Tacos Are on the Menu Again

January 26, 2026

Market Roundup for the Week

The trading week of January 19–23, 2026, was a "zigzag" affair where heightened geopolitical uncertainty—specifically involving Greenland—stole the spotlight from traditional economic data and the start of the Q4 earnings season. President Donald Trump reiterated his interest in Greenland during remarks at the World Economic Forum in Davos, Switzerland. Trump said he intends to begin negotiations "immediately" to pursue control of the territory, adding to broader global uncertainty that weighed on investor sentiment.

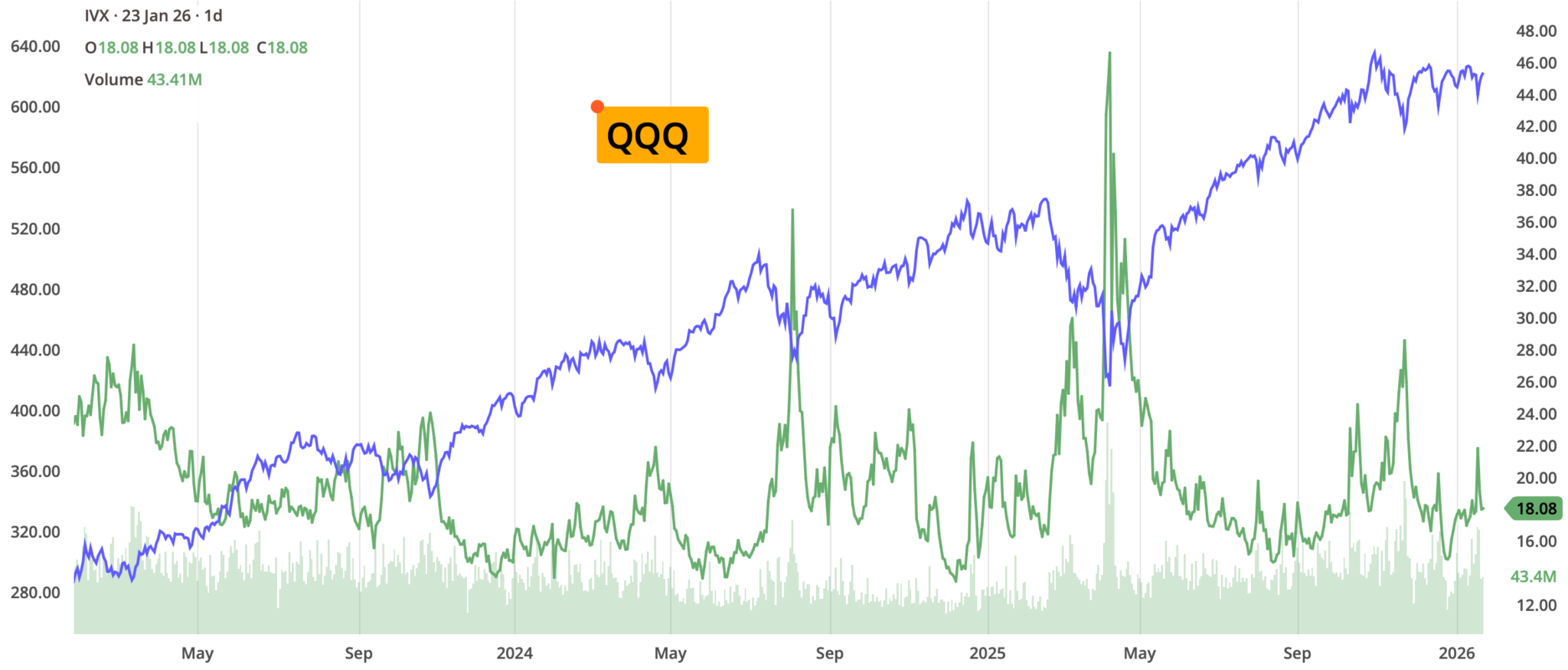

The major indices ended the week mixed, with the S&P 500 and Dow recording their second straight weekly loss, while the Nasdaq managed a fractional gain. Markets digested a steady stream of earnings reports, while safe-haven demand continued to support precious metals. Gold extended its rally, moving closer to the $5,000-an-ounce level as investors sought refuge amid rising geopolitical tensions and renewed concerns over the Federal Reserve's independence.

