War Drums Continue to Beat

June 23, 2025

Word on the street is that some traders open positions in MSTR (Strategy, formerly MicroStrategy) as a means of getting exposure to bitcoin. The company has apparently decided to stop selling software and simply become a bitcoin holding company. It appears to be a financial engineering plan: issue equity and debt, use the proceeds to buy bitcoin and let the stock trade as a premium.

These numbers were quite recently taken off their website:

Bitcoin owned: ₿592,100

Bitcoin NAV: $63.6B

Market cap: $106.9B

mNAV (Market cap / NAV): 1.86

It appears most inefficient to pay 1.86 for every $1 of bitcoin the company holds. Is the MSTR investor paying extra (almost twice as much) for someone else's leverage?

Check out Blackrock's etf, IBIT: gives investors exposure to bitcoin, trades near NAV AND has listed options.

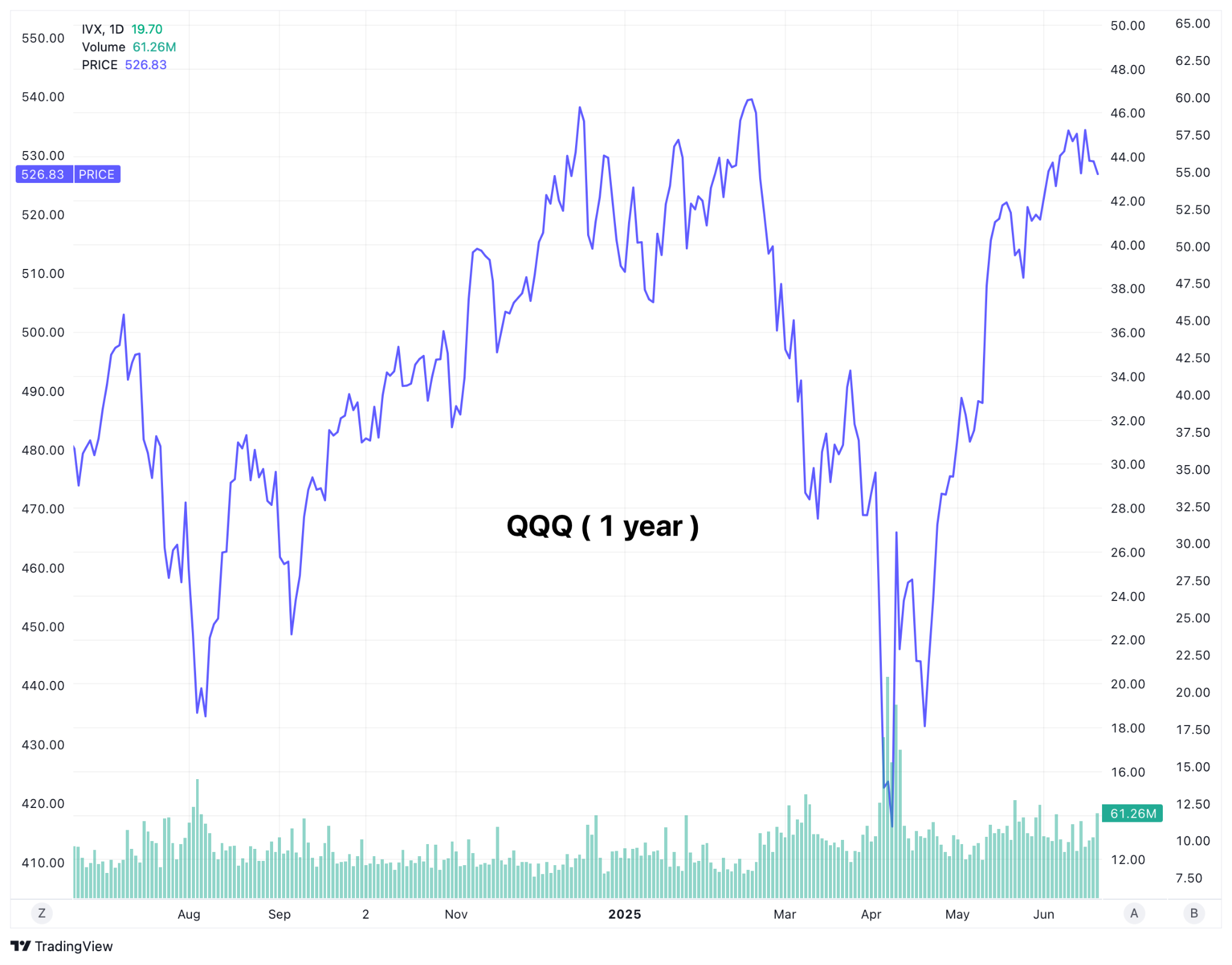

Major Indices for the Week

S&P: down .22%

DOW: essentially flat

Nasdaq: up .6%

Bitcoin: down 3%

10 year yield: up about 1%

Gold: down 2%

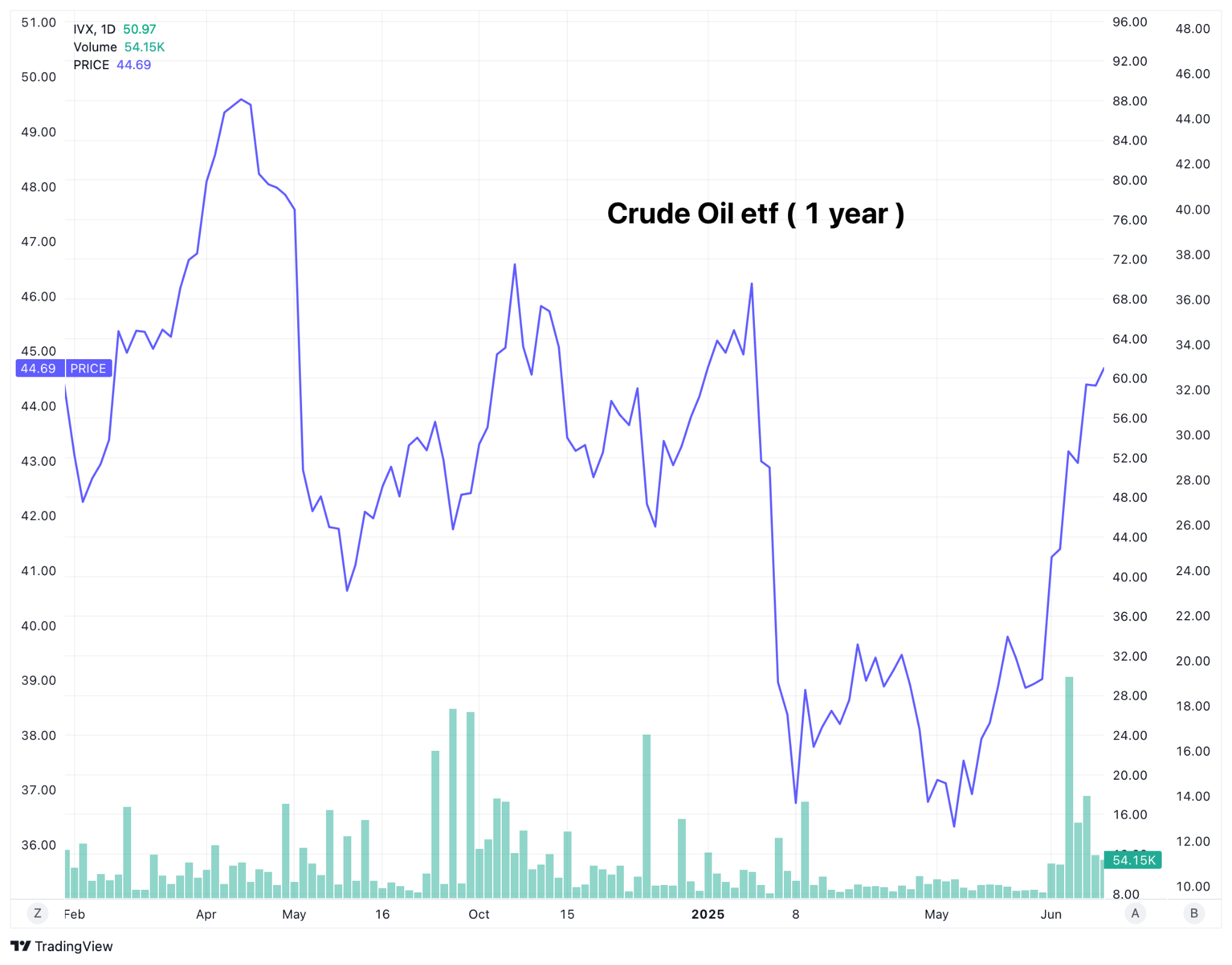

Crude oil: up about 4.5%

It appeared that the SPX and NDX are in the summer doldrums, running between the 8 and 21 ema.

