The fear of giving back profits can be stronger than the fear of losing |

The day started fairly poorly and the SPX made new lows for the year before turning around and rallying to finish up on the day. The 30d IVX in the SPX briefly traded above 30 before selling off to finish just above 27. |

A late day spot/vol divergence was also visible with implied volatility selling off more aggressively than spot rallied. The SPX finished below its intraday highs but the volatility finished at the lows. This phenomenon could be a sign that demand for volatility abated quickly as the index failed to stay around the lows. |

|

|

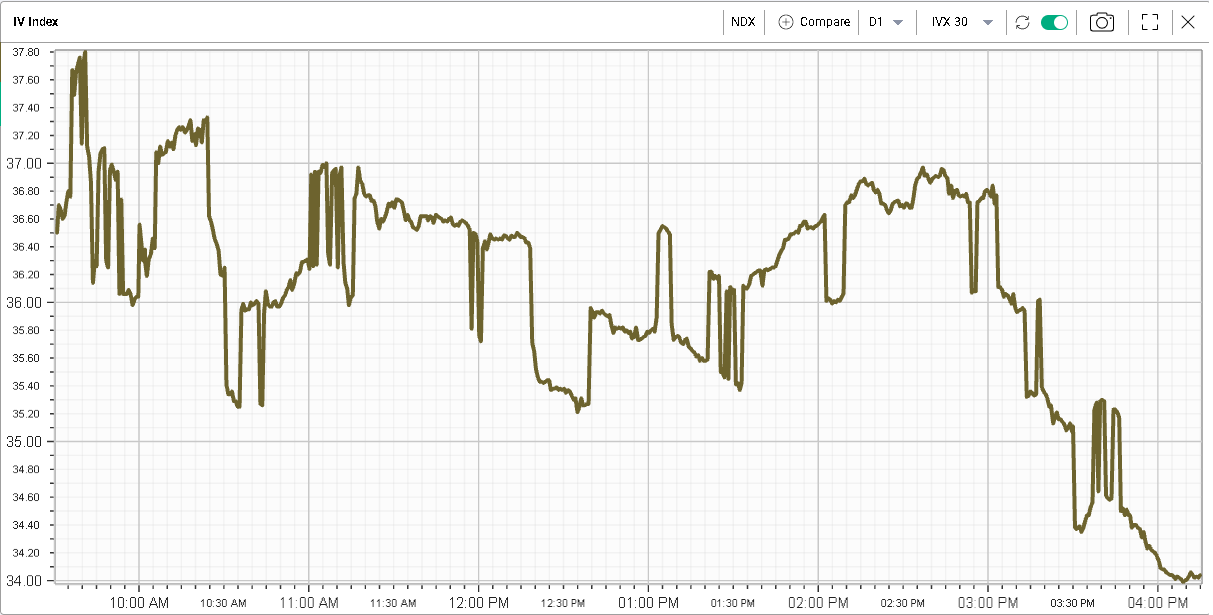

This is not something that was repeated in the NDX where the index finished the day 1.72% higher, above its prior intraday highs while implied volatility finished around the lows as well as shown below. |

|

|

Looking at sectors, it looked like market participants were willing to take on more risk by the end of the day. The overall sentiment felt overwhelmingly bearish over the past few days and it is possible that some traders and investors are seeing that as extreme and are happy to step in to play a bounce. |

