Let's talk about Chinese Equities |

Indices continued to bounce yesterday with the NDX finishing 2.6% higher, the SPX about 2% higher and the DJIA 1.3% higher. Europe also performed well with the German DAX up 1.5%. The best performing region was China with the HSCEI up more than 3.5% on the day as JP Morgan upgraded Chinese stocks. |

One of the most popular Chinese ETFs in the US is FXI. Although it was up 3% yesterday it is still down 16.6% on the year and is around 32% lower over the last 12 months as shown on the below chart. |

|

Implied volatility is elevated over the last 12 months but has remained very much in line with realized volatility. |

|

|

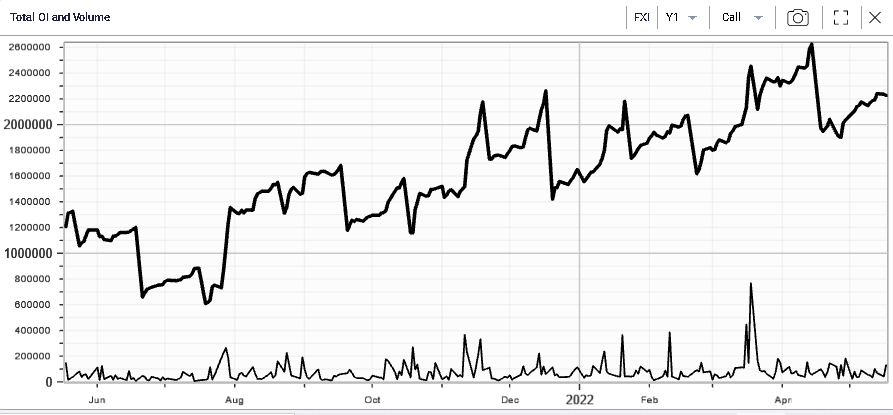

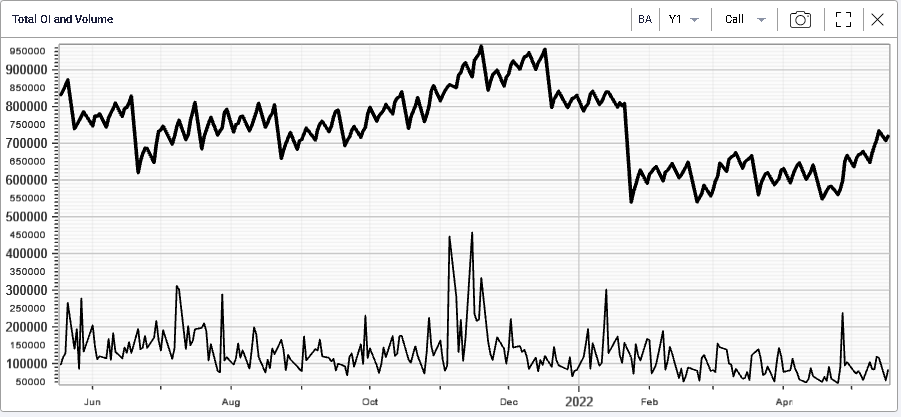

In terms of options activity, the call side has increased steadily as the spot has been trending lower as shown on the below chart displaying in bold the options outstanding open interest and in thin the options volume. |

|

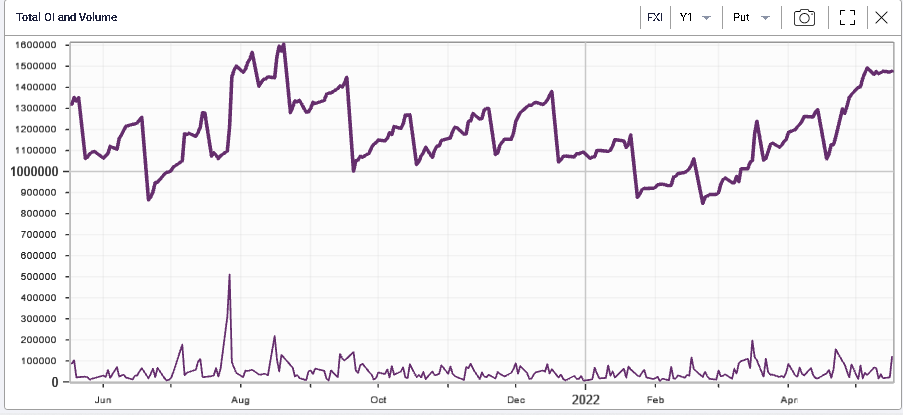

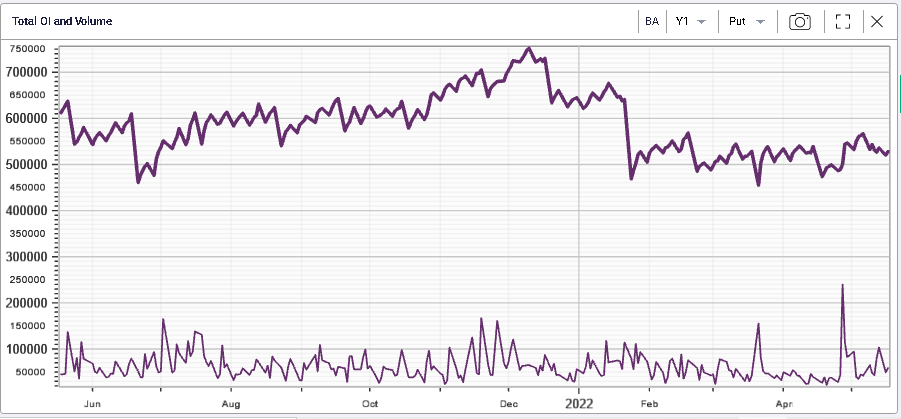

Put open interest and volumes have increased in 2022 and are now at their highs of 2021. |

