Call activity picks up on QQQ and TQQQ |

Markets rallied going into Apple and Amazon’s earnings with the NDX closing 3.5% higher, the SPX 2.47% and the DJIA 1.85%. Implied volatilities dropped over the day with the 30d IVX losing 4 points for the NDX, 3 points for the SPX and 2 points for the DJIA. |

After the close numbers from Amazon disappointed and the stock is now pointing to a loss of around 9% at the open while for Apple the guidance left investors disappointed and the stock is indicating around 2.5% lower. |

Looking at sectors, the Communications and the Technology spaces traded pretty much in line closing about 4% higher on the day. Implied volatilities deflated significantly as well down around 5 points on the day. |

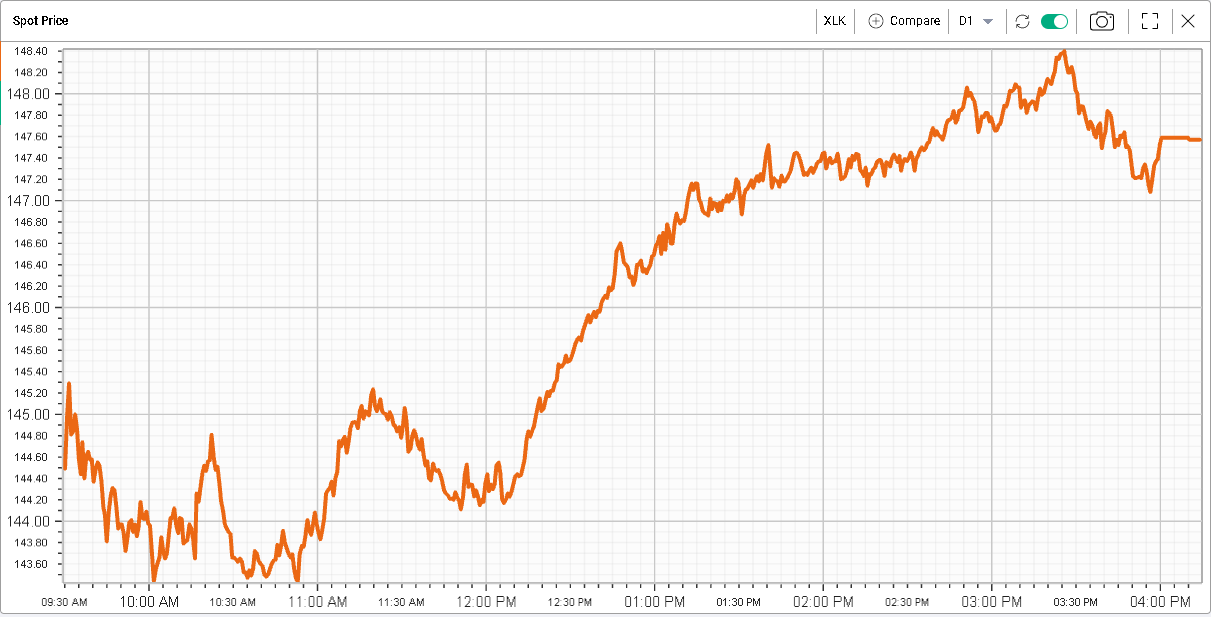

Technology sector in the US - 1-minute intraday chart |

Communications sector in the US - 1-minute intraday chart |

The energy space was also supported closing more than 3% higher for the day. |

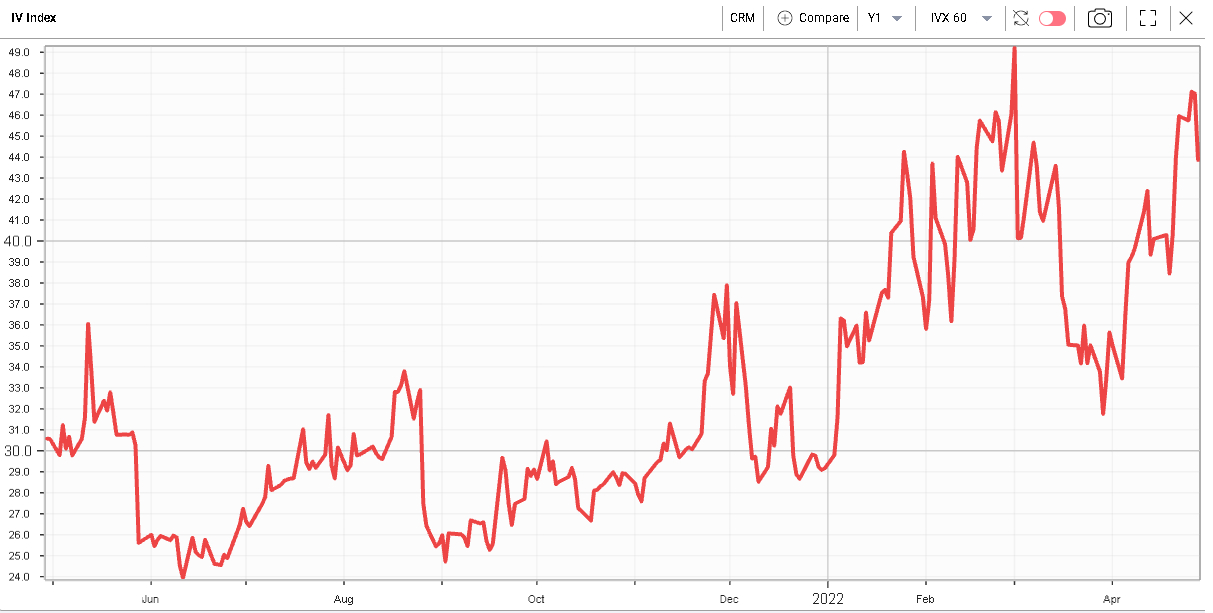

At the single stock level, CRM rallied fairly strongly yesterday closing more than 6% up on the day. The stock is still trading about 28% lower on the year and it will be interesting to see how the name will trade going into its earnings at the end of May. |

12 months spot price for CRM |

Traders looking to play a bounce in the name should take note of the implied volatility level trading almost at its highest level over the last 12 months. |

CRM 60d IVX - Last 12 months |

Looking at the RT Spread Scanner and bull vertical spreads, the system suggests the following combinations as being the most attractive from a Risk / Reward perspective. |

|

For instance, the July 200/270 bull vertical spread offer a risk/reward ratio of less than 15%. |

Investors seemed pretty happy about the results in MRK and the stock jumped almost 5%. Being a relatively defensive name, the stock is already up 15.2% this year and traders seem to be eyeing the 12 months highs at $90.54. |

12 months spot price in MRK |

Following earnings implied volatility in the name reset lower with the 60d IVX currently sitting around 22% at the low end of its range off the past 6 months. |

