Buffet's portfolio updates and an important week for traders |

Another heavy Friday to finish the week with the NDX closing 4.5% lower, the SPX finishing 3.6% lower and the DJIA 2.77%. The price action felt like there was very little appetite from buyers to step in and defend levels going into the weekend and spot finished at the lows of the day right on the close. |

|

Implied volatilities increased throughout the day and finished at the highs of the day. SPX and NDX 30d IVX were up 4 points and 30d IVX for the DJIA was 2 points higher by the close. |

|

Looking at sectors it seemed that traders pared their exposure to consumer discretionary and tech stocks going into the FOMC next week with the former finishing 5.1% lower on the day and the latter closing 4.1% lower. All sectors finished in the red, even the more defensives ones that have so far managed to hold their ground or even gain in 2022. |

At the single stock level, INTC was the worst performing stock closing almost 7% lower on the day driven by disappointing earnings and guidance. AMZN closed 14% lower on the day following weaker than expected earnings and AAPL closed about 4% lower following its numbers. |

MKR and HON managed to finishing in positive territory significantly outperforming broader indices. |

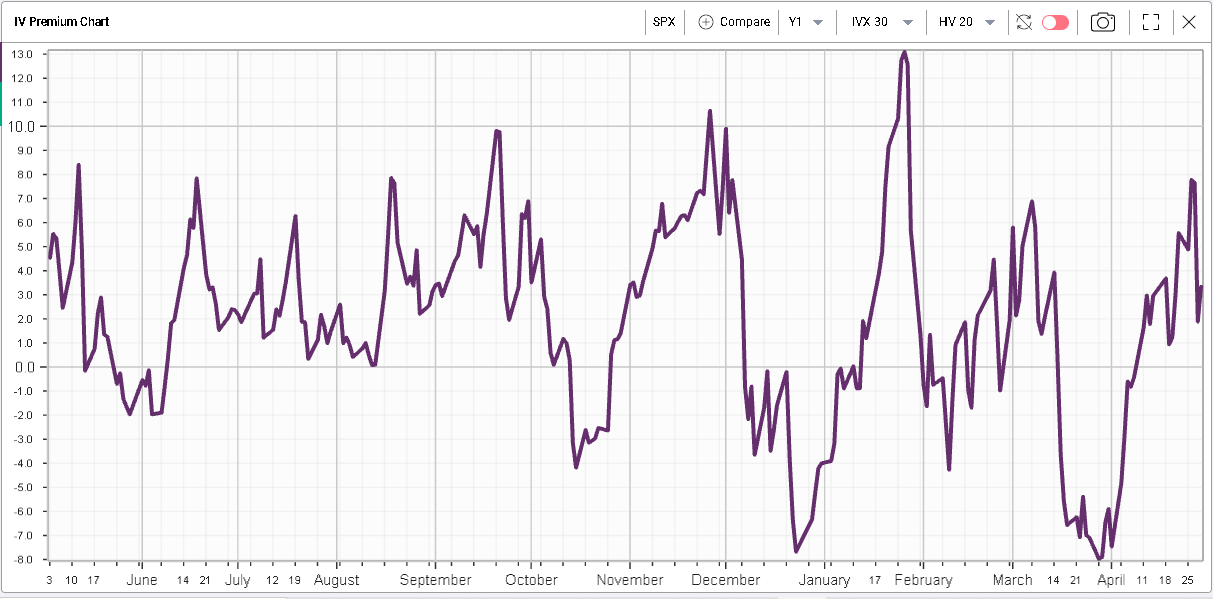

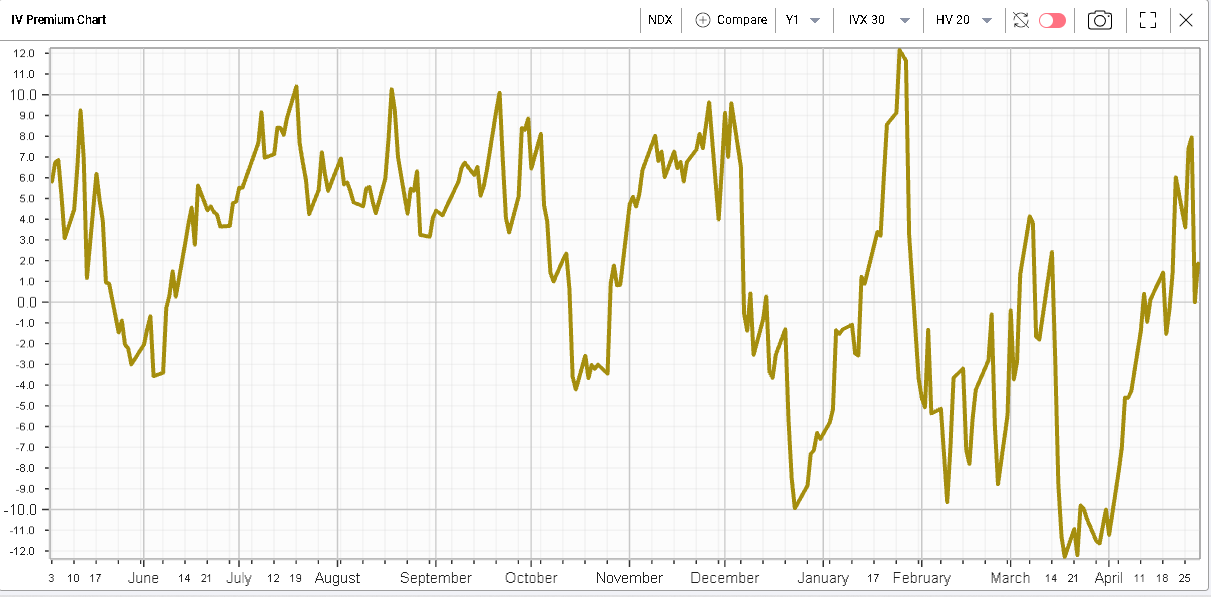

Despite the recent spike in implied volatilities, the premium over realized volatility has remained subdued for indices. We show below the 30d/20d IVX premium chart for both the SPX and the NDX. |

