IVolLive

Professional-grade tools for the options trader: charts, option chains, scanners, risk analysis and more

Join IVolLive and get instant access to:

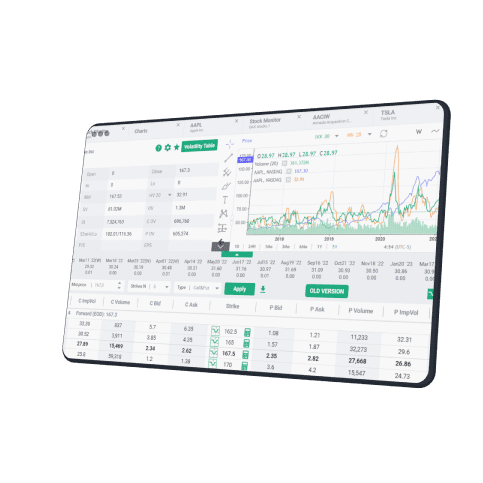

Advance Charts

Visualize all our datasets with powerful charts. From options open

interest to normalized historical volatility surfaces and many more,

we are able to provide you with invaluable information to help you

plan your trades in the best possible conditions.

Options & Probability calculators

Let us help you use the intelligence of the market to your advantage with our advanced calculators.

Want to understand how the parameters of a call or a put will change a the inputs change, the options calculator has all the information you need!

Want to calculate the probability of the market hitting a certain level or even closing below a specified level by a certain date pay a quick visit to our probability calculator.

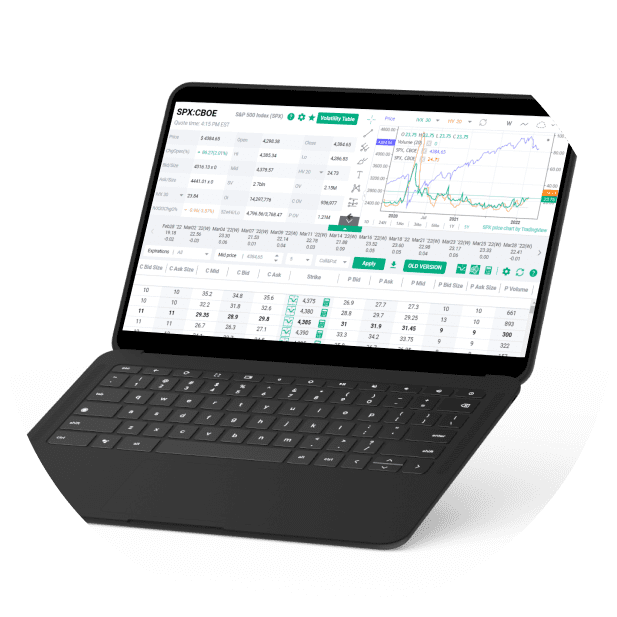

Intraday & Historical Volatility

Using our proprietary IV-Index (IVX) we help you visualize how

implied volatility evolves during the trading session for all the

ETFs, Indices and Stocks available.

Whether it is because you want to optimize your trade execution, to find new entry points for directional trading or simply to follow the volatility market, seeing changes in real time during the day can help you gain an edge.

Looking for long time series on volatility? We've got you covered with data going back more than 10 years on multiple underliers.

Whether it is because you want to optimize your trade execution, to find new entry points for directional trading or simply to follow the volatility market, seeing changes in real time during the day can help you gain an edge.

Looking for long time series on volatility? We've got you covered with data going back more than 10 years on multiple underliers.

Intraday price action and IV analytics for every options contract

Day traders, looking to evaluate opportunities around intraday

option trades will find this tool incredibly useful to perform quick

visual backtests. You can rapidly backtest ideas by visualizing an

option contract's price and IV action throughout the day with

minute-by-minute data, comparing your hypotheses about options

prices through the day against empirical data. For the first time,

take a data-driven approach to intraday strategies that were once

only available to the best resourced equity derivatives desks.

Trusted by the World's Top Investment Banks

For more than 20 years, we have been providing derivatives market

leaders with options and futures data.

