Fasten Your Seat Belts

February 9, 2026

Market Roundup for the Week

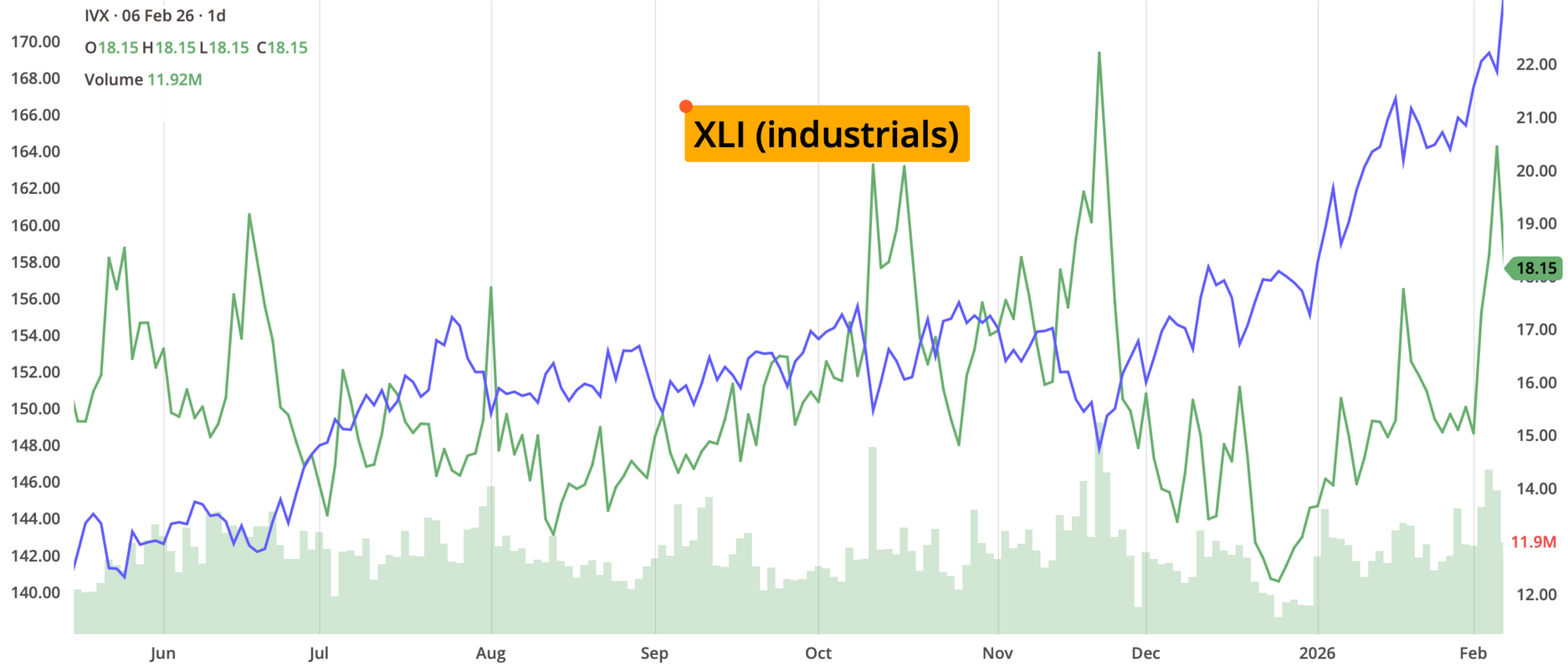

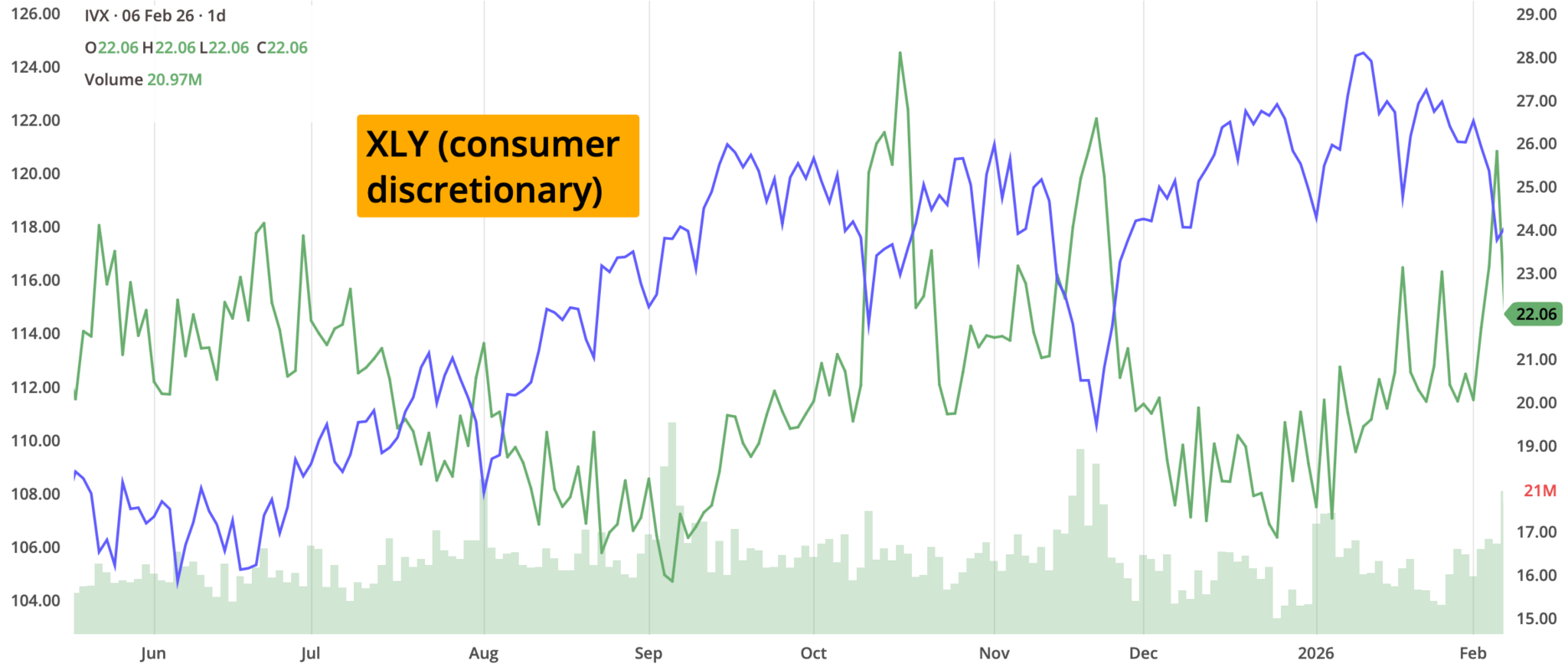

Last week was defined by a massive "Value Rotation" and a historic milestone. While technology and growth stocks spent most of the week in a tailspin, the "Old Economy" industrials dragged the market into the history books on Friday.

The early part of the week, the narrative was dominated by a brutal sell-off in software and Big Tech. The market was in a state of AI exhaustion. Amazon and Alphabet spooked the market by announcing massive AI spending plans ($200B and ~$180B respectively). Investors worried that the "AI bill" is coming due long before the "AI profits" arrive. Software stocks have lagged the broader market since early January as investors reassess how quickly AI could reshape the enterprise software market. The core fear is that AI agents may take over functions long provided by traditional vendors, a worry that sharpened after Anthropic introduced Cowork, an AI agent designed for enterprise use, and Claude Code, which has made stunning strides in coding work once dominated by software companies.

The software sector saw its sharpest weekly decline since 2008 earlier in the week, as companies like Salesforce and Microsoft were sold off to fund a rotation into "cheaper" industrial stocks. Capital moved aggressively from Growth to Value.

Bitcoin hit a 16-month low near $61,000 mid-week before staging a frantic Friday recovery to close back near $70,000. Despite the bounce, it remained down double-digits for the week. For years, crypto advocates pitched bitcoin as a modern safe haven: decentralized, detached from central banks, and a hedge against inflation, often grouped alongside gold. That thesis appears to be breaking down. Instead of tracking gold higher amid geopolitical uncertainty and policy volatility, bitcoin has diverged sharply, behaving more like a risk asset.

Silver continued to trade "violently," falling significantly from its January highs as the CME hiked margins to cool the speculative frenzy. After hitting highs in late January, Silver had an "epic" collapse, falling nearly 30% from its peaks due to margin hikes and forced de-risking.

Gold remained the "safe haven" play of choice, holding steady near $4,900/oz even as silver and crypto saw wild swings.

