Data Solutions

IVolatility MBS Solutions

MBS Data & No-Model Data-Driven Analytics

IVolatility MBS products and services allow our clients to outsource time- and cost intensive data and quantitative tasks, enabling them to focus on what they do best - their core business—maximizing returns and serving their clients:

Analytics Solutions

Data Solutions

Analytics Solutions

Use Cases

Our clients leverage MBS Data Insights to generate additional revenue by conducting data-driven relative value, pricing, and risk management analyses. Additionally, they reduce costs by performing analyses and reporting in a more efficient, timely, and streamlined manner.

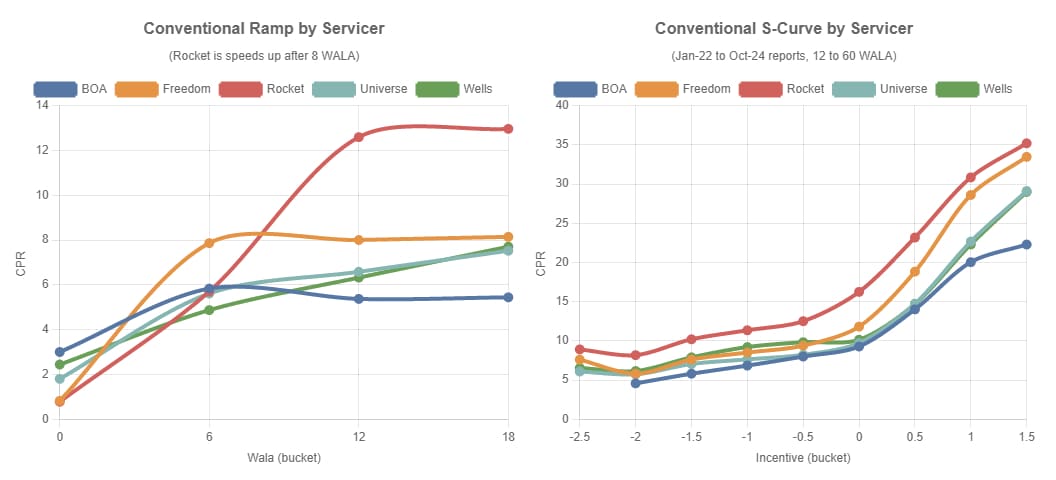

Prepayment Analysis

With just a few clicks, users can slice and dice MBS collateral data by numerous attributes to analyze CPR/VPR time series, S-curves, and RAMPs, helping them accurately price and manage their positions. Analyses across different products (e.g., FN, FH, GN, CRT) can be seamlessly combined for cross-product comparisons.

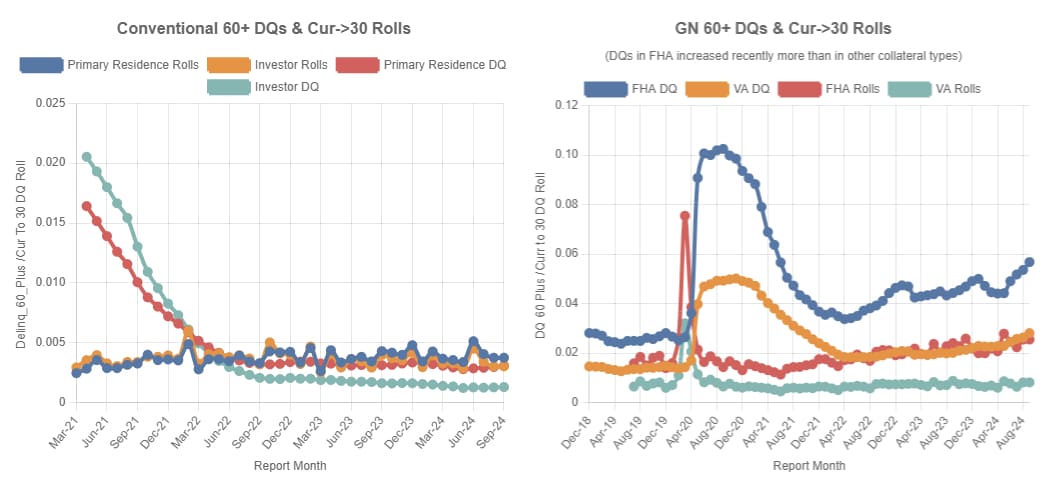

Credit Analysis

Extensive credit analyses are conducted for various collateral types, enabling users to analyze delinquencies, credit rolls, CDR, severity, and losses across multiple credit scenarios for both agency and non-agency products.

Monthly & Ad Hoc Reports

Our clients create customized reports based on their specific requirements (e.g., collateral performance comparisons against benchmarks). These reports are shared across their organizations through our online portal, Tableau, Excel tools, SFTP, or email.

Data Hosting

We host and enhance client and third-party data, delivering it in real time through Tableau, our intuitive Mortgage Analyzer user interface or Python development environment, empowering clients with immediate access to actionable data-driven insights.