Strategy Corner

Based on last week's market movements, here are some trading ideas and option strategies for the readers' consideration. The strategies can be scaled bigger (or smaller), according to individual account size.

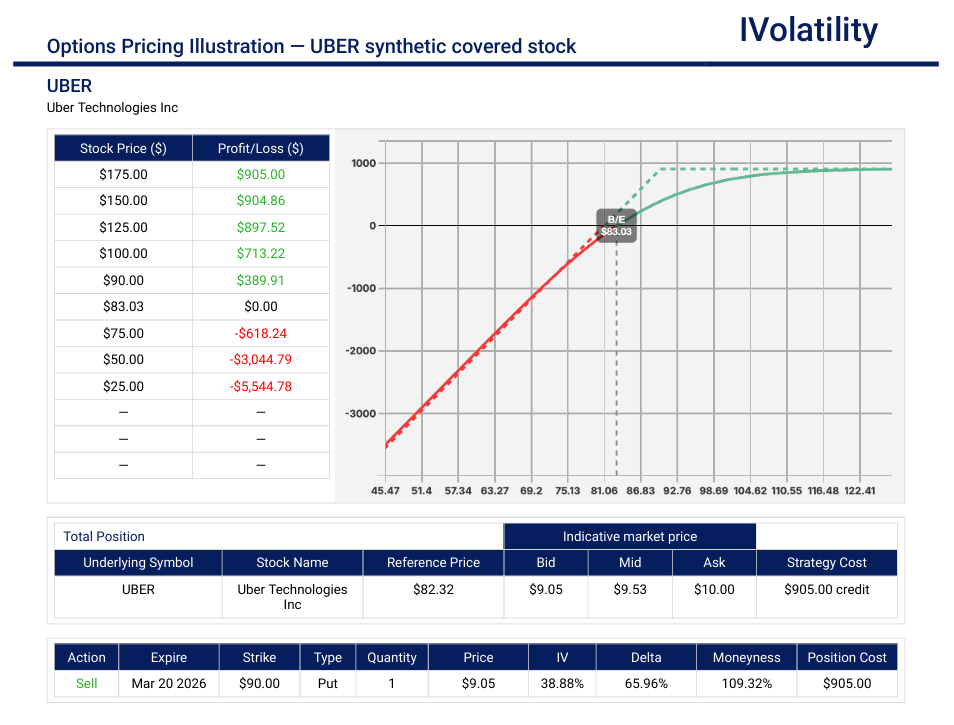

- UBER (closed at 82.30 on Friday, Jan 23rd)

The outlook for UBER in 2026 is a classic battle between strong current financials and "future fear." While the company is currently a "cash cow" with massive growth, the stock price is being heavily weighed down by the looming shadow of Tesla and Waymo. As of late January 2026, the majority of Wall Street remains bullish, though price targets have been trimmed slightly to account for the "Tesla Wildcard."

If a trader believes that Uber will successfully become the "Amazon of Transportation" (the platform where everyone else puts their robotaxis), the stock is currently "on sale."

Sell the Mar20 90put for about $950.

This is the synthetic equivalent of a covered stock position, deploying about ⅓ of the capital requirement.

