.

- Lucid Group jumped nearly 5% on reports that 2025 vehicle deliveries rose 55% year over year, signaling improving scale despite ongoing EV demand concerns.

- Tesla rebounded over 3%, snapping a prolonged losing streak after recent selloffs tied to disappointing Q4 deliveries and rising competition from BYD.

- Qualcomm made a splash at CES, rising nearly 2% after it unveiled its new PC chip and detailed its plans to build humanoid robots.

- Duolingo gained nearly 5% after Bank of America upgraded the stock to Buy, highlighting its bright future as a mobile gaming company.

- Centrus Energy Corp. surged over 10% after the US awarded the nuclear fuel manufacturer $900 million to support next-generation reactor fuel development and a new enrichment facility in Tennessee.

- Coinbase rose nearly 8% after Goldman Sachs upgraded the stock to Buy from Neutral, with analysts highlighting the recent pullback as a buying opportunity.

- Novo Nordisk climbed over 5% after launching the first GLP-1 pill for obesity in the US.

Monday's Movers to the Downside:

- Viking Therapeutics fell over 9% and Eli Lilly slipped over 3.5% after Novo Nordisk launched the first GLP-1 obesity pill, as both companies are also developing oral GLP-1 drugs of their own.

- Versant Media Group fell over 13% in its trading debut following its spinoff from Comcast.

- Zenas BioPharma plummeted over 50% after disclosing it is ineligible for milestone payments from Royalty Pharma tied to its INDIGO trial, a mid-stage study for a rare autoimmune disease.

- Domino's Pizza slid 3.25% after TD Cowen downgraded the stock, pointing to weakening demand in the pizza delivery market.

Tuesday's Markets and News:

The S&P 500 ended the day at a new record high as Nvidia CEO Jensen Huang's comments at CES gave the AI trade a boost, while the Dow closed above 49,000 for the first time ever.

Treasuries were steady here in the US, but the big winner today was Venezuelan bonds. Debt issued by the country and state-owned oil company PdVSA has popped, delivering a big win for bond holders who endured a 2017 default.

Copper powered to yet another record after breaching $13,000 per ton for the first time on Monday. The hot commodity is up 20% over the last three months.

Tuesday's Movers to the Upside:

- Shake Shack rose over 7.5% after Deutsche Bank upgraded the stock to Buy from Hold, citing upside from increased traffic tied to the forthcoming World Cup.

- Sandisk jumped over 27.5% after enthusiasm from Nvidia's CES keynote boosted optimism around AI-driven demand for memory storage. Fellow storage stocks jumped as well, including Seagate Technology (up 14%) and Western Digital (up 16.77%).

- Aeva Technologies soared nearly 35% after the LIDAR maker was picked to help the NVDA to build its self-driving platform.

- Microchip Technology climbed over 11.5% after issuing stronger-than-expected fiscal third-quarter revenue guidance.

- OneStream surged nearly 30% after agreeing to be acquired by Hg Capital for $6.4 billion, a 31% premium to Monday's close.

- Veeva Systems gained nearly 7.5% after announcing a $2 billion share buyback.

- Vistra Corp rose over 4% after unveiling a $4 billion acquisition of Cogentrix Energy, aimed at meeting surging electricity demand from AI data centers.

Tuesday's Movers to the Downside:

- Data-center cooling stocks slid after comments from Nvidia CEO Jensen Huang raised concerns about future data-center demand: Trane Technologies lost 2.52%, Modine Manufacturing dropped 7.44%, and Johnson Controls tumbled 6.26%.

- SoFi Technologies fell nearly 8% after Bank of America resumed coverage with an Underperform rating.

- American International Group slipped nearly 7.5% after CEO Peter Zaffino said he will step down by mid-year and transition to executive chair.

- Adidas AG fell over 4% after Bank of America Securities warned competition from Nike could pressure growth.

- Credit score stocks sank thanks to comments from FHFA Director Bill Pulte on X about their pricing models. TransUnion lost 4.83%, Equifax fell 3.81%, and Experian dropped 1.85%.

Wednesday's Markets and News:

Indices switched leaders with the S&P 500 and Dow pulling back from record highs while the Nasdaq surged on tech stock optimism.

10-Year Treasury yields fell after ADP's report revealed that private employers added 41,000 jobs in December, erasing November's losses and signaling a steadying labor market.

Energy Secretary Chris Wright said the US will control Venezuelan oil exports "indefinitely", a day after President Trump said Venezuela will give the US up to 50 million barrels of sanctioned oil. Meanwhile, US special forces seized a Venezuelan oil tanker being escorted by the Russian navy.