|

|

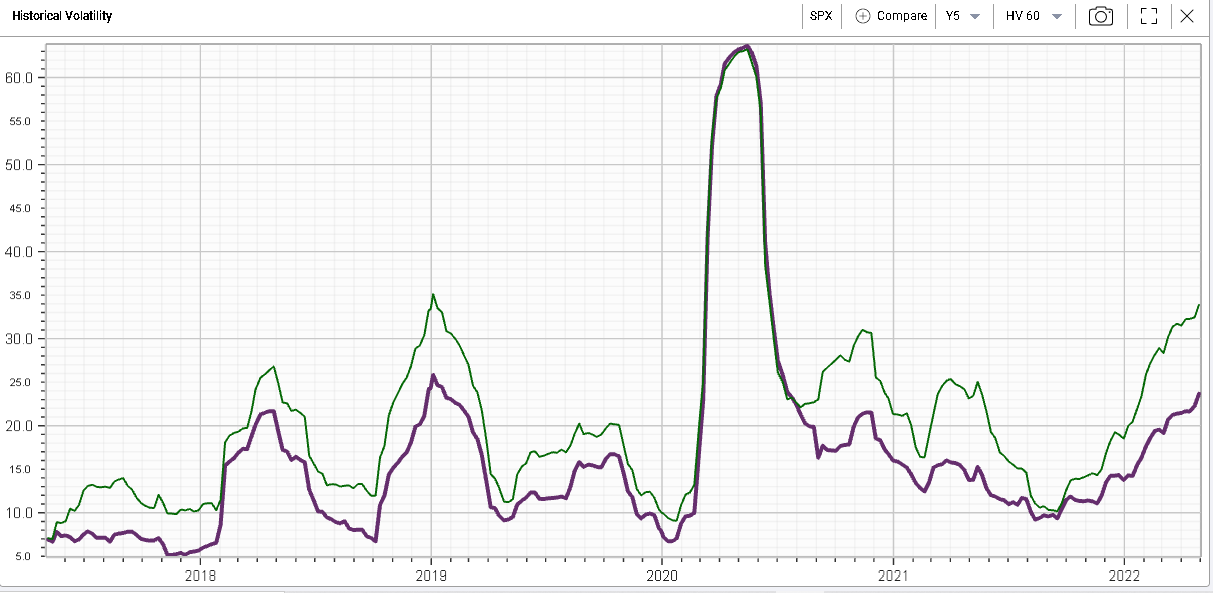

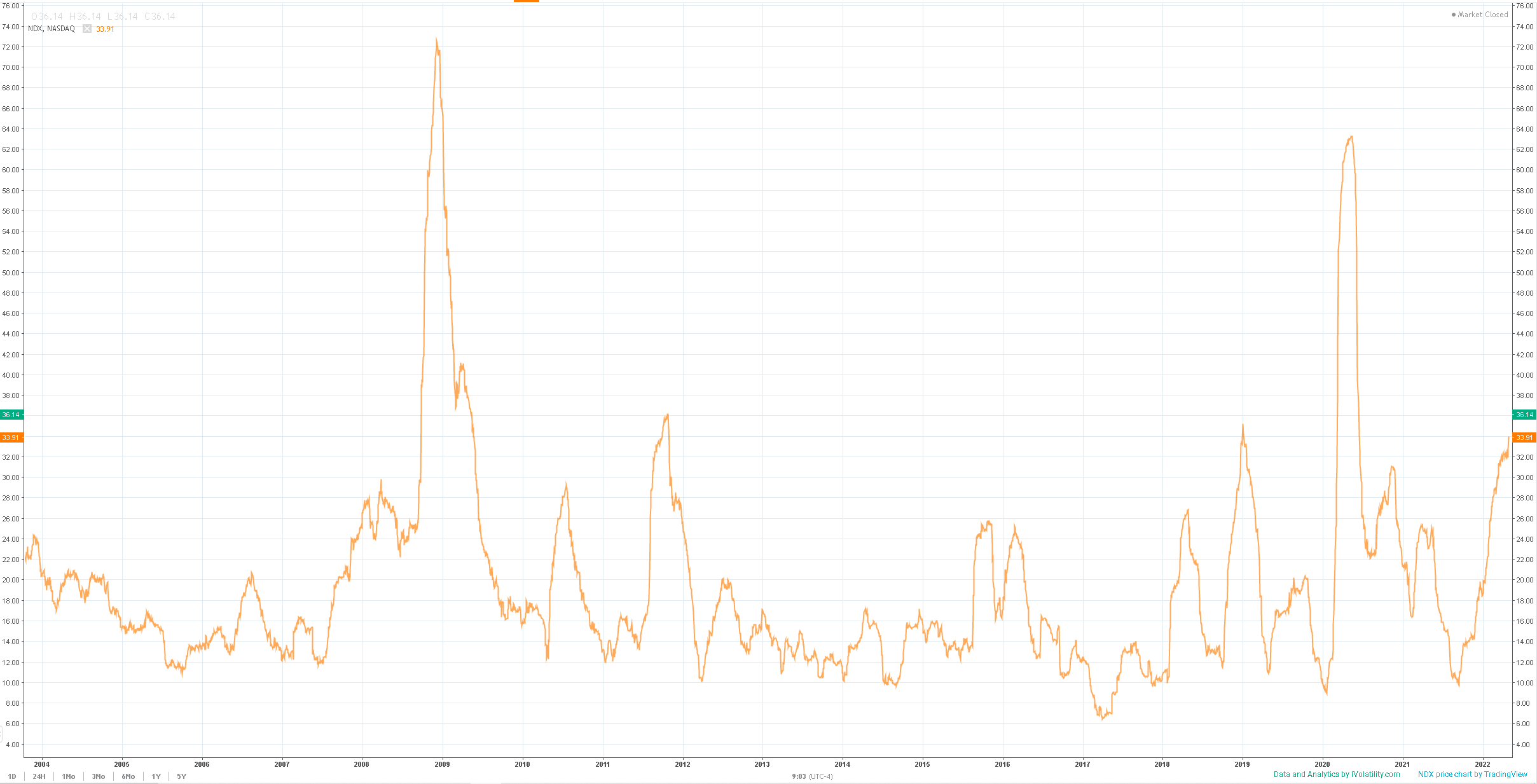

Looking at 60 days realized volatility over the past 5 years, the volatility expansion phase that started in the middle of 2021 continues for now. 60d RV has reached its highest level in 5 years for the NDX outside of the pandemic crash. |

|

Looking at our long-term charts for 60 days RV we can see that the current volatility expansion remains very important historically. |