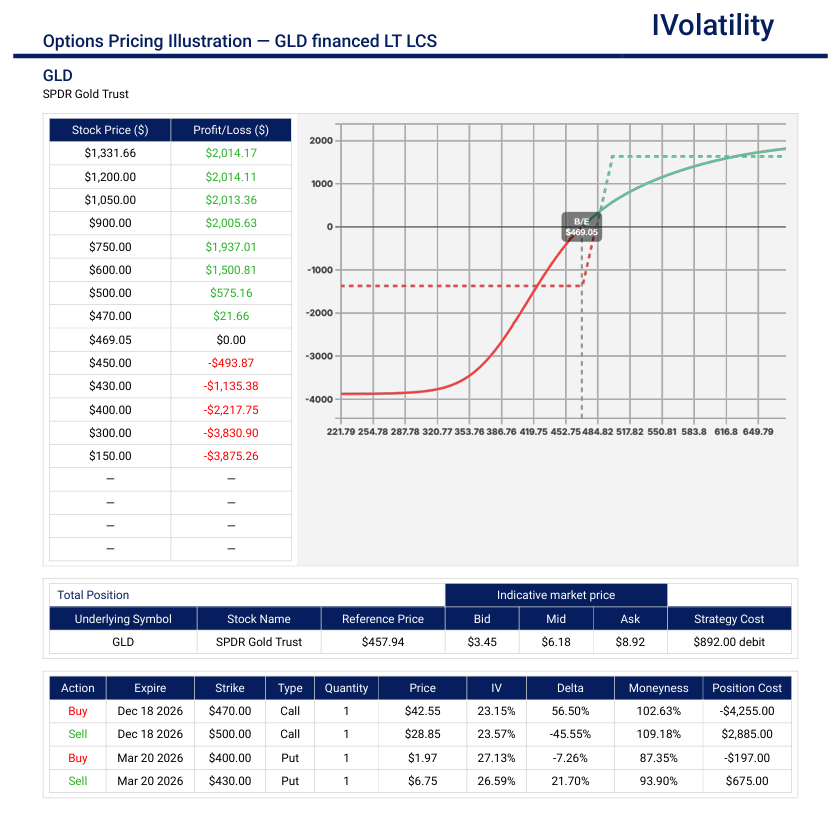

PnL Calculator from the IVolLive Web - GLD (closed at 458.01 on Friday, Jan 23rd)