12 months 60d IVX for MRK |

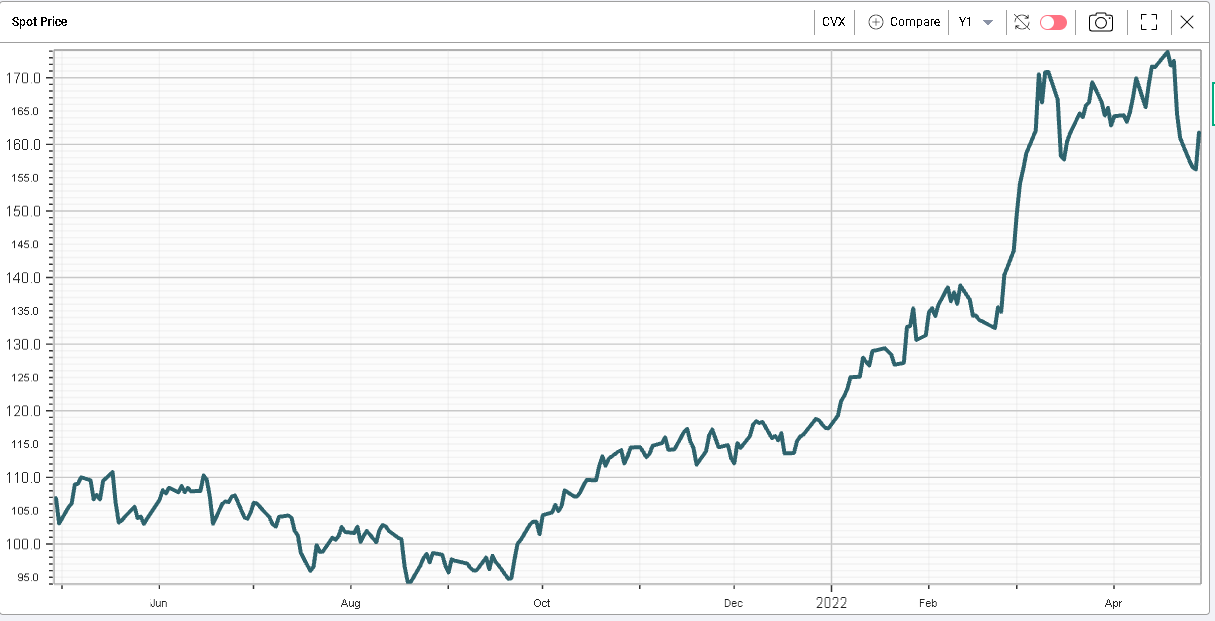

After seeing what looked like profit taking, CVX seemed to have a fairly good day yesterday rising 3.5%. The stock is up 36% on the year and continues to trade fairly closely to Oil prices. |

CVX spot price - Last 12 months |

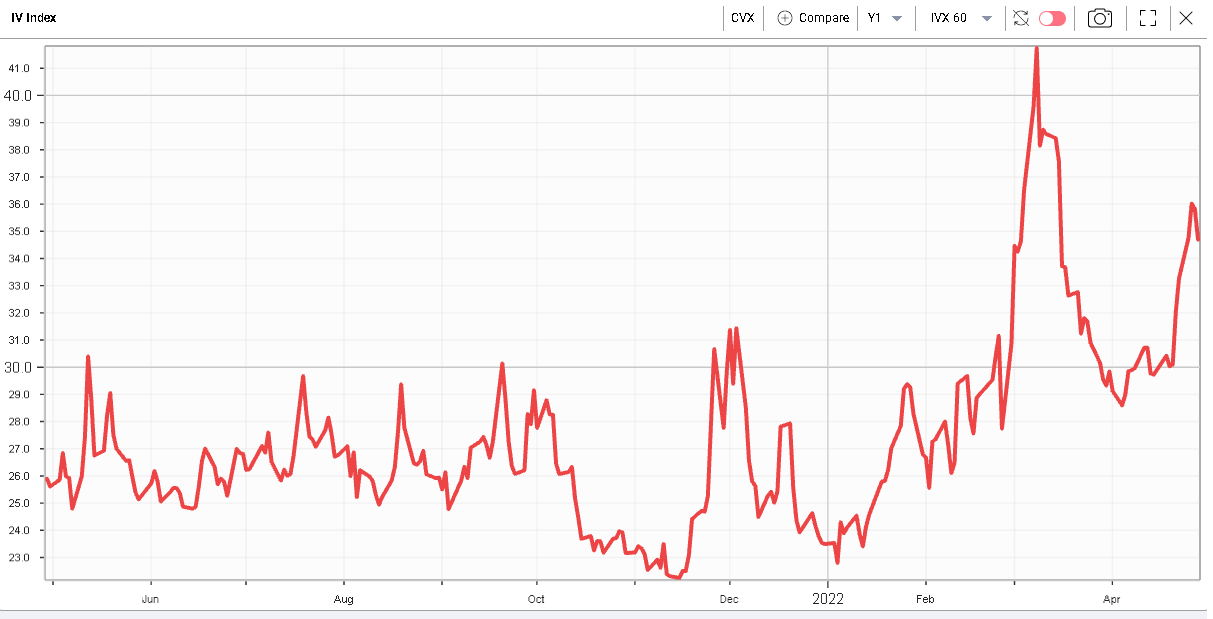

Volatility in the name has failed to reach its previous highs established early March as realized volatility has compressed over the past month and a half. |

