We offer multiple professional grade services to help you gain insight on volatility trading. Do not hesitate to try our products FOR FREE by clicking HERE |

The Market Update is a daily newsletter written by the team at iVolatility.com. Leveraging our analytics and data we are able to update you on key developments in the volatility market. To receive the Market Update directly into your inbox, please open a free account or visit our SITE where it is published every day. |

Market Update: 2022-03-17 |

In our market update on Monday, we looked at the selloff in Chinese stocks and highlighted the extent that he had reached. Yesterday saw one of the largest bounces in a day with HSCEI closing more than 12% higher on the day. 30d IVX finished the day about 12 points lower. |

Over in the US, the market was cautious going into the FOMC press conference but traders felt somewhat reassured by Jerome Powell’s speech and the NDX closed about 4% higher while the SPX finished up about 2%. |

Finally in Europe, we saw a relief rally as headlines about progress being made in the negotiation between Ukraine and Russia seemed to reassure traders, the German DAX finished about 4% higher. |

In terms of sectors, the consumer discretionary space was the best performing sector over the day up 3.5%. Worth noting that the 30d IVX was little changed over the day in the sector over the day as the market probably expects volatility to remain elevated over the next few weeks in this space. |

We highlighted recently how that sector had been one of the most impacted by the recent risk-off price action. At the stock level, NKE had a pretty strong bounce, up almost 5% on the day with 30d IVX finishing around 4.5 points lower. |

Financials were also quite strong with the XLF up almost 3% while JPM finished up more than 4% on the day. |

As usual, we can leverage the information from the RT Spread Scanner in order to identify potential trade candidates. For traders looking at playing the upside in NKE for instance they might find bull vertical spreads attractive as they fix both the maximum loss and the potential gain for the trade. |

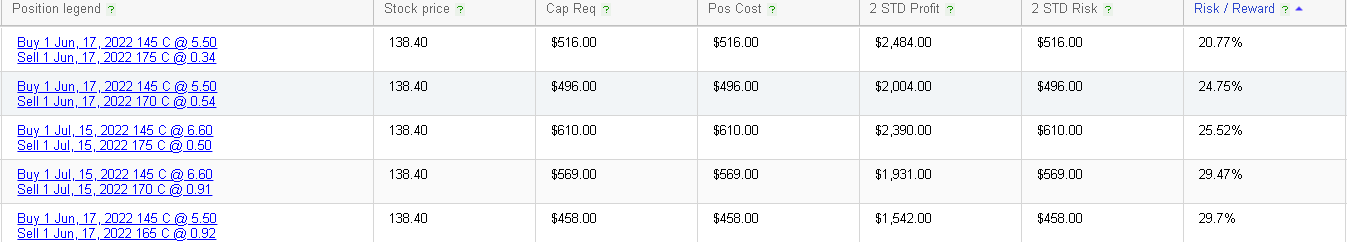

The RT Spread Scanner uses that information to try and find the best possible combinations depending on some preset criteria. In our example we get the following 5 ideas for mid term out of the money bull vertical spreads. |

|

The same search can be performed on any optionable stock, etf or index that we cover. For instance, JPM also offers similar risk to reward ratio in the current market conditions for bull vertical spreads. |

|

On the other hand, for traders looking to sell bull vertical spreads, for instance as a way to finance long spreads or naked in other names, the system also offers the possibility to find the most attractive structures from a risk to reward perspective at the index level. Scanning for short bull vertical spreads on SPY produces the following results: |

