The Roller Coaster Ride Continues

February 16, 2026

Market Roundup for the Week

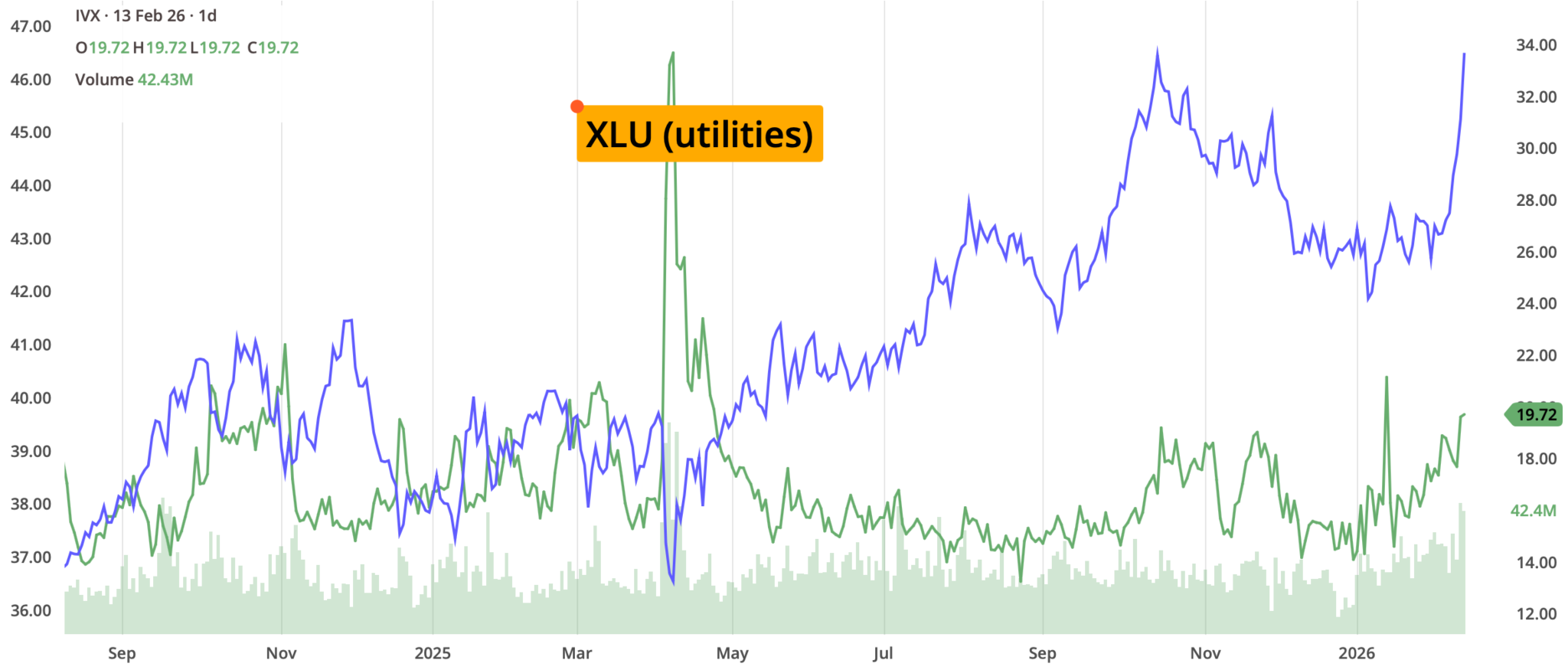

Last week's market movement can best be characterized as a "Great Rotation"—a sharp, fear-driven migration away from the high-flying AI and technology sectors into "Old Economy" value and defensive plays. While the week was punctuated by the Dow Jones crossing the 50,000 milestone, the underlying sentiment was anxious, marked by a significant spike in volatility as investors questioned the immediate returns on massive AI investments.

A new narrative related to the "AI disruption" took hold this week. Could AI not just assist software and white-collar industries, but obsolete them? This was apparently enough to trigger a sell-off in software and financials, wiping out nearly $1 trillion in market value from the software index alone.

