Deterioration or Rotation

January 19, 2026

Market Roundup for the Week

The week of January 12th–16th, 2026, was defined by extreme anticipation regarding trade policy, a massive rebound in semiconductors, and a strong start to the Q4 2025 earnings season. While the broader indexes hit record highs early in the week (with the Dow crossing 49,000 for the first time), the week ended with a mix of exhaustion and high-stakes waiting. Wall Street closed the trading week modestly lower, with the S&P 500 remaining within striking distance of the historic 7,000 level.

The primary driver of market tension was the Supreme Court's delay in the Learning Resources v. Trump decision. Retail and industrial stocks saw significant volatility on Wednesday and Friday mornings as investors "camped out" for a verdict on the global reciprocal tariffs. Because the Court did not release the opinion, the uncertainty of a potential $150 billion refund to importers remains priced into the market as a "coiled spring" for next week. The "window of impact" has shifted to Tuesday, January 20th (after the MLK holiday).

After a slow start to the year, the technology sector roared back on Thursday and Friday. The Nasdaq and SOX (Semiconductor Index) outperformed the broader market late in the week. Taiwan Semiconductor (TSMC) reported blowout earnings and announced a massive $50B+ capital expenditure plan for its U.S. operations in 2026. This signaled to investors that the AI infrastructure build-out is nowhere near its peak, lifting Nvidia and other chipmakers.

