Is the Trade War Really Over?

May 19, 2025

The Markets at a Glance

Early signs of negotiations between the US and China pointed away from a prolonged trade war. The momentum in talks between the two countries removed much of the risk for a global recession, which sent demand-sensitive crude oil prices appreciably higher. China is taking in a lot of oil from Russia and Iran because of steep discounts amid fresh US sanctions.

The week's CPI and retail sales data offered investors clues about how the trade war has impacted U.S. consumers.

Investors used Walmart as a gauge for consumer health because it is one of the largest retailers in the United States. An earnings report from Walmart was particularly notable amid the ongoing trade war between the United States and China because Walmart sources heavily from Chinese manufacturers.

US retail sales figures were in focus for a check on recession risk. Were markets ready to start thinking about the economy again? Will consumers give the stock market something new to celebrate? Are they ready to cancel the onset of a recession? Will shoppers absorb the extra costs and keep on buying as usual.

Is this a ceasefire in the trade war or a true and lasting peace agreement? Will focus now return to the economy, interest rates, recession, etc.

How does Friday's downgrade of US debt affect markets in the short/long run? Will the downgrade cause bonds and the dollar to fall and gold to rise?

For the week

U.S. Indices: The S&P 500 advanced +5.3% the tech-heavy Nasdaq Composite climbed +7.2%, the Russell 2000 rose +4.5% and the blue-chip Dow added +3.4%. With all this, the CBOE volatility index sank over 21%.

Some important market profiles are presented below:

Daily Recap

Monday's Recap:

A series of weekend meetings between representatives from both sides produced what the US administration termed a "total reset" of trade relations. The crucial part of the meetings was a 90-day pause of reciprocal tariffs above 10% by both sides. This translated into a drop in US duty rates from 145% to 30% and from 125% to 105 in Chinese duty rates.

The markets applauded amid signs of a rapid de-escalation of the US-China trade war. The Dow exploded 1,000 points in pre-market trading, and the rally never waned. Both the Dow and the S&P 500 are nearly back to even for the year, while the Nasdaq clawed its way out of bear market territory.

Treasuries fell across the curve as a risk-on sentiment overcame traders. Cash on the sidelines appeared to be coming back into play.

Gold dropped and traders sold the safe-haven metal and played in equities.

Crude popped on the hopes of stronger economic growth for both the US and China.

Notable movers to the upside:

- The thaw in the trade war, popped semi-conductor stocks like NVDA, TSMC, AMD, BRCM and QCOM

- The magnificent seven also shot up higher, particularly AAPL, AMZN and TSLA, most heavily to be affected by any higher tariffs.

- Chinese ADRs, like JD, BABA and BIDU climbed as well.

Tuesday:

The CPI report had a mild reading which was considered good for the economy.

With tariff deals on the horizon, analysts were appearing to drop their doom and gloom tone and revise their forecasts.

Both Goldman Sachs and JPMorgan lowered their odds of a recession by large percentages and raised their GDP growth forecasts for the 4th quarter of the year.

Turmoil no longer appeared to engulf global markets. US equity markets rose today as market sentiment improved following news of a deal that will allow Saudi Arabia to buy semiconductors and graphic processing units (GPUs) to boost the country's artificial intelligence infrastructure. The S&P 500 officially turned green for the first time since the beginning of 2025. Such an incredible turnaround was difficult to predict just a month ago.

Additionally, crude oil prices rose substantially to extend the previous week's gains. Traders may be seeing the demand outlook for the commodity improving as the US and China hash out a trade agreement.

The taxation of trade between China and the US was no longer in dispute – The runway is clear, at least for the next 89 days. Trader expectations are now pegged at just two 25-basis-point (bps) rate cuts in 2025.

Notable movers to the upside:

- Coinbase exploded on news that the crypto trading platform will be added to the S&P 500 next week.

- Boeing rose following news that the Chinese government has removed its ban on domestic airlines accepting orders from the plane manufacturer.

Notable movers to the downside:

- Honda Motors fell after the company warned that tariffs will ding its bottom line and postponed its plans to build an EV plant in Canada.

- Hertz Global plunged after it missed analyst estimates across the board and announced it will offer fewer cars for rentals this year.

- Enphase Energy dropped on a downgrade from analysts, who foresee slower demand for residential solar power products.

Wednesday:

Washington and Beijing agreed to pause tariffs for 90 days as negotiators work out the mundane details. The US tariff rate will drop to 30% from 145%, and Chinese tariffs on US goods will drop to 10% from 125%.

Normalcy continued to settle in for financial markets in the wake of the US-China trade war truce. The spot VIX was back under 20, while gold prices started to crack below 3200. The fear trade appeared to have subsided. Sentiment appeared to be cautiously optimistic about deregulation and taxes, constrained in parallel by measured pessimism about trade policy (growth and inflation).

Traders continued to buy US equities with technology stocks leading once again.

As equities rose, sentiment about gold's outlook continued to fall, bringing the weekly loss to just about the worst since June 2021.

Bitcoin met quite a lot of resistance above $105,000.