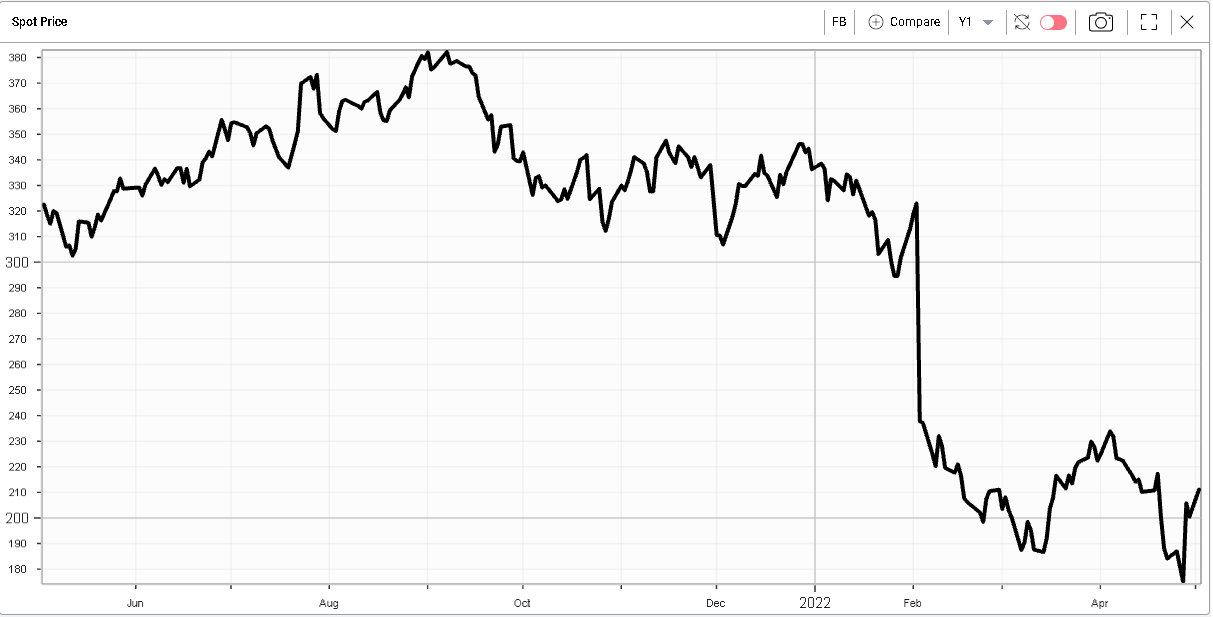

Communications stocks outperformed yesterday closing up about 4%. Facebook continues to bounce following numbers that seemed to reassure the market last week. |

Facebook spot price - Last 12 months |

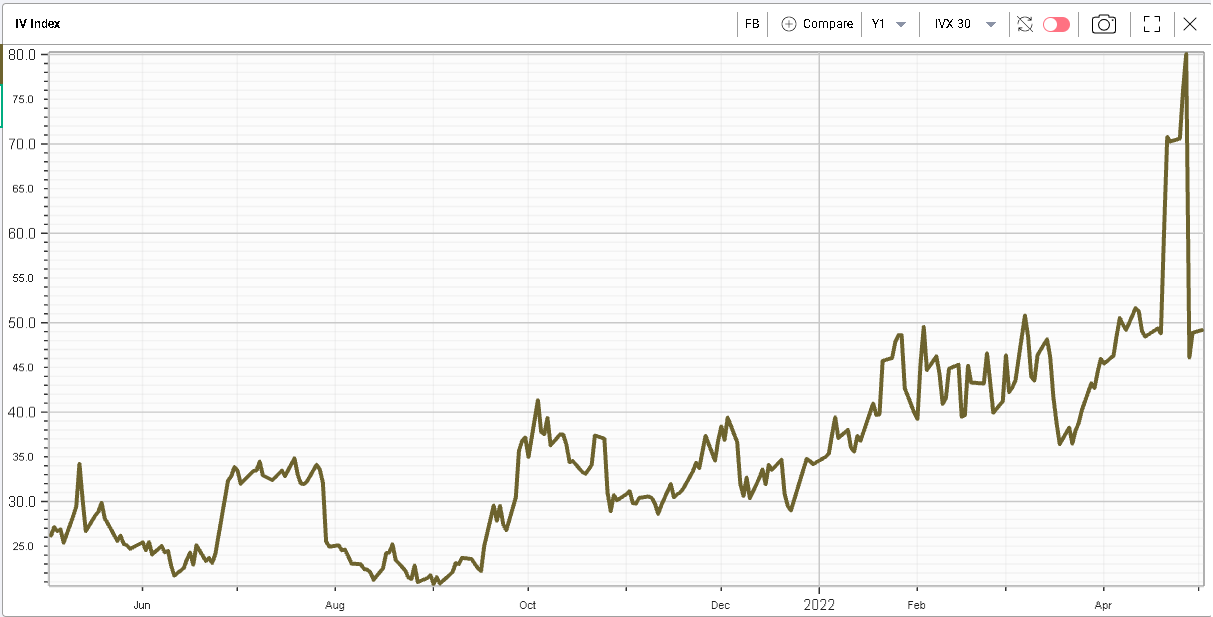

Implied volatility in the name remains elevated historically as shown on the below chart and traders looking to express views in the name might find spreads attractive. |