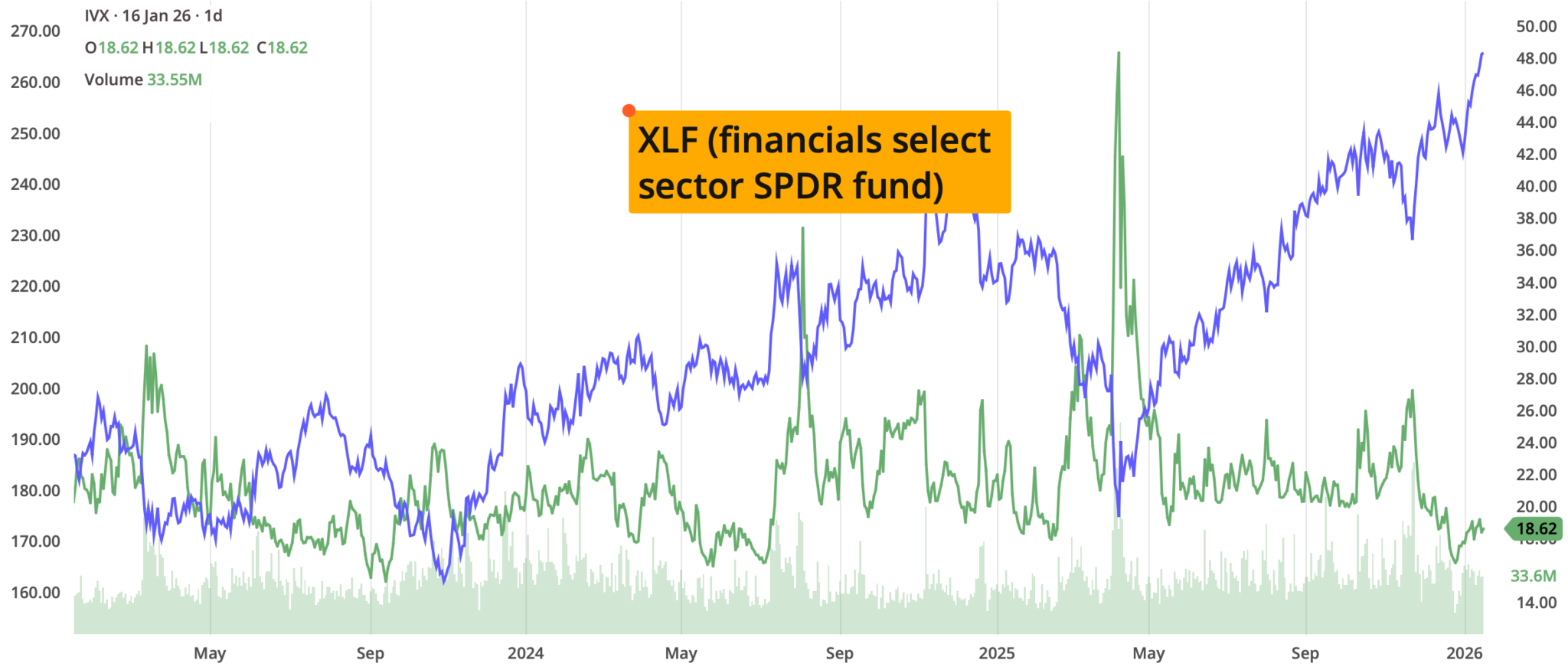

Big banks began reporting Q4 results, providing the first real look at the health of the 2026 economy. The big bank earnings were characterized by a sharp divide: Goldman Sachs emerged as the standout "king" while several other major institutions faced significant pressure. On the whole, robust deal-making activity and resilient consumer spending data offset concerns about a "soft landing" turning into a "stagnation."

Core CPI edged slightly below expectations, suggesting modest moderation in consumer inflation, while PPI met forecasts, sending a mixed signal on underlying price pressures.

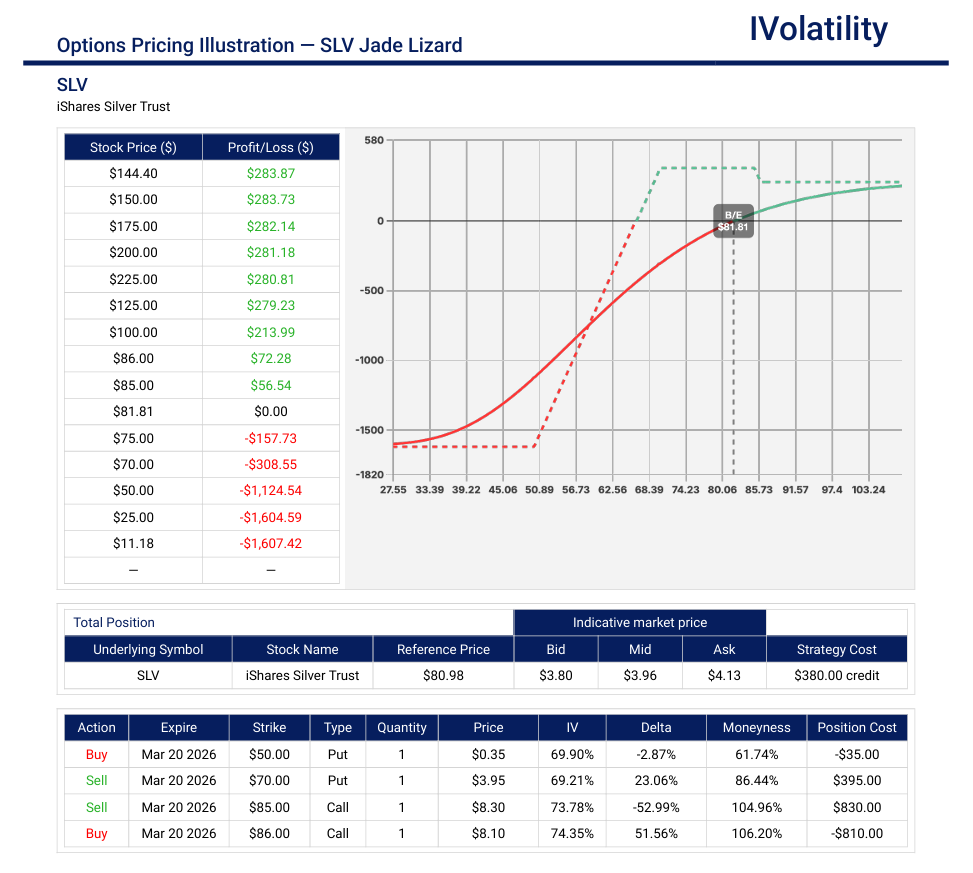

Silver continued its upward trajectory. The precious metal was supported by softer U.S. inflation data that reinforced expectations for Federal Reserve rate cuts, alongside geopolitical uncertainties, strong industrial and investment demand, and tightening supply conditions.