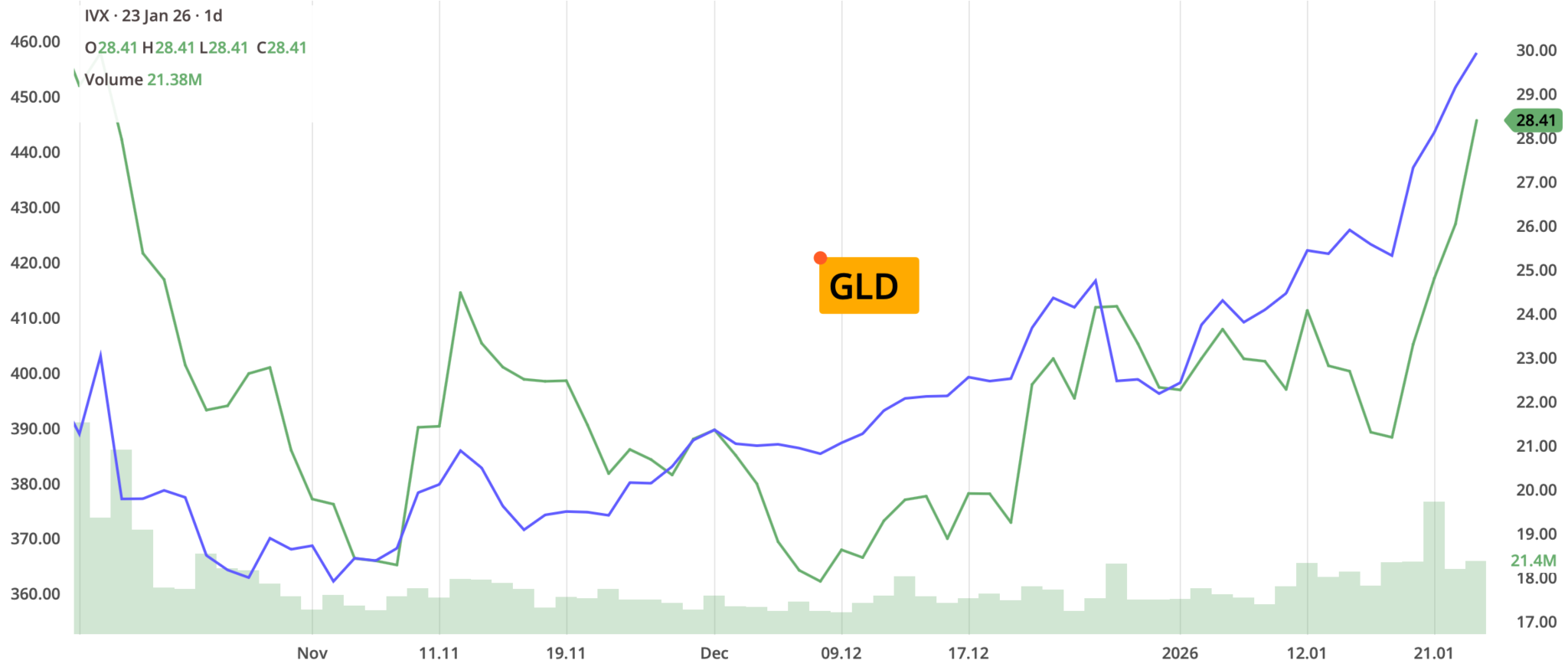

The outlook for GLD for the remainder of 2026 is exceptionally bullish, with major financial institutions significantly raising their price targets in just the last few days. After gold surged over 60% in 2025, most analysts expect the momentum to continue toward a major psychological milestone of $5,000 per ounce. Goldman Sachs has set a $5400 price target for spot gold. If that target is reached, GLD would likely trade in the $500–$515 range by year-end.

If a trader would like to get bullish over the year, then the following position could be productive.

Buy the Dec18 470/500 long call spread for about $11.20

Finance this purchase by selling monthly put spreads against it. Start with the sale of the Mar20 400/430 put spread for about $500.

Net starting cost is about $620.

PnL Calculator from the IVolLive Web

Movement of the Major Market Indices:

| INDEX | UP | DOWN |

| SPY | 0.73% | |

| QQQ | 1.79% | |

| IWM | 1.39% | |

| DIA | -0.05% | |

| GLD | 7.55% | |

| BTC/USD | -6.14% | |

| TLT | -0.93% | |

| Crude Oil | 3.94% | |

| VIX | -20.41% |

Movement of the Major Sectors:

| SECTOR | UP | DOWN |

| TECH (XLK) | 1.40% | |

| FINANCIALS (XL) | -1.04% | |

| INDUSTRIALS (XLI) | -0.33% | |

| ENERGY XLE | 2.28% | |

| HEALTHCARE (XLV) | 2.26% | |

| UTILITIES (XLU) | -1.32% | |

| MATERIALS (XLB) | 3.35% | |

| REAL ESTATE (XLRE) | -1.61% | |

| CONSUMER STAPLES (XLP) | 1.17% | |

| CONSUMER DISCRETIONARY (XLY) | 2.3% |

Notable gainers for the week of January 19th – 23rd:

The week was characterized by significant gains in commodities (precious metals) and specific technology sectors, driven by geopolitical shifts and fresh earnings data. While major indices saw volatility due to discussions surrounding a 10% cap on credit card interest rates and Federal Reserve leadership changes, several individual stocks surged.

Hecla Mining (HL) rose over 29%. Geopolitical tensions and a weakening US dollar drove traders to safe-haven assets like gold and silver.

First Majestic Silver (AG) rose over 14%, probably benefiting from a massive rally in silver prices and increased investor speculation regarding upcoming Fed rate cuts.

Moderna (MRNA) rose over 17%. The company released positive five-year follow-up data for its melanoma vaccine in combination with Merck's Keytruda.

Micron Technology (MU) rose over 13%. The company received a major analyst upgrade to Outperform and benefited from a sector-wide chip rally following the US-Taiwan trade deal.

Generac (GNRC) rose 10%. Severe winter weather forecasts and concerns over power grid stability drove demand for backup power solutions.

Notable losers for the week of January 19th – 23rd:

The week saw broad-market pressure as investors grappled with aggressive tariff rhetoric and a disappointing start to the tech earnings season. The Dow and S&P 500 both notched their second consecutive weekly losses, driven largely by a "risk-off" sentiment following fresh trade threats and manufacturing concerns.

Intel (INTC) plunged about 17% after issuing a dismal Q1 2026 forecast. CEO Lip-Bu Tan cited severe supply constraints and poor yields on its next-gen 18A manufacturing nodes.

NetApp (NTAP) sold off around 9.5% as part of a broader retreat in data storage and infrastructure stocks following Trump's "tough words" regarding trade with U.S. allies.

