Last Week’s Highlights at IVolLive:

- Register HERE for our next free, live webinar that we will be hosting tomorrow at 12 Noon EST. This webinar is titled Leverage the Real Time Option Spread Scanner to find Profitable Spread Option Trades in All Market Conditions - PART III.

- It's no secret that the market has been incredibly volatile recently, which can make traders and investors nervous. What's great about the RT Spread Scanner is it's a robot - it will find potentially profitable trade setups regardless of market conditions.

- On Saturday, our experts gave a LIVE walkthrough and demo on the IVolLive platform, including how to trade puts, calls, and spreads as well as how to add features like stocks, charts, the Stock Monitor, and the Profit and Loss Calculator. Watch the video HERE.

- You can register for any of our upcoming LIVE webinars HERE.

- You can watch and view any of our past videos on our YouTube channel HERE.

- Register for a free IVolLive Trial HERE.

A Mixed Basket...

April 10, 2023

U.S. Equity markets finished a holiday-shortened week as a mixed basket: The Dow rose 0.6% while the S&P 500 and the Nasdaq fell 0.1% and 1.1%, respectively.

In other words, a rather boring Easter Basket.

One interesting morsel from last week was the yield on the 10-year US Treasury Note (one of the most widely followed metrics in finance) fell below 3.3%. This is its lowest level since September of last year and shows that - at least for now - the rate of increases has slowed.

Oil prices also stood out last week. The black gooey stuff rose above $80 per barrel for the first time in over a month. Look to take advantage of any strong oil and gas names that are on your watch list.

Finally, earnings season officially kicks off next week, starting with big banks and financials. These will be especially interesting considering the recent market jitters stemming from the Silicon Valley Bank fallout.

We've seen some interesting upticks in implied volatility, especially in regional banking names.

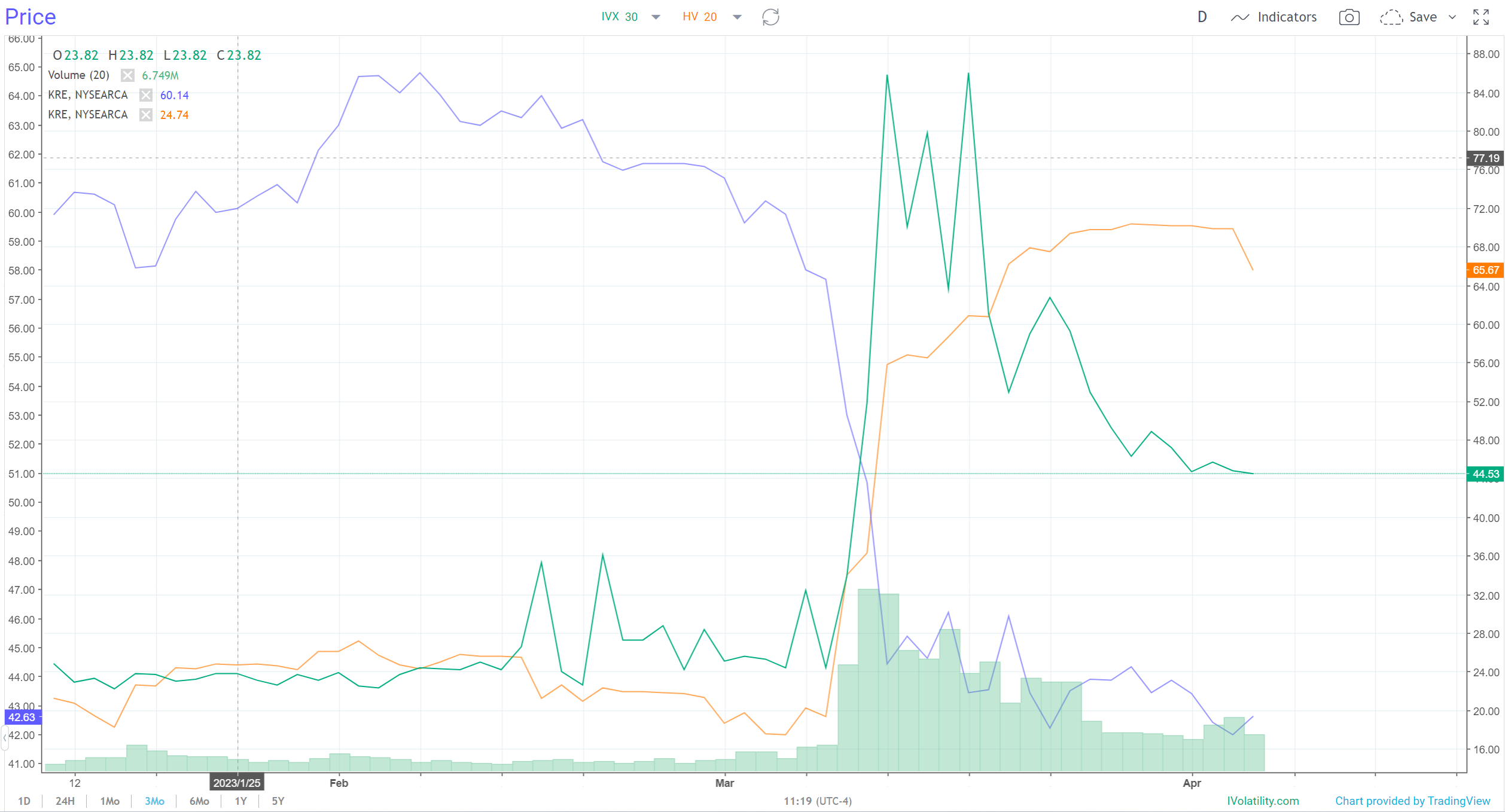

Here's a three-month chart of the S&P Regional Banking ETF (KRE):

In the chart, you can see that price (blue line) is declining while implied volatility is increasing (green line). This means that options premiums are relatively rich.

We'll be running scans on some of these names to find interesting actionable trades.

(Speaking of actionable trades, follow us on Twitter and Reddit for interesting potential trade setups.)

Summing Up

Last week the markets marched in place as oil increased and interest rates declined. This week, our focus will be on energy firms and financial names. We'll be looking for reversions to the mean trades as well.

Be sure to join us on tomorrow's webinar covering the Real Time Spread Scanner on IVolLive by registering HERE.

Register for a free IVolLive trial HERE.

Previous issues are located under the News tab on our website.