It's all about Central Banks |

The European Central Bank confirmed yesterday that it will be performing a hawkish shift in the months to come with rate hikes now expected in July and September. On the back of this, yields in Europe have continued to move higher with the 2-year German yield reaching +0.83% yesterday after a spectacular move over the past few months that has seen the yield move from -0.8% to +0.8% in 2 months. |

Source: Tradingview.com |

10-year yields in Germany have now reached 1.4% but more importantly, some of the other European nations have seen their yields reach levels that were not seen outside of crisis periods. For example, the 10-year Italian bonds are now trading with a yield of 3.7%. |

Source: Tradingview.com |

Although this may not, in and out of itself, trigger a renewed crisis in Europe, it is definitely raising concerns in the market and explains why President Lagarde spent much time explaining that the ECB would deploy anti-fragmentation tools should they deem it appropriate. |

This rising rate environment will create large risks particularly for countries that display the higher debt stocks. That stock has increased substantially for most countries with the pandemic as governments had to step-in and support both consumers and companies. This, combined with slowing economies created a powerful effect where debt when measured as a fraction of GDP increased for most countries. |

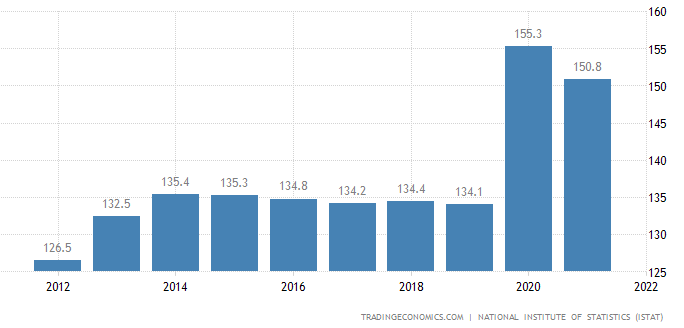

For instance, we show below the debt to GDP ratio of Italy, rising from 134% in 2019 to 155% in 2020. |

|

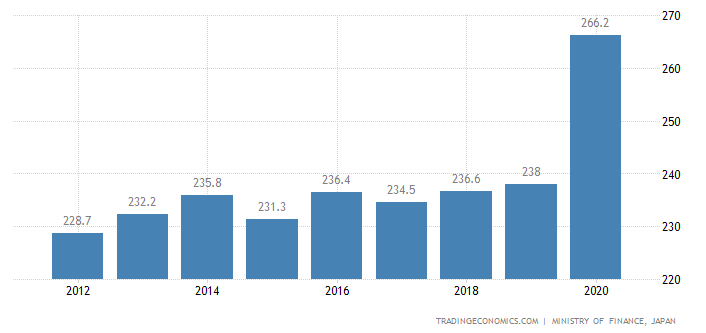

The same is visible in Japan for instance where debt to GDP jumped from 238% to 266%. |

|

That creates a complex situation for central banks which know all too well that debt levels may not be sustainable especially in a rising rate environment while having to respond to the upcoming threat of inflation. |

Prior to yesterday’s meeting, it felt that the ECB was still balancing between those two risks while the FED had made the decision a few months ago raising inflation to their top priority. |

On the other hand, in Japan, it seems that the BoJ is still maintaining a dovish stance for now. It is also important to note that the level of inflation in Japan has so far been more moderate at 2.5% in May’22 compared to 8.1% in the Euro Area and 8.3% in the United States. |

The resulting effect in Japan has been a fairly contained 10-year yield remaining for now at historically low levels around 0.25% and a very violent slide of the USDJPY which has dropped almost 17% and has reached 20-year highs. |

Source: Tradingview.com |

The consequence of yesterday’s ECB announcement was a sharp selloff of European assets which also hit US headline indices. The SPX lost 2.4%, the NDX dropped 2.74% and the DJIA -1.94%. |

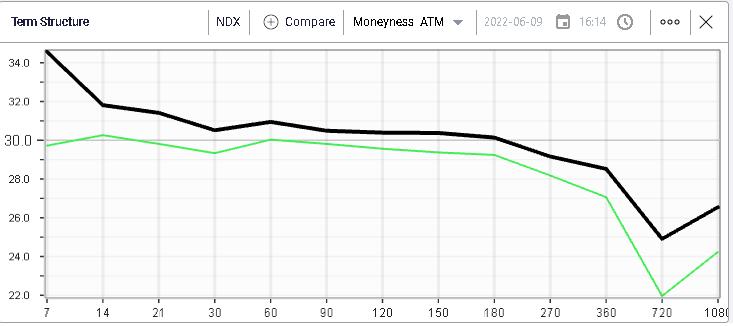

Those moves resulted in a grind higher of short dated volatility with the NDX 30d IVX gaining 1.6 points over the course of the session. |

|

The term structure has now inverted again over the course of this week in the NDX and the market is now getting ready once again for some action in the next few days/weeks. |

|

Looking at the DJIA components yesterday, only HD managed to finish the session in the green closing up 0.75%. On the downside, communications and technology stocks led on the downside with AAPL losing 3.6%, V losing 3.4% and AXP dropping 3%. Consumer Discretionary stocks and Banks also struggled on the day with DIS losing 3.7% and GS shedding 3.3%. |

Disclaimer - This information is provided for general information and marketing purposes only. The content of the presentation does not constitute investment advice or a recommendation. IVolatility.com and its partners do not guarantee that this information is error free. The data shown in this presentation are not necessarily real time data. IVolatility.com and its partners will not be liable for any loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from the use or reliance on the information. When trading, you should consider whether you can afford to take the high risk of losing your money. You should not make decisions that are only based on the information provided in this video. Please be aware that information and research based on historical data or performance do not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk. |