The irony is that the Dow finished the week up +2.5%, while the tech-heavy Nasdaq finished the week down -1.8%. Perhaps the catalyst was a combination of a blowout January Jobs report and a massive "short squeeze" on Friday turned what was looking like a losing week into a record-breaking celebration.

On Friday, Feb 6, after a rough three-day stretch of losses, a massive capitulation of the bears showed up. The Dow Jones Industrial Average (DJI) surged over 1,200 points to close above 50,000 for the first time in history.

Despite the Friday heroics, the Nasdaq and S&P 500 actually finished the week lower (down ~3.9% and ~2% respectively) because the early-week tech rout was so severe.

The economic data provided a mixed backdrop that ultimately helped the "rate cut" narrative. The Federal Reserve held rates steady (3.50%–3.75%) but signaled they are moving closer to a "neutral" stance.

Jobless claims ticked higher (231k), and the JOLTS data showed a slight softening in labor demand. This actually helped the market on Friday, as it reinforced hopes that the Fed would cut rates twice later this year.

The 10-year yield finished the week around 4.22%, while the 2-year yield dipped to 3.50%. This "steepening" of the curve can be seen as a sign that markets expect a transition from high inflation to a more normalized growth environment.

Strategy Corner

Based on this week's market movements, here are some trading ideas and option strategies for the readers' consideration. The positions can be scaled bigger (or smaller) to suit individual account size.

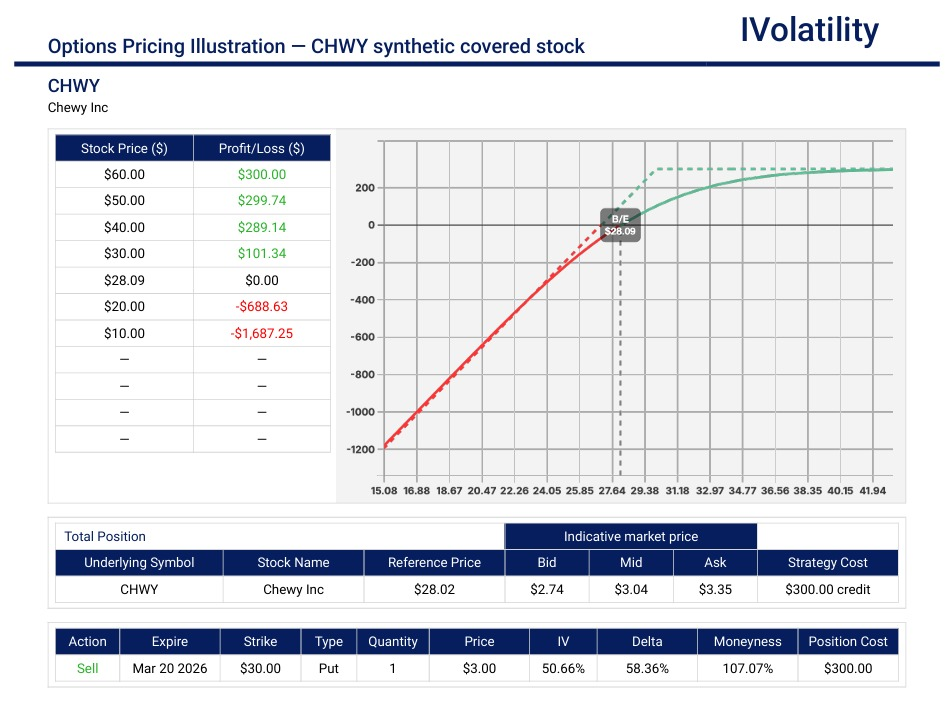

- CHWY (closed at 28.01 on Friday, Feb 6th)

This underlying has lagged significantly, down nearly 20% year-to-date and trading near its 52-week low. Its RSI is in "oversold" territory, which often precedes a bounce. Its fundamentals are strong given that Q3 2025 results were a blowout with EPS coming in at 32c vs an expected 13c. The consensus price target is upwards of $45.

If a trader would like to get bullish, an ITM put could be a good place to start. An ITM put is essentially a synthetic covered stock position but holds up considerably less buying power.

