Last Week’s Highlights at IVolLive:

- Don't forget to register for our next live webinar on Tuesday, September 26th 2023 Webinar Topic: How to Add, View, and Use Price, Volatility, and Implied Volatility Charts to Create Options Trades HERE

- Get a free IVolLive Trial HERE.

Time for a Pause...

September 22, 2023

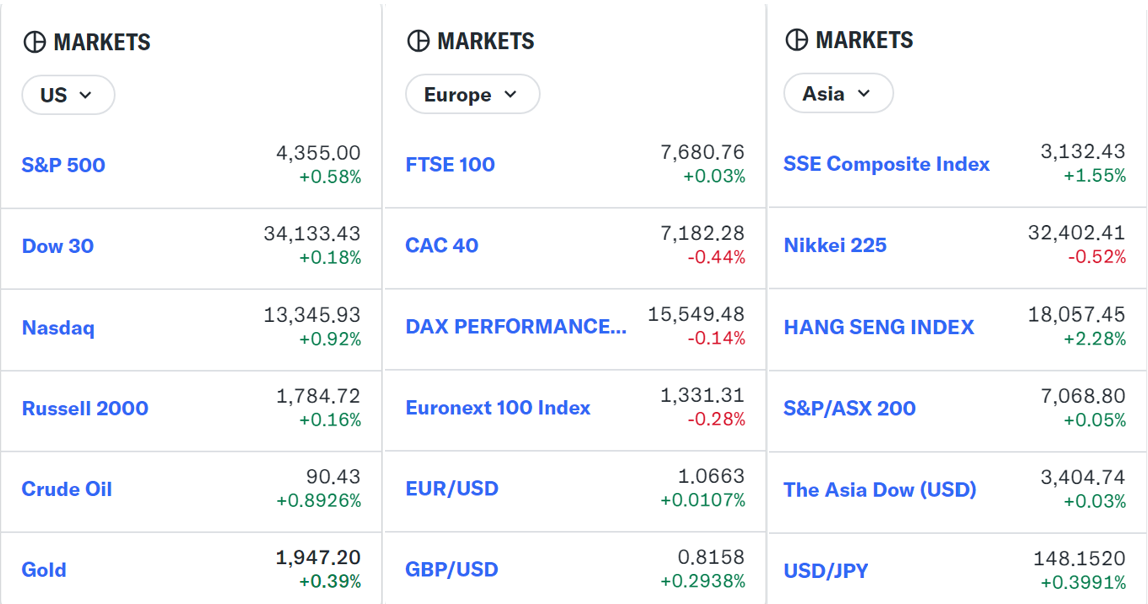

This Wednesday, the Federal Reserve opted to hold rates steady, pausing from the fastest interest rate cycle since the 1980's. Fed funds rates have risen from essentially zero in March 2022 to over 5%.

That said, Jerome Powell made it clear that future increases are not out of the question, with an eye toward cooling inflation and trimming the Fed balance sheet (this removes liquidity from the market).

Macro factors affecting the economy as we roll into the final quarter of the year are:

• A 30% rise in the cost of oil over the past four months

• The ongoing strikes with the United Auto Workers Union and in Hollywood

• The resumption of student loan payments which eats into the pockets of American consumers

Regardless, the "wait and see" approach by the Fed is a welcome respite to the market since rising rates are viewed negatively - as it makes capital more expensive.

Across the pond (and the globe) the Bank of England and the Bank of Japan have also paused with their interest rate hikes.