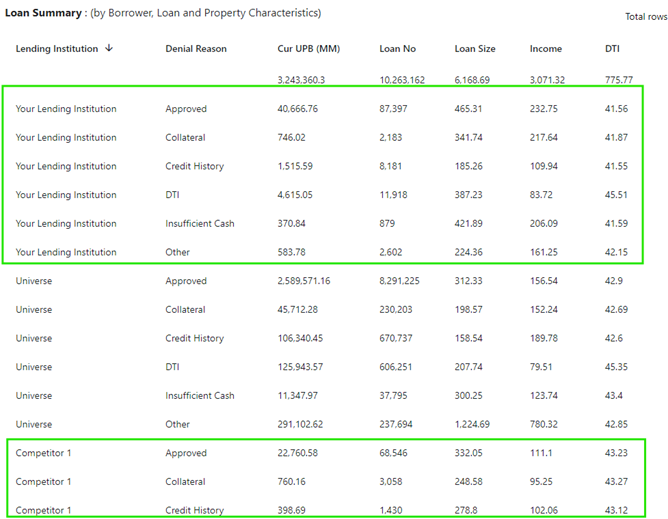

Mortgage Lenders - Instant Access to Competition, Marketing, & Performance Loan Level Data

Why not leverage loan-level data covering more than 5,000 lending institutions, paired with a wealth of actionable metrics?

With just a few clicks, you can use this data to grow your business by targeting the most profitable borrower sectors, benchmarking your loan production against competitors, and analyzing loan performance.

Benchmark Loan Origination Metrics vs. Competitors:

Gain insights into how your lending institution measures up to competitors across critical origination metrics:

- Compare key metrics like borrower income, age, gender, race, discount points, lender credits, and loan costs across approved and not-approved loans, loan types, geographies (State, MSA, Census Tract), and more.

- Identify Profitable Borrower Sectors: Target the most lucrative demographics for your marketing efforts.

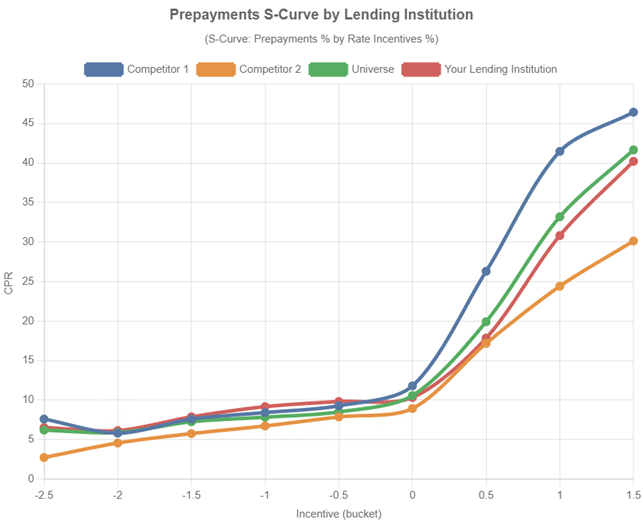

Analyze Loan Performance Like Wall Street Pros:

Track voluntary and involuntary prepayments (CPR, VPR, CDR), delinquencies, and draws to stay ahead of the curve:

- Optimize Post-Origination Decisions Use performance data to make quantitative, informed choices on buyouts, pooling, and modifications.

- Maximize Your Pool's Pay-Ups: Leverage data-driven insights to demonstrate why your pools deserve premium pricing.

MBS Data Insights Features

MBS Data Insights offers comprehensive datasets and analytical tools for analyzing historical data from Fannie Mae, Freddie Mac, and Ginnie Mae. It helps users gain a better understanding of MBS collateral characteristics and forecast future prepayment and credit performance.

Data

For each agency MBS trading product, we provide normalized and enriched loan-level and pool-level datasets spanning over 200 fields. Analyses can be conducted immediately right out of the box, without the need for an additional technological development.

The following products are supported at both the loan and pool levels: Fixed RMBS, ARM RMBS, HECM, and CRT.

- standard calculated fields (e.g. CPR/VPR/CDR/Draws, Delinquencies, Rolls, Incentives, Product Type, UMBS)

- normalized fields (e.g. Servicer, Originator)

- calculated analytics fields (e.g. SATO, Cur LTV, Burnout, Spec Pool Type, Cumulative Losses/Defaults, Dirty/Clean Credit Rolls, Severity (with and without MI) and more)

-

matched fields from a variety of data sources e.g:

- Econ: Mortgage Rates, HPA

- Census Tract: Income, Property Value, Borrower Age, Minority %

- Borrower: Age, Income, Ethnicity, Race, Gender

- Loan: Discount Points, Lender Credits, Loan Costs, Origination Charges, High Cost (HOEPA) Status, Detailed Loan Purpose (e.g. home improvement), Secondary-Market Purchaser

- Lender: Type, Licensed Geo, Assets, Peer Group (similarly charted or sized lenders)

We deliver data to clients through multiple channels, including AWS S3, Snowflake, REST API, Excel, or via our easy-to-use online Mortgage Analyzer user interface.

User Interface

The Mortgage Analyzer user interface allows clients to explore complex MBS data with just a few clicks. Users select multiple fields from MBS datasets, create custom fields, slice and dice the data, presenting results in a chart or table form. Numerous preconfigured templates are available, making it easy to achieve their desired results.

Development Tools

MBS Data Insights provides on-line Python, SQL and Tableau development environments. Users have seamless access to extensive MBS data analysis libraries, including MBS pricing, statistics, optimization, machine learning, and more.

Excel Tools

MBS Data Insights Excel tools allow users to query and analyze MBS data (e.g. historical reports, S-Curves, RAMPs, transition matrices) directly within Excel. This enables users to customize their reports and combine the results with other data sources.