Sell the Mar20 30put and collect about $300 / contract

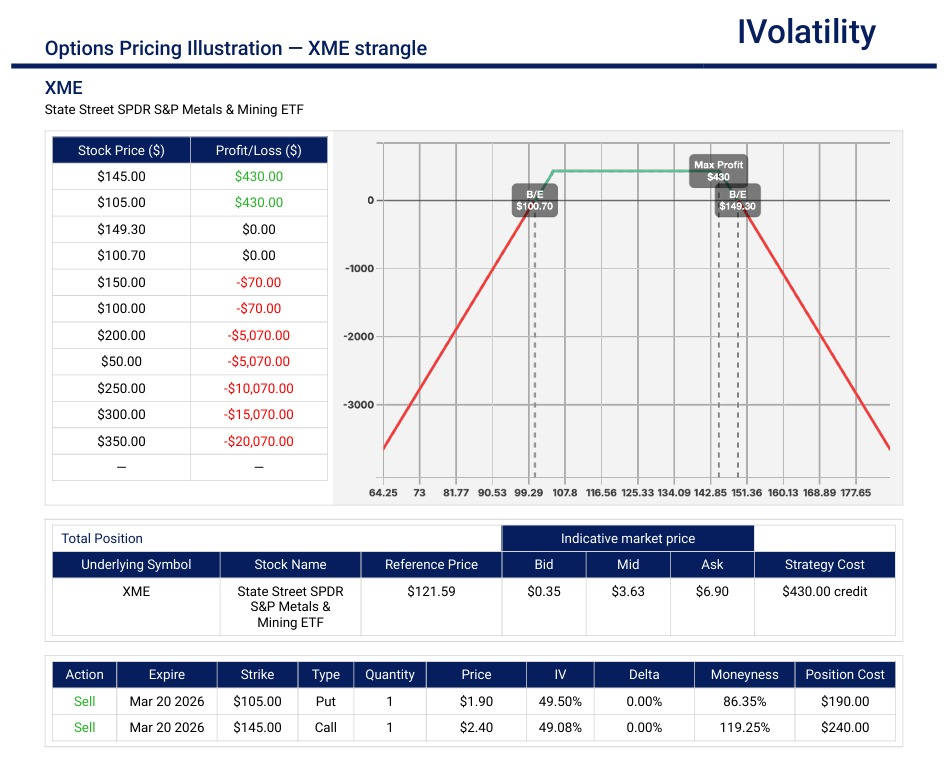

PnL Calculator from the IVolLive Web - XME (closed at 122.51 on Friday, Feb 6th)

If a trader would like to be neutral through the March expiration, then consider selling a 105/145 strangle and collect about $430.

This strangle has a 63% probability of profit ties up about $1100 / contract in buying power.

PnL Calculator from the IVolLive Web

Movement of the Major Market Indices:

The week of February 2–6, 2026, was a rollercoaster that started with a brutal tech sell-off and ended with a historic, record-breaking milestone for the blue chips.

| INDEX | UP | DOWN |

| SPY | -0.2% | |

| QQQ | -1.97% | |

| IWM | 2.07% | |

| DIA | 2.45% | |

| GLD | 2.36% | |

| BTC/USD | -16.24% | |

| TLT | -0.71% | |

| Crude Oil | -2.55% | |

| VIX | 1.83% |

Movement of the Major Sectors:

| SECTOR | UP | DOWN |

| TECH (XLK) | -1.92% | |

| FINANCIALS (XL) | 1.53% | |

| INDUSTRIALS (XLI) | 13.47% | |

| ENERGY XLE | -0.35% | |

| HEALTHCARE (XLV) | 1.75% | |

| UTILITIES (XLU) | 1.57% | |

| MATERIALS (XLB) | 0.31% | |

| REAL ESTATE (XLRE) | 2.00% | |

| CONSUMER STAPLES (XLP) | 13.2% | |

| CONSUMER DISCRETIONARY (XLY) | -2.35% |

Notable gainers for the week of February 2nd–6th:

The period from market close on January 30 to market close on February 6, 2026, was characterized by a massive rotation. While tech giants suffered early-week "earnings indigestion," the broader market—specifically industrials and consumer staples—saw explosive gains that carried the Dow to 50,000.

Nvidia (NVDA): Despite a volatile week, it surged nearly 8% on Friday alone, finishing the week strong as investors realized Big Tech's massive Capex (like Amazon's $200B plan) directly benefits chipmakers.

United Rentals (URI): Jumped over 6% on Friday, riding the wave of "Old Economy" strength.

Deere (DE): Gained over 2.5% during the Friday rally, a staple of the industrial surge.

Caterpillar (CAT) & 3M (MMM): Both saw significant mid-week inflows as investors rotated out of high-multiple software stocks into cyclical value.