The Jobs Report was rescheduled due to a government shutdown. When released, the January payrolls blew past expectations (130,000 vs. 70,000 expected) and this "good news is bad news" scenario forced traders to push back expectations for Federal Reserve interest rate cuts, hitting high-multiple growth stocks.

Reports that tech giants like Amazon and Google plan to spend a combined $380 billion on AI infrastructure in 2026 seems to have led to investor fatigue. Markets shifted from cheering AI potential to demanding rigorous proof of ROI.

The markets had a euphoric start where tech recovered from previous lows and the Dow hit 50,000. Then a mid-week rout occurred where the blockbuster jobs data and AI-skepticism led to the worst two-day stretch for the Nasdaq since late 2025. At week's end, a cooler-than-expected CPI report (2.4% vs 2.6%) acted as a relief valve, allowing the S&P 500 to pare its losses and Treasury yields to retreat to 4.05%.

The week was a reality check for a market that had been "drunk" on AI optimism. It shifted from a speculative rally to a "show me the money" environment. The fact that the equal-weighted S&P 500 outperformed the tech-heavy version suggests that the "Magnificent 7" era is facing its toughest structural challenge yet.

Strategy Corner

Based on this week's market movements, here are some trading ideas and option strategies for the readers' consideration. The positions can be scaled bigger (or smaller) to suit individual account size.

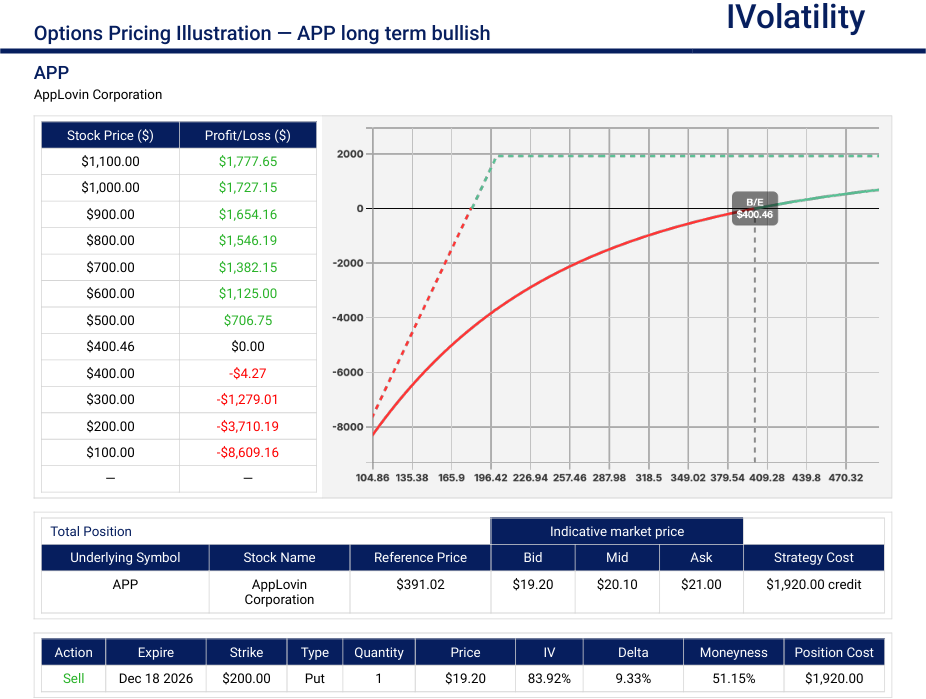

- APP (closed at 390.78 on Friday, Feb 13th)

Getting bullish on AppLovin (APP) for a December expiration is a high-conviction "rebound" play, but it carries a specific set of risks given how the stock has started 2026.

After a monster 2024 and 2025, the stock has been slammed recently—dropping from over $700 in December to roughly $450 this week. APP is a cash machine. It reported $3.95B in annual FCF (up 91% YoY). For a December expiration, an investor is seen as betting that the company uses this cash to aggressively buy back shares, which provides a natural floor for the stock.

