IVolatility Data Options API

Our team's data processing model uses over 600 filters to deliver the cleanest, most accurate data available for global markets. With IVolatility's extensive global coverage, you can analyze, measure, and code with the confidence that all data is cleansed by a team of dedicated data analysts, creating predictable, consistent, and accurate results.

And now, IVolatility's market leading data sets are just a simple API call away...

Harness the ease and efficiency of API to power your:

- Machine Learning and Algo Trading

- Back Testing

- Historical Data Pulls

- Portfolio Management

- Valuation Strategies

- Asset Management

- Risk Assessment

- Structured product and ETF development

Backtest API Essential:

- Access to Stock & Option Prices, Options Backtesting

- EOD Equity & Equity Options Data

- Perfect to Start with at a Great Price!

Backtest API Plus:

- Everything in Backtest API Essential, plus Greeks, Surfaces, Indices, and Earnings

- EOD Equity & Equity Options Data + 1-Minute Snapshots for Options

- Ideal for Backtesting

Futures Backtest API:

- Access to Futures & Futures Options Prices, Option Backtesting

- EOD Data

- Perfect for Accessing Future Options

Options Real-Time API:

- Access to Real-time Option Prices, plus Greeks and Indices

- Additional EOD Equity Data

- Perfect for Accessing Real-time Options Data

Access to All Options Data & More

Additional API Endpoints Exclusively for Professional Users

RESTful and WebSocket APIs offer flexible and powerful ways to access our data

Real-time Display Fair Value Prices with No Exchange Fees or Approvals

Real-time Display Market Prices. Experts to Help Navigate Exchange Rules

Customized Solutions, Dedicated Support Team Access, Priority Support, & SLAs

Goal: Get valuable insights into strategy performance.

Calling all futures options traders! IVolatility now presents an exclusive offering - the Futures Backtest API package.

Unlock the Power of Real-Time with Our Cutting-Edge Options API!

- WebSocket APIs offer flexible way to access our data

- Real-Time Display Fair Value Prices – No exchange fees or approvals required

- Real-Time Display Market Prices – Seamless access to live market data

- Expert Support – Navigate exchange rules with confidence

Earnings API is a service that compiles information on upcoming company earnings announcements.

Backtest API PRO

Backtest API Plus

Backtest API Essential

Futures Backtest API

Options Real-Time API

Stocks

Futures

Options

Reference Data

Features

The Only API for Serious Traders and Engineers

IVolatility Data API Use Cases

- Secure key data points to battle test strategies

- Measure potential profit and loss

- Calculate VaR, beta, and other risk metrics

- Automatically limit potential exposure

- Report portfolio exposure

- Power charts and other visualizations

- Provide readers with historical comparisons and historical pricing

- Build attractive market analysis tools to draw and drive traffic

- Enhance portfolio management with granular volatility and Greek metrics

- Train, test, and validate Machine Learning algorithms

- Simulate future events using past inputs

- Normalize volatility models

- Create automated signals

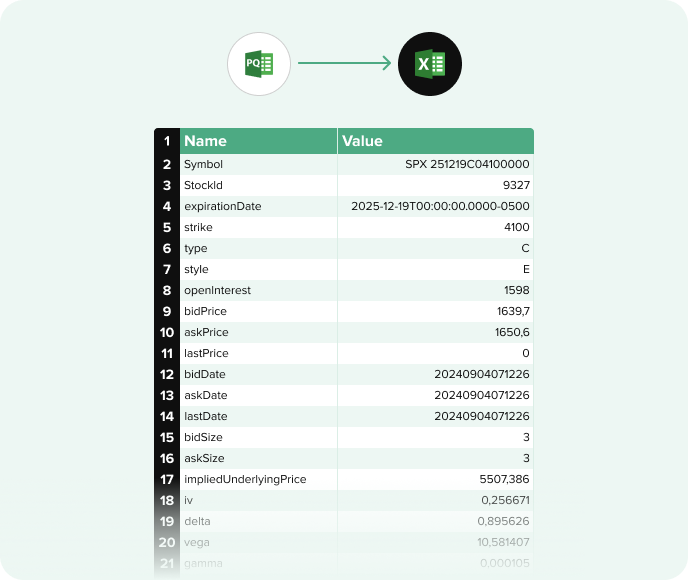

Simplify your workflow with our API, allowing you to access and analyze options data directly in Excel using Power Query. Say goodbye to data entry errors and hello to streamlined efficiency.