The bottom line is that the push-pull rotation of sectors continues to set the tone for the overall markets.

Strategy Corner

Based on last week's market movements, here are some trading ideas and option strategies for the readers' consideration. The strategies can be scaled bigger (or smaller), according to individual account size.

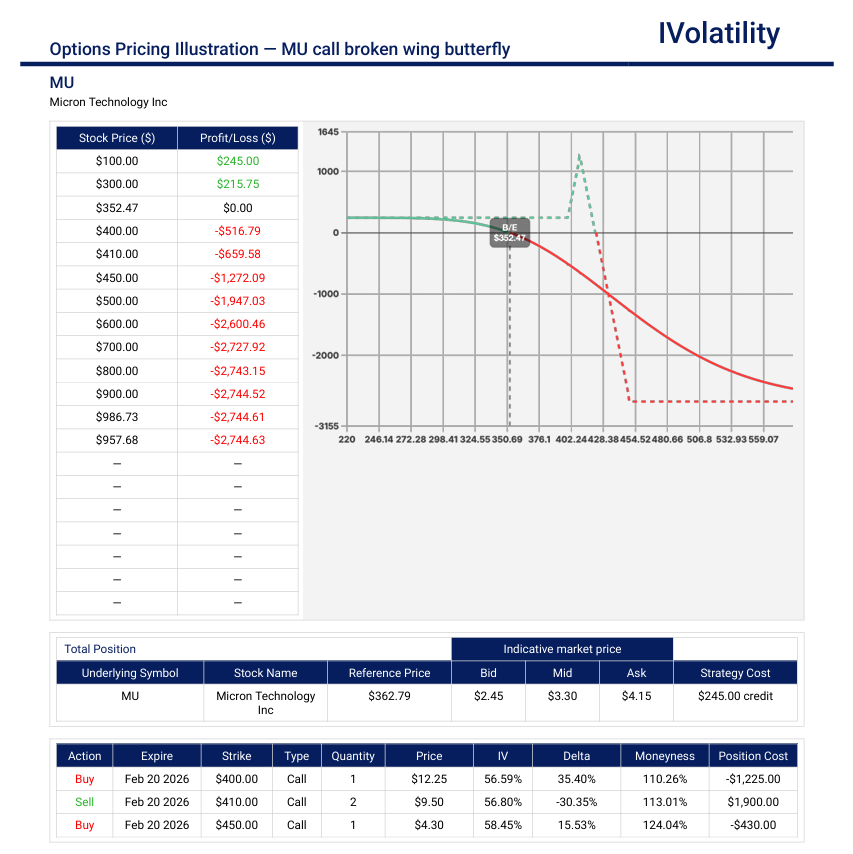

- MU (closed at 362.75 on Friday, Jan 16th)

While the outlook for MU over the next 45–60 days is exceptionally bullish from a fundamental standpoint, technical indicators suggest a "high-volatility" environment as the stock tests uncharted territory.

The stock is currently trading near all-time highs, having gained over 25% in the first two weeks of 2026 alone. If a trader believes that MU might consolidate over the next 34 days or even sell off a bit, then a call broken wing butterfly could be profitable. A move up, though limited, could also be profitable.

In the Feb20 expiration, buy one 400call, sell two 410calls and buy one 450call to cap off the risk.

Premium collected about $350 with upside breakeven around 423 (about 20delta) and no risk to the downside.

Probability of profit about 84%

Max potential profit could be $1330 with a pin at 410 on expiration.

PnL Calculator from the IVolLive Web - SLV (closed at 80.99 on Friday, Jan 16th)

After silver tripled in 2025 and surged another 25% in the first two weeks of 2026, the market currently could be considered to be in a "consolidation" phase. So a trader could assume a bullish position with a defined-risk Jade Lizard strategy.