Review selected market profiles below:

Top Headlines this week

Monday's Recap:

Fears of a widespread conflict between Israel and Iran appeared to have cooled off, although both countries continued with airstrikes. US equities erased losses from the previous week and crude oil prices relaxed more than 7% after touching their highest level since last July. Traders apparently had no need for "safe havens" as treasuries, gold and the US dollar were all down on the day.

The Nasdaq 100 traded back above 22000, while the S&P 500 traded back above 6000 and spot VIX dropped back down to 19.

A 20-year bond auction yielded strong demand seemingly pointing to renewed investor confidence in US fixed income.

Notable movers to the upside:

- X, the US steel company climbed over 5% after the US president signed an executive order approving its takeover by Nippon Steel. The companies also signed a national security agreement that includes a golden share for the U.S government.

- ROKU jumped over 10% after announcing a partnership with Amazon that gives advertisers the ability to reach roughly 80% of American households with connected TVs.

- AMD, rose 8.81% on an upgrade from Piper Sandler analysts, who think the semi stock's AI business will boom.

- MGM climbed over 8% after the casino company updated its guidance for the full year.

- META jumped nearly 3% after the company announced that it adds advertising to WhatsApp.

- CELH, the energy drink company rallied more than 5% after receiving an analyst upgrade to BUY from HOLD.

Notable movers to the downside:

- SRPT plunged over 40% after the pharma company reported a second death of a patient taking its Duchenne muscular dystrophy treatment Elevidys.

- Energy stocks dropped as oil prices dropped on reports that Iran wants to end hostilities.

Tuesday:

Markets sagged as fighting between Israel and Iran continued, with investors worried about escalation after President Trump called for the "unconditional surrender" of Iran's Supreme Leader Ali Khamenei.

Oil prices popped this morning after Trump warned that Tehran should be evacuated.

Bond yields sank after US retail sales came in much lower than anticipated, raising fears of an economic slowdown.

Notable movers to the upside:

- Verve Therapeutics nearly doubled in price on the news that the gene-editing company will be acquired by Eli Lilly.

- Reddit popped over 6% after the social media site rolled out new AI-powered tools for advertisers.

- Oil stocks (Valero Energy / Chevron / Hess) climbed back up again as the conflict between Israel and Iran threatened to grow.

Notable movers to the downside:

- Lennar, the homebuilder, sank over 4% after missing profit forecasts.

- The rise in oil prices caused airline stocks to drop.

Wednesday:

