A very large expiration day

September 16, 2022

With expiration today a lot of the attention will be on managing positions until the closing bell. In today’s market update, we leverage our powerful REST API in order to get an understanding of exactly how much will disappear by tonight’s close.

Before we jump into this, let us recap yesterday’s price action. The SPX drifted lower and settled 1.1% in the red, the NDX was 1.7% lower and the DJIA lost 0.6%.

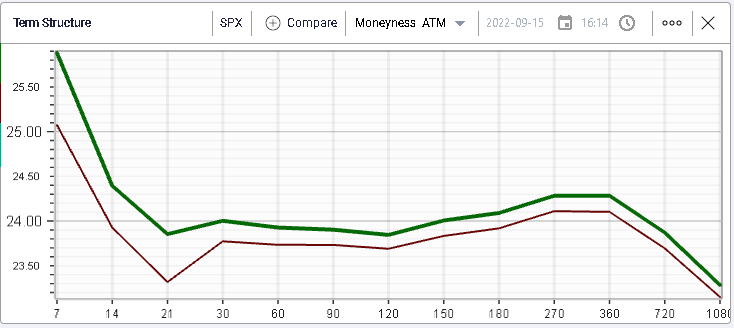

Looking at the below, we can see that the implied volatilities remarked higher across the curve led by the front-end with 30d IV gaining around 0.3%.

Looking at sectors, only two segments of the market managed to gain yesterday, first the healthcare sector which gained 0.56% over the session but also the financials which managed to finish +0.33% higher.

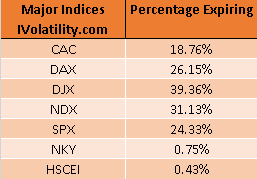

Going back to today’s expiration, we can see that, amongst the major global indices, the DJIA and the NDX see the largest expiration in percentage of total outstanding positions with almost 40% for the DJX expiring today.

Even in Europe we are seeing some very large option expirations with around 26% of all outstanding options ceasing to exist tonight for the German DAX and 19% for the French CAC. Asian indices are on a different schedule which explains why the expiration looks relatively small.

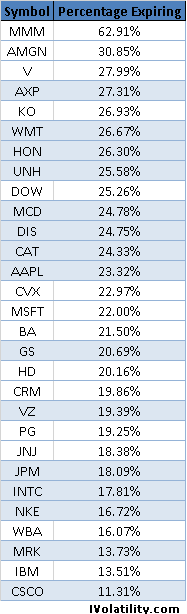

Looking at single stocks, one name that stands out is MMM where around 63% of all outstanding option positions are expected to disappear tonight.

The stock is bit of a special situation with the spinoff of the healthcare division and the way this was structured creating a large spike in call and put volumes over the past few weeks.

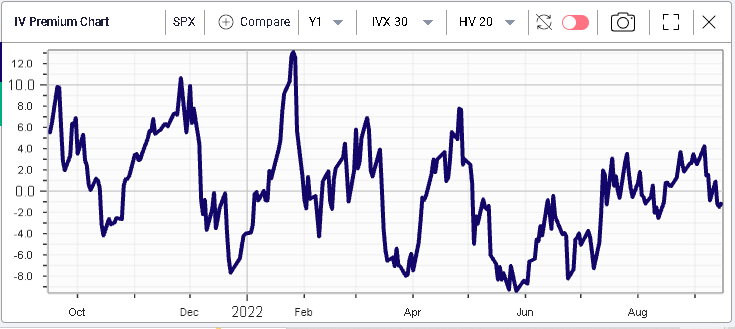

Going into this expiration, the IV Premium for the SPX is back in negative territory, despite the move lower seen yesterday in spot.

The same is pretty much true for the NDX as well as shown on the below.

Finally, looking at the DJIA components, we can see that on average around 23% of all outstanding options will expire tonight which, considering the size exchanged in some of those names is a really meaningful event.