Our team of data scientists apply powerful, refined, and well-tested calculations to millions of financial instruments every day, creating big data insights used across the industry to create options strategies, find actionable options contracts, and analyze existing positions.

Our historical options data is an industry leader in financial data, providing consistent, accurate insights you won't find elsewhere. IVolLive allows you to access the same present and historical options data used by over half of the top 50 Investment Banks and over half of the top 30 derivatives funds to build strategies which can compete in the 21st century.

Our team of data scientists apply powerful, refined, and well-tested calculations to millions of financial instruments every day, creating big data insights used across the industry to create options strategies, find actionable options contracts, and analyze existing positions.

Our historical options data is an industry leader in financial data, providing consistent, accurate insights you won't find elsewhere. IVolLive allows you to access the same present and historical options data used by over half of the top 50 Investment Banks and over half of the top 30 derivatives funds to build strategies which can compete in the 21st century.

Monthly

Yearly

Pro Realtime

$150/month

Billed monthly, individual use

IVolLive Platform

Stock Monitor

Realtime

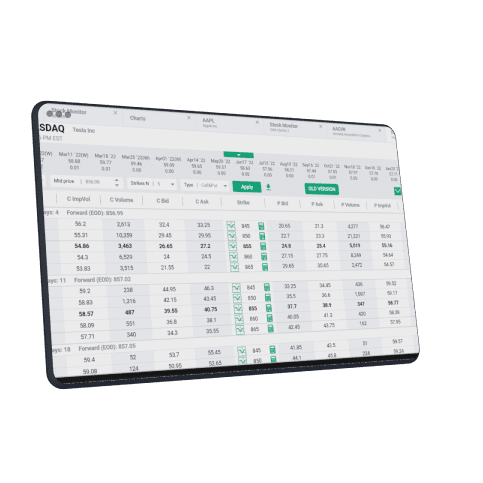

Options Chain

Realtime

IVX Monitor

Realtime

Probability Calculator

Realtime

Options Calculator

Realtime

Contract Viewer

Realtime

Charts

Realtime

Sentiment Analyzer

EOD

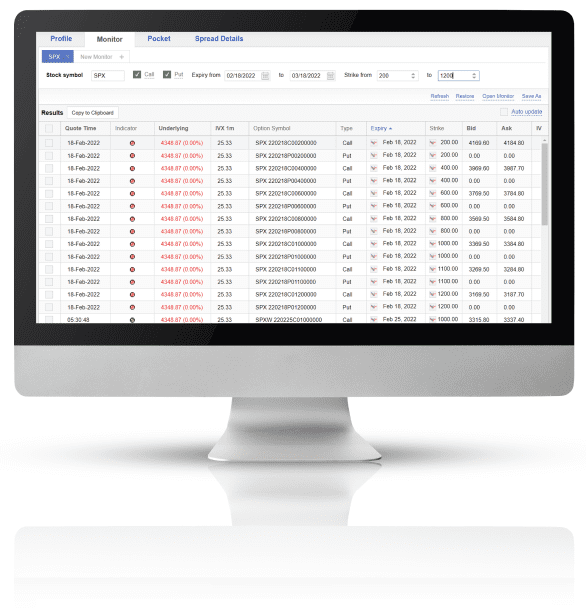

Spread Scanner

Realtime

PnL Calculator

Delayed

Data Download

EOD

include 80$/month credit

Advanced

$60/month

Billed monthly, individual use

IVolLive Platform

Stock Monitor

Delayed

Options Chain

Delayed

IVX Monitor

Delayed

Probability Calculator

Delayed

Options Calculator

Delayed

Contract Viewer

Delayed

Charts

Delayed

Sentiment Analyzer

EOD

Spread Scanner

Delayed

PnL Calculator

Delayed

Data Download

EOD

include 25$/month credit

For personal non professional single use

For professional use, please contact sales@ivolatility.com to discuss professional license arrangement to use Services. Terms of use are available here.

Ready to get started?

Get Free Trial