Wipro (WIPRO) dropped over 8% and led the decline in the IT sector as investors pivoted away from large-cap Indian tech firms amid fears of 10–25% tariffs on Indian exports.

Dell Technologies (DELL) suffered an 8% decline from sector-wide rotation out of hardware providers as manufacturing supply chain concerns resurfaced.

3M Co. (MMM) fell 7% as global trade tensions weighed on sentiment for multinational conglomerates with high exposure to European markets.

Lululemon (LULU) dropped 6.5% as the company faced pressure along with consumer discretionary stocks and investors feared that new tariffs would significantly increase import costs for apparel.

Netflix (NFLX) dropped about 5%. Despite record subscriber growth (325M+), shares fell due to softer-than-expected Q1 guidance and a pause in buybacks to fund the $83 billion acquisition of Warner Bros. Discovery.

Review selected market indices below:

Daily Notable Market Action

Monday's Markets and News:

The capital markets were closed in observance of Martin Luther King national holiday. However, the rest of the world were jittery over President Trump's threats to slap eight European nations with tariffs if they won't let the US have Greenland. European stocks fell, and gold and silver—havens where spooked investors park their cash—continued to hit record highs.

Tuesday's Markets and News:

There was little or no green to be seen in the markets today. The VIX broke above 20 for the first time since November as investors digested a slew of geopolitical and market news.

Despite governmental claims that tariffs will be paid for by foreign companies, a news report revealed that Americans absorbed 96% of tariff costs.

Today, world leaders assembled at Davos for the World Economic Forum. The cloud hanging over the assembly is President Trump's threats to take over Greenland and his vow to inflict tariffs on countries that stand in his way.

Rising geopolitical tensions meant that the "Sell America" trade was back once again. Stocks sank today, while bond prices fell and yields jumped. The dollar plummeted, while the euro rose against the dollar.

Tuesday's Movers to the Upside:

- Expand Energy rose nearly 5% as natural gas prices surged 25% during the recent cold snap.

- Intel advanced nearly 3.5% after dual upgrades from HSBC and Seaport, and with analysts betting server-chip demand will grow 30% to 40% annually in 2026.

- Sandisk rallied 9.5% after Citi nearly doubled its 12-month price target to $490, citing steady hyperscaler spending on cloud data centers.

- IAMGOLD climbed over 15%, AngloGold Ashanti rose nearly 8%, and Gold Fields advanced 7% as investors leaned into the rising prices of gold.

Tuesday's Movers to the Downside:

- Lululemon dropped nearly 6.5% after pulling a workout line following complaints over fit and transparency.

- 3M fell nearly 7% as tariff worries overshadowed a solid Q4 and reignited concerns about its consumer business.

- Logitech, NetApp and Hewlett Packard Enterprise all sagged around 4-5% after Morgan Stanley turned cautious on IT hardware.

- Nvidia eased over 4% as market jitters and fresh doubts about the AI boom weighed on sentiment.

Wednesday's Markets and News:

Today's market action erased Tuesday's losses and put the S&P back into positive territory. One could characterize this move as a serious case of whiplash and probably why traders still sought safety in gold, powering the precious metal above $4,800 per ounce for the first time ever.

The Supreme Court heard oral arguments in the case of Fed Governor Lisa Cook, and justices did not appear to be too fond of the government's case.

In remarks at the World Economic Forum in Davos today, President Trump called for "immediate negotiations" over his latest hyperfixation of taking over Greenland. He declared that he would not use the military to take over the territory. Stocks immediately rebounded after those comments, which gave investors a sense of assurance that at least some diplomatic normalcy was still in place after the double-whammy of Nicolas Maduro's ousting and the president's heated rhetoric about Greenland.

That "normalcy" was soon shattered by the president's stunning announcement that he had reached an agreement with NATO Secretary-General Mark Rutte about the future of Greenland.

"Based on this understanding, I will not be imposing the Tariffs that were scheduled to go into effect on February 1st". In remarks at the World Economic Forum in Davos today, President Trump called for "immediate negotiations" over his latest hyperfixation—taking over Greenland—and said he won't use the military to take over the territory.

Stocks immediately rebounded after those comments, which gave investors a sense of assurance that at least some diplomatic normalcy was still in place after the double-whammy of Nicolas Maduro's ousting and the president's heated rhetoric about Greenland.