Sell the Mar20th 70put along with the 85/86 call spread. Buy the 50put to define the risk.

Collect $400 in premium, tying up about $800 in buying power. Downside risk is around 66 (about the 17delta) and there is no risk to the upside since the width of the call spread is covered by the premium collected.

PnL Calculator from the IVolLive Web

Movement of the Major Market Indices:

| INDEX | UP | DOWN |

| SPY | -0.06% | |

| QQQ | -0.34% | |

| IWM | 2.43% | |

| DIA | 0.72% | |

| GLD | 1.60% | |

| BTC/USD | 4.15% | |

| TLT | .71% | |

| Crude Oil | 0.59% | |

| VIX | -1.18% |

Movement of the Major Sectors:

| SECTOR | UP | DOWN |

| TECH (XLK) | 0.3% | |

| FINANCIALS (XL) | -1.07% | |

| INDUSTRIALS (XLI) | 3.26% | |

| ENERGY XLE | 2.01% | |

| HEALTHCARE (XLV) | -1.01% | |

| UTILITIES (XLU) | 2.38% | |

| MATERIALS (XLB) | 0.64% | |

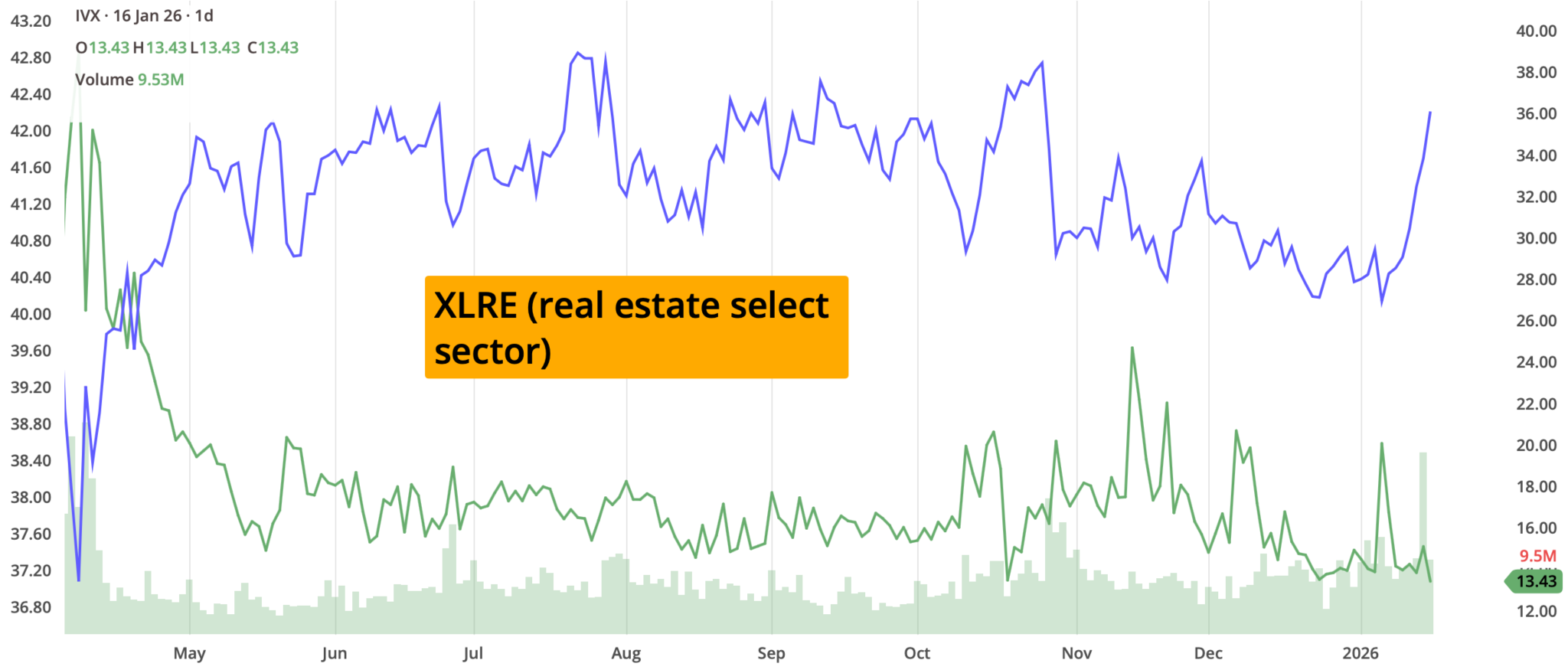

| REAL ESTATE (XLRE) | 4.09% | |

| CONSUMER STAPLES (XLP) | 3.24% | |

| CONSUMER DISCRETIONARY (XLY) | -1.27% |

Notable gainers for the week of January 12th – 16th:

The week was defined by a massive "Great Rotation" as investors moved money out of mega-cap tech and into small-cap and cyclical stocks. While the broader indices remained relatively flat, specific sectors like Biotech, Semiconductors, and Small-Caps saw explosive gains.

Moderna (MRNA) surged nearly 22% on positive clinical trial updates and a broader rally in innovative healthcare.

Roblox (RBLX) jumped nearly 20% following bullish analyst upgrades regarding their 2026 monetization strategy.

Venture Global (VG) popped nearly 22% benefitting from fresh record highs in energy demand and strategic contract wins.

Intellia Therapeutics (NTLA) surged almost 21% benefitting alongside the high-growth genomics sector rotation.

Notable losers for the week of January 12th – 16th:

While many sectors saw gains during the week, the market was characterized by a sharp rotation. This led to significant pullbacks in Financial Services, Communication Services, and Software, as investors grew wary of high valuations and AI-driven disruption.

Intuit (INTU) dropped about 16%, underperforming the broader markets as part of a general sell-off in legacy software and "tax-tech" names.

