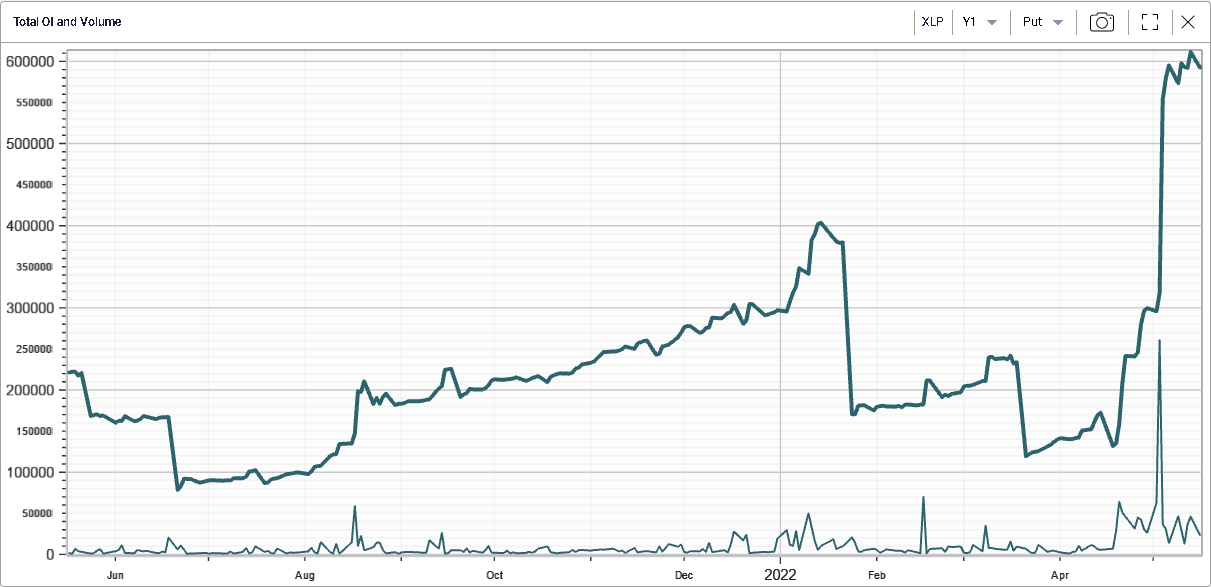

Put volume increases in XLP |

The week started slowly with a quiet performance from indices compared to what we have been accustomed to over the past few weeks. The NDX settled about 1% lower, the SPX about 0.4% lower and the DJIA unchanged. |

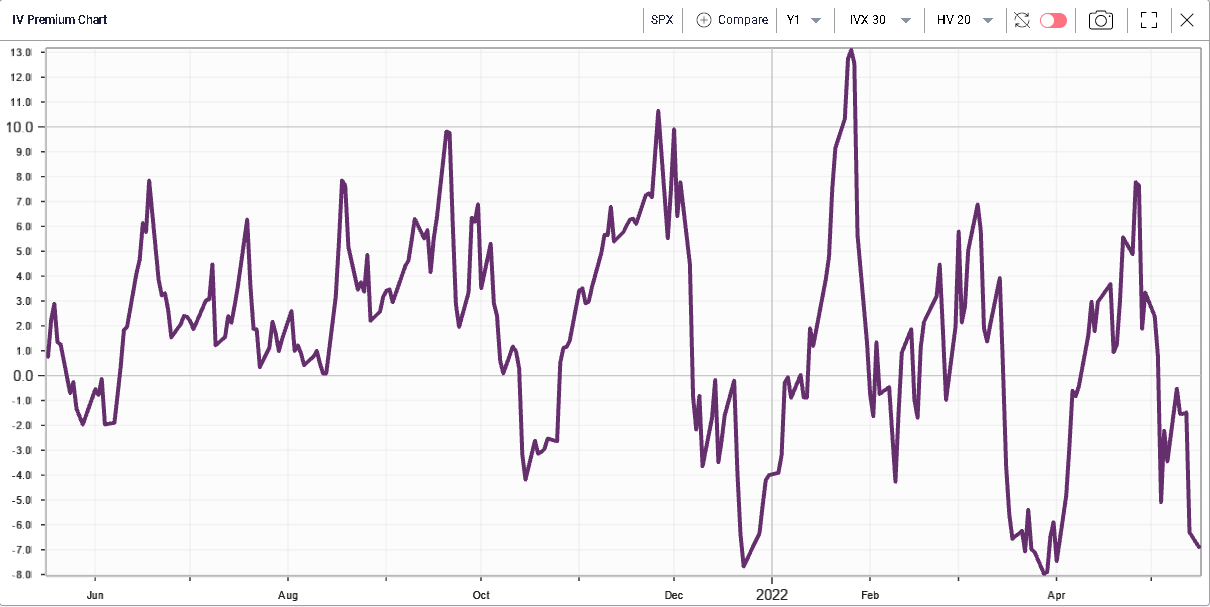

Implied volatilities remained under pressure, the 30d IVX on SPX finished about a point lower and sold off throughout the day. |

|

This is happening despite realized volatilities remaining fairly elevated as shown on the chart below with the 10d HV in purple and the 20d HV in green for the SPX. |

|

As a result, the IV Premium is now trading pretty much at its lowest level over the last 12 months. |

|

Looking at the price action yesterday, defensives continue to fare pretty well with MRK the second-best performer of the DJIA up 2.1%. CAT is up 1.4% and CVX is the best performing stock in the DOW up 3%. |

