This is probably one of the biggest trades of the year |

Summary: |

|

Markets broke the 3800 level that held us during Wednesday’s session and settled 0.9% lower for the SPX and the DJIA and 1.3% lower for the NDX. |

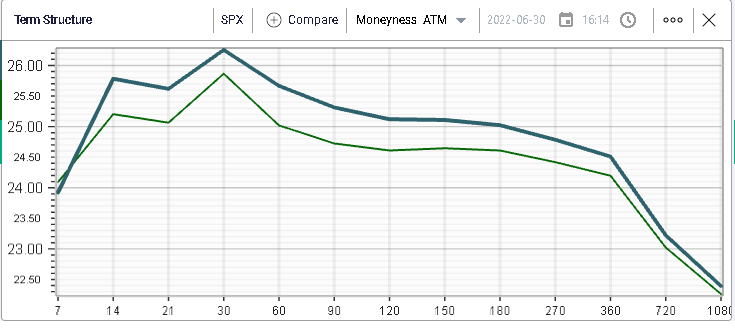

Looking at implied volatility for the SPX, it parallel shifted by around 0.5% across pretty much the entire curve. |

|

In today’s market update, we will review the trades that took place this week to try and see if we can decipher what other market participants have been doing. If you want to understand the methodology, we employ in order to find those trades, please watch the following YouTube video: https://www.youtube.com/watch?v=84UzxH6gdu4 |

27th Jun’22: |

Source: Tradingview.com |

On Monday, the market sold off right after the open but found a bottom around 3890. The range for the day was fairly tight and after the initial action, the market traded sideways for the rest of the day. |

In terms of flows on Monday, most of the attention was focused on very short dated options with expiration dates on the 29th or the 1st July. Interestingly, as we pointed out in Tuesday’s market update, most of the flow was focus on short dated puts for the SPX. We also flagged that 12.7k of the Sep’22 4250 calls traded on the day. |

Over in Europe, there was some notable action on the German DAX with puts trading in decent sizes 3.1k of the Sep’22 13000 puts, 2.4k of the Dec 10600 puts, 2k of the Sep 14000 puts and 1.6k of the July 13300 puts. |

Interestingly, the price action (shown below) on the German DAX was very different from what was seen over in the US as the market pushed higher right around the European open before meeting some very powerful resistance that pushed prices lower. |

Source: Tradingview.com |

28th Jun’22: |

On Tuesday, the market accelerated lower breaking the previous day’s lows and settled around 3820 where the first signs that bulls were stepping-in emerged. |

Source: Tradingview.com |

On the options side, the most active SPX option was the Oct 4300 calls that traded around 12k times. The July 3900 calls were also exchanged 8.2k times during the session. The rest of the focus was once against turned towards short dated options but relatively split between calls and puts. |

For the NDX, there was some activity as well on the upside with the 12000 calls and the 11600 calls trading around 250 each. |

29th Jun’22: |

Wednesday was another relatively calm session with the market finding support around 3800 and resistance at 3840 and settling right in the middle at 3820. |

Source: Tradingview.com |

Once again on the flow side, most of the activity was on very short-dated options that expired on the 30th Jun’22 but there were two notable flows on longer expirations: 10.3k of the 3000 puts and 9.3k of the 3200 puts in Sep. |

Over in Europe, the activity for the German DAX was a bit more split between calls and puts with the July 13500 calls trading 5.9k, the Sep 14000 calls trading 4.2k while on the downside traders were active on the 12000 and 12800 puts expiring in September and December 2022 respectively for 3.4k and 2.5k lots. |

30th Jun’22: |

On the final day of the quarter, the activity seemed to pick-up with the market breaking the 3800-level right off the open and collapsing to 3740. From there it seemed to find some support and managed to get back to 3820 before losing momentum. We settled below 3800 for the first time since the 23rd of June and the activity in the options market picked up meaningfully. |

Source: Tradingview.com |

In particular, it is worth noting a very large trade executed on the SPX for around 46.7k contracts on the 30th Sep’22 options. The strikes were the 4005 calls, the 3020 and the 3580 puts. |

From experience we would estimate that the trade was performed as a bear vertical spread against a short call position, a bearish structure meant to protect a portfolio of longs against a drift lower in the market while the call would act as an automatic profit taker should we rally and break back above 4000. |

Outside of this huge trade, the NDX saw some action on the upside with the 12000 calls in August trading 556 lots and another 445 of the August 11400 calls. |

Conclusion: |

Overall, the week was fairly muted when it comes to flow outside of that gigantic SPX trade that was exchanged yesterday. It is interesting that for Monday and Tuesday, it felt like the attention was mostly towards upside calls as the market had seen a very large bounce over the prior week while on Wednesday and Thursday, the flow seemed to turn more towards downside puts and protection trades. |

Disclaimer - This information is provided for general information and marketing purposes only. The content of the presentation does not constitute investment advice or a recommendation. IVolatility.com and its partners do not guarantee that this information is error free. The data shown in this presentation are not necessarily real time data. IVolatility.com and its partners will not be liable for any loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from the use or reliance on the information. When trading, you should consider whether you can afford to take the high risk of losing your money. You should not make decisions that are only based on the information provided in this video. Please be aware that information and research based on historical data or performance do not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk. |