Time to hedge? |

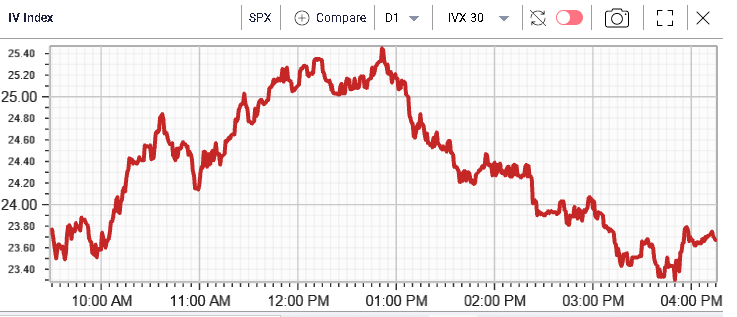

Markets started June in the red with the NDX and the SPX both closing around 0.75% lower while the DJIA settles 0.5% in the red. Despite this move lower, implied volatilities underperformed spot as shown on the below charts displaying in black the SPX index over the session and in red the 30d IVX. |

|

|

Despite the SPX settling around 60 points lower than where it opened, the 30d IVX finished the day around its opening print of 23.8. |

The way implied volatility is reacting in the US is quite surprising considering that realized volatility remains fairly elevated. Even looking at yesterday’s range for the SPX we had an intraday range of around 2.2%. The chart below shows 10d realized volatility in the SPX (orange) alongside 60d realized volatility in green. |

|

This phenomenon creates a situation where for about 2 weeks the IVX Premium has been at its lowest level in 12 months with implied volatility being marked around 8 points below realized volatility when comparing 30d implied and 20d realized. |

|

This situation is exactly the same in the NDX with a 30d implied volatility trading more than 10 points lower than where 20d realized volatility is. |

|

Importantly, this situation is not replicated in other global indices, for instance below we can see that the DAX implied volatility is trading around flat to its realized volatility. |