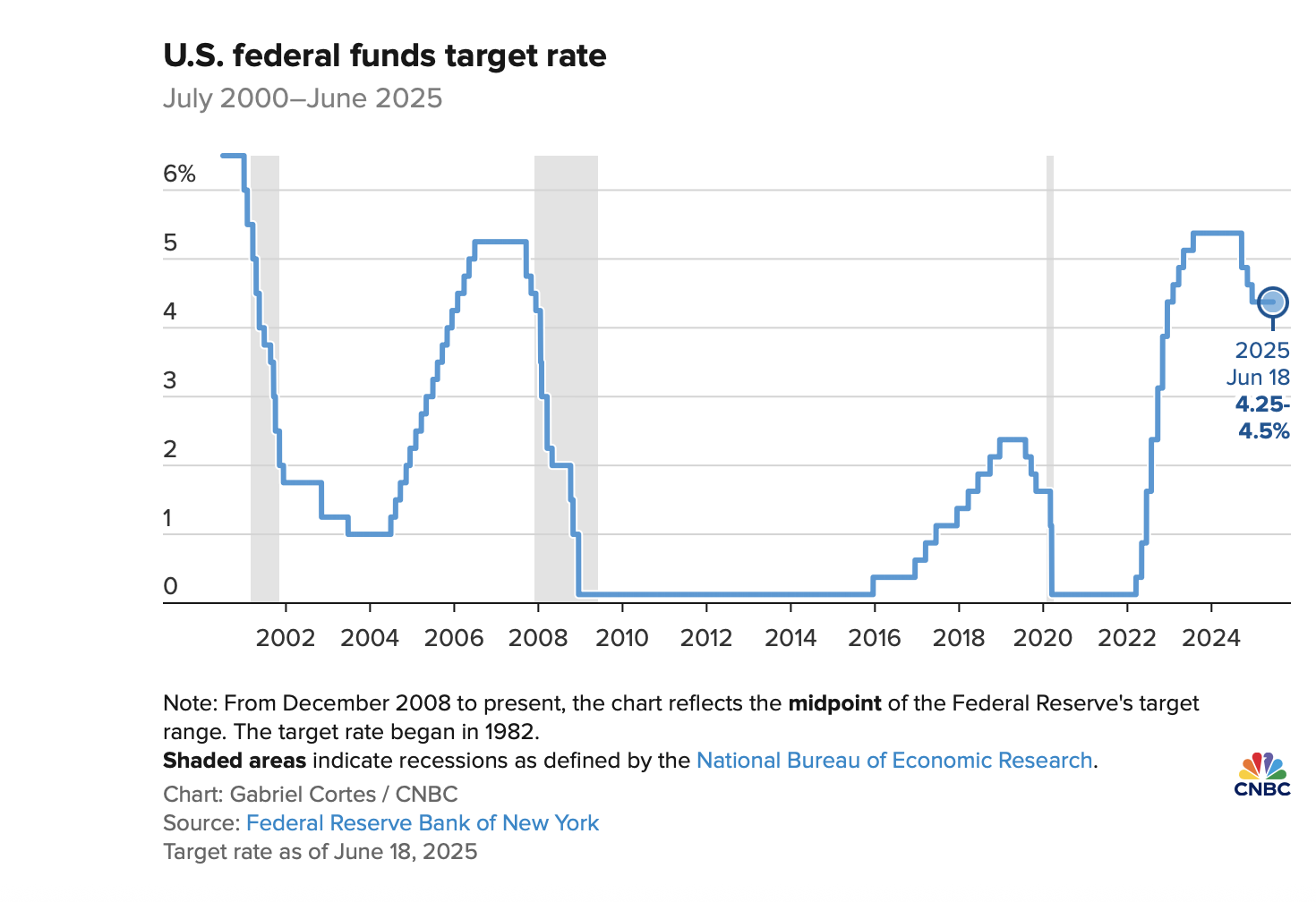

The Central Bank kept interest rates steady and the DJIA was modestly lower. Chair Jerome Powell signaled that the central bank will hold rates steady and wait to see how the size and duration of President Trump's tariffs impacts inflation.

The committee's updated economic projections for 2025 still appeared to show two rate cuts for this year, but growth expectations were revised, and unemployment and inflation estimates were bumped up.

Analysts called a top on gold and platinum climbed to a four-year high.

The Senate passed the GENIUS (Guiding and Establishing National Innovation for U.S. Stablecoins) Act, a landmark stablecoin legislation. Stablecoins are going mainstream and the world's largest retailers are plotting tokens of their own.

Notable movers to the upside:

Crypto stocks made giant moves up due to the passing of the GENIUS act. COIN rose over 16% and CRCL added nearly 34%. JPM announced the rollout of its own stablecoin.

Notable movers to the downside:

- Credit card companies tumbled on fears that stablecoins will disrupt the payment industry. Both MA and V dropped nearly 5%.

- ZTS, a pets and livestock medicine and vaccine company, lost over 4% due to a downgrade from analysts who cited increasing competition.

Thursday:

Markets were closed for observation of Juneteenth national holiday.

Friday:

Today was not only the longest day of the year but also a triple-witching day when stock options, index futures, and index options contracts all expire on the same day, ratcheting up market volatility.

As President Trump appeared to emphasize negotiations with Iran and Iranian negotiators arrived in Geneva, stocks traded higher while bonds, metals and energy were weaker.