Wednesday's Movers to the Upside:

- Alphabet rose 2.5% to surpass Apple and become the second-largest US company by market cap for the first time since 2019.

- Strategy climbed nearly 2.5% as MSCI backed away from a proposal to remove crypto-treasury firms from its indexes.

- GameStop gained over 3% after unveiling a new CEO pay package for Ryan Cohen designed to incentivize "extraordinary growth".

- Amgen rose nearly 3.5%, extending its rally after acquiring Dark Blue Therapeutics.

- Eli Lilly rose over 4% on reports that Lilly is in talks to acquire Ventyx for about $1 billion.

Wednesday's Movers to the Downside:

- Deckers Outdoor fell over 4% after downgrades from Baird and Piper Sandler weighed on the Ugg and Hoka owner.

- First Solar dropped over 10% following a Jefferies downgrade, citing weak booking visibility and uncertain strategic decisions.

- Western Digital fell nearly 9% giving back some of the previous day's double-digit gains.

- Seagate Technology slid nearly 7%, giving back some of the prior session's double-digit gains.

- Cal-Maine Foods sank over 1.5% on reports of a 52% drop in EPS and a 19% decline in sales, driven by falling egg prices.

- AST SpaceMobile fell over 12% after analysts flagged tough competition from Elon Musk's Starlink and the company's lack of retail customers.

- Defense companies tumbled after President Trump posted on Truth Social that he will not permit them to issue dividends or buy back shares until they meet his demands. Lockheed Martin lost 4.82%, General Dynamics fell 4.18%, and Northrop Grumman sank 5.5%.

Thursday's Markets and News:

Markets were mixed as President Trump's comments about the defense industry propelled the Dow higher while a slow day for Nvidia dragged the Nasdaq lower. Investors bailed on tech and rotated into small caps, helping the Russell 2000 close at a new record high.

Initial jobless claims came in below economist forecasts, while last month employers announced the lowest number of layoffs since July 2024.

Traders appeared to be souring on silver, with HSBC calling for the red-hot metal to give up recent gains this year. Meanwhile, Trump wants to get oil down to $50 per barrel.

Thursday's Movers to the Upside:

- Costco jumped nearly 4% after posting stronger-than-expected December sales.

- Karman rose nearly 10.5% on a $220 million deal to acquire maritime defense tech firms Seemann Composites and Materials Sciences.

- Applied Digital gained over 8% following a strong fiscal second quarter.

- Bloom Energy surged nearly 13% on a $2.65 billion fuel-cell supply agreement with American Electric Power.

- Neogen jumped over 30% on better-than-expected quarterly results and a higher outlook.

- Gap climbed nearly 7% thanks to a UBS upgrade to Buy, driven by growth prospects in its beauty business, handbags, and Athleta.

- Revolution Medicines surged 4.5% on reports that Merck may be a potential buyer.

Thursday's Movers to the Downside:

- SanDisk sank over 5% and Seagate Technology lost nearly 8% as investors took profits following a sharp rally in memory-storage stocks.

- Alcoa declined over 2.5% on a JPMorgan downgrade, with analysts favoring copper over aluminum in the months ahead.

- Shell fell 1.72% after flagging weaker fourth-quarter oil-trading performance.

- Jefferies Financial slid over 5% after a charge tied to its exposure to bankrupt First Brands overshadowed stronger fourth-quarter revenue.

Friday's Markets and News:

All three major indexes wrapped the first full week of the new year in the green, with the S&P 500, Dow, and Russell 2000 each capping things off with another record closing high.

Short-term yields have fallen faster than long-term yields, creating a "bull steepening" that sets bank stocks up nicely for a strong earnings season next week.

Oil climbed after US forces seized a fifth Venezuelan oil tanker, while civil unrest in Iran has traders wary of lower supply from the Middle East.

Friday's Movers to the Upside:

- Following President Trump's order to purchase $200 billion in mortgage bonds aimed at pushing down mortgage rates, Rocket Companies rose nearly 10%, UWM Holdings climbed nearly 14%, Better Home & Finance surged 6.5% and Opendoor Technologies jumped over 13%.

- Intel rose nearly 11% after Trump publicly praised CEO Lip-Bu Tan following their meeting.

- Chevron advanced over 1.75% on reports it could add $700 million in annual cash flow from higher Venezuela output.

- Cleveland-Cliffs jumped over 4% after a Morgan Stanley upgrade tied to a deal with Korean steelmaker POSCO.