Worst performing stock yet again, BA closes 2.5% lower while DIS finishes 2% lower on the day. |

One interesting sector that has seen a lot of activity is the staples sector. This sector is made of the companies that produce goods that are deemed essentials for consumers. Those are quite favored in the current market environment as the purchasing power of consumers is being threatened by rising inflation and those names are seen as the more defensive end of consumer plays. |

Food and beverages are obvious candidates for inclusion in this space alongside some household’s products. The performance of the sector has been very telling in 2022 with the XLP ETF unchanged on the year. |

|

These stocks have proved to be a far superior hedge against the recent market selloff than for instance Fixed Income products which are generally considered as safe havens. For instance, TLT is down almost 20% on the year. |

|

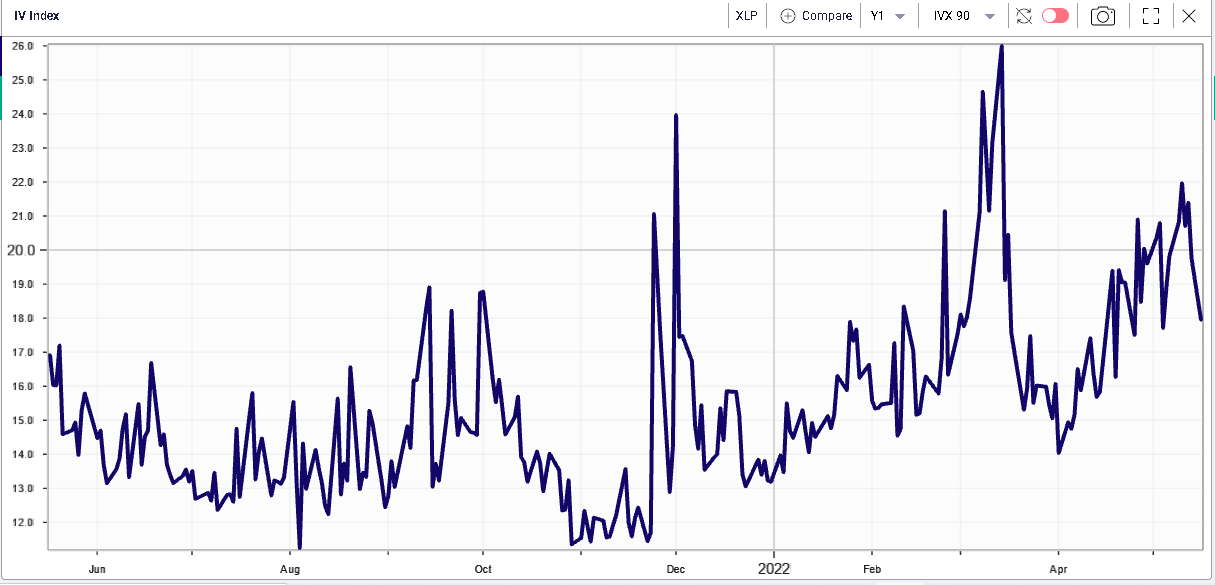

As a result of this generally defensive theme for the sector, implied volatility has remained relatively steady over the year with 3 months implied volatility around 18%. |

