Trading the Downside vs. the "Non-Upside"

March 7, 2024

The Markets at a Glance

QQQ

Despite some sharp upmoves resulting from earnings announcements in stocks such as Target (TGT) and Crowdstrike (CRWD), an unusual spurt of selling took the major indexes down on Tuesday (3/5), raising once again the question of whether the rally from October was getting ready to roll over. The QQQ (which led the rally and is often considered the bellwether that determines when the rally will end as well) was down 1.8%. There was only one other day since last October that a decline of that size occurred on a single day.

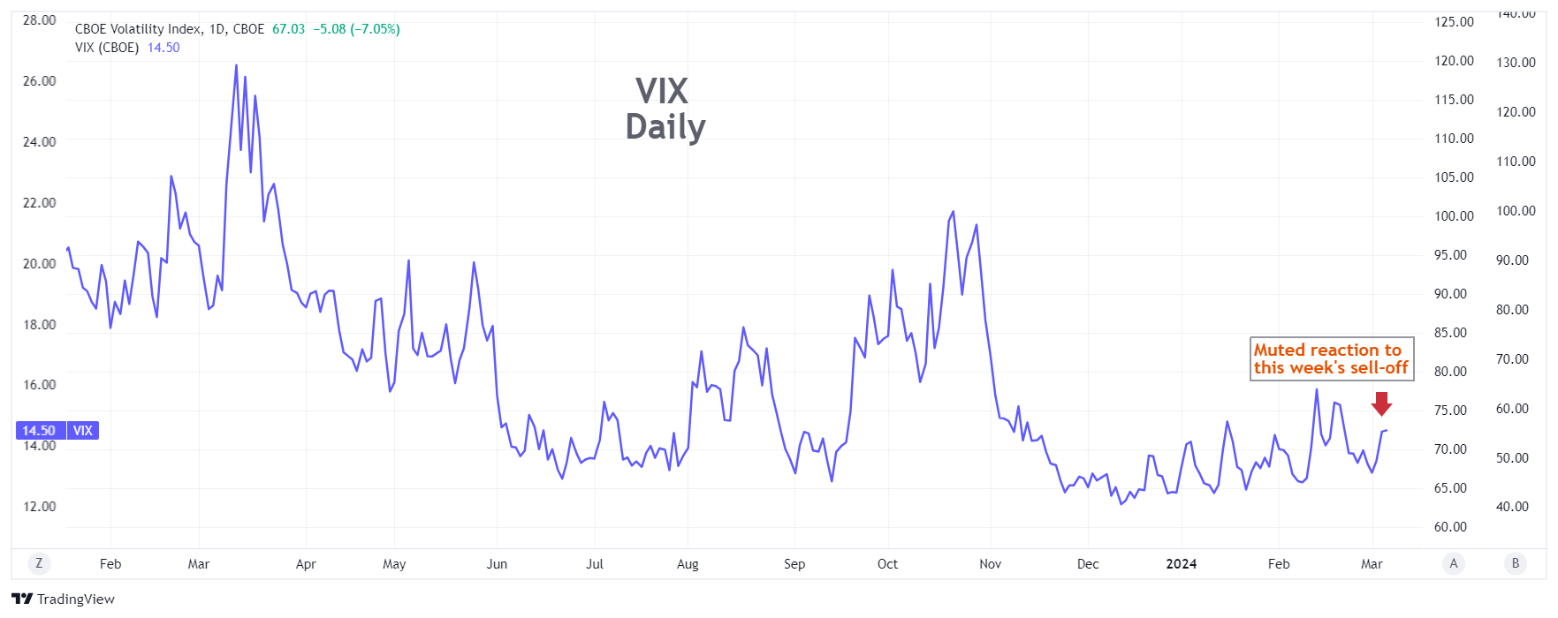

Looking at the VIX index, implied volatility on the S&P 500 moved up only slightly but did not make a dramatic leap upward by any stretch and remains below the highest levels from February. This suggests that the decline in SPY and QQQ did not send institutions running to purchase put options - at least not yet.