Salesforce (CRM) lost about 13%, marking its worst weekly performance in nearly two years, as "AI anxiety" and a broader software sell-off wiped out over 12% of its market value.

Biogen (BIIB) experienced a sharp decline, falling over 12% over the five-day trading period. Biogen's slump was part of a broader "risk-off" move in large-cap biotech. While the early part of January saw a surge in the sector, last week saw significant profit-taking as investors shifted capital toward Semiconductors and Small-Caps.

AppLovin (APP) faced a turbulent week, ultimately closing down approximately 14%. While the stock started the week with modest gains, it was dragged down mid-week by a broader tech sell-off and geopolitical concerns affecting the semiconductor industry. This move was largely attributed to reports that Chinese authorities were blocking certain AI chip imports, sparking fears that the high-growth AI software sector—where AppLovin is a key player—could face supply chain or international friction.

Royal Caribbean Cruises (RCL) experienced a notable pullback, falling over 11% as it gave back some of its strong early-January gains. While RCL has strong fundamentals, it was swept up in the mid-week "tech and growth" sell-off. As a high-beta stock, RCL tends to move more aggressively than the S&P 500 when market sentiment shifts.

Review selected market indices below:

Daily Notable Market Action

Monday's Markets and News:

Wall Street was shocked at Sunday's news that the Department of Justice issued a subpoena against the Federal Reserve but quickly recovered as tech stocks pulled markets higher.

Treasury yields jumped while bonds sank as investors worried about the independence of the US monetary system.

Oil was remarkably unshaken while seemingly every other commodity on the market popped or dropped on rising tensions between the White House and the Federal Reserve.

Monday's Movers to the Upside:

- Walmart jumped 3% after joining the Nasdaq 100 and announcing a partnership with Google.

- Albemarle climbed nearly 5% following a Scotiabank upgrade on a more constructive lithium market outlook. The call lifted peers as well such as Lithium Argentina and Lithium Americas.

- Dexcom advanced over 5% after the medical device company posted preliminary fourth-quarter results that came in ahead of expectations.