|

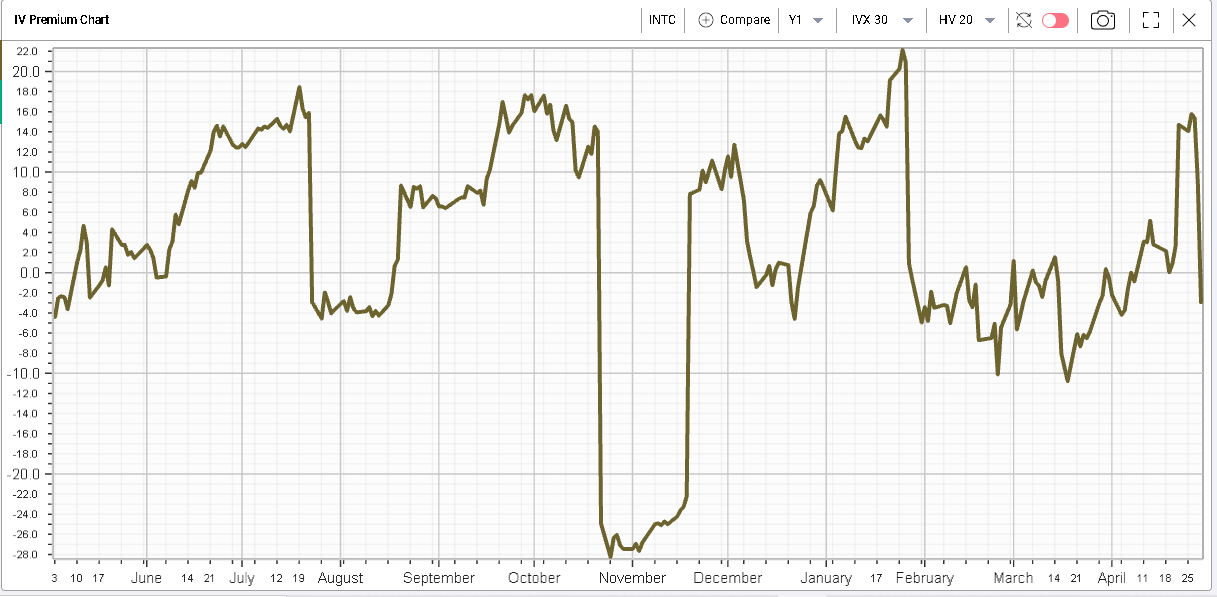

Looking at volatility changes, it is interesting to note the IV crush post earnings for INTC pushing the 30d/20d IVX premium into negative territory. |

|

Last week we also had an update from Berkshire Hathaway and the company announced some of the purchases that were made during the first quarter of this year with around $41bln of stocks bought (net of stock sales). |

