Complacent Week Shattered by the Start of a War?

June 16, 2025

This newsletter provides a snapshot of the movements of the Capital Markets during the past week, captures major market headlines and suggests some strategies that an options trader might consider for the coming weeks.

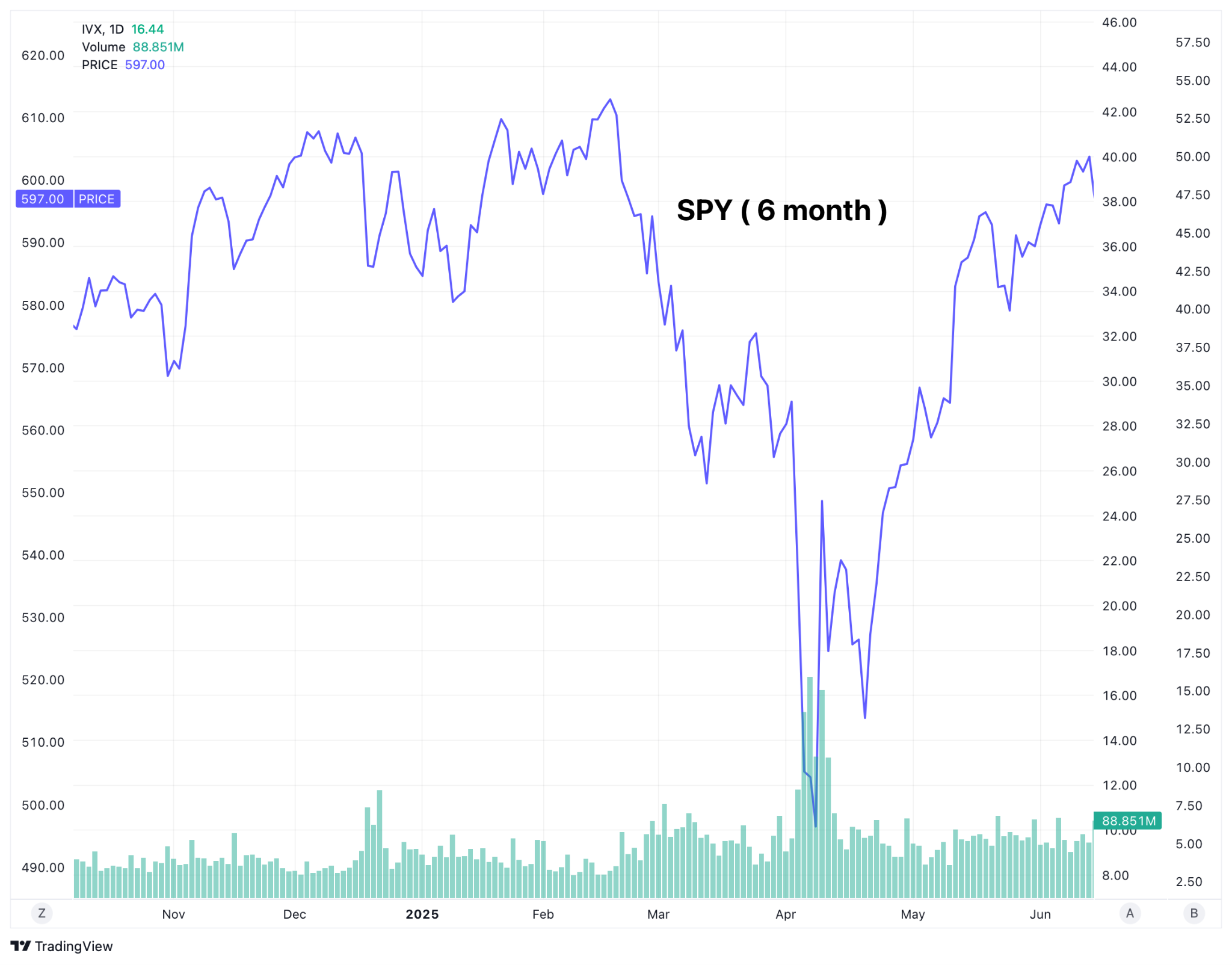

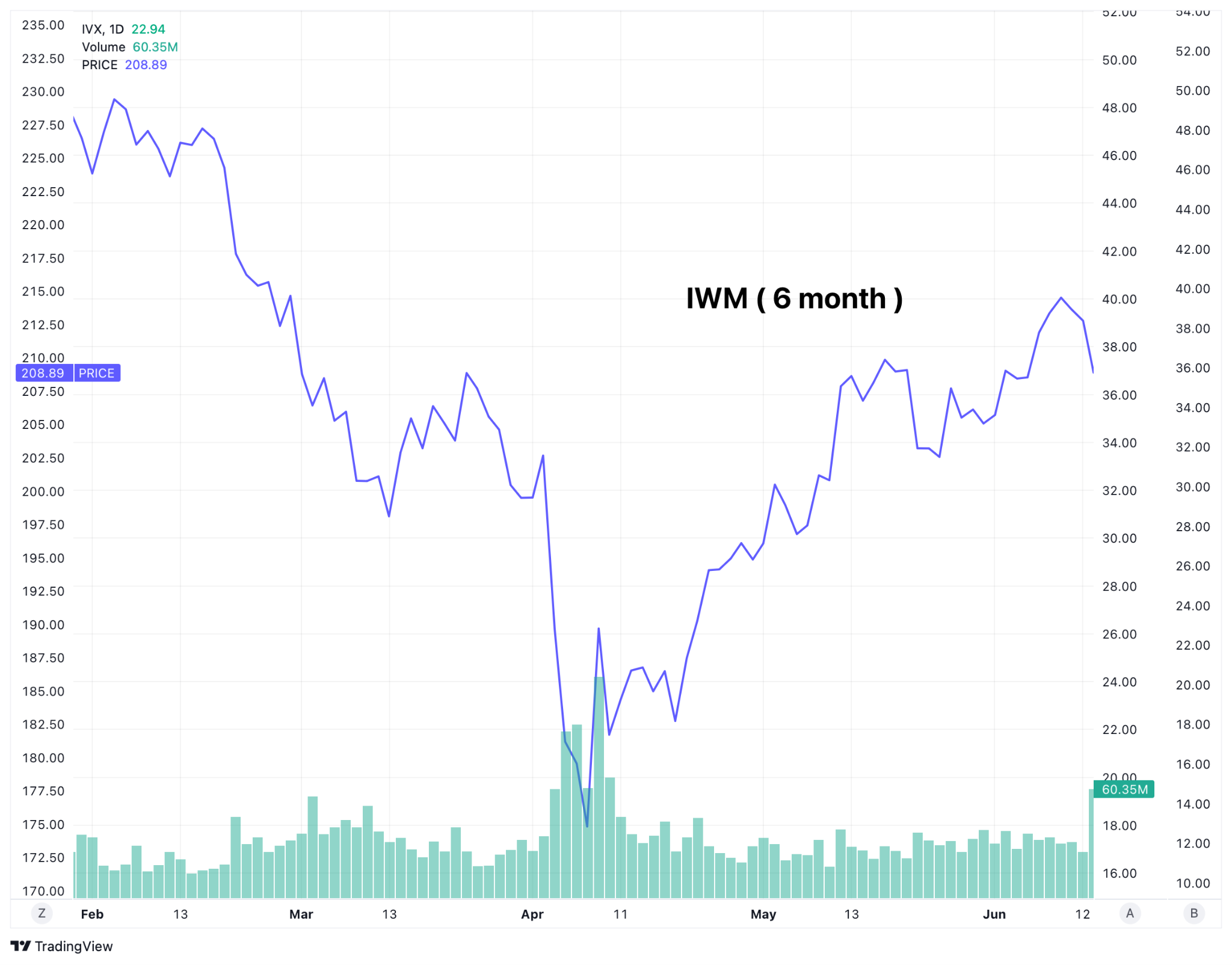

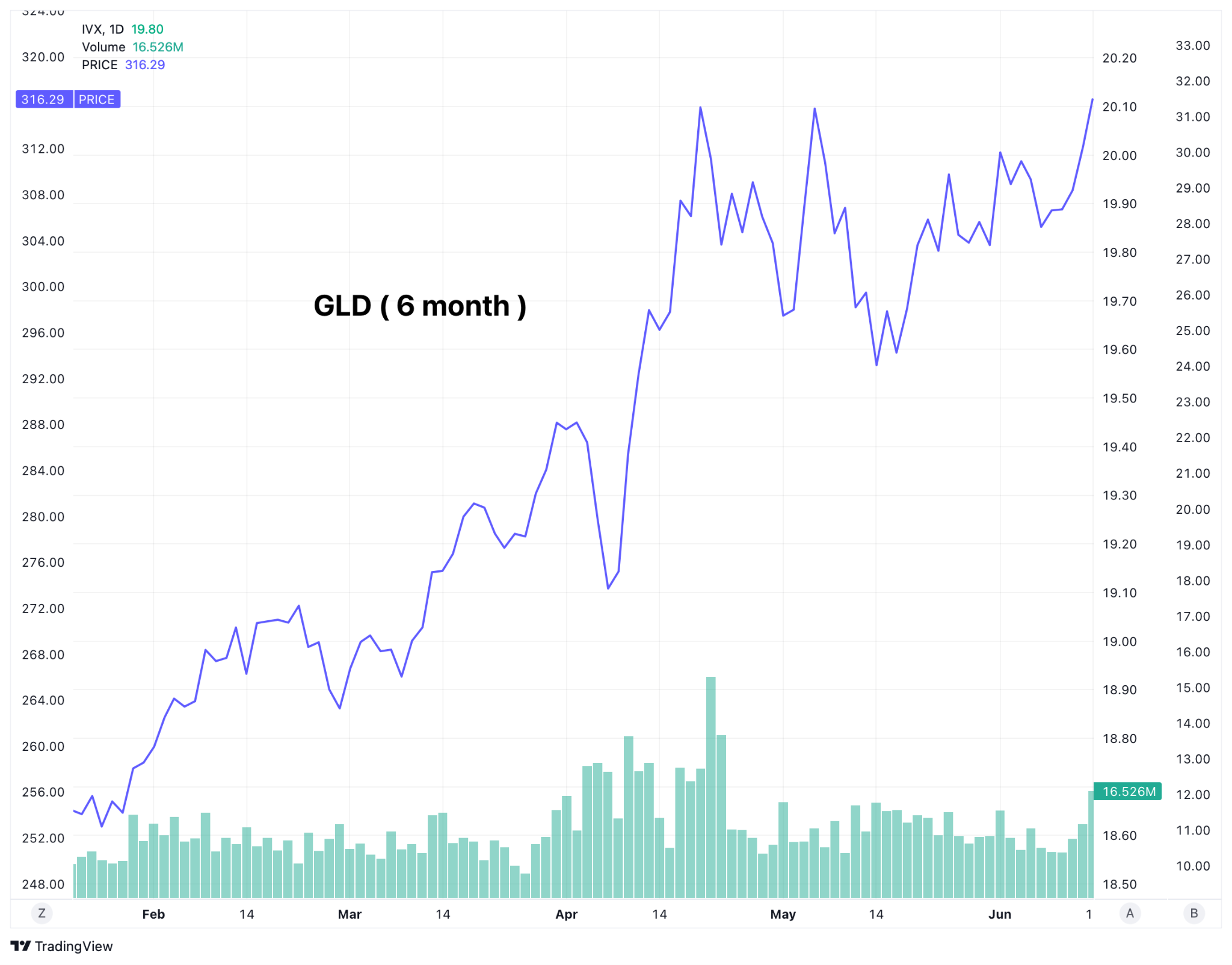

Major Indices for the Week

S&P: dropped 1.15%

DOW: dropped 1.3%

Nasdaq: dropped 0.6%

Bitcoin: dropped 0.24%

10-year yield: dropped 0.09%

Gold: rallied 3.7%

Crude oil: rallied 13%

Review selected market profiles below:

Top Headlines this week

Monday's Recap:

Equities inched higher on a couple of optimistic headlines. First, the US and China trade teams meeting in London expressed hopes that the two superpowers would come to an agreement over export restrictions.