- Beam Therapeutics soared over 20% after announcing it had reached an agreement with the US Food and Drug Administration on a possible accelerated approval path for its lead genetic disease treatment, BEAM-302.

- Abivax jumped over 3% on a report that Eli Lilly may be interested in acquiring the biotech company in a deal valued at $17.5 billion, pending regulatory assurances from France.

- Akamai Technologies rose over 3.5% after Morgan Stanley issued a rare double upgrade and called the stock its "top value idea" for 2026.

Monday's Movers to the Downside:

- Airline stocks, Delta Airlines and United Airlines, slid after President Donald Trump called for a 10% cap on credit-card interest rates, a potential blow to a major profit engine for carriers.

- Credit-card issuers also moved lower on the rate-cap proposal. Capital One slid over 6%, Synchrony Financial fell over 8%, and American Express dropped over 4%.

- Duolingo sank over 8% after the company disclosed that CFO Matt Skaruppa is stepping down.

Tuesday's Markets and News:

Market indices sagged under a wave of demands issued by President Trump over the last week, including kicking institutional investors out of the housing market, capping credit card interest rates, enticing oil companies into Venezuela, preventing defense companies from issuing dividends, and making Microsoft cover power bills from its data center buildout.

10-year Treasury yields fell following a better-than-expected inflation reading (more on that in a moment).

Oil prices popped after Trump promised Iranian protesters that, "Help is on its way."

Gold fell from its recent record while silver hit a new high.

Tuesday's Movers to the Upside:

- Warner Bros. Discovery rallied over 1.5% on a report that Netflix is considering amending its offer into an all-cash bid for the entertainment company.

- Orsted jumped nearly 3% after a US judge ruled the company could resume construction on its Rhode Island wind farm.

- Boeing rose nearly 2% as it outsold Airbus last year, marking its first win since 2018.

- Intel gained over 7% and AMD popped over 6% after KeyBanc upgraded both stocks to overweight, citing strong server chip demand from AI infrastructure growth.

- Cardinal Health climbed nearly 3% after raising its fiscal-year outlook, driven by momentum in its specialty medicine segment.

- Moderna surged 17.02% after projecting 2025 sales of $1.9 billion, exceeding the midpoint of prior guidance.

Tuesday's Movers to the Downside:

- Delta Air Lines slipped nearly 2.5% even as the company forecast a more than 20% earnings jump in 2026, with record highs possible on strong premium travel demand.

- JPMorgan Chase dipped over 4% despite beating on Q4 earnings, as weakness in investment banking tempered enthusiasm around strong trading results.

- Travere Therapeutics dropped over 14.5% after the FDA requested more information to assess the clinical benefit of its kidney disease drug, Filspari.

- Microsoft fell nearly 1.5% due to growing concerns over the environmental and energy impact of AI data centers.

Wednesday's Markets and News:

Indices slid lower, pulled down after big bank earnings announcements failed to impress investors.

Gold and silver capitalized on recent geopolitical uncertainty yet again, rising to new all-time records.

Oil tumbled after President Trump indicated that he may hold off on attacking Iran.

Bitcoin rose finally broke above $97,000 after US senators introduced a new bill that would create a regulatory framework for the crypto market.

Wednesday's Movers to the Upside:

- Intel rallied over 3% after KeyBanc upgraded the stock to overweight, pointing to progress in its manufacturing turnaround and rising AI data-center demand.

- Honeywell International rose 1.3% after confirming plans to take its quantum computing unit, Quantinuum, public.

- Greenland Technologies jumped over 24% despite having no actual connection to Greenland, as the New Jersey-based transmission and drivetrain systems provider caught a speculative bid tied loosely to geopolitical headlines.

- Critical Metals surged over 32% after the rare-earth miner reported strong results from its drilling project in Greenland.

- Viking Therapeutics popped nearly 12% following the CEO's comments at the JPMorgan healthcare conference that the company, working on a weight-loss drug, may soon make a deal.

