Last Week’s Highlights at IVolLive:

- Register for Our Upcoming Webinar (June 13th, 2023) Webinar Topic: Leverage the Real Time Option Spread Scanner to find Profitable Put and Call Option Trades in All Market Conditions HERE

- Get a free IVolLive Trial HERE.

Is the Bull Back?

June 12, 2023

What's Happening Now in the Markets

Has the Bull Market returned?

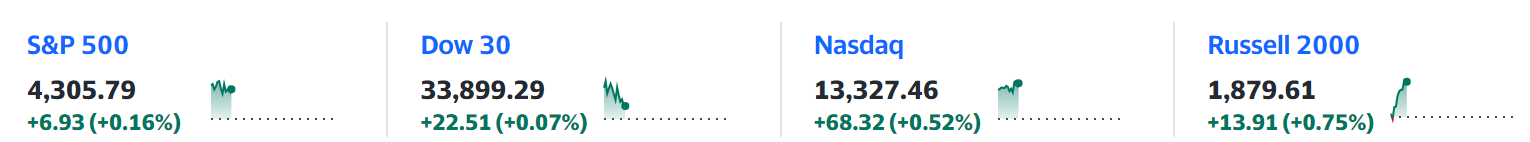

On the heels of optimism surrounding a pause in Federal Reserve interest rate hikes, the S&P 500 rose above 4,300 for the first time since August.

This means that the market is up more than 20% from its lows, the technical definition of a new bull market.

Tesla (TSLA) - never a dull name - was the best performing stock in the index last Friday after announcing a landmark deal to allow General Motors' vehicles (GM) to use its charging stations.

Over in the Dow corner of the market, Salesforce (CRM) led the index, rising 2.5%.

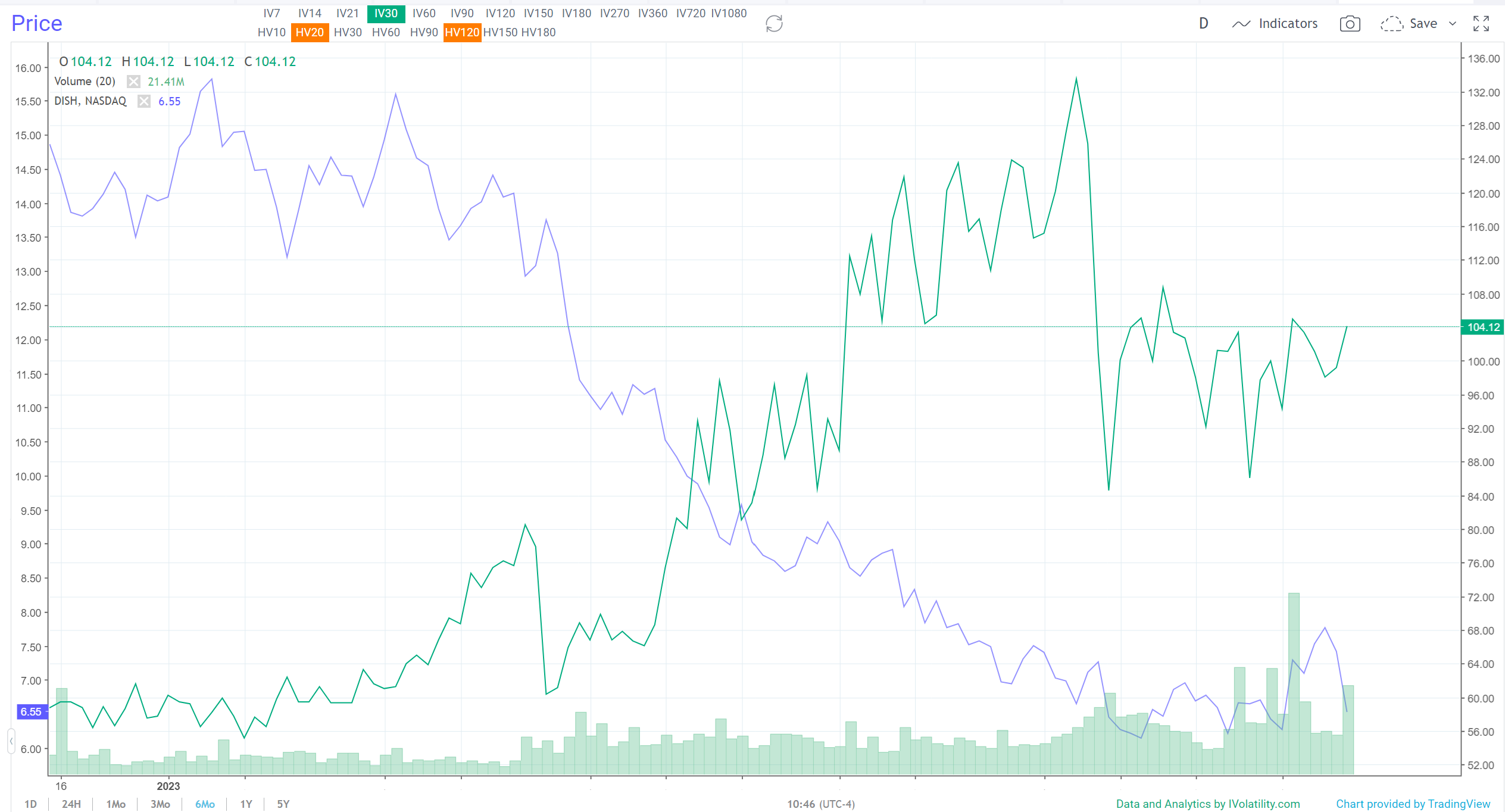

On the negative side of the ledger, DISH (DISH) shares plummeted as the company scrambles to raise funds to execute on its plan to supply roughly 70% of the U.S. with 5G coverage by the end of the month.

Interestingly, even before the report surfaced, our scanners picked up on the issues at DISH. You can see that at play in the six-month chart below.

Implied Volatility has been steadily rising (green line) - indicating some kind of news was about to break. Now, we know what that is/was:

This is one of the key advantages of using IVolLive. Thanks to the proprietary implied volatility metrics, we are able to spot potential swings and stock movement ahead of time by monitoring implied volatility levels.

That's why the first thing we do when the market opens is to look at the charts of the VIX and S&P 500 for signals and timing. We demonstrate how to do so HERE.

We can clearly see the inverse relationship between a rising stock market and a falling VIX. From here, we can drill deeper, apply technical analysis and other tools to determine our best trading move.

Bottom line: At present, the market appears overextended - especially semiconductor names like NVIDIA that have surfed the wave of the surge in investor interest as it relates to AI.

How to Play It

With the market crossing into bull territory, implied volatility remains low across the market overall. This also signals that options premiums are low. At the same time, the market's technical indicators are overextended to the upside.

From where we sit, the best move for now is to hold on to or trim profitable long positions and wait for a market pullback on strong names that take temporary, one-off hits, leading to a decline in price, and a rise in implied volatility.

Interesting opportunities:

• Semiconductors: On the short side, AI-fueled stocks like NVIDIA and AMD (AMD) have tripled and doubled since January. This is not sustainable - look for opportunities to go short.

• Crypto: On the long side, consider exploring crypto. With the recent regulatory lawsuits in the sector, names like Coinbase have been hammered. While it's unlikely shares will skyrocket higher, the shock and awe of the headline risk has likely passed. Options premiums are rich, leading to potential interesting setups for spreads and selling put options.

Register for a free IVolLive trial HERE.

Previous issues are located under the News tab on our website.