The Market Update is a daily newsletter written by the team at iVolatility.com. Leveraging our analytics and data we are able to update you on key developments in the volatility market. To receive the Market Update directly into your inbox, please open a free account or visit our SITE where it is published every day. |

Market Update – Is the rising USD a risk for your stocks? (2022-03-22) |

Yesterday saw markets pause with SPX and NDX almost unchanged at end of day. Implied volatilities were steady although NDX remarked about 1 point higher on the day. |

Most of the action yesterday did not happen in the equity space but rather in Fixed Income. Looking at IEI (iShares 3–7– year Treasury bond ETF) as a proxy for intermediate rates and TLT (iShares 20+ year Treasury bond ETF) as a proxy for long rates, we can see that the selloff was pretty uninterrupted over the day in those two ETFs. It must be noted that over the past few days and almost culminating yesterday, there has been a constant flow of FED rhetoric that insists on the hawkish shift that the FED is implementing. |

This shift was obvious at the FOMC meeting last week but was emphasized by Powell yesterday when he suggested that he would back a 50 basis-point hike in May if necessary. |

This created a large repricing across US curves with 2-year rates now trading at 2.16% and 10-year rates at 2.33%. |

TLT Spot Price – 2022/03/21 |

IEI Spot Price – 2022/03/21 |

The initial reaction in the NDX was bearish with the index giving up about 150 points in the hour that followed the headline before being bought into the close to finish almost unchanged on the day. |

NDX Spot Price – 2022/03/21 |

At the sector level, the XLE restarted its move higher and finished about 3% higher on the day as Crude Oil approached $110. |

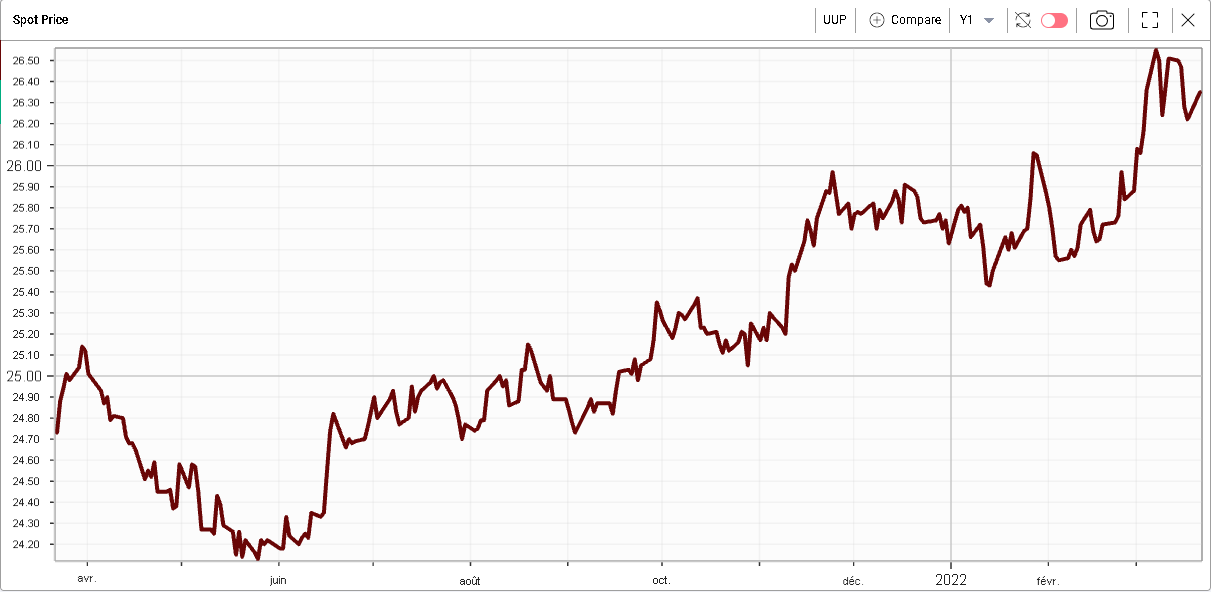

Despite rates reaching new highs yesterday, the USD failed to get back to its prior top as shown on the below 12 months chart for UUP (Invesco DB US Dollar Index Bullish Fund). |

|

Over the last 12 months the USD is up about 6.5% helped by geopolitical risks as well as the more resilient US economy and a more hawkish FED. |

Now a higher USD is not necessarily a bad thing for the stock market and in fact the correlation is generally thought to be pretty positive. When the USD rises it is generally because the overall economy is doing pretty well and as a result US stocks tend to benefit overall. This being said, some companies may start to be impacted by this higher USD, especially those with large foreign revenues. For instance, names like PG and KO which reported in 2021 that a weakening USD would be positive for their earnings will be interesting to watch. |