Notable movers to the upside:

- Oklo jumped 14.12% after the nuclear power startup revealed a smaller-than-expected loss last quarter.

- Exelixis soared after the oncology company reported a shockingly strong beat-and-raise quarter.

Notable movers to the downside:

- American Eagle Outfitters (AEO) tumbled after the retailer cut its fiscal guidance, announced it's writing down $75 million in merchandise, and forecast a decline in next quarter's sales.

Thursday:

Wholesale inflation as measured by the PPI index posted its biggest drop since 2020.

The manufacturing sector reported a drop in activity for the third straight month and US factory production sank for the first time in six months. US retail sales rose just 0.1% in April, shy of expectations as consumers slowed their spending spree.

Oil took a tumble on comments by the US administration that a deal with Iran is imminent over its nuclear program that could lift sanctions against the country.

With the US president visiting the Saudi kingdom, several deals were announced. The spotlight was on the newly launched AI enterprise Humain, owned by Saudi Arabia's sovereign wealth fund. The main beneficiaries identified thus far are NVDA, AMD, BA and AMZN.

For now, the effect of tariffs on the economy remains a pain point for the market.

Notable movers to the upside:

- Foot Locker (FL) almost doubled in price on the news that Dick's Sporting Goods will acquire the footwear retailer for $2.4 billion.

- Birkenstock (BIRK) moved up after earnings beat though revenues came up shorter than analyst estimates.

- Cisco climbed up after not only beating analysts' expectations but also issuing better-than-expected fiscal guidance.

Notable movers to the downside:

- Apple (AAPL) fell 0.41% on news that President Trump scolded Tim Cook for trying to build iPhones in India.

- Meta Platforms (META) dropped after a WSJ report that its AI model was experiencing delays in its debut.

- UnitedHealth Group (UNH) plummeted on a WSJ report that the health insurer is being investigated for criminal Medicare fraud.

- Coinbase crumbled on news that hackers bribed employees to steal customer information and that it will take $400 million to fix the mess.

- Alibaba (BABA) dropped due to a lowered growth rate due to lower consumer spending and increasing competition. This happened despite the company's new focus on AI has raised the stock price over 45% in 2025.

- Walmart (WMT) reported good earnings but shares fell because of a warning that tariffs are going to hurt the bottom line and price increases may be inevitable.

Friday:

The markets had their best week in over a month with most of the positive sentiment being attributed to the surprise US-China trade deal announcement.

The benchmark rose for a fifth straight session, had its second best week of the year and finally turned positive for the year. It seems that investors have renewed appetite for risk.

Gold had its worst week since November 2024 and treasuries sank as well.

Notable movers to the upside:

- Nvidia climbed on reports of a deal that would allow the UAE to import 500,000 chips per year.

- Virgin Galactic rocketed up high on an announcement that it will restart commercial space flights.

- Coinbase climbed up big after analysts said the market's reaction to recent news of a hack and an SEC probe were "overblown".

- CoreWeave soared after Nvidia disclosed a large stake in the company.

- Archer Aviation soared after being named the Official Air Taxi Provider of the 2028 Los Angeles Olympic and Paralympic Games.

Notable movers to the downside:

- Novo Nordisk slipped on news of its CEO stepping down.

- Applied Materials sank after earnings fell short of analyst estimates.

- Cava crumbled 2.27% due to financial forecasts of slower growth.

- Take-Two Interactive Software dropped due to weaker-than-expected projections for net bookings this quarter and this year.

But...after the markets closed, the credit rating agency, Moody's, dropped a bombshell. Moody's lowered the US debt rating down one notch from Aaa to Aa1, citing the growing burden of financing the US federal government's budget deficit and rising cost of rolling over existing debt. Until Friday, Moody's had been a holdout in keeping U.S. sovereign debt at the highest credit rating possible. This downgrade brought the 116-year-old agency in line with other major credit rating agencies.

"Successive U.S. administrations and Congress have failed to agree on measures to reverse the trend of large annual fiscal deficits and growing interest costs," Moody's analysts said in a statement. "We do not believe that material multi-year reductions in mandatory spending and deficits will result from current fiscal proposals under consideration."