Additionally, a new survey from the New York Fed found that consumer expectations for inflation eased in May.

The biggest surprise on the first day of Apple's annual Worldwide Developer's Conference (WWDC) was a new software makeover called Liquid Glass. Apple shares dropped though perhaps due to the absence of much discussion on AI development.

Warner Bros Discovery, the entertainment giant, announced that its splitting into two – Global Networks (consisting mostly of TV channels) and Streaming & Studios (consisting of its film studios and streaming services).

Notable movers to the upside:

- An executive order to spur drone manufacturing, pushed up aviation startups like Archer, Joby, Vertical and Blade Air Mobility

- After its IPO the previous week, stablecoin issuer, Circle, continued its meteoric rise for the third straight day of gains

Notable movers to the downside:

- When rumors of Robinhood and AppLovin being included in the S&P and Dow Jones Indices were denied, both Robinhood (HOOD) and AppLovin (APP) gave up their recent gains

- Intuitive Surgical, a medical technology company, dropped over 5% after a Deutsche Bank analyst gave it a SELL rating citing intense competition looming over the next few years

Tuesday:

Markets meandered higher as investors awaited news from ongoing US & China trade negotiations in London.

Oil soared to its highest price since April on hopes that a trade deal between the world's largest economies could spur demand, but plunged back to earth after the US said oil output will fall next year.

