The US Rally Deflates on Failed Hopes for a March Rate Cut

February 1, 2024

The Markets at a Glance

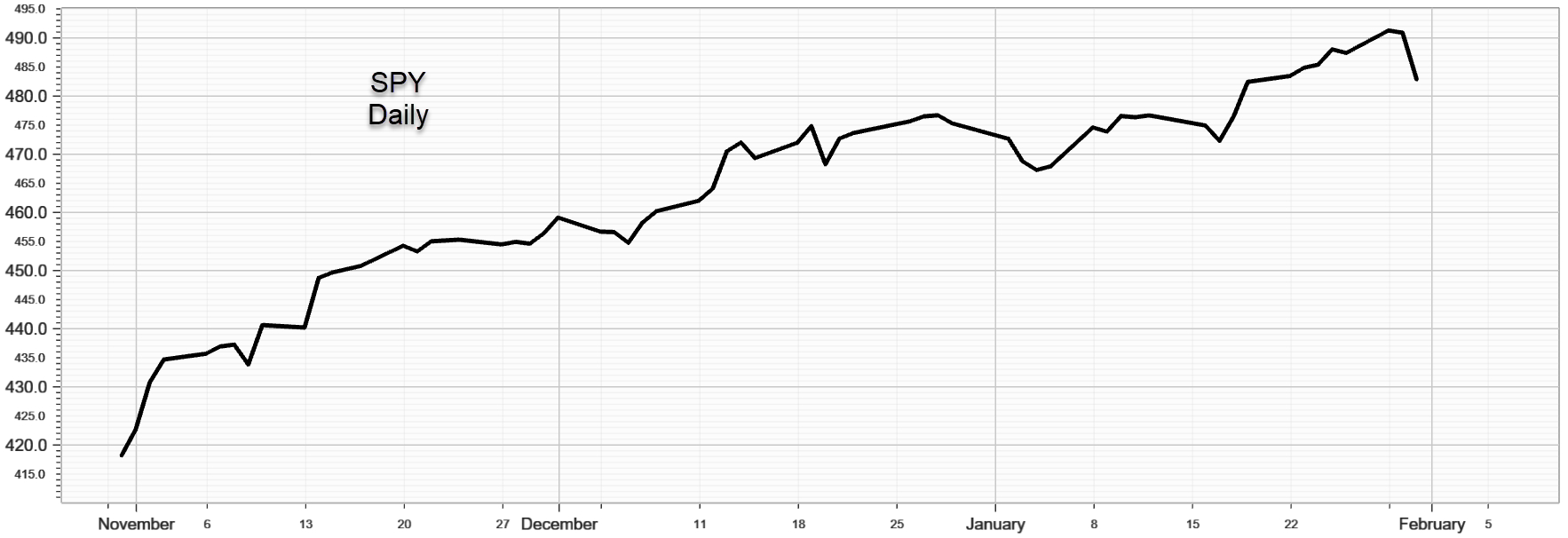

The S&P 500 (SPY)

SPY closed on Wednesday at 482.88 after peaking at another new high at 491.27 just two days earlier. For the bulls, it can be perceived (at least so far) as just another minor corrective move in an otherwise intact rally from October '23. The technical perspective would support this view by pointing out that the uptrend does still remain visually intact.

But for the bears, this is potentially much more meaningful. Today's drop was -1.6%, the first one-day drop of this magnitude since September 21st 2023. There have been only four one-day declines of this magnitude in the last year. For the bears, this is hope that momentum on this leg of the bull market might finally be losing steam.

The Christmas rally (that really happened in November or not at all) is over. The January pension boost should now be mostly invested and repurchases from tax harvesting in 2023 should be more or less complete as well. So the timing is right for a drop in new money to push things yet higher and for the market to take a breather.

More importantly, the best economic scenarios have now been priced in, leaving even the least bit of disappointment to spook overbought investors. We saw the result of that clearly today as the market sold off on the news that while rates will not be increased any more on this cycle, and will soon be lowered back down a bit, it just won't likely happen in March.