|

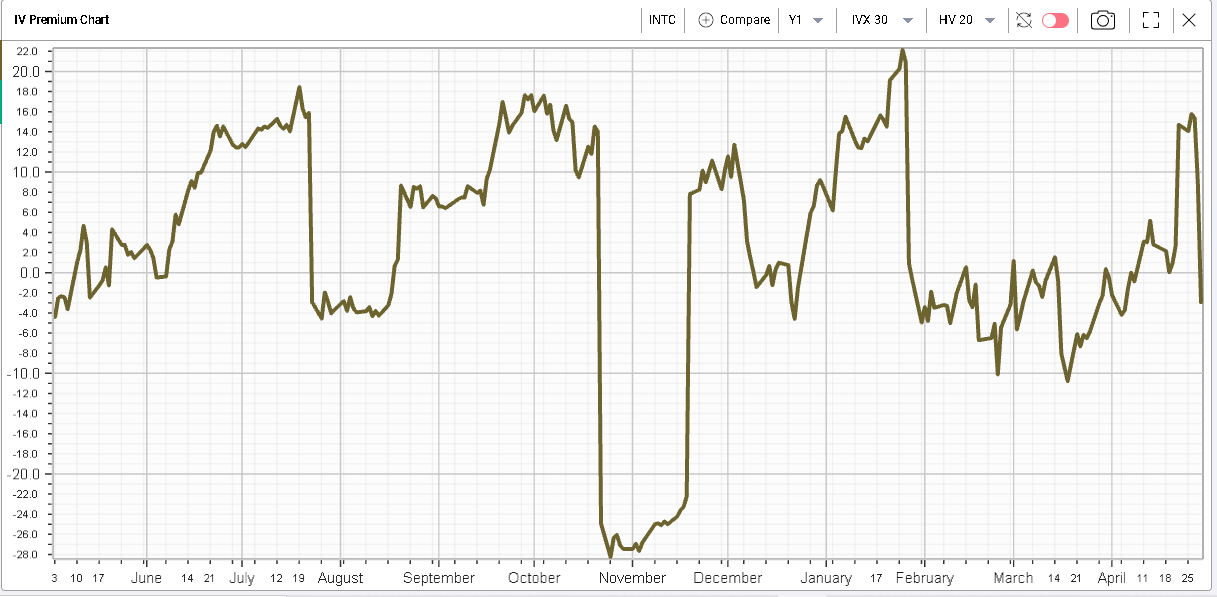

Looking at volatility changes, it is interesting to note the IV crush post earnings for INTC pushing the 30d/20d IVX premium into negative territory. |

|

Looking at the RT Spread Scanner for mid to long term bull vertical spreads in FB, we get the following list. |

|

For the first structure, the Risk/Reward of 11.85% indicates that we risk losing around 11.85c for each $1 we stand to make (all based on 2 standard deviation moves). |

Following the announcement that Berkshire's stake in ATVI reached 9.5% (see our previous market update for more information), traders seemed interested in replicating that position and ATVI was up around 3.25% on the day. |

Consumer discretionary stocks also had a fairly strong day with the space finishing around 1.5% higher on the day. |

TSLA was up 3.7% and traded back above $900 and HD continues to hold the $300 level that we looked at a few days ago in a previous market update and closed 2.2% higher. On the other hand, following disappointing results last week, AMZN continues to struggle and finished unchanged on the day. |

Staples were sold finishing 1.3% lower on the day. The selloff was fairly uniform with most names finishing around 1-1.5% lower on the day. Defensives more generally finished lower on the day, with utilities closing 1% lower and Healthcare finishing 0.6% lower. |

Overall, yesterday felt like a fading of the recent trends that have prevailed in the market. When positioning on specific themes becomes overcrowded and positions stop to perform, traders can get nervous and look to unwind. On many counts, the fear of giving back profits can be stronger than the fear of losing and that will often given rise to some very powerful counter-trend moves as we may have witnessed yesterday. |

Some names still standout from that picture. CVX finished about 2% higher and shows an overall performance of around 34% in 2022. The news that Warren Buffet increased its position may explain part of that outperformance as traders may look to replicate Berkshire's portfolio. |

BA also struggled yesterday finishing 0.15% lower despite being around 29% lower on the year. MCD is another example finishing 1% while being around 8% lower in 2022. |

Disclaimer - This information is provided for general information and marketing purposes only. The content of the presentation does not constitute investment advice or a recommendation. IVolatility.com and its partners do not guarantee that this information is error free. The data shown in this presentation are not necessarily real time data. IVolatility.com and its partners will not be liable for any loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from the use or reliance on the information. When trading, you should consider whether you can afford to take the high risk of losing your money. You should not make decisions that are only based on the information provided in this video. Please be aware that information and research based on historical data or performance do not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk. |