Wednesday's Movers to the Upside:

- Intel rallied over 11% as investors looked ahead to the company's upcoming earnings report.

- United Airlines jumped over 2% following a strong fourth quarter and forecasts of record earnings this year on solid travel demand.

- Interactive Brokers Group climbed 6% after it beat fourth-quarter expectations, helped by heavy trading activity.

- Progress Software gained over 10.5% on a strong fourth-quarter earnings report.

- Lucid surged nearly 18% after the luxury EV maker said it expanded its partnership with Rockwell Automation to support manufacturing growth in Saudi Arabia.

Wednesday's Movers to the Downside:

- Ubisoft fell over 11% after the company canceled six games, shut two studios, and confirmed additional layoffs as part of a major restructuring.

- Xerox dropped over 10% after the company announced plans for a $250 million securities offering.

- MakeMyTrip slid over 12% after mixed fiscal third-quarter results, with higher tax and financing costs pushing profits down over 70% from a year earlier.

Thursday's Markets and News:

The rally continued across the market following a thaw in international relations. The jubilation was strongest in the Russell 2000, which beat the S&P 500 for a 14th straight session and posted its 8th record close of the new year.

Investor exuberance extended gold's rally, pushing the metal above $4,900 per ounce just a day after hitting $4,800 for the first time ever. Meanwhile, natural gas prices continued their upward move, skyrocketing nearly 70% over the past five days. This was the best week ever for natural gas as the US braced for a winter storm this weekend.

Thursday's Movers to the Upside:

- Plug Power popped over 16% after its CEO announced he'll host an "Ask Me Anything" Q&A on Reddit.

- Meta Platforms advanced over 5.5% as Jeffries analysts pointed to its valuation discount versus Alphabet.

- Moderna surged over 4% as investors welcomed positive results from a cancer vaccine trial.

- Alibaba gained over 5% after announcing plans to restructure its AI chip unit into a standalone business ahead of a potential IPO.

- Karman Holdings climbed over 6% after raising fiscal 2026 revenue guidance and expanding into autonomous maritime technologies.

- Datadog popped over 6% after Stifel upgraded the stock from Hold to Buy, citing potential stronger-than-expected fourth-quarter results.

Thursday's Movers to the Downside:

- Abbott Laboratories fell over 10% after fourth-quarter revenue missed expectations, dragged down by continued weakness in its Nutrition segment.

- GE Aerospace slipped over 7% despite a Q4 earnings and sales beat, as investors focused on its outlook for low-double-digit revenue growth in 2026.

- McCormick & Company dropped over 8% after warning that higher input and tariff-related costs are expected to pressure profits this fiscal year.

- Mobileye Global slid nearly 3.5% after issuing full-year 2026 revenue guidance that came in below analysts' expectations.

Friday's Markets and News:

A wild week ended on a high note for the S&P 500, and the index outperformed the Russell 2000 for the first time this year. But the S&P 500 still declined over the last five days—concluding its first back-to-back weeks of losses since June 2025.

Gold and silver were the stars of the show and platinum also hit a new record high today. Copper, tin, and nickel all surged higher.

The US dollar posted its worst week since May thanks to the "Sell America" trade, while bitcoin briefly poked its head above $90,000 before getting pushed back down.

Friday's Movers to the Upside:

- Nvidia rose 1.5% after Chinese officials told major domestic tech firms they could prepare orders for H200 AI chips.

- Fortinet climbed over 5% following an upgrade by TD Cowen, with analysts noting that fears around rising memory prices are overdone.

- Life360 surged over 24% after the family locator app added 4.2 million users in its fourth quarter.

- Booz Allen Hamilton rose nearly 7% on strong guidance, despite quarterly sales falling 10% year over year.

Friday's Movers to the Downside:

- Intel fell nearly 20% after issuing weak guidance and warning of a supply shortage.

- Capital One Financial slid over 7.5% after agreeing to acquire payments startup Brex for $5.15 billion.

- Walt Disney dropped 2% amid leadership uncertainty, with the company signaling it will appoint a new CEO in early 2026.

