Earnings in focus

July 12, 2022

Markets moved lower yesterday led by the NDX which dropped 2.2%. The SPX shed 1.15% and the DJIA 0.52%.

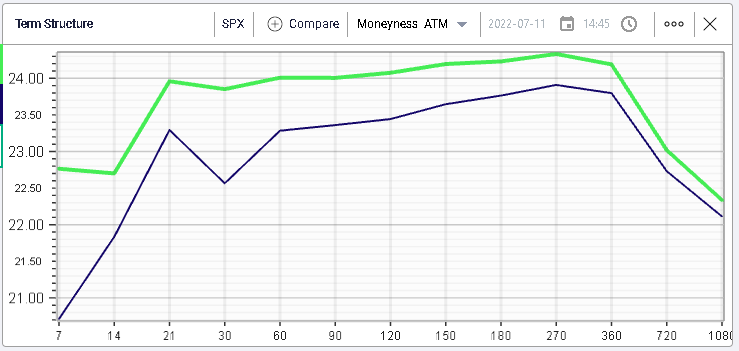

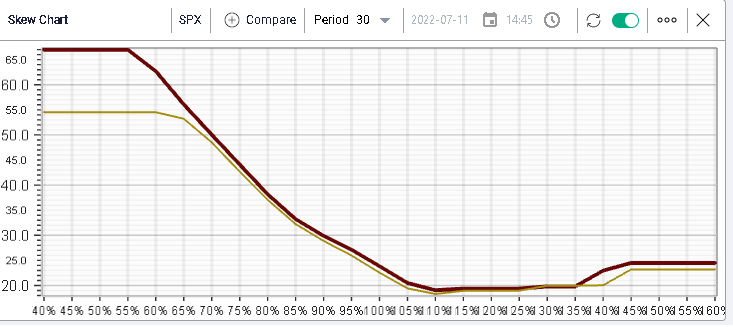

Implied volatilities moved higher with 30d IV gaining about 1.5 points. The move was fairly evenly split across all strikes as shown below.

All sectors finished in the red except for the Utilities space which managed to gain 0.6% on the day. The worst performing sector was the Communications space which lost around 3% with names like META dropping 4.7%, GOOG losing 3% or NFLX finishing 5.15% lower on the day.

Consumer Discretionary also settled lower dropping 2.74% with AMZN -3.3%, TSLA -6.5% and NKE -2.6%.

As earnings season really kicks off this week, traders have their eyes on a few names that are expected to be in play over the next few weeks. One such name is ETSY which is due to report on the 3rd Aug’22.

The company’s stock is down 59% on the year and the 30d IV is now trading above 90% for the third time this year.

NFLX is another one of those names where traders are going into numbers expecting a lot to be priced as a result of the release. The stock has lost more than 70% of its value in 2022 and the 30d IVX is trading at record levels of around 80%. The company is expected to report on the 19th July.

On the other hand, there are also names that are due to report and for which the market has remained fairly relaxed for now.

For example, TRV is due to report on the 21st July’22 but its 30d IVX has remained fairly flat, a sign that traders may not be expecting too much from the company.

The same is visible in VZ due on the 22nd July’22 with an implied volatility index around 22%.

As with all things in trading, opportunities come from the difference between your understanding of a situation and the generally accepted consensus. The great thing about consensus is that, especially when the range of outcomes is wide, it is pretty much never right. It simply reflects an average scenario that in most situation does not materialize.

Going into earnings, option prices have to reflect some sort of average scenario but very rarely do they get it perfectly right. That opens up the possibility for traders with good knowledge of specific companies to play earnings either directionally or not.

If you would like to discuss further, do not hesitate to reach us on support@ivolatility.com and book your free 1:1 introductory demo.