Sell the Dec2026 200 put and collect around $2000/contract in premium. The probability of profit for this position is about 75%.

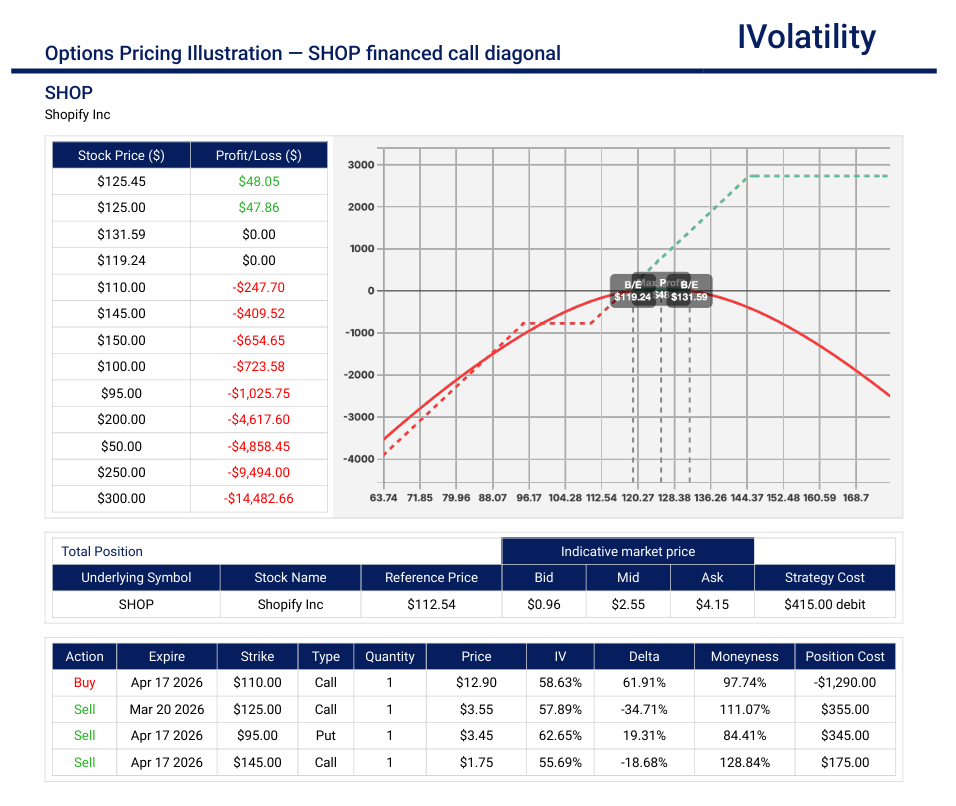

PnL Calculator from the IVolLive Web - SHOP (closed at 112.66 on Friday, Feb 13th)

Getting bullish on Shopify (SHOP) for a March or April expiration is a classic "buy the dip" play. As of February 14, 2026, the stock is trading around $112, having fallen nearly 34% in the last month—largely due to a post-earnings sell-off on February 11th. Despite the price drop, Shopify's Q4 results were actually strong and beat analyst estimates. Management announced a massive share repurchase program. This provides a "synthetic floor" for the stock; every time it dips, the company itself is likely stepping in to buy, which can fuel a quick bounce.

If a trader would like to get bullish, buying a call diagonal and partially financing the purchase with the sale of a strangle could be a productive strategy.

Buy the April 110call / Sell the March 125call for about $868/contract.

Sell the April 95/145 strangle for about $611/contract.