|

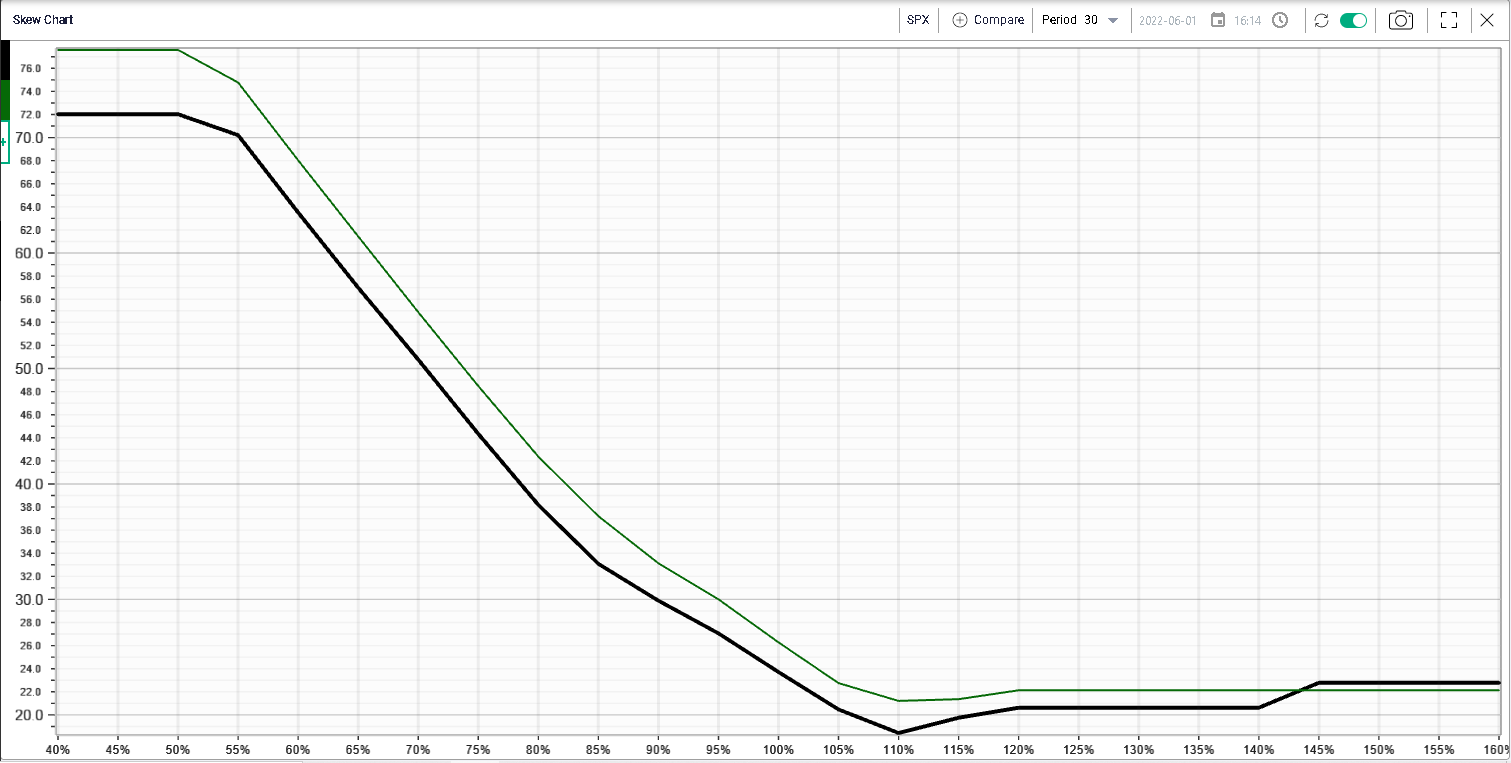

Looking at skew, volatility has dropped across all strikes but slightly more for downside puts as shown below. |

|

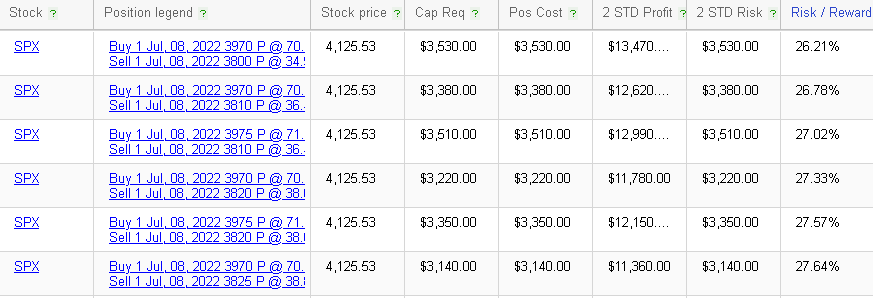

Using the RT Spread Scanner and searching for the most attractive bear vertical spreads, we get the following list. |

|

Sorting those structures by Risk / Reward ratio gives us the ones that offer the best ratio. For instance, the 8th Jul’22 3970/3800 bear vertical spreads cost around $3,530 and offer a possible net gain of $13,470. |

Looking briefly at single stocks, CRM had another strong performance yesterday gaining almost 10%. This was on the back of better earnings and guidance. As oil continues to grind higher so does CVX which closed up by 1%. |

|

On the downside, WMT had a bad day losing 2.5% and JPM which had been a stellar performer over the past fortnight settled 1.75% lower on the day. |

Disclaimer - This information is provided for general information and marketing purposes only. The content of the presentation does not constitute investment advice or a recommendation. IVolatility.com and its partners do not guarantee that this information is error free. The data shown in this presentation are not necessarily real time data. IVolatility.com and its partners will not be liable for any loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from the use or reliance on the information. When trading, you should consider whether you can afford to take the high risk of losing your money. You should not make decisions that are only based on the information provided in this video. Please be aware that information and research based on historical data or performance do not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk. |