Bitcoin has now stayed above $100,000 for 30 days straight for the first time ever.

According to the World Bank's latest estimates, it predicts weakest growth since the 1960s. The Chief Economist, Indermit Gill, cited "international discord – about trade, in particular" for the pessimistic outlook. The World Bank lowered forecasts for nearly 70% of economies, but did not go so far as to foresee a global recession.

Notable movers to the upside:

- Tesla climbed another 6% around the hype of the robotaxi reveal and possible patch up between Elon Musk and the US President

- Disney rose almost 3% after agreeing to purchase a large stake in the popular streaming service Hulu

- Insmed, a biopharma company, exploded almost 30% up after reporting strong results for its new treatment for pulmonary arterial hypertension

- Silver hit a 13-year high

Notable movers to the downside:

- McDonalds, an international fast food company, received its third analyst downgrade in three days and dropped nearly 1.5%. There might be headwinds from obesity drugs

Wednesday:

The May US inflation report came in cooler than anticipated, much to the delight of traders, increasing the odds of Federal Reserve interest rate cuts in July and September.

After rising to a four-month high intraday, the S&P finished the session down, despite progress being announced of a US-China trade truce and rosy CPI data. The two nations still had not formally agreed to the deal, which left investors feeling lukewarm about the news. Analysts warned that the full impact of tariffs hasn't hit and the rally petered out as investors took profits and hedged their bets.

Platinum prices continued to climb after hitting a four-year high as traders sought less expensive alternatives to gold.

Notable movers to the upside:

- Oklo roared almost 30% higher after the nuclear power startup announced it has been conditionally selected to provide power to an Air Force base in Alaska

- SailPoint soared nearly 15% after the cybersecurity company reported better-than-expected earnings last quarter and raised its fiscal forecast

Notable movers to the downside:

- GameStop, a video game retailer, tumbled over 5% after the company reported disappointing revenue growth last quarter

- Chewy, a pet food retailer, lost over 10%, despite beating Wall Street's forecasts last quarter

- Lockheed Martin, a defense contractor, stumbled over 4% after the Pentagon substantially cut its order for new F-35 fighter jets in half

- Steel stocks (CLF, NU and STLD among others) took it on the chin today thanks to a report that the US and Mexico are nearing a deal that would reduce the 50% tariff on steel imports

Thursday:

The data on wholesale prices, PPI, reinforced the narrative that tariff price pressures have yet to show up in the economy. This resulted in a rise in the markets. In addition, traders were focused on positive results from the trade negotiations between the US and China and potentially two interest rate cuts starting in the month of September.

Goldman Sachs reduced the probability of a US recession from 35% to 30%.

Notable movers to the upside:

- Oracle popped up over 13% after the cloud computing giant beat Wall Street forecasts. The CEO predicted that revenue growth rate in FY26 will be "dramatically higher". The stock has outperformed all of tech's megacaps so far this year

- Cardinal Health climbed almost 5% after the healthcare products maker raised its fiscal guidance for the year

- Datadog, a cybersecurity company, rose almost 3.5% after an analyst upgrade with rapid growth due to AI

Notable movers to the downside:

- Boeing (BA), sank nearly 5% after an Air India 787 plane crashed

- GameStop (GME) plummeted nearly 25% after the video game retailer announced the sale of $1.75 billion in convertible bonds to buy more bitcoin

Friday:

Israel struck Iran with missiles, raising concerns of an all-out war. Markets tumbled at the open but the selloff deepened in the afternoon after Iran retaliated. The markets gave up the entire week's gains and ended in the red. Oil prices spiked over supply worries and traders flocked to the safe haven of gold. Gold-related investments also climbed in apparent flight to safety.

Overnight the oil prices jumped almost over 14% based on fears of disruptions in supply due to the Israel-Iran conflict. By the end of the day, those gains in oil subsided. However, gold continued to climb as investors sought safety from further escalation in hostilities.

Travel stocks took a hit as Israel's attack on Iran raised questions about the outlook for international travel. Cruise and airline stocks fell as investors worried about how rising oil prices might weigh on profits.