PnL Calculator from the IVolLive Web

Movement of the Major Market Indices:

The week of February 9th through 13th, 2026, was characterized by extreme volatility and a significant "rotation" out of technology into "old economy" sectors. While the week started with a historic milestone for the Dow, a series of economic data points and AI-related fears pulled the broader indices into the red by Friday.

| INDEX | UP | DOWN |

| SPY | -1.28% | |

| QQQ | -1.27% | |

| IWM | -0.78% | |

| DIA | -1.15% | |

| GLD | 1.57% | |

| BTC/USD | -2.38% | |

| TLT | -3.8% | |

| Crude Oil | -1.04% | |

| VIX | 18.41% |

Movement of the Major Sectors:

| SECTOR | UP | DOWN |

| TECH (XLK) | -4.75% | |

| FINANCIALS (XL) | -4.81% | |

| INDUSTRIALS (XLI) | 0.82% | |

| ENERGY XLE | 1.86% | |

| HEALTHCARE (XLV) | 1.79% | |

| UTILITIES (XLU) | 3.76% | |

| MATERIALS (XLB) | 3.49% | |

| REAL ESTATE (XLRE) | 3.60% | |

| CONSUMER STAPLES (XLP) | 1.70% | |

| CONSUMER DISCRETIONARY (XLY) | 0.39% |

Notable gainers for the week of February 9th–13th:

While the major averages like the S&P 500 and Nasdaq were dragged down by a tech rout during the week of February 9–13, 2026, there were standout "pockets of green." The week was defined by a "Great Rotation"—a massive exit from AI-driven growth stocks into "Old Economy" value sectors and defensive safe havens.

Fastly, Inc. (FSLY) rose almost 100% to become a top momentum play in February, benefiting from "mean-reversion" flows as investors looked for cheaper software alternatives.

Tri Pointe Homes (TPH) rose almost 30%. Even though housing demand remained resilient despite rate volatility, the sector gained on strong forward guidance.

PG&E Corp (PGE) was up almost 10% after reporting strong 2025 earnings and a massive $73B capital investment plan for 2026–2030 focused on grid modernization.

Palantir (PLTR) jumped about 4.5%. It was a "dip-buyer favorite" on Friday after investors decided its AI execution was superior to "legacy" software firms.

Gold (GLD) rose 1.5% and broke past the $5,100 psychological barrier early in the week.

Notable losers for the week of February 9th–13th:

While the week saw the Dow cross the historic 50,000 mark, it was a brutal period for many high-flying growth stocks. The "Notable Losers" were largely defined by a massive AI skepticism movement and reactions to the February 11th earnings reports.

AppLovin (APP) plummeted 18% despite a "beat and raise" quarter on Feb 1. Investors were spooked by management's guidance, which implied a deceleration in growth. Having surged over 700% in the prior two years, the market treated anything less than perfection as a "sell" signal.

Shopify (SHOP) dropped 13% even though revenue expectations were exceeded. Management guided for higher spending on AI initiatives in Q1, leading investors to fear that the path to profitability might be slower than hoped and fear of margin pressure.

Cisco Systems (CSCO) dropped over 12% after issuing weak guidance for the remainder of 2026. A side effect of the AI hardware rush could be resulting in higher internal expenses and potential pricing pressure on computer memory.

Morgan Stanley (MS) shed nearly 5% due to financials being hit by fears that AI-driven wealth management tools might undercut the need for traditional advisory services, leading to fee compression.

CBRE Group (CBRE) dropped nearly 9%. Logistics and Real Estate services face "disruption jitter" sell-offs, as traders bet that AI would streamline these middle-man industries, reducing their traditional profit margins.

Novo Nordisk (NVO) shed 14% after warning that 2026 sales for Ozempic/Wegovy could decline due to stiffer competition and U.S. government pricing pressure.

PayPal (PYPL) fell 14% after missing earnings estimates and providing a weak forecast, struggling to prove its growth story against Apple Pay and AI competitors.

Amazon (AMZN) dropped nearly 6% after announcing a massive $200 billion capex plan for 2026. Investors balked at the sheer cost of staying in the AI arms race.

Review selected market indices below:

Daily Notable Market Action

Monday's Markets and News:

Equities rebounded following a turbulent week, propelled higher by big tech stocks. The Dow continued its hot streak, closing at another new record high—and Wall Street says there's more gains on the way (we'll talk about that later).