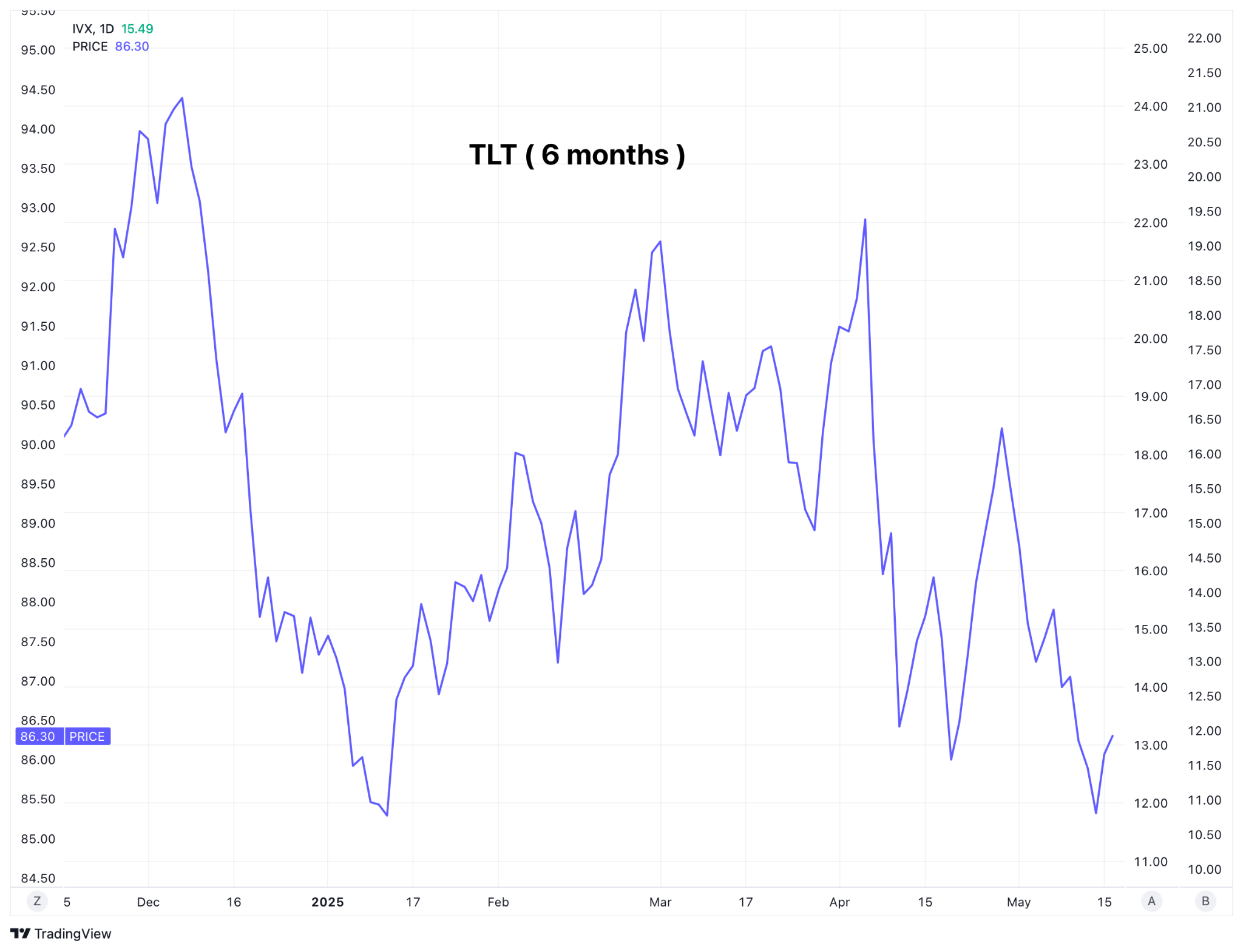

The decision to lower the United States credit profile would be expected, at the margin, to lift the yield that investors demand in order to buy U.S. Treasury debt to reflect more risk, and could dampen sentiment toward owning U.S. assets, including stocks. In after-hours trading, the yield on the 10-year treasury note climbed 3 basis points in after-hours trading, the 20+ year treasury bond etf, TLT, and the S&P 500 both fell about 1%.

Strategies to Consider

- SNOW

Earnings to be released on May 21st, after the bell.

If bullish, buy the ATM long call spread in the weekly expiration.

Finance the purchase of the call spread with the sale of a call (or call spread) in the monthly expiration. Place the short call beyond the expected move for the duration. - GLD

If bullish, sell the June 270/280 put spread

delta: + 8

credit received: $100

buying power withheld: $900

probability of profit: 84%

probability of 50% profit: 94%

Considerations for the Coming Weeks

Economic reports are few and far between next week.

On the board are:

- leading economic indicators on Monday

- initial jobless claims, PMIs and existing home sales on Thursday

- new home sales on Friday

- the earnings season is winding down but a few names are worth mentioning: PANW, HD, TOLL, LOW, TGT, BIDU, TJX, SNOW, INTU, DECK

In Case You Didn't Already Know This...

24-hour stock trading is about to become a reality for all investors. A pertinent agency has declared its intention to ask the SEC for permission to extend the hours of the public data feeds that provide prices to investors. It is possible then that trading would run from 8pmEST on Sunday through 8pmEST on Friday, with just a one-hour pause each day for critical house-keeping issues such as exercise of options and trade settlements.

Information affecting markets comes out around the clock, including social-media posts and announcements from overseas companies. Consequently, traders would benefit from access to markets around the clock as well.

The shift should make it easier for international investors – and particularly those based in Asia, where the trading day doesn't really overlap at all with the U.S. For example, it's pretty difficult for a trader in Korea to work all day then stay up all night and try to trade the U.S. market.

A transition of this kind is not without its problems. For example, it's unclear exactly where exchanges will draw the line between one trading session and the next.

Questions / Comments

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use support@ivolatility.com.

Previous issues are located under the News tab on our website.