Notable movers to the upside:

- Restoration Hardware (RH), a luxury home furnishings retailer, beat earnings expectations by over 200%

- Circle Internet Group, (CRCL), a financial technology company best known as the issuer of the USD Coin (USDC) stablecoin surged 25.54% a day after Shopify announced it will accept USDC stablecoin payments on its e-commerce platform

Notable movers to the downside:

- ADBE, one of the world's largest digital media solutions provider, missed earnings expectations

- DraftKings, a gaming app developer, fell nearly 4% after the company's announcement to add a $0.50 surcharge to every bet made on its platform in Illinois to offset a new state tax

Strategy Corner

Some trading ideas and option strategies are presented here for the readers' consideration:

- GLD short put (GLD currently at 316)

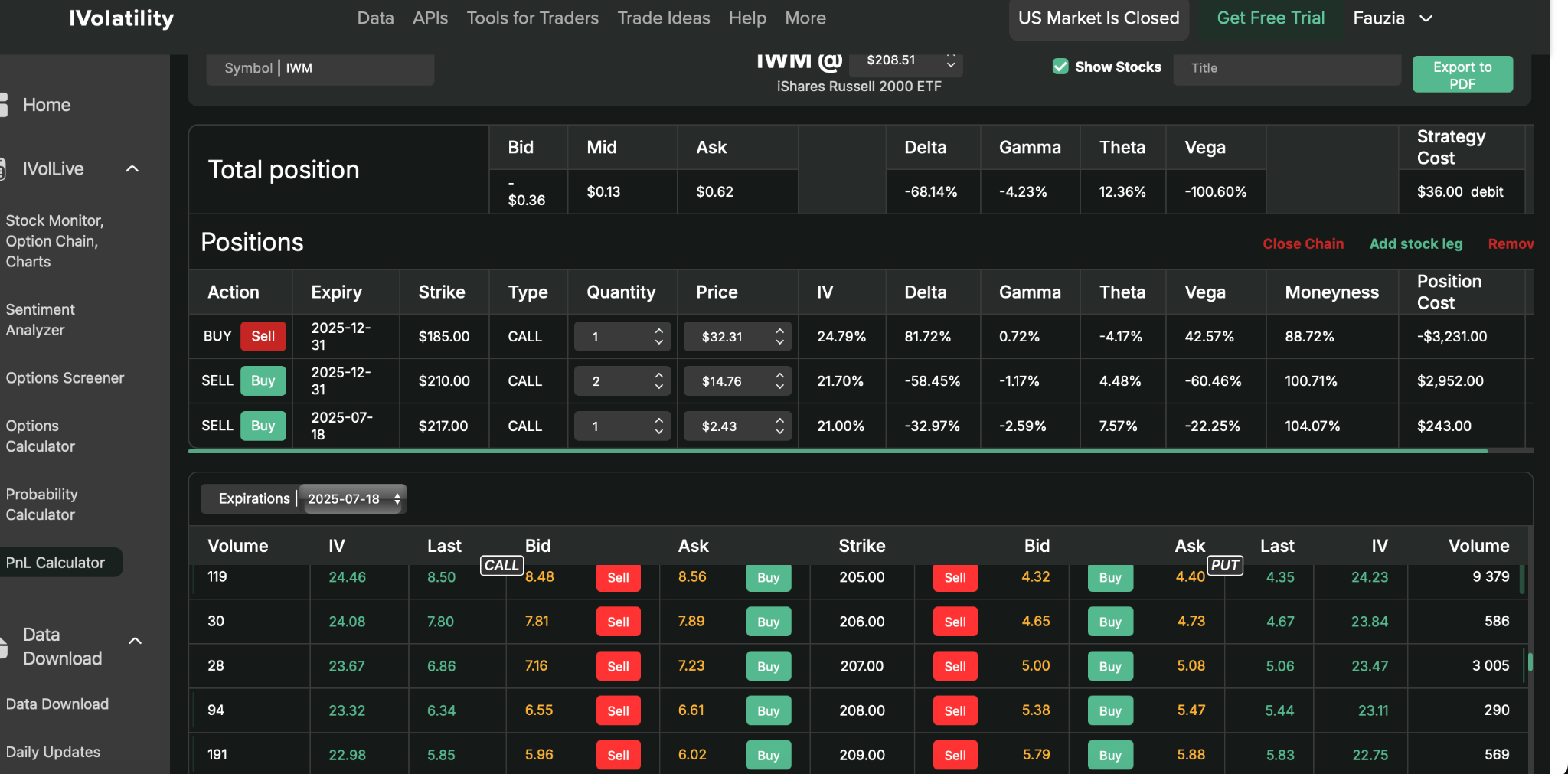

To establish a bullish position, sell the july 305 put (or 20 delta) - IWM covered call zebra (IWM currently at 209)

In a far month, buy 2 Dec31 185 calls / sell 1 Dec31 210 call: this creates a synthetic long stock position of about 96 deltas

Cover the purchase of this synthetic long stock with the sale of a near-month July 217call

Total covered stock position has a net position delta of about 67deltas and costs around $3600 and could realize a total value of around $6000 if IWM continues upwards and expires above 217

If option synthetics are not used, a covered stock position in IWM would cost around $9000 in a margin account

This strategy is bullish on IWM in the coming months. As time passes, there are multiple opportunities to roll out the covering short call and reduce the cost of the total position.