CVX 60d IVX - Last 12 months |

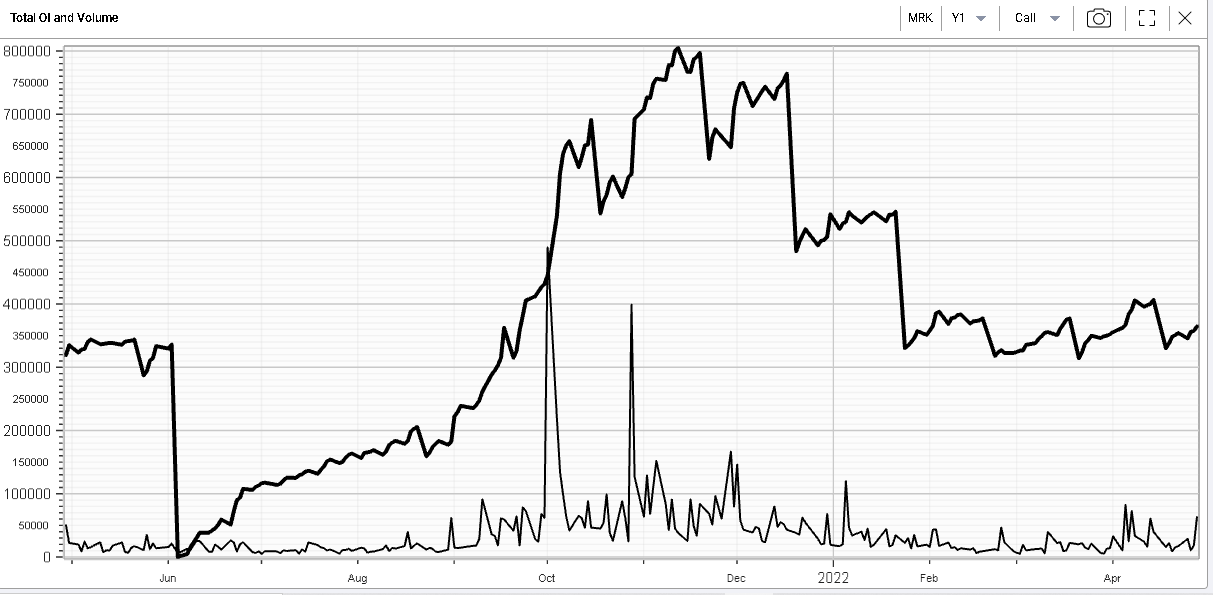

Looking at options activity, yesterday saw a little uptick in MRK volume for calls |