Primoris Services (PRIM): A standout gainer, jumping over 8.5% for the week, fueled by strong energy and utility infrastructure demand.

Flowserve (FLS): Gained 8% by appearing to benefit from the same "pick-and-shovel" infrastructure play.

Vicor (VICR): Surged nearly 8% as specialized electronic component manufacturers were re-rated following AI infrastructure spending news.

Lumen Technologies (LUMN): Continued its volatile run, finishing the week up +29% as its fiber-network-for-AI narrative gained fresh momentum.

DaVita (DVA): One of the top-ranked performers for early February, gaining over 26% since the start of the month as it cleared key regulatory and earnings hurdles.

Moderna (MRNA): Extended its January rally, closing the week higher on positive clinical updates for its cancer vaccine pipeline.

MicroStrategy (MSTR): After a mid-week plunge, it surged over 26% on Friday, finishing the week in green territory following Bitcoin's rebound to $70,000.

MARA Holdings (MARA): Gained over 20% in the Friday session alone, erasing much of its earlier weekly losses.

Notable losers for the week of February 2nd–6th:

The week of February 2–6, 2026, was a tale of two markets: while the Dow hit 50,000, the tech and crypto sectors experienced a brutal "recalibration" of valuations.

The automotive sector suffered a historic blow on Friday, Feb 6, which dragged several major names into the red for the week. Despite the Friday rally, several "Magnificent Seven" stocks couldn't recover from mid-week earnings jitters regarding their massive spending plans.

Stellantis (STLA): dropped 25% and was the week's biggest high-profile loser. It announced a massive $26 billion (€22B) charge and a total "reset" of its EV business, citing an overestimation of the energy transition. Most importantly for capital markets, it suspended its 2026 dividend, sparking a mass exit by income investors.

Ford (F) & GM (GM): Both saw sympathy sell-offs as the market questioned the profitability of the entire Detroit auto sector's pivot toward hybrids over EVs.

Amazon (AMZN): shed 12% and led the Dow decliners for the week. Investors were spooked by the company's plan to spend $200 billion on AI infrastructure, fearing that the payoff for such a massive investment is too far in the future.

Advanced Micro Devices (AMD) dropped 17% despite beating earnings estimates and its forward guidance failed to satisfy the market's sky-high expectations for AI chip demand.

Molina Healthcare (MOH) dropped 26% and led the Nasdaq decliners following a disappointing earnings report and a bleak outlook for Medicaid margins, which sent shockwaves through the managed care sector.

Salesforce (CRM) & Microsoft (MSFT): Both finished the week lower (down ~4-5%) as a "software slump" took hold. Traders shifted capital out of application software and into hardware/industrials, fearing AI would disrupt traditional SaaS business models.

Peloton (PTON): swooned 28% continuing its slide, hitting fresh lows after another quarter of widening losses and shrinking subscriber numbers.

Bitcoin (BTC/USD): dropped over 16%

MicroStrategy (MSTR) and Coinbase (COIN) saw double-digit weekly losses, failing to fully recoup the mid-week Bitcoin plunge.

Review selected market indices below:

Daily Notable Market Action

Monday's Markets and News:

Equities were buoyed by the news that the US manufacturing sector expanded for the first time in a year. The Dow soared, while the S&P 500 ended the day inches away from a new all-time high.

Gold and silver continued to reverse their record-breaking rallies, tumbling further following the news that Kevin Warsh is poised to be the next Fed chair.

Oil sank after tensions between the US and Iran appeared to de-escalate.

Over the weekend, bitcoin fell below $80,000 for the first time since last April as traders appear to be less exuberant.

SpaceX and xAI are going to merge.

The US and India struck a trade deal: India will stop buying Russian oil, and the US will lower its reciprocal tariff rate to 18%.

62% of homebuyers purchased a house below its asking price last year, the highest since 2019, as the housing market shifts in favor of buyers.

Organized crime is going digital: Chinese organized crime networks laundered $16.1 billion through cryptocurrency transactions last year.

Monday's Movers to the Upside:

- Sandisk leapt another 15% after analysts raised the price target for the memory storage stock to $1,000.

- Walmart rose over 4% and Target rallied nearly 4% on the first day of work for each company's new CEO.

Monday's Movers to the Downside:

- Disney's theme parks and cruises business hit $10 billion in quarterly revenue for the first time ever, but shares still sank over 7% without news of a Bob Iger successor.