That may not be an all-clear signal for outright bearish strategies just yet, but it might well open the door to 'non-bullish' strategies like writing calls or bear spreads to capture premium.

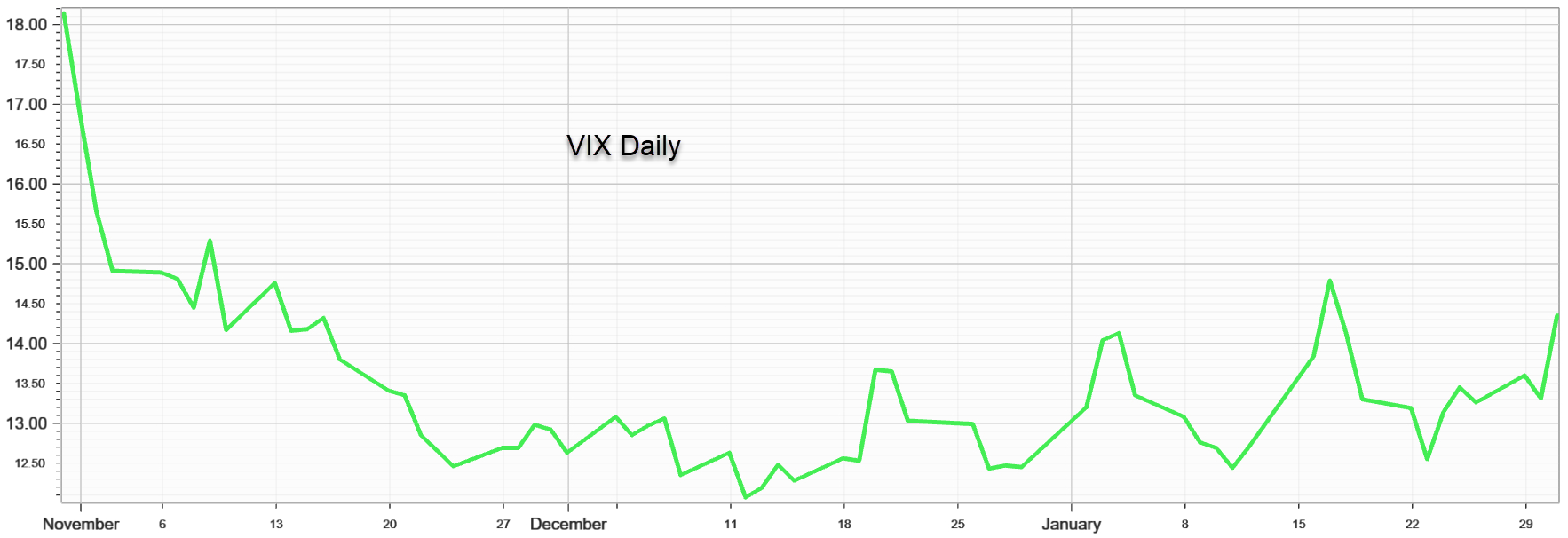

Option Volatility on SPY

Implied volatility on the SPY popped to 14.35 on today's decline, giving the chart a shot at a fourth successively higher peak since mid-December, supported by successively higher lows as well. That still leaves implied volatility on the low side historically, but the trend is pushing upward and that bodes well for writing strategies to become attractive again.