This is not entirely surprising considering for instance that international sales for PG represented more than 50% of total revenues in 2021. For KO, sales outside the US were about two-thirds of total revenues in 2021. |

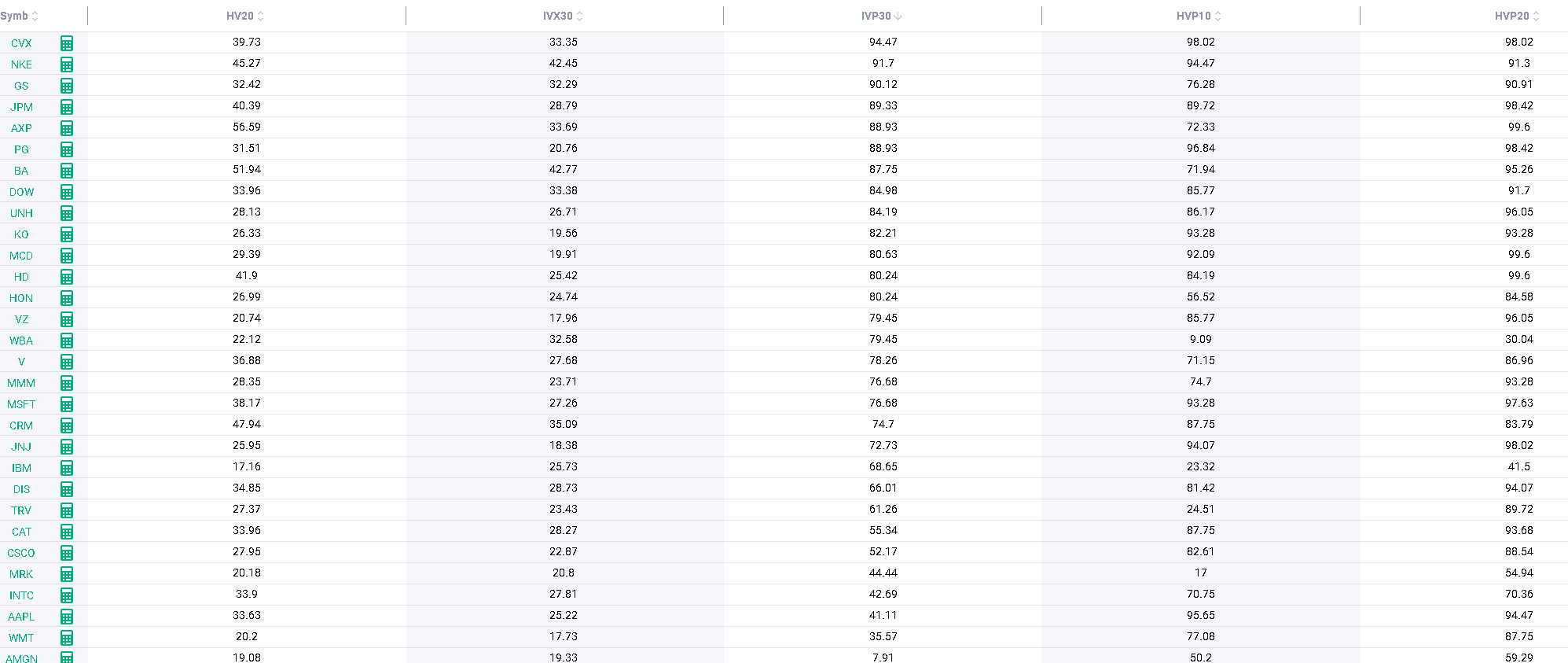

Looking at the DJIA components, we can see that implied volatilities have dropped from their recent highs for most of the stocks. |

|

Looking at realized volatility, it remains elevated historically when measured using the 20-day realized volatility but we can also note that realized volatility has started to come off as the percentiles for 10-day historical volatility are starting to compress. |

Some stocks are already pricing a significant drop in implied volatility over the next few weeks. AAPL is one such example with the 30-day IVX trading in its 41st percentile while both 10d and 20d realized volatilities are trading in their 95th percentiles. |

Looking at both the 30d IVX in green compared with the 20d realized volatility in orange, we can spot the recent divergence. |

|

As with all things, this on its own does not constitute a trading opportunity as realized volatility is backward looking while implied volatility is forward looking but it helps frame the current expectations from the market especially compared to what is being seen on other underliers. |

Disclaimer - This information is provided for general information and marketing purposes only. The content of the presentation does not constitute investment advice or a recommendation. IVolatility.com and its partners do not guarantee that this information is error free. The data shown in this presentation are not necessarily real time data. IVolatility.com and its partners will not be liable for any loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from the use or reliance on the information. When trading, you should consider whether you can afford to take the high risk of losing your money. You should not make decisions that are only based on the information provided in this video. Please be aware that information and research based on historical data or performance do not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk. |