Inflation and Gold may explain yesterday’s price action

July 14, 2022

The main action yesterday was the release of the highly anticipated inflation figures which showed that CPI reached an annual rate of 9.1%, a larger than anticipated number that saw some market participants predict a 1% rate increase at the FOMC meeting on the 27th of July.

Although the immediate reaction in the Equity market was a 2% selloff in the underlying Futures, traders seemed to find some support as the market approached the key 3750 area and as the cash market opened a strong buying pressure emerged that pushed prices back towards 3800. Looking at the overnight session, we are seeing some renewed selling pressure on low volumes, a possible sign that bears remain in control of the situation for now.

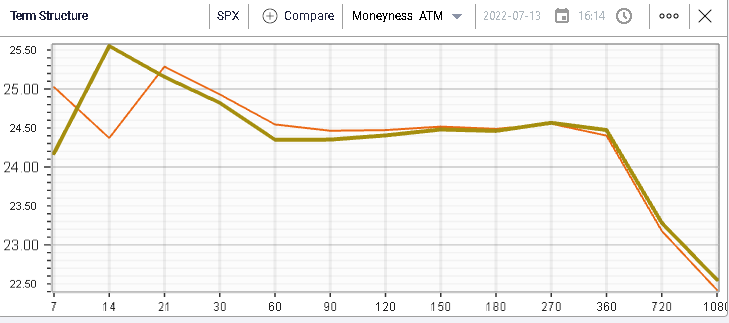

Volatility traders were a little puzzled about how to react to this development. On the one hand, they were getting signals that uncertainty was generally rising with the FOMC meeting outcome becoming less certain while on the other hand, they watched spot prices rally back to pretty much reach the pre figures level. At the bell, the SPX settled in the red but only by 0.5%, the NDX was down 0.14% and the DJIA down 0.67%. Implied volatility sold off throughout the session and finished pretty much in line with where they were on Tuesday evening as shown on the term structure chart below with Wednesday’s close in yellow and Tuesday’s TS in orange.

Under the surface, things remained relatively calm as well. Industrials underperformed losing around 1.2% while Consumer Discretionary and Consumer Staples gained respectively 0.82% and 0.1%. NKE was the best performing stock of the DJIA gaining 1.75% while UNH was the worst performing name dropping 2.7%

A lot of traders recently have asked about Gold’s performance. The lack of reaction that Gold has shown during the recent releases of inflation figure has come as a surprise for many traders.

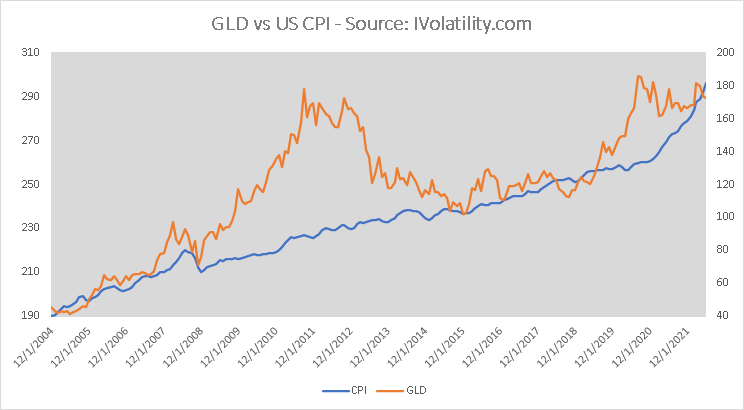

When we look at a long-term chart of GLD against the US CPI, we find that Gold had actually anticipated a lot of the current inflation during 2020. In fact, Gold rallied from $1,200 an ounce to $2,070 between early 2019 and August 2020.

CPI Date Source: BLS

The chart above, showing in GLD in orange and US CPI in blue reflects that anticipation by Gold that inflation would later spike. The fact that we are now stuck in a $1,700/$2,100 range could be an indication that market participants still think that the FED will manage to keep inflation under control.

That concept could also at least partly explain the market’s reaction yesterday. There is a widespread view at the moment that the biggest risk for markets and for inflation is if the FED does not take it seriously and fails to reply swiftly.

As such, the larger than anticipated inflation print we saw yesterday combined with expectations that the FED might have to do even more than the 0.75% planned in July could reassure Equity investors that the Central Bank will do whatever is necessary to control inflation.