So, we have what could be the beginning of a correction but is not sufficient yet to warrant traders buying puts yet either. This brings up the subject of today's strategy talk: option strategies for playing the downside vs. strategies for playing a "non-upside".

Strategy talk: Trading the Downside vs. the "Non-Upside"

Anticipating trend changes is an activity that tempts traders as it offers the ability to capture potentially above-average trading profits somewhat quickly, avoid the trading losses that trend followers face when a trend ends, and provides a certain personal satisfaction that comes from outsmarting the crowd.

But calling trend changes is highly challenging and very few people can do it consistently. Buying puts in anticipation of the end of a rally can prove quite costly if the rally continues. Incorrectly anticipating a turn several times not only loses more money but can cause the trader to feel the need to “get even” by making even bigger bets or by continuing to buy puts in order to avoid the regret of missing the turn when it finally does happen. Such behavioral challenges can dramatically alter a trader's objectivity and lead to excessive losses.

Other option strategies get more complex but offer alternative approaches with better risk-reward characteristics. Most of the advantages come from selling options to create spreads and combinations. The simplest would be to use bear spreads rather than puts alone. That would involve selling a lower strike put in the same expiration as the long put purchased. Let's take Amazon (AMZN) as an example. The stock closed Wednesday at 173.51 and is shown below.

If you believed AMZN has temporarily peaked, you might consider purchasing an at-the-money put, say a March 175 for $4.40. In a quick, sharp drop, that put could produce a nice return. But in the absence of a quick sell-off, it will tend to lose money. You would need the stock to fall to 171.60 at expiration before you made any money.

Buying long puts means paying a lot for time value that will shrink regardless of whether the stock goes your way or not. In addition, a long put offers downside gains all the way to a price of zero on the underlying stock. But a trader's objective would not be predicated on the stock going to zero, so why pay for all that additional downside. If you believe that a reasonable target on the stock by March 15th is say 165, then why not sell someone else the gains below that price.

That would mean selling the March 165 put to create a 175/165 bear put spread. The 165 put can be sold now for $.95, reducing the initial cost of $4.40 to $3.45. That not only reduces the cost (and maximum risk) of the initial put by 22%, it also raises the breakeven price on the stock at expiration to 172.55. This gives the trader an advantage on all scenarios for AMZN down to around 164. Only below that will the initial long put by itself do better.

A further reduction in risk can be had by creating a butterfly spread, which is adding a bull spread at the lower strike (165) to the bear spread above. That would entail selling an additional 165 put and purchasing a 155 put. That spread yields another $.84 credit, further reducing your initial cost to $2.61 and raising your breakeven to 173.39.

Another approach entirely is to reconsider your underlying premise. Instead of trying to profit from a sharp downward movement in the stock, how about trying to profit from the absence of an upward movement (a "non-upside" strategy). This would turn your thinking toward writing out of the money calls rather than buying long puts.

A bear call spread above the current price of the stock (say a short March 175 call coupled with a long 180 call) would take in a credit of $1.45 and have a net margin requirement (and maximum risk) of $355. The strategy can thus only make a maximum of $1.45 per spread, but it makes that profit for all prices below 175 at expiration. Thus, it can make money if the stock just stalls or goes down slightly. For more room on the upside, a trader could sell a 177.50 call and purchase a 182.50 call for around $1.00 credit.

Using a bear call spread instead of buying a put offers less profit potential with each short-term trade, but profits even if the stock stalls or slightly rises and puts time in your favor rather than against you. After making successive downside trades trying to hit a peak in the stock price, the bear call spread approach is much more likely to show a profit than multiple long put attempts.

Got a question or a comment?

We're here to serve iVol users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use rhlehman@ivolatility.com.

Previous issues are located under the News tab on our website.