Last Week’s Highlights at IVolLive:

- Register for Our Upcoming Tuesday Webinar Tomorrow's Topic: How to Use the IVolLive Stock Monitor Screener Tools to Find Actionable Option Trades HERE

- Register HERE for our free, live webinars that we host every Tuesday and Saturday at Noon EST.

- You can watch and view any of our past videos on our YouTube channel HERE.

- Register for a free IVolLive Trial HERE.

Interest Rate Decisions. Earnings. Volatility

May 1, 2023

What's Happening Now in the Markets

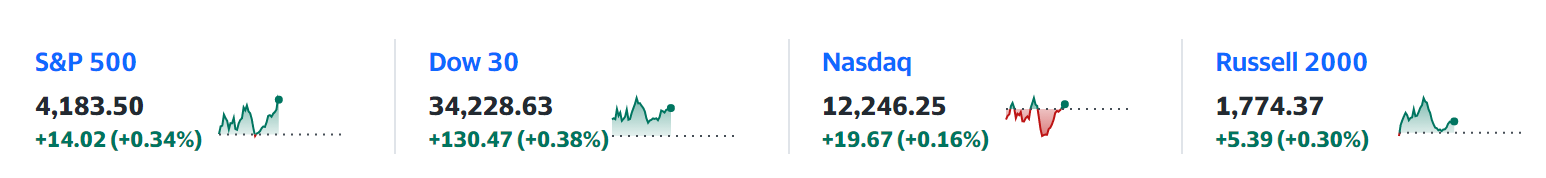

Last week, all three large U.S. Indexes finished higher (S&P 500 +0.8%, Nasdaq +1.3%, and the DOW +0.9%), with the small cap Russel 2000 showing a slight decline of -1.2%.

The strongest sector was Communications Services, which gained 3.8%. On the other hand, the weakest sector was Utilities, dipping 1% on the week.

Looking ahead, all eyes will be on the Federal Reserve (Fed) this Wednesday. The Fed is expected to raise another 25-basis points, which would bring the benchmark rate to a range of 5.00-5.25%. This would be the highest level since 2007, and also mark the 10th straight hike.

Speaking of rate hikes... the European Central Bank is also expected to hike by 25- to 50-basis points when it meets on Thursday.

Also, earnings season continues with the largest US company by market cap, Apple (AAPL), set to report on Thursday. We'll also have our eyes on Starbucks (SBUX), Uber (UBER), and Kraft Heinz (KHC) for clues on consumer health and spending.

Of the 53% of S&P 500 companies that have reported so far, 79% have reported EPS above consensus estimates — which is above the five-year and ten-year averages.

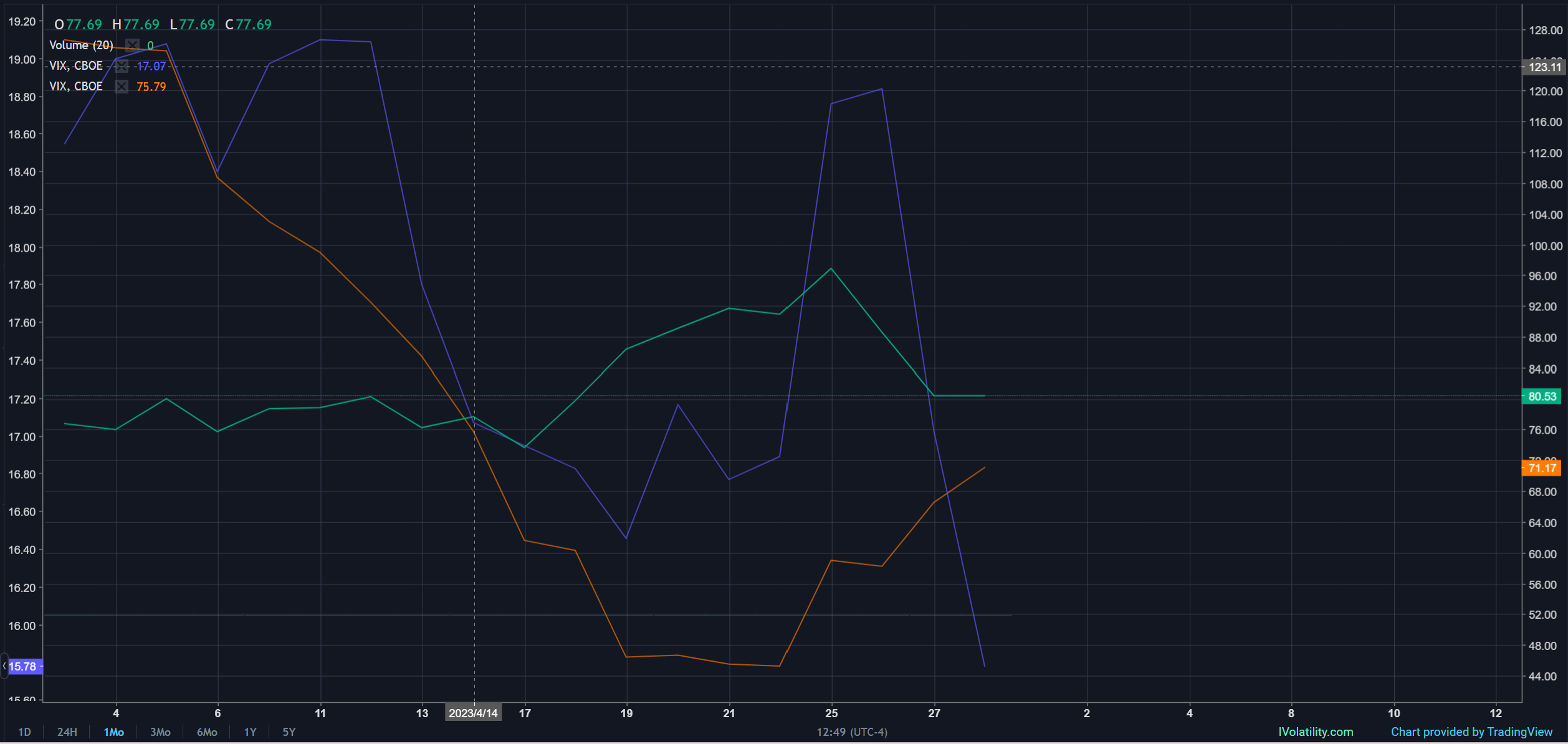

As markets brace for further rate increases, the VIX continues its downtrend – albeit with inflated implied volatility levels:

As you can see in this one-month chart of the market's fear gauge, the VIX, as price (the blue line) has fallen, implied volatility (green line) and historical volatility (orange line) remain elevated. Not only that, but VIX call options are much more expensive than VIX put options.

This tells us that traders are betting on a spike in the VIX. A spike in the VIX typically corresponds to a fall in the market and an increase in options premiums.

How to Play It

With implied volatility and price diverging on the VIX, like a canary in a coal mine, this is out signal that volatility will likely spike in the coming weeks. This means:.

* While volatility is low at the moment, buying options on names you like could be a great strategy. We're looking at tech and energy names that beat on earnings but don't see an immediate pop in their underlying share price.An earnings decline could lead to downward pressure in stock prices - leading to a surge in implied volatility, and interesting trading opportunities.

* Once volatility spikes, options premiums will increase - making it a great time to sell options as the income per contract will be higher.

Register for a free IVolLive trial HERE.

Previous issues are located under the News tab on our website.