- Bausch Health plunged nearly 10% after disappointing Phase 3 trial results for a hepatic encephalopathy treatment.

- Moderna declined nearly 6% as the company signaled a pullback from late-stage infectious disease vaccine trials.

Notable Earnings to be announced Jan 26th – 30th:

The actual date may vary, so do confirm with your broker to confirm. If a trader wishes to open a position to participate in earnings announcements, it is important to check whether the earnings are released BEFORE the markets open or AFTER the markets close on the date of earnings.

The week of January 26th is one of the busiest of the Q4 earnings season, featuring four of the "Magnificent Seven" and several industrial and financial titans. Investors will be focused on the "Big Tech" pulse via Netflix and the health of the consumer through major credit card and retail names.

Monday: RYAAY / BOH / NUE / STLD / WAL

Tuesday: UNH / RTX / BA / UNP / GM / UPS / KMB / STX /FFIV

Wednesday: T / ADP / PGR / GD / MSFT / META / TSLA / IBM / NOW / LRCX / LVS / WM

Thursday: CAT / MA / BX / SNY / NOC / SO / HON / HSY / AAPL / V / AMZN / GILD / TMUS / MDLX / EW

Friday: XOM / CVX / AXP / VZ / CL / CHTR / BAH

Microsoft, Meta, and Google (reporting nearby) will be under the microscope to see if their massive AI investments are finally translating into significant bottom-line growth.

With Boeing, Caterpillar, and General Motors reporting, traders will get a clear look at how industrial demand is faring amidst shifting interest rates.

Starbucks and American Express will provide insights into consumer resilience as to whether high-end and everyday consumers are still spending freely.

Key Economic Indicators due from Jan 26th – 30th:

The coming week could be critical for the economy. The first Federal Reserve interest rate decision of the year will be revealed along with a "re-opening" of the data spigot as government agencies catch up on reports delayed by the recent 43-day federal shutdown. The daily schedule of notable economic data releases is:

Monday:

Durable Goods Orders (Nov): A key measure of manufacturing activity. This report was previously delayed by the government shutdown and is expected to show a modest rebound.

Chicago Fed National Activity Index: A monthly index designed to gauge overall economic activity and related inflationary pressure.

Dallas Fed Manufacturing Index (Jan): A regional outlook on the health of the manufacturing sector.

Tuesday:

CB Consumer Confidence (Jan): A high-impact report measuring how optimistic consumers are about the economy and their personal financial situation.

New Residential Sales (Nov): Another delayed report providing insight into the health of the housing market toward the end of 2025.

S&P Case-Shiller Home Price Index (Nov): A leading indicator of housing prices across 20 major U.S. cities.

Wednesday:

FOMC Interest Rate Decision: The Federal Reserve is widely expected to hold the target range steady at 3.50% – 3.75%.

Fed Chair Jerome Powell Press Conference: Markets will be hanging on every word for clues about potential rate cuts in March or June.

EIA Crude Oil Inventories: The weekly update on U.S. oil supplies.

Thursday:

Weekly Initial Jobless Claims: A real-time look at the health of the labor market.

U.S. International Trade Balance (Nov): A delayed look at the deficit/surplus in goods and services.

Wholesale Inventories & Factory Orders (Nov): Further data points helping to refine the final GDP calculations for the previous quarter.

Friday:

Producer Price Index (PPI) (Dec): A crucial inflation report that measures the change in the price of goods sold by manufacturers.

Closing Thoughts

While data centers may not be the construction projects of anyone's dreams, they are the ones commercial builders are counting on this year. The Wall Street Journal reports that construction consulting company FMI projects that spending on building new offices, hotels, apartments, and warehouses will fall, but spending on data center construction this year will increase by 23% compared to 2025 as tech companies race to build out infrastructure. That would elevate data centers to more than 6% of non-residential construction—compared to just 2% in 2023.

And it may be a dream come true for builders, after all. One construction company president told the WSJ that while most major commercial building projects cost hundreds of millions of dollars and require hundreds of workers, data centers can cost north of $1 billion and need thousands of workers. With cash readily flowing from Big Tech, the only limitation may be finding those laborers.

Questions / Comments

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use support@ivolatility.com.

Previous issues are located under the News tab on our website.