- Robinhood Markets tumbled nearly 10% as investors worried that the end of the NFL season would be a blow to the broker's fast-growing prediction markets business.

- Crypto stocks sank following bitcoin's big weekend selloff. Coinbase lost over 3.5%, Mara Holdings fell 4%, and Strategy dropped nearly 7%.

- BYD sank nearly 7% on reports of lower auto sales for a fifth month in a row, yanking the rest of the EV industry down with it.

- Tesla tumbled nearly 2% along with its peers, and the news that self-driving competitor Waymo is looking to raise $16 billion at a valuation of $110 billion only pushed shares lower.

Tuesday's Markets and News:

Market Indices began the day on a high note thanks to strong earnings from Palantir, but the rest of the software industry sank, pulling the tech sector—and the broader market—down with it. One out of every 12 stocks on the S&P 500 hit a new 52-week low today.

Traders were buying the dip, pushing gold and silver higher after a disastrous couple of down days.

Oil prices popped after a US aircraft carrier shot down an Iranian drone in the Arabian Sea.

Bitcoin fell below $73,000 at one point, its lowest level since November 2024, as traders continue to rotate out of risk-on assets.

Amazon announced more cuts in their corporate jobs.

There's new data showing that the "K-shaped" economy is getting even more pronounced.

Tuesday's Movers to the Upside:

- Walmart rose nearly 3% to hit a $1 trillion market cap, fueled by growth in its digital businesses and continued customer gains.

- Merck climbed over 2% following strong earnings and revenue tied to oncological, respiratory, and cardiometabolic treatments.

- Teradyne jumped over 13% on a strong fourth quarter with $1.08 billion in revenue, its first billion-dollar quarter since 2021.

- Rocket Companies gained nearly 8.5% as management pointed to a surge in mortgage loan volumes.

- PepsiCo rose nearly 5% after a Q4 beat, thanks to improved organic sales across the business.

- AES rose over 9% amid reports that BlackRock's GIP unit and EQT are weighing a joint bid for the power producer.

- Homebuilders Lennar Corp and Taylor Morrison Home Corp each popped over 3% on plans for a large-scale "Trump Homes" program aimed at easing the US housing affordability crunch.

Tuesday's Movers to the Downside:

- Pfizer fell over 3% after reporting lower Q4 sales as demand for its Covid-19 vaccine and antiviral treatment continued to fade.

- PayPal plunged over 20% following the announcement that CEO Alex Chriss will step down, naming former HP chief Enrique Lores as his successor.

- Novo Nordisk sank over 14.5% after the drugmaker warned that sales growth will slow this year, citing lower US prices and the loss of exclusivity for Wegovy and Ozempic in several international markets.

- NXP Semiconductors slipped over 4.5% even with higher fourth-quarter sales and a positive growth outlook.

- Pandora dropped nearly 10% after analysts downgraded the stock from Buy to Hold, warning that volatile silver prices could pressure margins.

Wednesday's Markets and News:

The software slump continued to weigh the market down, while a private payrolls report from ADP that came in well below expectations didn't bolster investors' moods.

Oil climbed as reports continue to come in that US-Iran negotiations have stumbled ahead of expected talks on Friday.

Bitcoin slid lower, prompting traders on Polymarket to put the odds that the crypto king will fall below $65,000 this year at 82%.

The tech sector took a sharp hit yesterday as investors grappled with a familiar fear in a new costume: AI is beginning to undercut core software businesses.

Anthropic's release of new tools designed to automate legal work spooked markets and sparked a selloff, but panic quickly spread into financial and data software names. Investors appear to be questioning how defensible "must-have" platforms really are in an AI-first world.

France is quitting Zoom and Teams as it moves to rely less on American big tech.

Raytheon has secured a seven-year agreement to build missiles for the US military.

Regulators are probing Nike over allegations of discrimination against white employees.

Wednesday's Movers to the Upside:

- Eli Lilly climbed over 10% on a strong Q4, driven by surging demand for Zepbound and Mounjaro.

- MGM Resorts International rose over 8% after BetMGM reached profitability and reported 2025 net revenue of $2.8 billion, up 33% year over year.

- Silicon Laboratories surged nearly 50% after Texas Instruments agreed to acquire the chip designer for $7.5 billion.

- Amgen climbed over 8% following strong Q4 results, with total revenue up 9% from a year earlier.

- Enphase Energy advanced nearly 40% after quarterly earnings and guidance topped expectations, supported by solid microinverter and battery demand through 2026.

