Last Week’s Highlights at IVolLive:

- Register for Our Upcoming Webinar (June 6th, 2023) Webinar Topic: How to Use Implied Volatility and Pricing Charts to Time and Make Actionable Options Trades HERE

- Get a free IVolLive Trial HERE.

Inching Towards a Deal.

May 31, 2023

What's Happening Now in the Markets

U.S. equities finished last week on a high note as it appeared likely lawmakers would be able to strike a deal on the debt ceiling ahead of the June 5th cutoff. That said, for the week, the major indices were mixed with the S&P 500 and Nasdaq gaining 0.3% and 2.5%, respectively, while the Dow dipped 1%.

Despite hopes for a deal getting done, U.S. Treasury yields rose to their highest level in two months as traders weigh the potential of the Fed continuing with its rate hike cycle. Oil prices rose slightly going into the Memorial Day weekend, though not material enough to make an impact either way on drivers' budgets.

Speaking of Memorial Day... this week will be a holiday shortened trading week, as markets were closed on Monday as U.S. holiday air passenger travel tops 2019 pre-COVID levels (translation: the U.S. consumer is spending and traveling hand over fist - look for stocks and companies that benefit from this trend).

Across the pond in Europe, inflation shows signs of cooling, dropping to 6.3% from its 7% print in April. While this is progress from the all-time high of 10.6% set in October, it remains well above the ECB's 2% target rate.

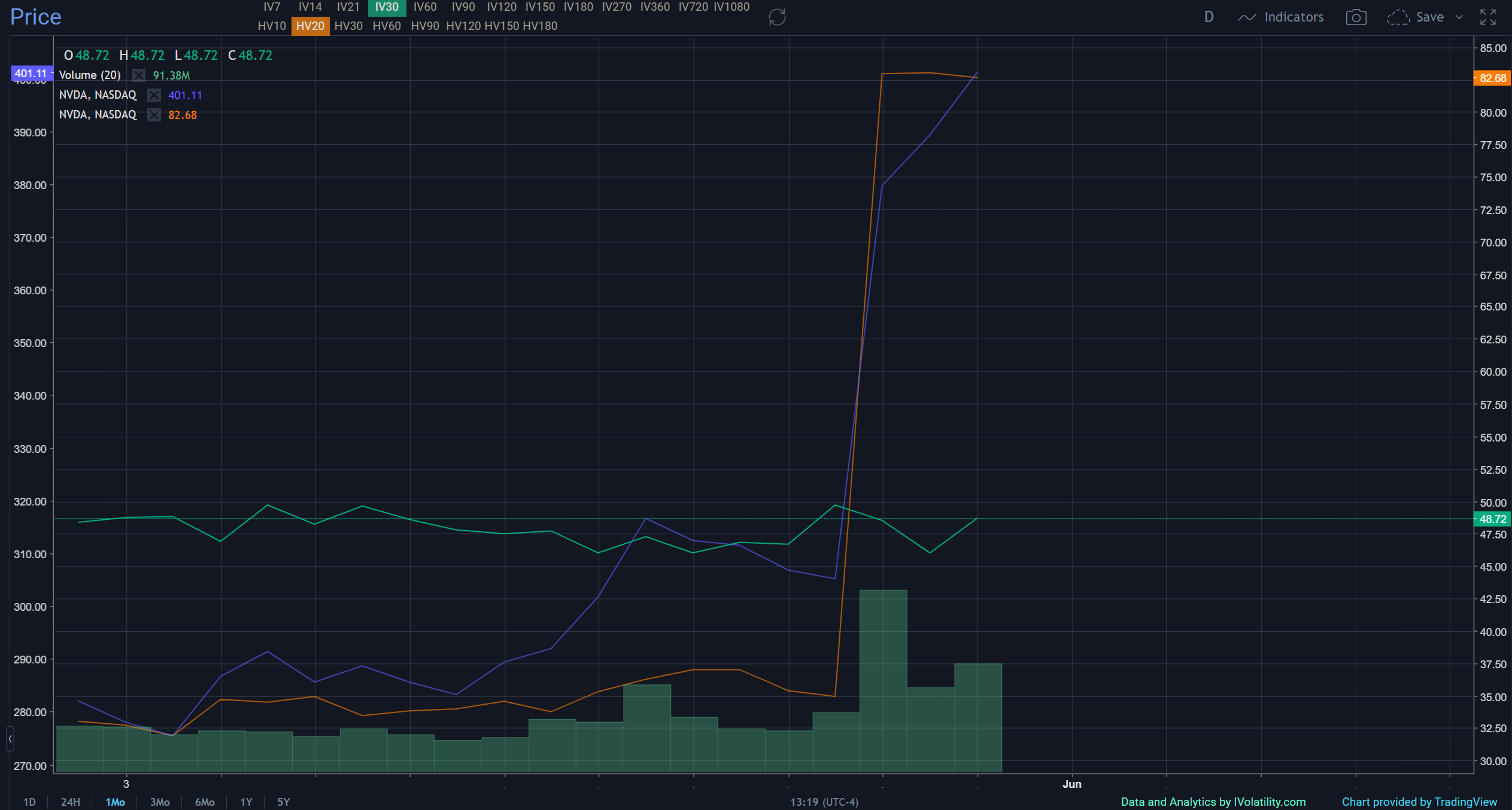

Drilling down to market sectors, anything related to artificial intelligence (AI) remains red hot. Indeed, chip leader Nvidia (NVDA) broke out to all - time highs yesterday - and became only the fifth U.S. company to join the "trillion-dollar market cap club" - on the heels of soaring demand for AI chips.

