A Rare One-Dimensional Volatility Skew

March 28, 2024

The Markets at a Glance

The Market Trend Remains in Place

Not only did the major indexes remain solidly in their uptrends, VIX dropped back to 13.24 on Wednesday - the lowest level since early February. This tends to dispel any current notions that implied volatility might be suggesting an impending trend change in stocks. It also means that short-term options on the S&P are about as cheap as they can be right now, making it tough for options writers on the index to find attractive writing opportunities.

Strategy talk: A One-Dimensional Volatility Skew

As such, it is not surprising that options activity is being directed elsewhere and one place that it went this week was into the stock whose symbol is the initials of a certain ex-President we are all too familiar with - DJT. With a chart like the one below (and barely any fundamentals), how could options players resist?

Stocks can present traders with dramatic volatility time skews, where near-term implied volatility is not just larger, but a multiple of long-term implied volatility. This often happens around earnings announcements when lots of people are making bets on a stock's near-term post-announcement move while paying little attention to its long-term prospects. Demand for near-term options causes implied volatility to shoot up prior to the announcement, while longer-term implied volatility remains somewhat subdued.

Then, immediately following the announcement, the stock makes its move and everyone looks to exit their trades, causing implied volatility to crash back to 'normal' almost immediately. The goal in such situations is generally to capture the overpriced near term IV without subjecting oneself to an outsized directional risk. If you do want to play a direction, you can always do a covered call write, a naked put write, or a diagonal spread to capture premium. But you'll need to use a different approach to capture premium while maintaining a directionally neutral strategy.

To do that, you'll want to look at using two straddles - a long straddle in a more distant expiration coupled with a short straddle in a close one. As long as the post-earnings move in the stock is not too large, you should make money, though occasionally an earnings surprise will indeed create a move that is greater than what options players on both sides were anticipating, and your strategy will lose money.

A volatility time skew is happening right now in DJT but not because of a pending earnings announcement. It is happening as the stock shoots up on near-term enthusiasm for the newly public Trump Social Media Platform, Truth Social. The SPAC that acquired Truth Social has shot up from a price in the mid-30s to nearly 80 in a week causing calls at strikes as high as 115 to see action.

But this is not an earnings announcement event. It is simply a great deal of speculation about where the stock might go, considering how it is being fueled by a feverish political following, many of whom are likely viewing this as a Trump campaign contribution that actually might also become a profitable investment. As some people in the media have been quoted, trading in DJT "is completely divorced from its fundamentals". And absent an event (like a planned earnings announcement), one cannot expect that at any particular time, the implied volatility on short-term DJT options will crash back to a more reasonable level.

Meanwhile, something ELSE is going on with DJT that makes its volatility skew even more unique. The time skew is only showing up in the calls, not the puts! This is rather unusual, and is being caused by a unique array of crosscurrents.

Opposing the MAGA-crowd's eagerness to drive the stock higher are those on the other side of the Trump pendulum, who see DJT as a opportunistic short sale due to its lack of underlying fundamentals. The stock is in minimal supply, so shorting it has become extremely expensive. Therefore, some those who want to have an effective short position in the stock are using options instead, driving the put prices sky high. And that's not just in the near term. Put valuations are sky high in all expirations!

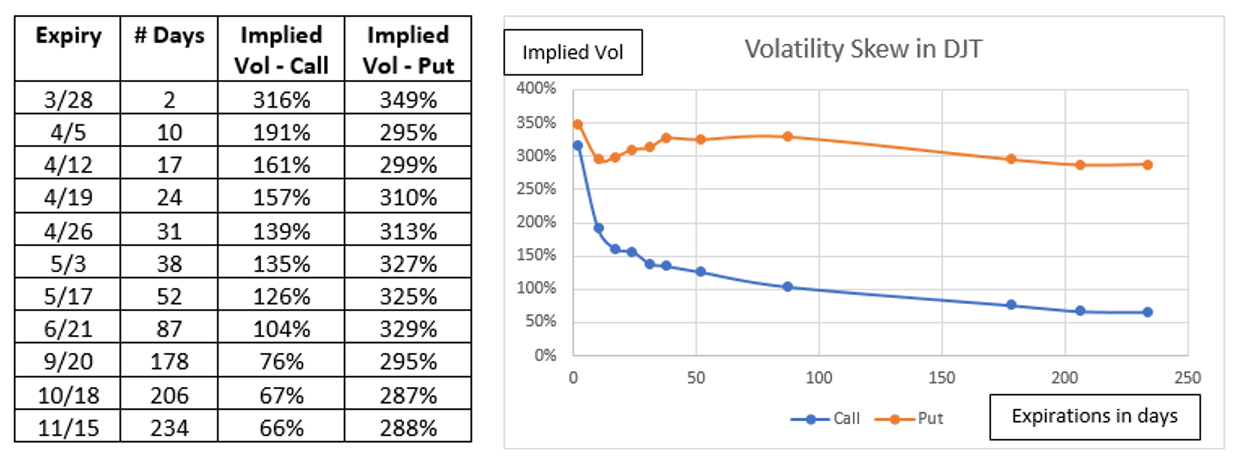

Below are the implied volatilities for DJT's nearest ATM strike (65) in each of the next 11 expirations, with a graph of the results (based on Wednesday night's close).

Normally, the two lines above would be almost superimposed, but here there is a substantial time skew on the calls (with IV going from near 200% on the April-5 calls to around 60% late this year). You could buy a calendar spread (long a September call and short an April call) to take advantage of that skew, but if the stock backs off (a high likelihood), you could easily lose more to direction than you gain from reduced IV. So, a call calendar spread is not advised.

Meanwhile the puts are extremely highly priced and remain so all the way out in time. If you use a classic two-straddle strategy to exploit the time skew, your long puts could crash from both direction (further upward movement on the stock) and an unexpected reduction in IV (they cannot maintain a 300% IV forever). So, that won't work either.

What to do, then???

Sometimes, a trader needs to stand aside and recognize that, while an extremely tempting price distortion is staring them in the face, a strategy with an attractive risk-reward profile to exploit it may not exist...at least for the moment. An additional consideration is the liquidity of the more distant options on DJT, which is somewhat poor, resulting in wide bid-ask spreads.

For my taste? I am using some put butterflies to play the potential drop in the stock with low risk. But I am certainly going to watch it to see what else might unfold. If you have a creative way to play DJT and want to share it, let me know.

Got a question or a comment?

We're here to serve iVol users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use rhlehman@ivolatility.com.

Previous issues are located under the News tab on our website.