Turnaround Thursday

October 14, 2022

Following the release of the higher than anticipated CPI figures, equity indices initially reacted by selling off aggressively. The combination of light positioning (highlighted in yesterday’s note) and strong technical supports saw a large influx of buying around the lows of the day that resulted in a solid momentum for Thursday’s session.

From a technical perspective, the market hit the lower end of the 2022 downtrend as shown on the below chart from tradingview.com and managed to bounce quite aggressively from there.

The second technical indicator came from the weekly chart, with the market being supported at the 200 weeks moving average as shown once again on the below chart from tradingview.com.

The intraday session was quite spectacular in the US with the SPX dropping around 3% on the CPI report before turning around to gain more than 5.5% over the following few hours. The resulting effect is a bottom left to top right chart with very little standing in the way over the course of the session.

Considering this large amount of intraday volatility (recall our piece about this market favoring intraday traders), it was fairly logical for implied volatility to remain relatively firm in the second part of the session.

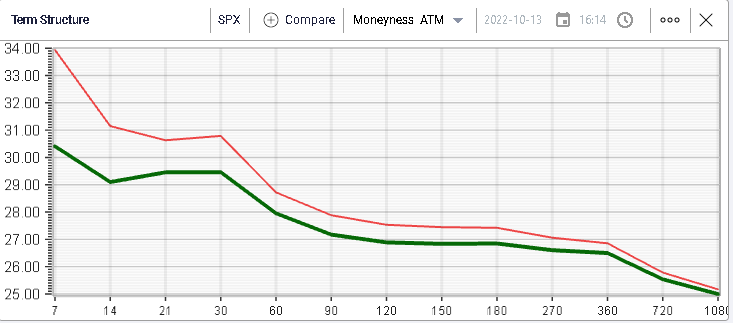

Over the day, the term structure shows that implied volatilities remarked lower, led by the front-end with 30d IVX closing below the 30% mark.

Options volumes were extremely high over the day with more than 3.6 million contracts exchanging hands on the SPX almost equating the recent record volume day of September.

Energy and Financials led the charge on Monday with both sectors gaining more than 4% by the close. Today’s reports from JPM and MS will be highly anticipated as indications of a possible trend in the sector. As such, considering the 32% loss displayed by JPM year to date, it is possible that speculative money rushed into the name ahead of the earnings with the stock gaining 5.56% over the course of yesterday’s session. MS, which is now 21% lower on the year, finished +3.55% yesterday.

As underperformers we continue to see Consumer Discretionary stocks being affected. The sector has lost more than 33% in 2022 and managed to only gain 1% yesterday.