Oil climbed after the US Department of Transportation warned that ships should avoid Iranian waters in the Strait of Hormuz, a key waterway for crude oil shipments from the Middle East. Gold climbed back above $5,000 per ounce as investors bought the dip, while silver enjoyed a big bounce.

Bitcoin's recovery slowed, though it also managed to rise above a key psychological support level at $70,000.

Monday's Movers to the Upside:

- Oracle surged nearly 10% as D.A. Davidson upgraded the stock to Buy, pointing to upside from its OpenAI partnership.

- Kroger rose nearly 4% after naming former Walmart executive Greg Foran as its new CEO.

- Valaris jumped nearly 35% and Transocean climbed nearly 6% on news of a $5.8 billion all-stock merger that would create a combined 73-rig offshore drilling fleet.

- STMicroelectronics gained nearly 9% as the company expanded its partnership with AWS to support AI and cloud data centers.

- Nexstar and Tegna both rose nearly 9% with Trump backing the proposed deal between the two TV station operators.

- Samsung jumped nearly 5% after kicking off large-scale production of its new memory chip.

Monday's Movers to the Downside:

- Hims & Hers Health fell over 16% after Novo Nordisk filed a lawsuit against the telehealth company seeking to block knockoff versions of Ozempic and Wegovy.

- Monday.com slid nearly 21% despite beating quarterly expectations, weighed down by a weaker-than-expected 2026 outlook.

- Cleveland-Cliffs dropped over 16% after reporting a Q4 EBITDA loss and flat year over year sales.

- Kyndryl plummeted over 50% following the sudden departure of its CFO amid an accounting review due to accusations that it had manipulated its finances.

- Lab equipment provider Waters Corp slid nearly 14% after forecasting first-quarter profit below Wall Street estimates.

- Workday fell over 5% as CEO Carl Eschenbach stepped down, with co-founder Aneel Bhusri set to take over.

Tuesday's Markets and News:

An early rally petered out by mid-afternoon due to fears that yet another industry is about to get decimated by AI, though the Dow managed to reach a new all-time high as investors rotate out of tech.

A slowdown in US retail sales during December pushed treasury yields lower, though it also raised the likelihood that the Fed will cut interest rates this year.

Tuesday's Movers to the Upside:

- SoftBank Group jumped nearly 6% after its telecom arm raised its full-year profit outlook.

- Harley-Davidson rose almost 4% even though Q4 results and 2026 guidance missed expectations, as investors took some comfort from an upbeat tone by new CEO Artie Starrs.

- Ferrari jumped 8% higher as earnings beat forecasts and management delivered solid margin guidance for the year ahead.

- Datadog popped nearly 14% after a Q4 beat and stronger-than-expected Q1 revenue outlook reassured investors on growth.

- Ichor Holdings rallied over 30% as robust demand for etch and deposition services (pivotal for making semiconductor chips) powered a Q4 earnings beat.

- Marriott International rose 8.5% on strong Q4 results, driven by international travel demand and continued growth in its loyalty program.

- UniFirst popped over 15% on reports that the uniform rental company may be acquired by rival Cintas.

Tuesday's Movers to the Downside:

- Coca-Cola fell 1.5% on weaker-than-expected quarterly revenue, its first miss in five years.

- British Petroleum slid nearly 6% after posting Q4 profit in line with expectations and suspending share buybacks as lower crude prices weighed on results.

- Amentum Holdings dropped over 12% after fiscal Q1 revenue and EBITDA both missed analyst consensus.

- ZoomInfo Technologies shares tumbled nearly 9.5% on weak Q1 EPS guidance that disappointed investors.

- Upwork fell nearly 20% as its first-quarter results and guidance came in well short of expectations.

- Financial services stocks took a hit after a new AI tax-planning tool sparked disruption fears, with Charles Schwab sliding over 7%, Raymond James Financial falling 8.75%, and Morgan Stanley losing 2.45%.