Wednesday's Movers to the Downside:

- Bank of America fell over 3.75%, and Citigroup tanked nearly 3.5% as earnings failed to spark enthusiasm.

- Biogen slid over 5% after warning it will take a $222 million pretax charge in the fourth quarter.

- Trip.com fell over 17% after China's top business regulator opened an investigation into the online travel agency.

- Rivian Automotive dropped over 7% after a UBS analyst downgraded the stock to Sell from Hold, marking its second downgrade this week.

- Airbnb slipped over 5% after data showed a 6% drop in foreign visitors to the US. Its peers Booking Holdings and Expedia Group also lost value.

- AppLovin sank over 7.5% as a broader tech selloff overshadowed Evercore ISI's bullish initiation.

Thursday's Markets and News:

After two straight days of selloffs, the major indices staged a comeback thanks primarily to AI stocks. But the highlight was small-cap stocks, which helped the Russell 2000 beat the S&P 500 for a 10th trading session in a row—its longest winning streak since 1990.

Bitcoin tumbled after Coinbase CEO Brian Armstrong pulled his support for the Digital Asset Market Clarity Act.

Crude oil fell below $60 per barrel after President Trump toned down his rhetoric on Iran.

Initial jobless claims fell to 198,000 last week. Any number below 200,000 is historically low, and it's only the second time in a year that this has happened.

Thursday's Movers to the Upside:

- Beyond Meat rose over 8% after launching its new protein drink, Beyond Immerse.

- Talen Energy climbed over 11% on plans to buy three power plants for $3.5 billion, adding 2.6 gigawatts of natural-gas capacity.

- Penumbra jumped nearly 12% after Boston Scientific agreed to acquire the healthcare company for $15 billion in cash and stock.

- Managed-care stocks rose after President Trump urged Congress to move forward with his healthcare framework. The movers were Humana, Centene, Molina Healthcare and UnitedHealth Group.

- Nokia rose nearly 4% after Morgan Stanley upgraded the stock, touting upside from AI and cloud-driven network demand.

- DraftKings advanced nearly 3.5% after Wells Fargo upgraded the stock while downgrading rival Flutter Entertainment, citing strong short-term upside for DraftKings ahead of an expected solid fourth quarter.

Thursday's Movers to the Downside:

- Spotify fell nearly 4% after announcing a $1 monthly price hike for its Premium plan starting in February.

- Vail Resorts slid over 2% after reporting season-to-date skier visits down 20% compared with last year.

- Disc Medicine fell nearly 8% and Eli Lilly slid nearly 4% after reports that the FDA is lengthening review times for drugs granted priority review vouchers.

- Reddit sank over 9% after RBC analysts warned that the social media site's advertising performance has failed to impress.

- Coinbase Global declined nearly 6.5% after the Senate Banking Committee delayed its markup of the Clarity Act, following public opposition from CEO Brian Armstrong.

Friday's Markets and News:

Indices sank late in the day, with the S&P 500 falling into the red to close out a losing week. In fact, every major index except the Rusell 2000 fell this week.

Gold slipped and Treasuries fell after President Trump told National Economic Council Director Hassett he'd prefer to keep him in his current position instead of making him Fed chair.

Friday's Movers to the Upside:

- Novo Nordisk rose over 9% after UK regulators approved a higher Wegovy dose for obesity patients, plus early demand for its weight-loss pill has soared.

- AST SpaceMobile rallied over 14% after being named an eligible vendor for the Pentagon's SHIELD program.

- ImmunityBio surged nearly 40% thanks to upbeat guidance for its bladder cancer drug Anktiva.

- PNC Financial Services added nearly 4% after posting a strong fourth quarter with record revenue.

- Dominion Energy popped over 1.25% after a judge ruled that it can restart construction of a wind energy project off the coast of Virginia.

- Energy stocks GE Vernova, Bloom Energy and Quanta Services advanced substantially as President Trump signaled Big Tech may help pay for new power plants.

Friday's Movers to the Downside:

- Constellation Energy and Vistra dropped substantially as the Trump administration's push to lower electricity prices raised concerns about rising supply and tougher competition.