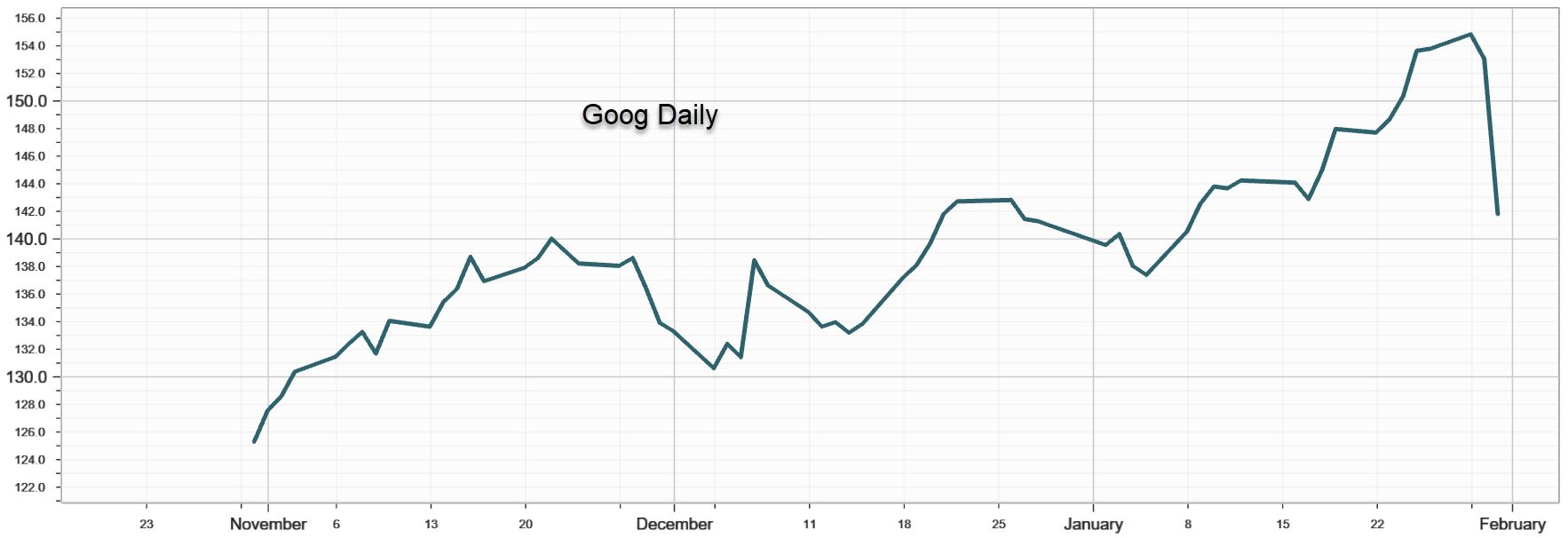

This Week's Stock Highlight -- GOOG

Evidence from elite stocks like Alphabet (GOOG) supports the thesis that much of the market was overbought and that even good news is being met with profit-taking. A 7.5% drop today after a solid earnings beats suggests that the market has been recently priced to near perfection, a view many people (like Jeff Gundlach) have recently echoed in the media.

From the chart, I'd say that the forceful drop today will require some rebuilding, which gives option traders a chance to get in with bullish diagonals, covered call writes, and put writes that will take advantage of a powerhouse stock, now on sale, and with more implied volatility in its near-term options.

As an example, the ATM 141 calls expiring this Friday on GOOG now have an implied vol of 37% while next Friday's are 27% and thereafter most are at 24%. If you believe the stock will hold support in this area, you can buy a long April 130 call at around 13.70 as a proxy for owning the stock, and start writing weekly call options against that at strikes in the mid-140s, rolling in the weeks ahead as desired. The implied vol of near-term options is likely to remain elevated for a while and you'd be implementing a hedged bullish strategy on a stock that is a juggernaut in the US market.

Strategy tip: More on Diagonal spreads

To add to last week's strategy tip, the spread identified in GOOG above illustrates two advantages to using diagonals:

- As a way to do leveraged covered call writes on high-priced stocks; and

- As a way to take advantage of a near-term volatility skew by capturing overpriced short-term premium while purchasing lower implied volatility further out.

The first strategy can be utilized as a staple portfolio strategy in the same way that owning core stocks is a staple of a large portfolio. Covered calls are a relatively low-risk strategy for option players that can continually generate option premium, usually on a weekly basis. As an option portfolio grows in size, you may want to incorporate less risky strategies to preserve capital and generate income.

The second part of the strategy is more temporary and opportunistic. When stocks drop sharply, a volatility skew usually occurs, pushing near-term implied volatilities much higher than longer-term implied volatilities that are priced more 'normally' for the stock in question. The diagonals allow you to capture short-term overpriced options without taking any naked option risk.

And of course, you can use puts to implement the same type of diagonal strategies on the downside.

Previous issues are located under the News tab on our website.