- Southwest Airlines surged nearly 3.75% following a rare double-upgrade from JPMorgan, citing expectations for strong 2026 earnings.

- Lam Research climbed over 8.5% after Goldman Sachs raised its price target amid broad strength in chip equipment stocks.

- CG Oncology soared nearly 30% after the cancer drugmaker pulled the publication of data from the Phase 3 trial of its bladder cancer treatment up to the first half of this year.

Friday's Movers to the Downside:

- Rio Tinto fell over 5% after reports it's in early merger talks with Glencore to form the world's biggest mining company.

- General Motors retreated 2.65% after flagging more than $7 billion in Q4 charges, driven by EV cutbacks and a $1.1 billion writedown tied to its China joint venture.

- WD-40 declined nearly 7%, sliding to a 52-week low after missing expectations in its first-quarter earnings report.

Notable Earnings to be announced Jan 12th – 16th:

The actual date may vary, so do confirm with your broker to confirm. If a trader wishes to open a position to participate in earnings announcements, it is important to check whether the earnings are released BEFORE the markets open or AFTER the markets close on the date of earnings.

This week marks the official kickoff of the Q4 2025 Earnings Season. As is tradition, major U.S. banks and airlines will lead the way.

Key Themes to Watch This Week:

- The "AI Verification": On Thursday, TSMC will reveal if the "AI gold rush" is still accelerating or if chip demand is finally starting to level off.

- Credit Card Delinquencies: Analysts will be scouring the JPMorgan and Bank of America reports to see if American families are starting to struggle with debt after the holiday season.

- The Travel "Write-off": Delta is expected to address how the late-December government shutdown and winter storms affected their bottom line.

Monday: –

Tuesday: JPM / DAL / BK

Wednesday: BAC / WFC / C

Thursday: TSMC / GS / MS / BLK

Friday: –

Key Economic Indicators due from Jan 12th – 16th:

This week is a critical "data dump" for the markets. Because of the lengthy U.S. government shutdown in late 2025, federal agencies are still playing catch-up, meaning we are getting a mix of current December data and delayed reports from October and November.

The most important day to watch is Tuesday, January 13, when we get the first "clean" inflation reading in months.

Here is the schedule of notable economic data releases:

Monday:

NY Fed Survey of Consumer Expectations which is basically a gauge of what the public expects inflation to be in the future.

Tuesday:

Consumer Price Index (CPI) - Dec. This will be the first complete inflation look since the shutdown. Expectation: 2.7% YoY.

New Residential Sales (Delayed Oct/Nov). This number provides insights into housing demand during the high-rate period.

Wednesday:

Retail Sales (Nov)Delayed. This number shows how strong the holiday shopping season actually was.

Producer Price Index (PPI - Nov) Delayed. This is a measure of wholesale inflation and business costs.

Business Inventories / Social Financing which is an indication of the general health of corporate stock levels and credit.

Thursday:

Weekly Initial Jobless Claims which represents the most frequent pulse on the current labor market.

Empire State & Philly Fed Manufacturing Regional surveys that often predict national manufacturing trends.

Friday:

Industrial Production (Dec). This will provide a measure of the output of factories, mines, and utilities.

Closing Thoughts

AI data centers are energy hogs, so Meta Platforms has turned to nuclear fuel to meet this demand. META inked agreements with nuclear power providers Vistra and Oklo, as well as Bill Gates-founded startup TerraPower, which will collectively power Meta's Prometheus supercluster computing system in Ohio. This fusion of artificial intelligence and atomic energy sent nuclear stocks to explosive highs.

Meta's massive data center should come online later this year, and by 2035, today's nuclear deals are projected to infuse Prometheus with another 6.6 gigawatts of power. And just in case that's not enough to keep Prometheus firing on all cylinders, Meta already signed another deal last year with Illinois-based power plant Constellation to provide another 1.1 gigawatts of nuclear energy for 20 years.

Meta isn't the only Big Tech firm beefing up its atomic energy supply in the name of AI. Google hooked up its data centers with a new fleet of nuclear reactors by Kairos Power, Amazon teamed up with Energy Northwest and Dominion Energy to build a cluster of fission-powered small modular reactors, and Microsoft is looking to revive Three Mile Island.

AI's growth shows no signs of slowing down, and it looks like the nuclear sector will continue to ride its coattails and rake in the dough as long as AI fever lasts.

Questions / Comments

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use support@ivolatility.com.

Previous issues are located under the News tab on our website.