- Amcor declined over 7% after the packaging company completed a one-for-five reverse stock split.

- Sports gambling stocks slipped on reports that prediction markets are taking a bigger bite out of the NFL betting market than anticipated. DraftKings dropped 8%, and Flutter Entertainment lost over 6%.

- Mosaic slid nearly 4.5% after preliminary fourth-quarter sales volumes missed expectations amid weaker fertilizer demand.

Notable Earnings to be announced Jan 20th – 23th:

The actual date may vary, so do confirm with your broker to confirm. If a trader wishes to open a position to participate in earnings announcements, it is important to check whether the earnings are released BEFORE the markets open or AFTER the markets close on the date of earnings.

The week's earnings calendar represents a significant ramp-up in the Q4 2025 reporting season. Investors will be focused on the "Big Tech" pulse via Netflix and the health of the consumer through major credit card and retail names.

Monday: –

Tuesday: MMM / DHI / USB / FAST / NFLX / UAL / IBKR /

Wednesday: JNJ / ABT / PLD / TRV / ASML / HAL / PNFP /

Thursday: PG / GE / FCX / UNP / INTC / COF / ISRG / AA

Friday: SLB / BAH / CMA / WBS

Key Economic Indicators due from Jan 20th – 23rd:

The World Economic Forum kicks off its annual event in Davos, with President Trump expected to appear amid a standoff with EU nations over Greenland. Notable executives on the Davos program include CEOs of Nvidia, Microsoft, Salesforce, Pepsi, JP Morgan Chase and Goldman Sachs.

The economic calendar for the coming week is exceptionally heavy due to the "catch-up" of data delayed by the late-2025 government shutdown.

While the markets are closed on Monday, January 19, for Martin Luther King Jr. Day, the rest of the week features critical updates on inflation (PCE), economic growth (GDP), and consumer health. Friday's PCE report is the week's main event. Analysts are watching to see if the recent tariff implementations have started pushing "sticky" inflation above the current 2.7%–3% range. If core inflation remains high, expectations for further Fed rate cuts in Q1 may evaporate.

Here is the schedule of notable economic data releases:

Monday: –

Tuesday: ADP Weekly Employment

This will provide a private-sector glimpse into labor demand stability and generally has a moderate impact on the markets.

Wednesday: Pending Home Sales

This is a leading indicator for the housing market and mortgage demand and generally has a moderate impact on the markets.

Thursday: Q3 GDP (Updated)

This will provide a revised look at 2025 growth (estimated at 4.3% in earlier reads) and could have a fairly serious impact on the markets.

Friday: PCE & Core PCE (Dec)

This is the Fed's preferred inflation gauge, a good determinant for the next rate move and could have a critically serious impact on the markets.

S&P Global Flash PMI

This will be the first "real-time" look at Jan 2026 manufacturing and services health and is generally considered to have a moderate impact on the markets.

Closing Thoughts

The Russell 2000, home of small-cap stocks has outperformed the S&P 500 for 11 consecutive trading sessions, its longest winning streak in 36 years. So, what's the big deal with small caps?

Tiny stocks are getting a boost from a number of tailwinds these days. Small stocks tend to outperform when the economy is growing and the Fed is cutting interest rates—two trends investors expect to continue through the new year. And while bigger companies have only seen their market caps climb over the last few years, small caps look far less expensive in comparison.

One of the biggest variations between small caps and large caps on a valuation basis going back 50 years was noted by analysts earlier this week. Examining the forward price-to-earnings ratio of large caps versus small caps – focusing only on profitable companies – small caps are trading at about a 20% discount to parity. Excluding the COVID 2020 recession, this represents the cheapest small caps have traded in the 50-year period dating back to 1975.

The Russell 2000 has climbed 7.1% in 2026, far outpacing the S&P 500, and Wall Street expects this to continue to be a big year for small caps.

Questions / Comments

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use support@ivolatility.com.

Previous issues are located under the News tab on our website.