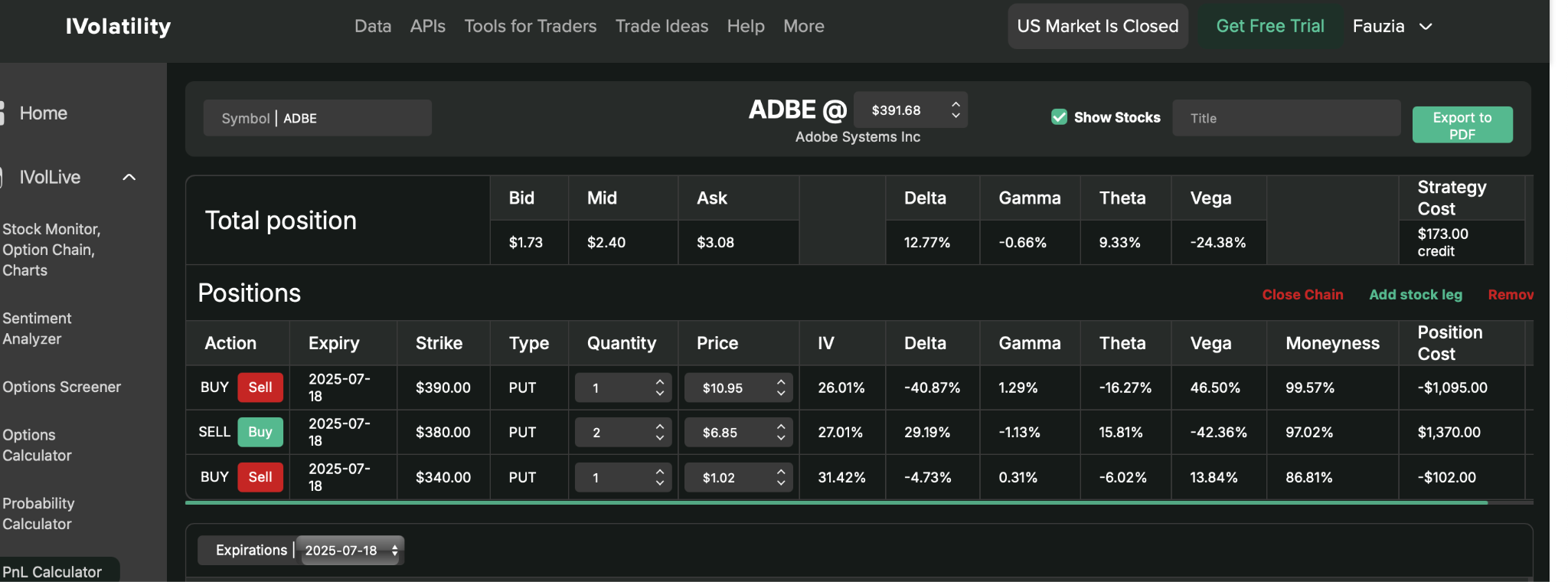

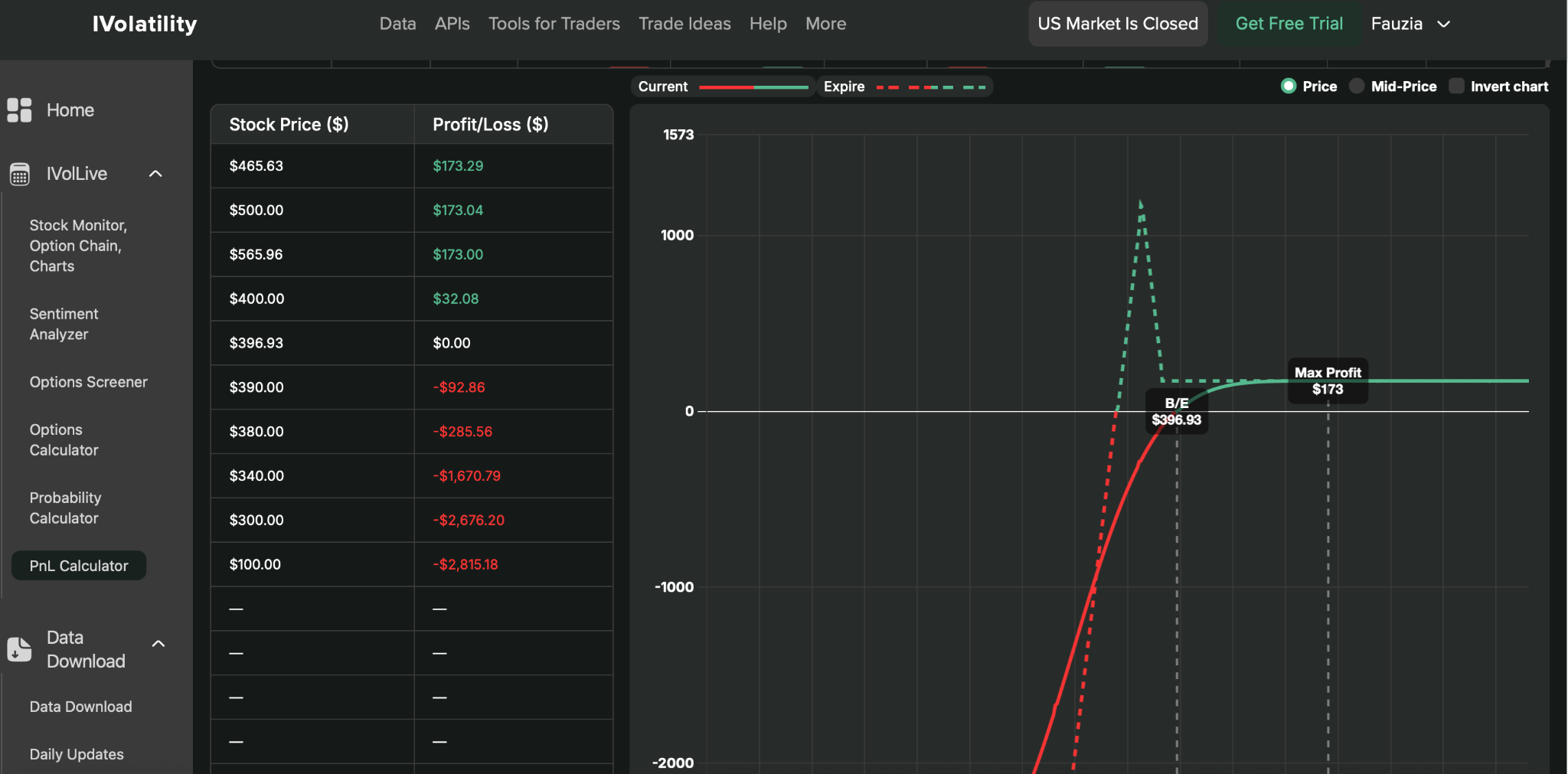

- ADBE (post earnings) (ADBE currently at 391)