|

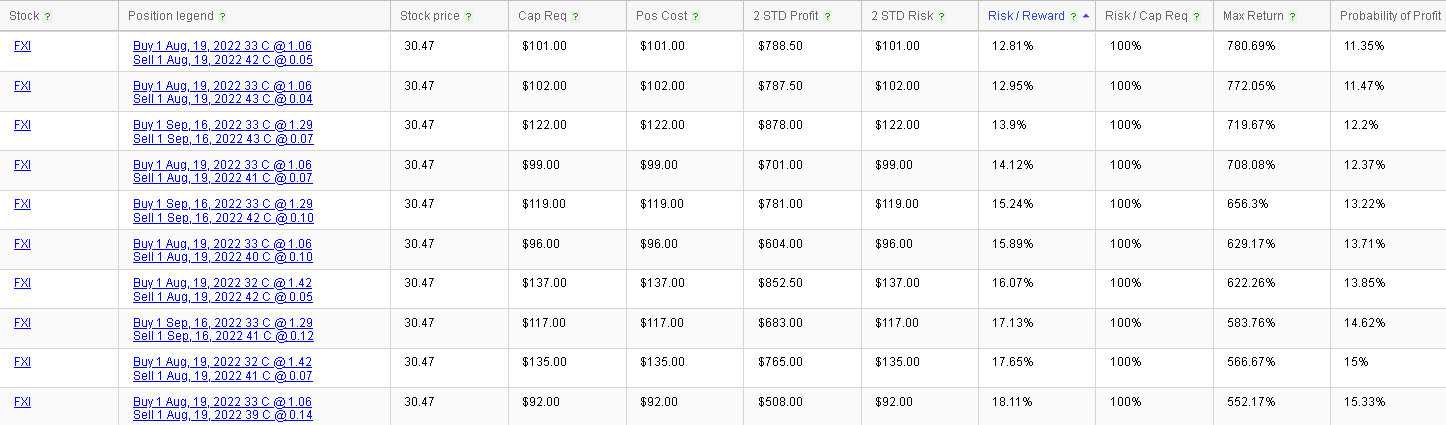

For traders looking to get exposure on the upside, for example in the form of bull vertical spreads, the RT Spread Scanner can help them find the most attractive combination based on their own set of criteria. |

|

For instance, in the above example, we asked the system to screen for mid to long term structures that remained fairly close to the current spot price levels and sorted them by risk/reward in order to find the combinations that allow for the greatest possible gain for each unit of risk taken. |

The structure that screens the best is the 19th Aug’22 33/42 bull vertical spread for a cost of $1.01 giving a possible total gain of $900 for a total cost of $101. |

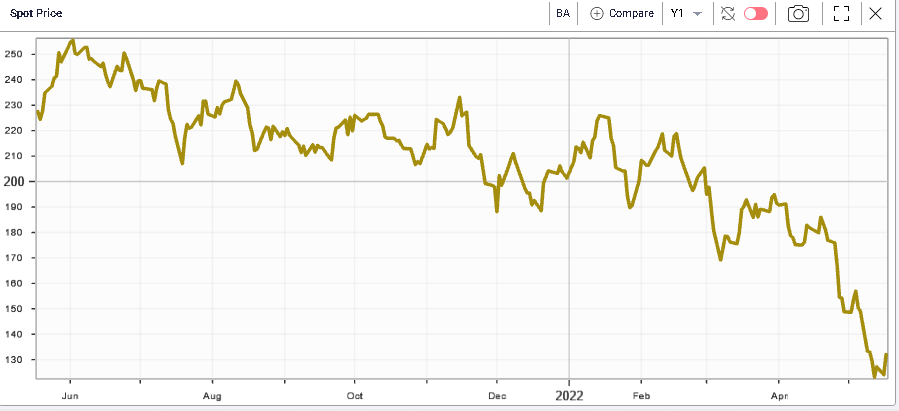

Looking at stocks yesterday, BA finally bounced slightly after being sold aggressively for the past few weeks/months. The name was up 6.45% |

It says a lot about the performance of a stock when a 6.5% move higher in a stock looks extremely small on the following graph. |

|

BA is still 37% lower on the year and has so far failed to attract significant option interest as shown below. |

|

|

Another name that we have mentioned here in the past is WMT. This was an interesting development with earnings disappointing investors sending the stock 11.4% lower on the day. |

In yesterday’s market update we discussed consumer staples as being companies that are generally perceived as defensives by the market because they sell products that are necessary for consumers. |

WMT is often perceived as a bell-weather of the state of the American consumer and yesterday’s numbers showed that inventories, fuel prices and wages all hit the bottom line. Net sales are still expected to increase this year so the problem flagged by WMT seems to really be on the margins. Even for its Q1 numbers, revenues outperformed expectations by the market. |

The capacity to pass on higher costs will be crucial for all companies in the coming months especially as profit margins have hit very elevated levels historically. |

Disclaimer - This information is provided for general information and marketing purposes only. The content of the presentation does not constitute investment advice or a recommendation. IVolatility.com and its partners do not guarantee that this information is error free. The data shown in this presentation are not necessarily real time data. IVolatility.com and its partners will not be liable for any loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from the use or reliance on the information. When trading, you should consider whether you can afford to take the high risk of losing your money. You should not make decisions that are only based on the information provided in this video. Please be aware that information and research based on historical data or performance do not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk. |