- Match Group rose nearly 6% after beating estimates, even as the dating app company issued soft guidance while ramping up spending on AI to reaccelerate Tinder growth.

Wednesday's Movers to the Downside:

- Palantir Technologies dropped nearly 12%, erasing the prior session's gains, with multiple price target cuts from analysts on valuation concerns.

- Uber Technologies fell just over 5% despite delivering 20% revenue growth, as investors focused on a soft profit guidance.

- Take-Two Interactive Software slid over 5% despite raising full-year guidance, caught up in the broader tech selloff.

- Boston Scientific sank over 17.5% after Q4 sales and adjusted EPS growth topped expectations, but forward guidance disappointed investors.

- Strategy sank 3%, MARA Holdings fell 8.5%, and Riot Platforms dropped nearly 8% as bitcoin prices continued to slide.

- Novo Nordisk sank over 6% after warning of a sharp sales slowdown, underscoring a deepening price war in obesity treatments.

Thursday's Markets and News:

The software scare has spread to the rest of the market, pushing the S&P 500 into negative territory in 2026 as investors watch AI go from hero to villain.

Natural gas stockpiles were hit with their largest drawdown ever last week while the US endured a barrage of winter weather.

Oil lost some of its mojo after the US and Iran announced that nuclear deal talks will take place tomorrow.

Bitcoin has dropped nearly 50% from its October peak, slipping below $70,000 – a level it hasn't traded at since November 2024, completely erasing its gains since President Trump's election. It has dropped 18% this week alone.

New York's pension funds are scrutinizing Palantir over its contracts with ICE.

The four largest credit-card issuers collected $146 billion in credit card revenue last year.

A barrage of bad jobs reports hit markets today, including:

- Layoffs in January rose 118% year over year, making it the worst January for job cuts since 2009.

- Job openings declined in December for a third straight month, hitting their lowest level since September 2020.

- Initial jobless claims rose to their highest level in nearly two months last week, though closures due to winter storms likely played a role.

Thursday's Movers to the Upside:

- Pandora rose over 16% after the world's largest jeweler said it will cut reliance on silver, easing exposure to volatile input costs.

- McKesson climbed over 16.5% as fiscal Q3 EPS beat the Street's highest estimate.

- Arm Holdings gained nearly 6% on strong Q3 results, with revenue up 26% year over year.

- Cardinal Health advanced nearly 10% after beating earnings, with bottom-line growth up 36.3% from last year.

- Hershey rose 9% as Q4 earnings and revenue topped expectations.

Thursday's Movers to the Downside:

- Alphabet fell 0.60% despite beating estimates after warning that AI spending will ramp up sharply in 2026.

- Shell dropped over 5% after missing expectations and posting its weakest quarterly profit in nearly five years.

- Peloton slid over 25% as it missed top and bottom lines and fell short of internal sales targets in the holiday quarter.

- Gemini Space Station sank nearly 9% after announcing plans to cut 25% of its workforce while winding down overseas operations.

- Qualcomm declined 8.5% following soft guidance tied to the ongoing memory-chip shortage.

- Glencore fell 7% after merger talks with Rio Tinto collapsed, dashing hopes for a $200 billion mining giant.

- Estée Lauder slipped 20% as restructuring charges and tariffs weighed on the bottom line.

Friday's Markets and News:

Investors were in "buy the dip" mode today, sending indices on a wild rally following a brutal week of selloffs. The Dow climbed over 1,000 points to close above 50,000 for the first time ever, while the S&P 500 clawed its way back into positive territory year to date. Even bitcoin jumped today after touching a 16-month low last night, though it's still down for the week.

Gold, silver, and oil stayed stable throughout the session, as exhausted traders ran out the clock until the weekend.

US consumer sentiment rose to a six-month high, mainly propelled by stockholders.

The Justice Department opened a probe into Netflix.

Amazon CEO Andy Jassy doubled down on the company's $200 billion spending plan.

Friday's Movers to the Upside:

- Under Armour rose over 20% after delivering a surprise quarterly profit and more than doubling its full-year earnings guidance.

- Novo Nordisk climbed nearly 10% after the FDA commissioner pledged to crack down on illegal copycat weight loss drugs.

- GoodRx gained 6.5% after becoming a key pricing partner on TrumpRx, a new government site offering discounted drug prices.