Wednesday's Markets and News:

The ongoing hiring spree in the healthcare industry helped propel the US to its strongest job growth in over a year, with 130,000 jobs added in January, while unemployment fell to 4.3%.

The strong jobs report pushed equities higher at the open, but stocks quickly gave up their gains. The S&P 500 failed to break through 7,000 yet again, while the Dow snapped a three-day winning streak.

Silver continued its strong upward surge.

Wednesday's Movers to the Upside:

- Cloudflare jumped over 5% after beating Q4 estimates and issuing upbeat guidance, citing AI-driven demand for its networking and security tools.

- SharkNinja rose over 5.5% following a stronger-than-expected holiday quarter, with management pointing to international expansion and two new product launches.

- Acadia Healthcare gained nearly 14% after hedge fund manager David Einhorn flagged the psychiatric facility operator as a recent buy.

- Vertiv climbed over 24% on 2026 guidance that topped expectations and a sharp pickup in fourth-quarter orders.

- BorgWarner advanced nearly 23% after announcing new deals to enter the AI data center power market.

- Generac added nearly 18% as strong 2026 sales guidance offset an earnings miss.

Wednesday's Movers to the Downside:

- Archer Aviation fell nearly 3% after Culper Research said flight logs show no recent ground or air testing and disclosed a short position in the flying taxi company.

- American Airlines slipped nearly 5% as its pilots' union challenged management over the carrier's strategy and operations.

- Mattel plunged nearly 25% after missing estimates, with weak US holiday sales weighing on results.

- Lyft declined nearly 17% despite a Q4 earnings beat, as rider metrics came in below expectations.

- Shopify slid 6.5% after missing earnings forecasts, even as holiday-driven revenue topped expectations and the company announced a $2 billion buyback.

- Moderna lost over 3.5% after the FDA declined to review its new flu vaccine.

Thursday's Markets and News:

Equities were hit hard after AI disruption fears reared their heads yet again, spreading from software to industries like wealth management, freight & logistics, and real estate.

Yields fell after home sales posted their largest monthly drop since 2022.

Oil tumbled thanks to a report from the International Energy Agency that crude demand will decline this years.

Gold sank as traders digested yesterday's strong jobs report.

Thursday's Movers to the Upside:

- Fastly surged over 72% on a strong fourth-quarter, with analysts upgrading the stock on growing AI potential.

- Anheuser-Busch rose nearly 4% after beating Q4 earnings expectations, as higher prices and premium growth offset a 1.5% drop in volumes.

- Crocs gained 19% after topping fourth-quarter estimates, signaling a rebound following last year's 22% slide tied to slowing growth and tariff concerns.

- Novocure jumped over 19% on FDA approval for its treatment targeting certain pancreatic cancers.

- Cognex advanced over 36% following a strong quarterly report, adding to signs of improving US manufacturing activity.

Thursday's Movers to the Downside:

- AST SpaceMobile fell over 15% after pricing $1 billion in convertible senior notes due 2036.

- QuantumScape dropped nearly 12% after it reported a fourth-quarter loss and guided to higher-than-expected capital spending in 2026.

- Baxter International slid nearly 16% on weaker-than-expected quarterly earnings and a subdued outlook for 2026.

- Lululemon declined 3.6% amid another "see-through" leggings issue, marking its second product quality controversy in under a month.

- Cisco fell over 12% despite beating estimates, as investors judged its AI momentum insufficient to clear Wall Street's elevated expectations.

- AppLovin plunged nearly 20% even after Q4 revenue jumped 66% to $1.66 billion and topped forecasts, with AI concerns weighing on its ad-tech outlook.

- Real estate stocks tumbled (notably CBRE Jones Lang LaSalle, Hudson Pacific Properties and Newmark) as investors rotated out of companies seen as vulnerable to AI disruption.

Friday's Markets and News:

Friday, the 13th, held a spot of good luck for equities, which bounced slightly higher after CPI came in cooler than expected.

President Trump said he plans to roll back tariffs on steel and aluminium goods.