|

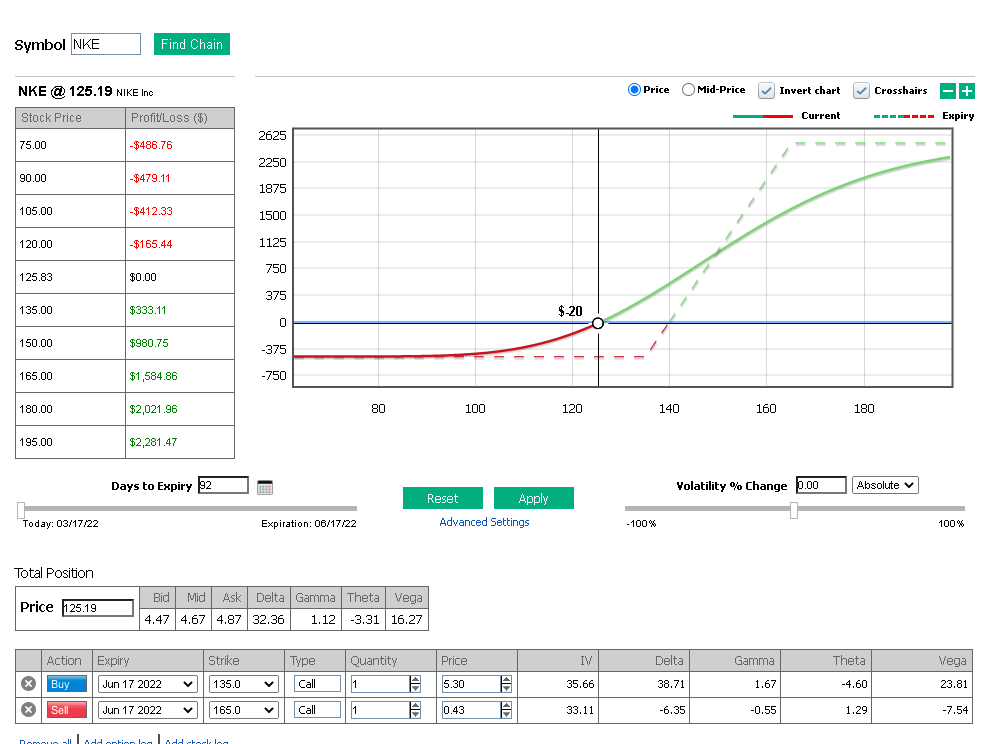

In order to better assess the possible scenarios of our bull vertical spreads, we can take a look at the PNL Calculator. This tool is designed to help traders get a quick understanding of all their exposures. |

Using the first bull vertical spread suggested by the RT Spread Scanner on NKE as an example, we get the following from the PNL Calculator: |

|

This tool is split in three major parts: |

|

As a result, we can see that the Jun’22 135 / 165 bull vertical spreads show a delta of around 32.36 shares at the current spot price of 125.19. |

We can also see that the theta of the structure is -3.31, telling us that if nothing happens over the day, the structure would lose $3.31. |

Combining those two numbers, we are able to approximate our daily breakeven move defined as the ratio of the theta over the delta exposure which gives a required daily up move of around 10c for NKE. |

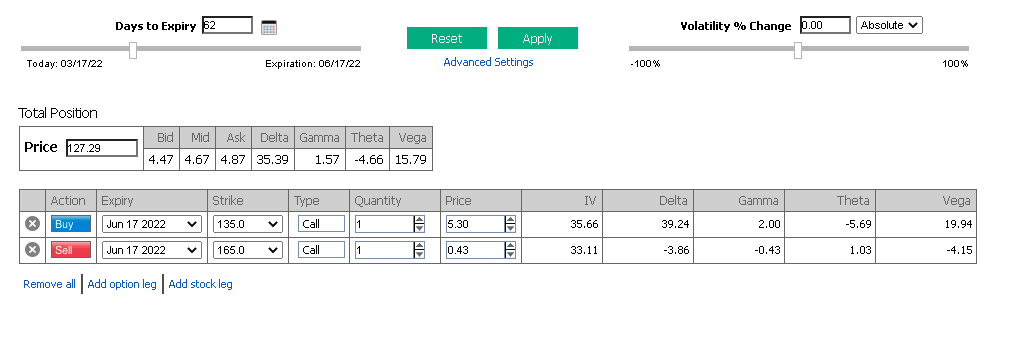

Assuming that we go up 10 cents a day for the next 21 days (which equates to 30 calendar days) and sliding through time by 30 days, we can see that the spot price would be at 127.29, that the delta would have increased to around 35.39 and that the theta would have jumped to -4.66 per day requiring this time a move higher of around 13 cents on average per day. |

|

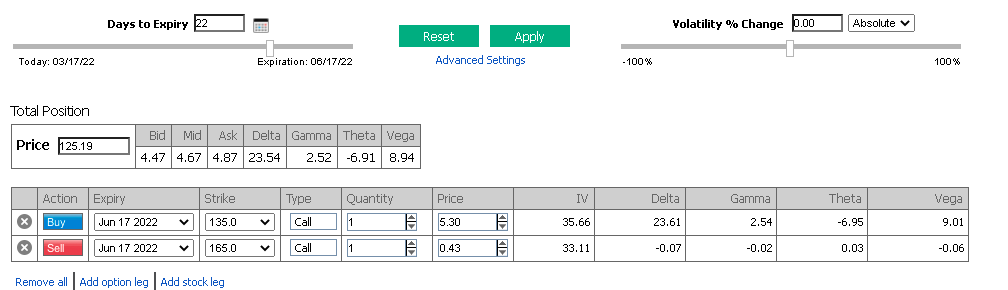

This very crude logic can be useful to convert an options position into an actual move required for that position to be profitable over the day. Readers more familiar with options will not be surprised to see that assuming the stock price does not move for the next 70 days, the breakeven would increase substantially as the option structure nears the expiration as shown below |

|

Preparing for the various scenarios in the market is a very important step in order to improve as a trader and this tool is certainly one that can play a key role for traders. |

Disclaimer - This information is provided for general information and marketing purposes only. The content of the presentation does not constitute investment advice or a recommendation. IVolatility.com and its partners do not guarantee that this information is error free. The data shown in this presentation are not necessarily real time data. IVolatility.com and its partners will not be liable for any loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from the use or reliance on the information. When trading, you should consider whether you can afford to take the high risk of losing your money. You should not make decisions that are only based on the information provided in this video. Please be aware that information and research based on historical data or performance do not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk. |