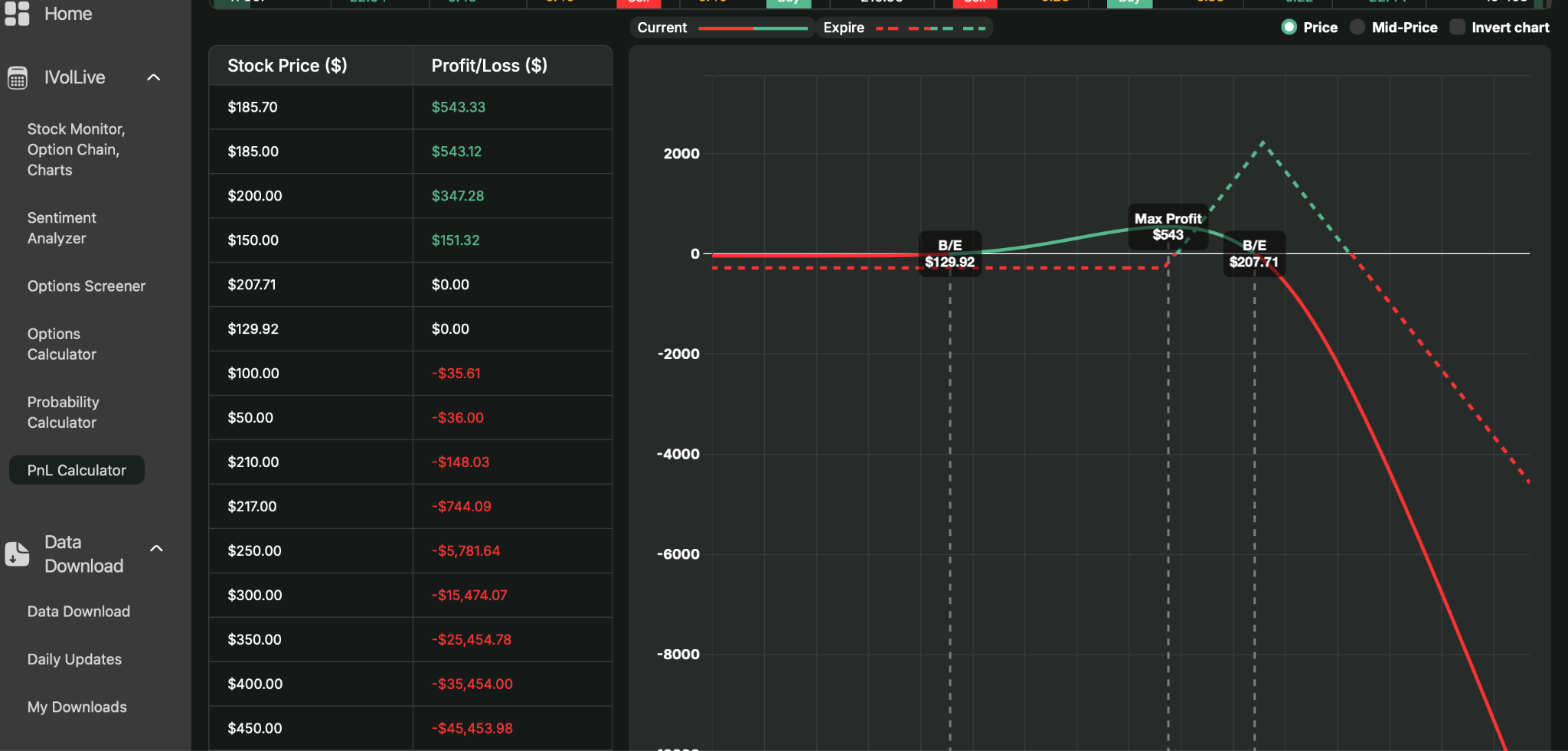

Buy one July 390 put / Sell two July 380 puts / Buy one July 340 put

Premium collected: $240

Buying Power: $2800

No risk to the upside; downside breakeven just below 270

A put broken-wing butterfly is a uni-direction trade that collects premium at the opening and potentially could collect more premium if ADBE sinks a bit further. If ADBE expires at the sweet spot of 380, an additional profit of $1000 could be realized.

Considerations for the coming week

The US Capital Markets will be closed on Thursday, June 19, 2025 in observance of Juneteenth National Independence Day.

Economic Data Releases:

- June 18th will be the Federal rate decision. The Fed Chair is expected to retain his wait and see approach to how the economy fares with the tariffs

- Other economic data highlights are US retail sales, homebuilder confidence, and housing starts

Earnings Reports:

The earnings calendar is pretty bare in the coming week. Homebuilder Lennar reports on Monday, June 16th and then it is not until Friday that earnings are reported by the likes of Lennar, CarMax, Kroger and Aurora Cannabis.

Closing Thoughts

Americans may soon be leaving their plastic behind and paying for their shopping sprees with stablecoins instead. Compared to cryptocurrencies like bitcoin, whose value seems to appreciate/depreciate in an uncorrelated manner, stablecoins offer the ability to complete a transaction at a "stable" price by tying its value to legal tender.

The stablecoin being offered by the fintech company, Circle Internet Group (CRCL) is known as USDC – and is pegged to the U.S. dollar. CRCL is the first major IPO in the crypto industry since COIN. CRCL generates interest income by investing in short-term US treasuries.

USDC stablecoins provide a reliable payment method that can be transferred at the speed of the internet with transaction costs at fractions of a cent. These transactions settle almost instantaneously.

Retailers have good reason to create their own stablecoins, or even potentially band together to create a consortium of merchants under one stablecoin issuer: It would allow them to do an end-run around traditional payment methods issued by banks and credit cards, which siphon off an estimated 1.10%-3.15% in fees for every transaction. For retail giants like Walmart and Amazon, that can add up to billions of dollars.

A bill, the GENIUS Act, making its way through Congress will help spur the acceptance of stablecoins across the economy. This has assured many investors about the efficiency of stablecoin markets, which have caught on as a way for companies to pay workers around the world, or for conducting peer-to-peer transactions.

Lobbying groups warn that the GENIUS Act could place "an excessive concentration of economic power" in an already powerful big tech company.

Given that many average Americans may not even know what a stablecoin is, they might hesitate to add it to their payment "wallets" without some serious education or incentives. Widespread acceptance is probably a long time coming!

Questions / Comments

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use support@ivolatility.com.

Previous issues are located under the News tab on our website.