Key ECB meeting this week

September 6, 2022

US Markets were closed yesterday so the focus was on European and Asian stocks. European indices caught up with US counterparts and the German DAX finished around 2.5% lower, the French CAC settled 1.25% lower.

Implied volatilities were fairly supported gaining around 2 points on the day for 30d IVX. Looking at the below remark on the German DAX, we can see that the price action Friday evening caught a lot of traders by surprise.

The weekly options jumped 6 points over one day and with the EURUSD FX pair hovering around parity, this week’s ECB meeting will be of the utmost importance for traders. The deposit rate is generally expected to increase by 0.5% although as the euro has weakened significantly over the past few weeks, calls for an even larger increase have taken place.

The interest rate differential between the EU and the US has been a key drive of the FX pair in 2022 as shown below with in blue the difference between the 2-year US yield and the 2-year German yield and in orange the USDEUR FX.

The dollar has been very strong relative to the common currency as the FED proved far more proactive in taming inflation than the ECB so far.

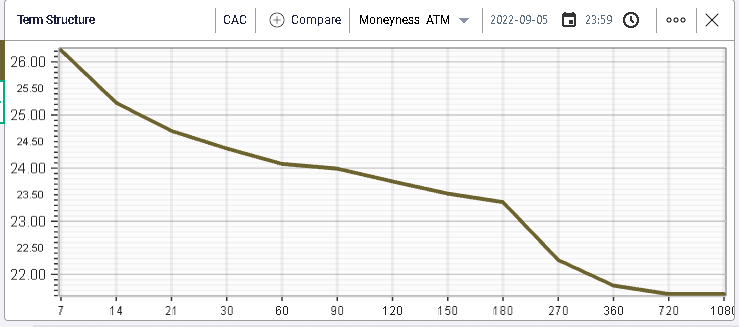

Even for the French CAC, short dated options have increase significantly in value with weekly options priced around 26% implied volatility and 60 days options around 24% IV.

Looking at the below, we can see that the German DAX and the French CAC realized volatilities have diverged slightly with the DAX picked up meaningfully while the French counterparts (more exposed to commodities and defensives) has managed to remain quiet overall.

The market is now anticipating a lot for this week’s event and it will be very interesting to see what the ECB delivers.