|

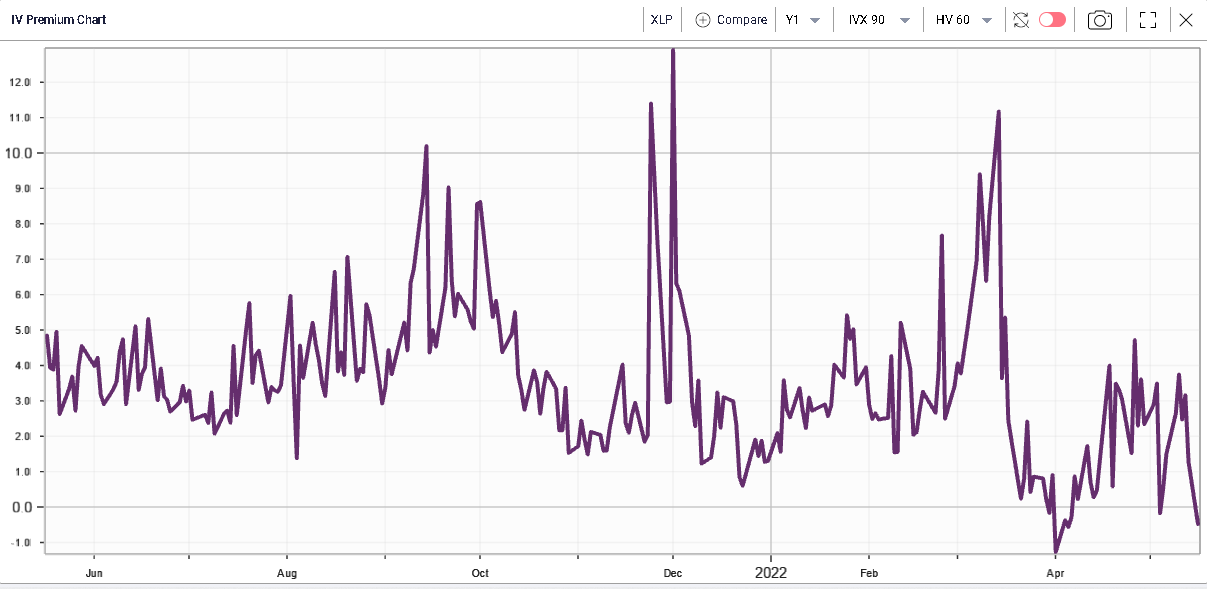

This has happened despite realized volatility picking up as shown below with 60 days realized volatility over the last 12 months. |

|

As a result, the IV Premium is at its lowest point as well over the last 12 months. |

|

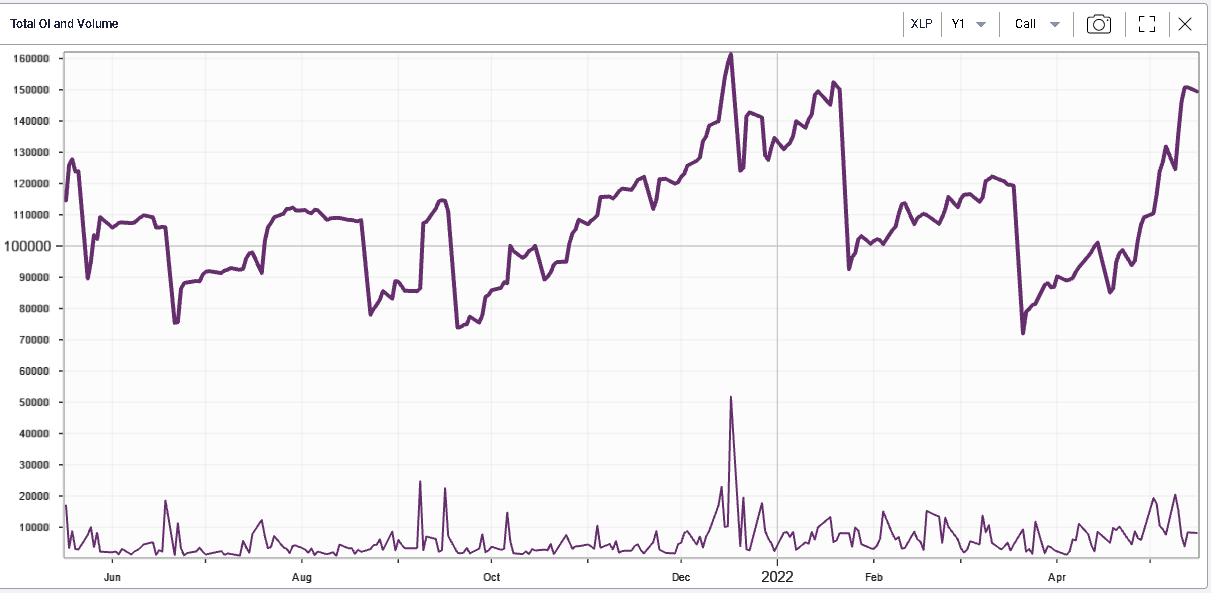

This has created a lot of interest for option in the XLP as shown below with most of the action happening on the put side. |

|

|

This tells us that a lot of attention is directed towards the staples sector and it might become an area of interesting moves over the next few weeks. |

Disclaimer - This information is provided for general information and marketing purposes only. The content of the presentation does not constitute investment advice or a recommendation. IVolatility.com and its partners do not guarantee that this information is error free. The data shown in this presentation are not necessarily real time data. IVolatility.com and its partners will not be liable for any loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from the use or reliance on the information. When trading, you should consider whether you can afford to take the high risk of losing your money. You should not make decisions that are only based on the information provided in this video. Please be aware that information and research based on historical data or performance do not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk. |