- Lumen Technologies rose nearly 30%, CoreWeave jumped over 20%, Applied Digital added 25%, WhiteFiber climbed nearly 30%, and Nebius Group advanced 16.5% as investors piled back into AI infrastructure stocks following last week's tech sell-off.

- Roblox soared nearly 10% after reporting a strong Q4, with bookings surging 63% year over year.

- Strategy rebounded 26% as bitcoin prices recovered, easing pressure after a $12.6 billion Q4 loss.

- Liberty Global surged nearly 50% on a five-year AI partnership with Google Cloud to boost automation across its European networks.

Friday's Movers to the Downside:

- Molina Healthcare fell over 25% after forecasting a steep drop in profit for the year ahead due to persistent Medicaid cost pressures.

- Centene dropped over 3.5% after posting a $1.1 billion quarterly loss tied to elevated medical expenses.

- Verisign declined 7.5% following a miss on Q4 earnings and weak guidance.

Notable Earnings to be announced Feb 9th – Feb 13th:

The actual date may vary, so do confirm with your broker to confirm. If a trader wishes to open a position to participate in earnings announcements, it is important to check whether the earnings are released BEFORE the markets open or AFTER the markets close on the date of earnings.

This will be one of the busiest weeks of the earnings season, featuring a heavy mix of "Old Economy" giants and high-growth tech firms.

Monday: BDX / CLF / ON

Tuesday: DDOG / KO / FI / F / HOOD / GILD / LYFT / NET / SPOT / BP

Wednesday: CVS / SHOP / HUM / CSCO / MGM / TWLO / MCD / TMUS

Thursday: MCD / ABNB / TTD / AMAT / DASH / DKNG / CROX

Friday: ENB / MRNA

Key Economic Indicators due Feb 9th – Feb 13th:

Capital markets are bracing for a "double-feature" of critical U.S. data. Due to a recent 43-day government shutdown, several high-impact reports that were previously delayed—including the January Jobs Report and the Consumer Price Index (CPI)—are now being released in the same week. This cluster of data could create significant volatility in Treasury yields and equities.

The primary focus will be on whether the labor market is cooling fast enough to justify rate cuts, or if sticky inflation will force the Fed to stay sidelined until June.

The daily schedule of notable economic data releases is:

Monday: NY Fed Consumer Inflation Expectations: A key gauge for "inflation psychology." High expectations can lead to wage-price spirals.

Tuesday: Employment Cost Index (ECI) & Retail Sales: Markets are watching for wage pressure (ECI) and consumer resilience (Retail Sales).

Wednesday: January Jobs Report (Delayed): Nonfarm payrolls are forecast to rise by ~70k, with unemployment expected at 4.4%.

Thursday: Consumer Price Index: Headline CPI is expected at 0.3% MoM. Any upside surprise will likely trigger a sell-off in bonds.

Friday: Producer Price Index: Wholesale inflation data to confirm if price pressures are easing at the production level.

Closing Thoughts

Not too long ago, electric vehicles were on a fast -track to take over the US. But lately, the industry appears to have hit a pothole. Has the US pulled the plug on EVs?

Stellantis is the latest car wreck, with shares careening off a cliff after the automaker announced a write-down of $25.9 billion, including $20 billion for its EVs and $4.1 billion in warranty fees. As if that weren't bad enough, the company slammed the brakes on dividends in 2026, "in recognition of the 2025 net loss". The problem, according to CEO Antonio Filosa, boils down to "over-estimating the pace of the energy transition". Basically, the industry bet too big, too fast on US appetite for EVs.

Ford took a $19.5 billion EV write-down in December and General Motors took a $7.1 billion EV write-down in January. Even Tesla has hit a rough patch—slashing prices, cancelling two of its models, and refashioning one of its US factories to build robots instead.

EVs ran out of gas, so to speak, after President Trump rolled back a slate of Biden-era federal policies geared to accelerate the adoption of zero-emissions vehicles.

Meanwhile, Chinese EV companies are racing to fill the void. Although the US slapped a 100% tariff on Chinese EV imports, that hasn't stopped these brands from capturing nearly 70% of global market share over the past five years. BYD has even overtaken Tesla as the world's top seller of battery-powered cars, making major inroads into Europe, South America, and more recently Canada, which lifted its own 100% tariff on Chinese EV imports.

Some auto experts worry that Chinese EVs could be an "existential threat" to the US auto industry.

Questions / Comments

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use support@ivolatility.com.

Previous issues are located under the News tab on our website.