Last Week’s Highlights at IVolLive:

- Register for Our Upcoming Webinar (June 27th, 2023) Webinar Topic: Leverage the Real Time Option Spread Scanner to find Profitable Put and Call Option Trades in All Market Conditions Part III HERE

- Get a free IVolLive Trial HERE.

A Long Way to Go...

June 22, 2023

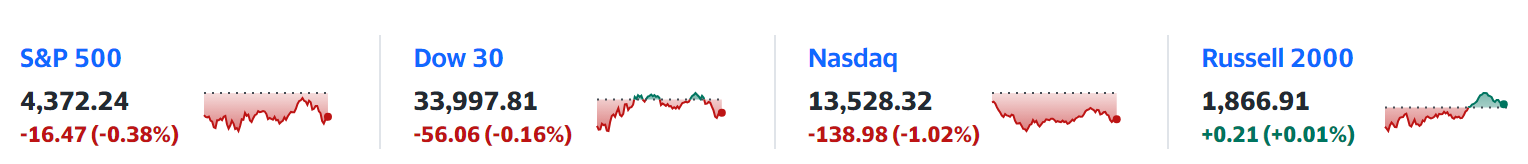

What's Happening Now in the Markets

In our last issue, we posed a deceptively simple question: Has the Bull Market returned?

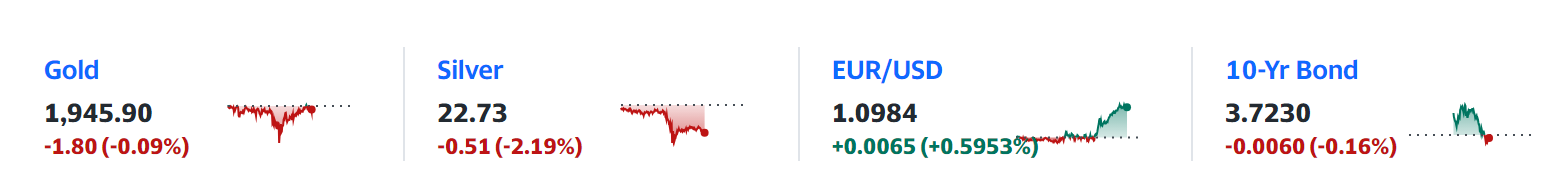

Since that June 12th issue went live, the market has turned a bit lower, and volatility has edged up a bit higher, as you can see in the IVolLive charts of SPX and its IVX below:

As you'll recall, this is exactly what we predicted would happen in our last issue. By applying technical analysis to our IVX measures, we knew the market was overheated and ready to cool off.

This is the power of the IVolLive platform. It helps telegraph movements that can then be translated into trades - or a decision to remain on the sidelines.

As we enter the second half of a holiday-shortened trading week, markets are mixed on the heels of Federal Reserve Chairman Jerome Powell announcing that he expects more interest rate increases.

In his view, getting inflation under control still "has a long way to go."

On the heels of Powell's statement, the so called "FAAMG" stocks (Facebook, Apple, Amazon, Microsoft, and Google) fell, as the market tends to sell the tech giants when perceived borrowing costs rise:

Using this chart of Apple (AAPL) as an example, you can see the sharp drop in price paired with the steep rise in implied volatility.

Speaking of drops, another large mover today that we've been watching was FedEx (FDX). The logistics giant was down 2.5% at close after disappointing Wall Street with its earnings that missed revenue expectations.

You can see the large red volume bar in the chart below showing steep selling action paired with a drop in FedEx's share price (and a rise in its implied volatility).

How to Play It

Multinational giants like FAANG stocks and FedEx generate rivers of revenue, cash flow, and dividends. Selloffs - like we saw today - are often temporary. That means, there's an opportunity to pounce via well thought out options plays... especially if the bull market is here to stay.

Once a name we like sells off, and we anticipate a rebound, we like to explore the following strategies:

• Buying a call option

• Selling to open a put option

• Opening a calendar spread

• Opening a bull vertical or diagonal spread

If you're an experienced options trader - or if you've been with us a while - you likely recognize these strategies. From here, you just need to use IVolLive to analyze the best options chain to suit your trading style.

You can view how to do so HERE.

Previous issues are located under the News tab on our website.