Gold moved slightly higher today after the softer-than-expected inflation reading.

Friday's Movers to the Upside:

- Applied Materials rose 8% after topping quarterly earnings and guidance, with its CEO forecasting more than 20% growth in its semiconductor business.

- Roku climbed over 8.5% following a strong fourth-quarter report, as analysts lifted price targets on upbeat guidance for the year ahead.

- Rivian gained over 26.5% after beating earnings and revenue expectations, even as deliveries fell amidst a 36% drop in US EV sales.

- Moderna advanced over 5% on a strong Q4, helped by stronger-than-expected US sales of its Covid-19 vaccine.

- Instacart jumped over 9% after topping revenue estimates and issuing strong guidance, reporting its strongest gross transaction value in three years.

- Coinbase rose nearly 16.5% despite missing earnings expectations, as investors cheered a sharp rebound in free cash flow to $3.07 billion.

Friday's Movers to the Downside:

- Constellation Brands fell 8% after naming Nicholas Fink as its new CEO.

- Norwegian Cruise Line dropped 7.5% after announcing its own CEO change and receiving a downgrade from JPMorgan, which cited heavier promotions and softer first-quarter net yield growth.

- DraftKings slid 13.5% on a significant fourth-quarter earnings miss and issued cautious guidance for its fiscal 2026.

- Expedia Group declined 6.5% despite beating earnings, as the company flagged emerging AI-powered platforms as a potential competitive risk.

- Pinterest sank nearly 17% after its fourth-quarter report detailed tariff-related disruptions and pullbacks in advertising spending from major retailers.

Notable Earnings to be announced Feb 16th – Feb 20th:

The actual date may vary, so do confirm with your broker to confirm. If a trader wishes to open a position to participate in earnings announcements, it is important to check whether the earnings are released BEFORE the markets open or AFTER the markets close on the date of earnings.

The week of February 16th–20th features a heavy concentration of reports from the retail, software, and cybersecurity sectors.

Monday: Markets are closed for President's Day holiday

Tuesday: MDT / PANW / BLDR / CDNS / DVN

Wednesday: ADI / GRMN / WING / BKNG / DASH / CRVA

Thursday: WMT / DE / OXY / DBX

Friday: LNT / LAMR

Key Economic Indicators due Feb 16th – Feb 20th:

The daily schedule of notable economic data releases is:

Monday: President's Day holiday and US stock markets will be closed.

Tuesday: January retail sales

Wednesday: FOMC meeting minutes

Thursday: Weekly jobless claims and pending home sales

Friday: Q4 GDP estimate and Core PCE Price Index

Closing Thoughts

For something called "rare" earths, it is curious that stories about them are fairly common these days. Recently, the White House announced plans to create a $12 billion stockpile of critical minerals like gallium and cobalt in an effort to reduce US reliance on China. Dubbed Project Vault, the idea appears to have merit. The US already has a strategic oil stockpile, and in fact there's already a national stockpile of critical minerals dedicated solely to the country's defense industry needs. The difference is that Project Vault would be for civilian needs, focused on accruing critical minerals and rare earths for automakers, tech companies, and US manufacturers. The project already has the backing of several major corporations including General Motors, Boeing, GE Vernova, Corning, and more.

Critical minerals are just that: critical. They're found in everything from cellphones to automobiles to missiles. The problem is that China controls an estimated 85% of the world's critical mineral processing capacity, and while trade war rhetoric between the US and China has cooled lately, the Trump administration has made it clear that securing critical minerals is vital to national security.

That's why the government has made deals with the likes of MP Materials, USA Rare Earth, Trilogy Metals, and Lithium Americas over the last year. However, the recent Project Vault not only underscores the country's commitment to securing critical minerals beyond piecemeal, individual investments, it will also create more demand for mining these minerals in general. And if the trade war heats up once again, it could serve to keep critical mineral prices steady, in turn keeping business cycles for miners less volatile.

Questions / Comments

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use support@ivolatility.com.

Previous issues are located under the News tab on our website.