12 months Call Open interest (bold line) and Volume for CVX |

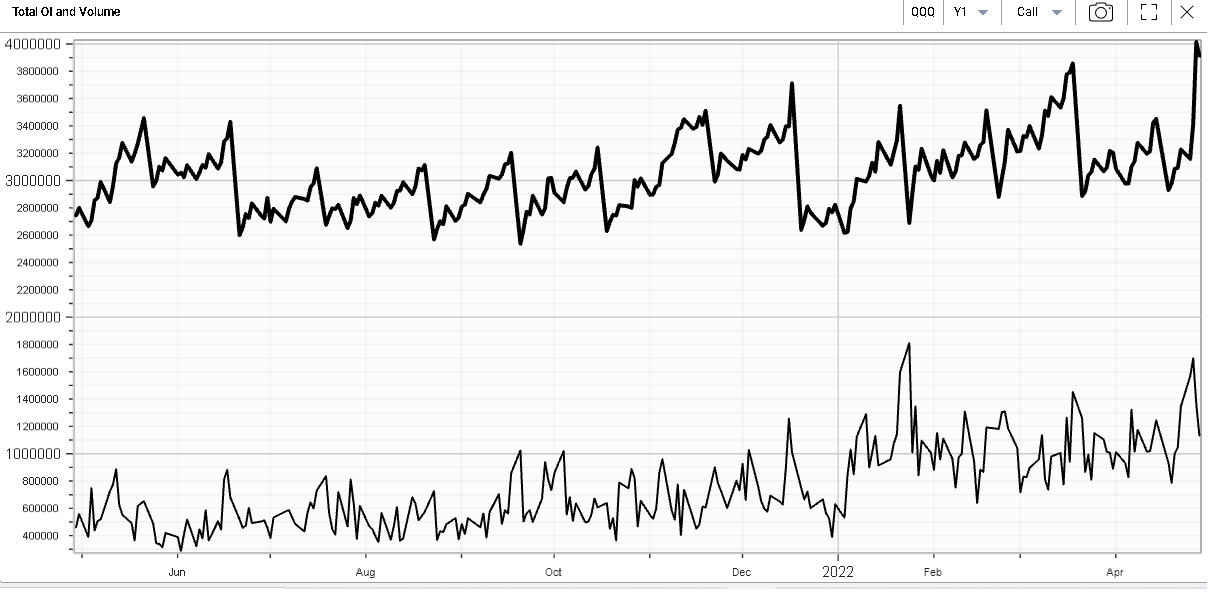

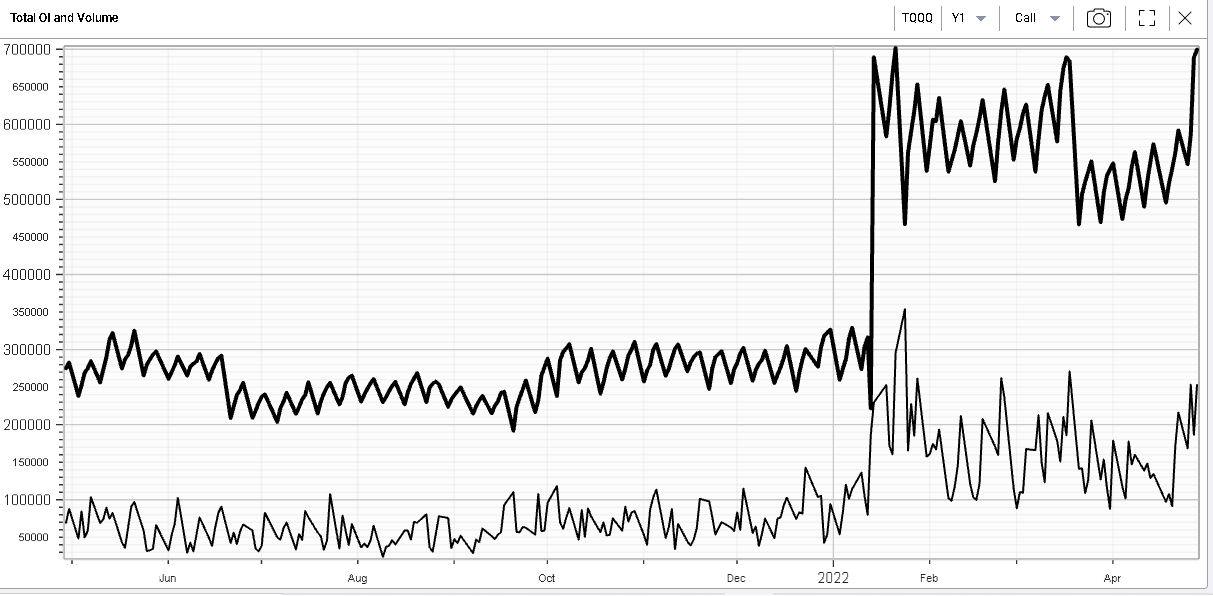

At the index level, call activity for the NDX picked up slightly but it was on the related products that most of the action took place. Below we show the call open interest (bold) and the volume lines for QQQ and TQQQ on the call side. |

QQQ Call Open interest (bold line) and Volume - last 12 months |

TQQQ Call Open interest (bold line) and Volume - last 12 months |

Both ETFs reached 12 months highs in terms of open interest on the call side and trading activity has been increasing. It will be interesting to see how the market reacts over the next few days on the back of that buildup in activity. |

Disclaimer - This information is provided for general information and marketing purposes only. The content of the presentation does not constitute investment advice or a recommendation. IVolatility.com and its partners do not guarantee that this information is error free. The data shown in this presentation are not necessarily real time data. IVolatility.com and its partners will not be liable for any loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from the use or reliance on the information. When trading, you should consider whether you can afford to take the high risk of losing your money. You should not make decisions that are only based on the information provided in this video. Please be aware that information and research based on historical data or performance do not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk. |