This momentum lifted competitors Broadcom (AVGO) and Qualcomm (QCOM) as well.

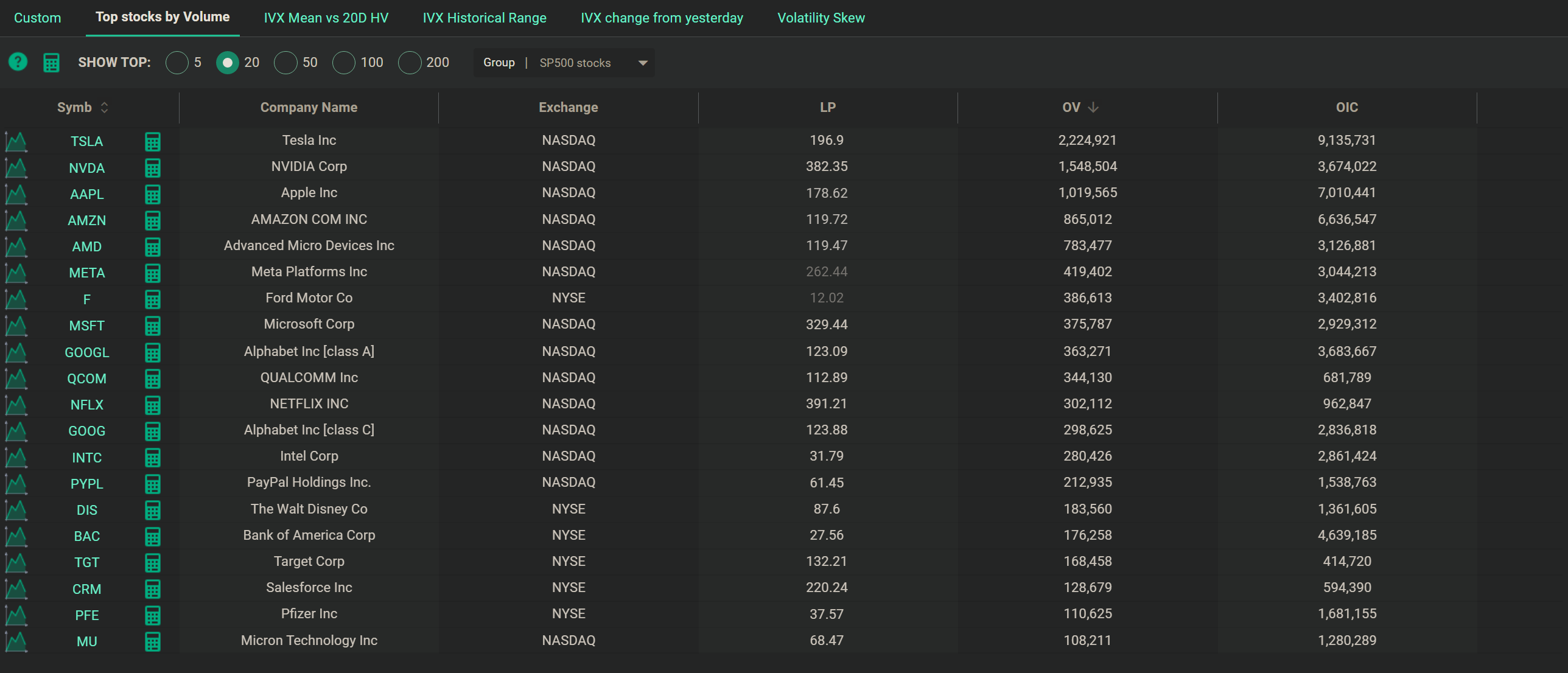

Shares in Tesla (TSLA) - one of the most heavily traded stocks by options volume on the planet as you can see in the chart below - are also rising as Elon Musk traveled to China to evaluate opportunities in the Orient.

Housing is also showing signs of resilience, with home prices rising two months in a row.

The market's fear gauge - the VIX - remains subdued, trading below the dividing line of 20.0 we use for high- and low-VIX markets:

Bottom line: Our money is on a debt deal getting done. It always does — the stakes are too high otherwise.

How to Play It

With implied volatility remaining low across the market overall, this signals that options premiums will be falling. This means now could be a good time to go long options, or long volatility.

At the end of the day, despite continued negotiations around the debt ceiling, markets remain relatively calm and resilient. We remain buyers on dips and weaknesses in specific names that tend to bounce over time (like Visa and AutoZone) could present compelling entry points - especially as options premiums are relatively low thanks to subdued volatility levels.

Interesting opportunities:

• Retail: In general, despite banking jitters and high inflation, the consumer has remained resilient. We're looking for overdone selloffs in select retail names like Walmart (WMT), Dollar General (DG), and Dollar Tree (DLTR).

• Travel: The consumer remains resilient. We're looking for compelling trade setups in major hotel and airline names.

Register for a free IVolLive trial HERE.

Previous issues are located under the News tab on our website.