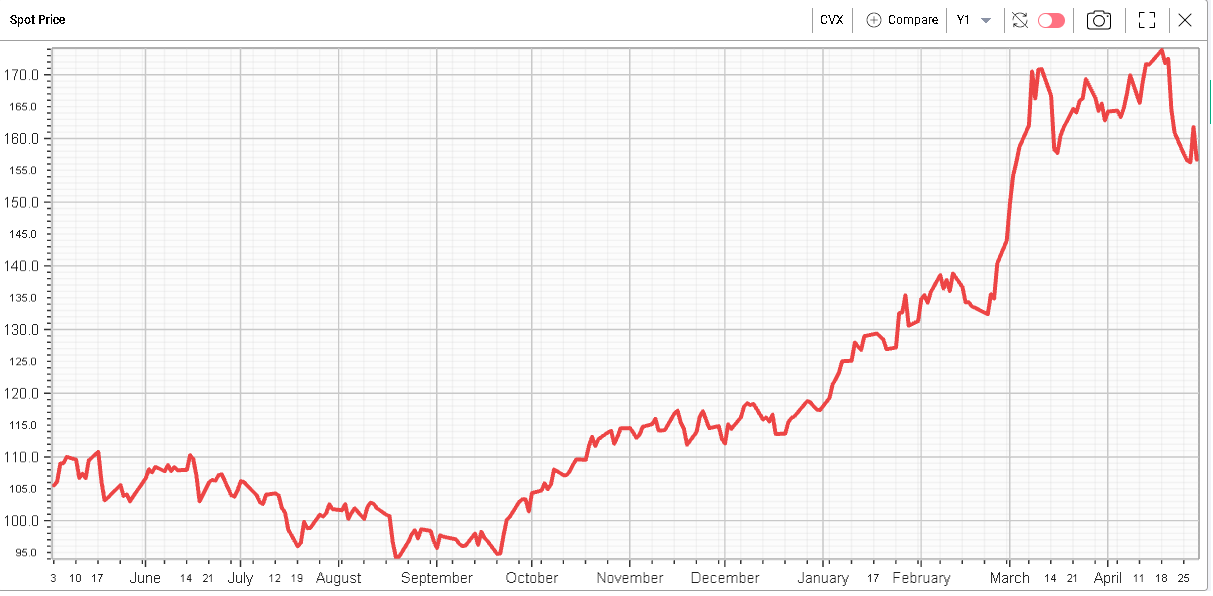

Berkshire increased its stake in CVX which is up around 31% so far in 2022. |

|

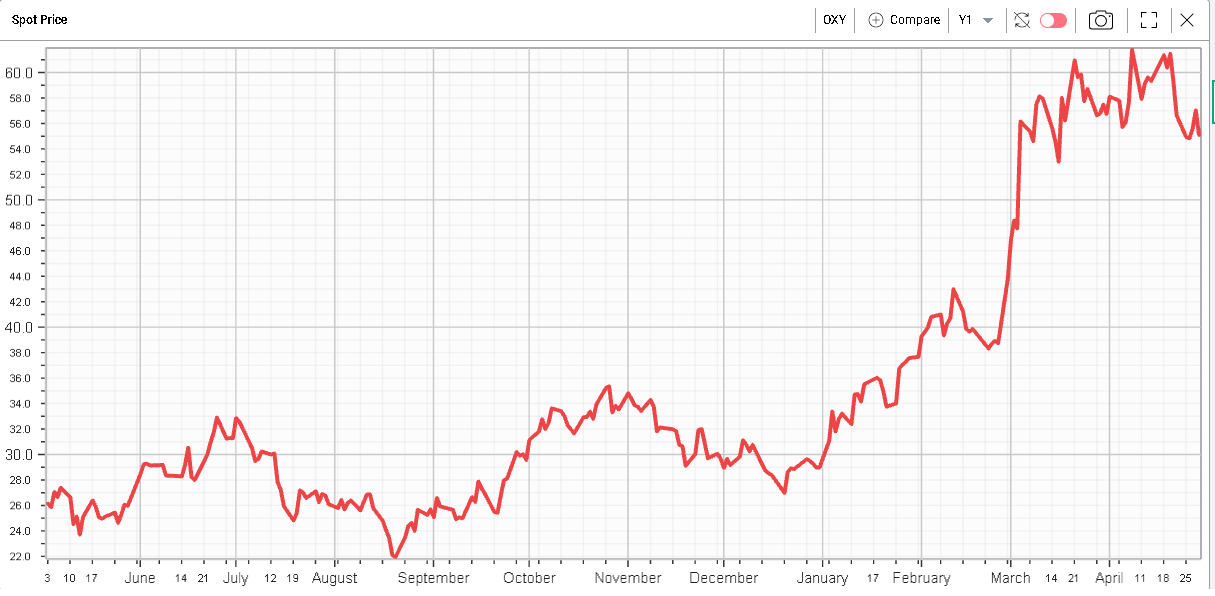

It also acquired OXY which has risen 77% in 2022 so far. |

|

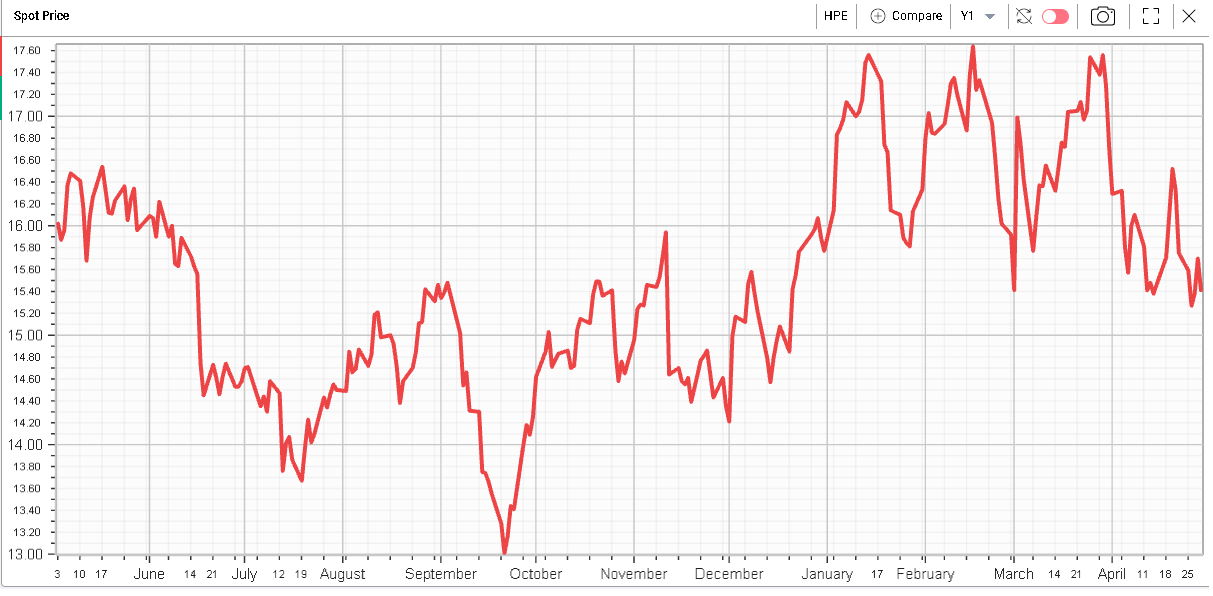

HP was also added, the stock is down around 4% this year. |

|

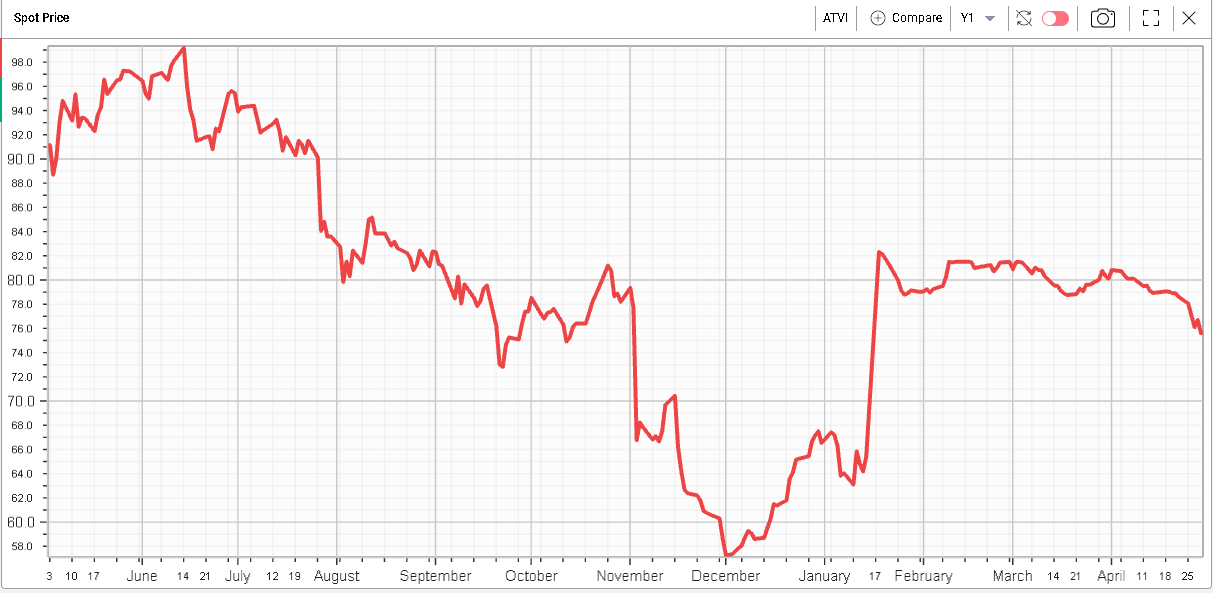

Another interesting trade disclosed by Warren Buffet’s firm was the total stake of around 9.5% of Activision shares on the back of the existing discount from the offer price from Microsoft at $95 compared with a closing price on Friday of $75.6. |

|

Next week will be important from a macro perspective with the following events: |

|

Disclaimer - This information is provided for general information and marketing purposes only. The content of the presentation does not constitute investment advice or a recommendation. IVolatility.com and its partners do not guarantee that this information is error free. The data shown in this presentation are not necessarily real time data. IVolatility.com and its partners will not be liable for any loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from the use or reliance on the information. When trading, you should consider whether you can afford to take the high risk of losing your money. You should not make decisions that are only based on the information provided in this video. Please be aware that information and research based on historical data or performance do not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk. |