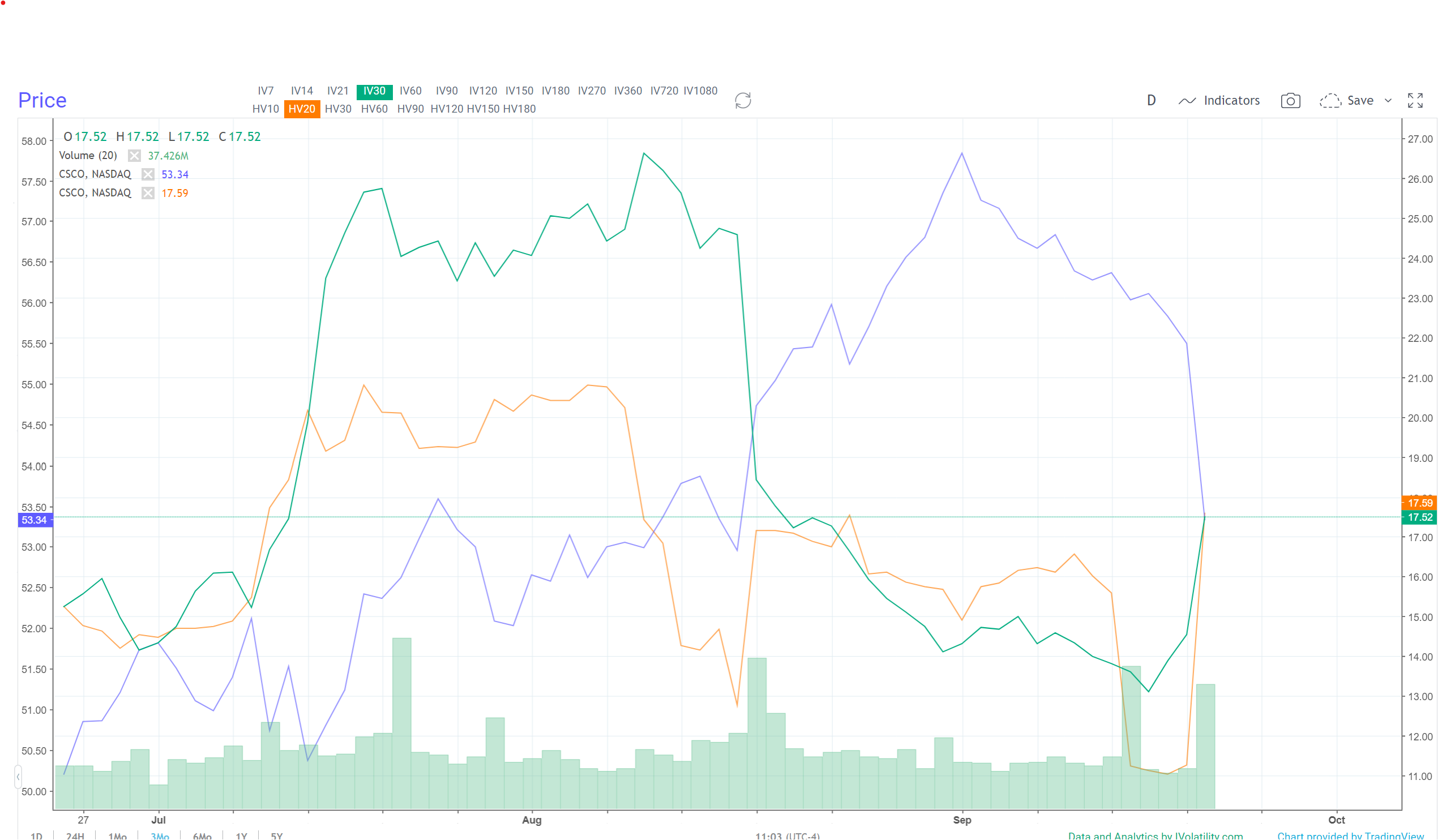

Despite rising rates and macro uncertainty, deals are still getting done. We saw this trend in action this week when tech giant Cisco (CSCO) announced plans to buy Splunk (SPLK) for $28 billion.

This is an expensive acquisition so the market sent Cisco's shares lower, and it's Implied Volatility (IV) higher:

How to Play It

As you can see in the three-month chart above, Cisco's spot price and its IV have now "kissed". This is one of our favorite chart setups. It means that option premiums are rising - and it can be an ideal place to sell a put to earn upfront income if one is bullish one the prospects of the underlying company (in this case, Cisco).

While the acquisition of Splunk is large - and there are bound to be complications along the way - the bottom line is that Cisco has nearly $30B in cash on its balance sheet, a stellar credit rating, and generates billions in net profits and cash flow every year.

While the road to closing this deal could be a rocky one, that will create plenty of trading opportunities for savvy traders along the way. And when the share price and implied volatility "kiss", that can be a good sign to strike...

Previous issues are located under the News tab on our website.