Markets ended largely flat for the holiday-shortened week, as traders wondered about an escalating conflict between Israel and Iran and the Federal Reserve's fourth monetary policy decision of the year.

Notable movers to the upside:

- Thirteen S&P 500 stocks hit new 52-week highs. Here are some of those names that reached that milestone: TTWO / EQT / CAH / JBL / MSFT.

- CRCL, the crypto company that recently went public, continued to soar, ending the week up 70%. The stock is up more than 500% since its IPO on June 5th.

- COIN shares rose 3%. The crypto exchange operator receives half of the revenue generated from the interest earned on Circle's USDC reserves. It also makes 100% of the interest on the USDC held directly on its own platform.

- KMX climbed nearly 7% after the auto seller reported better-than-expected earnings.

- KR popped nearly 10% after raising its full-year sales forecast.

Notable movers to the downside:

- Chip stocks came under pressure following a report by The Wall Street Journal that the U.S. may revoke tariff waivers for some semiconductor manufacturers. Notables such as NVDA, MRVL and TSMC and the semi-conductor index, SMH, all dropped.

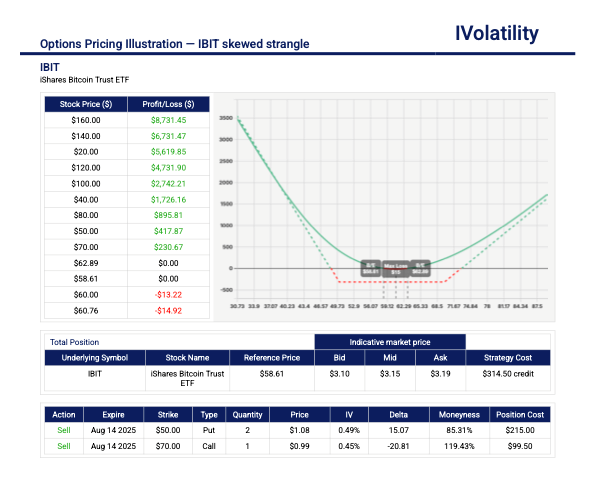

Strategy Corner

Some trading ideas and option strategies are presented here for the readers' consideration. The positions can be scaled bigger if suitable for larger accounts.

- IBIT (closed at 58.67 on Friday)

With Aug month IV at 60%, sell two 50puts and one 70call

Net position delta = 16 / Premium collected = $310

Buying power = $3355 / Probability of profit = 62%

Breakevens are about 49 and 73

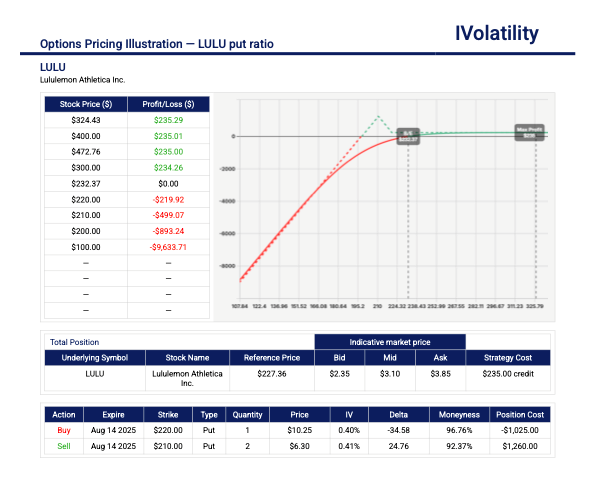

PnL Calculator from the IVolLive Web - LULU (closed at 227.47 on Friday)

With a precipitous drop from 340 to 230, a put ratio might be in order

Buy one Aug 220 put and sell two Aug 210 puts

Net position delta = 17 / Premium collected = $310

Buying power = $3125 / Probability of profit = 80%

Downside breakeven is around 197; no risk to the upside

PnL Calculator from the IVolLive Web

Considerations for the coming week

Economic Data Releases:

- The most important release will come from the housing market. Monday will bring manufacturing PMI reports and existing home sales. Tuesday will bring the S&P Case-Shiller home price index, and the latest data on consumer confidence. New home sales will be released on Wednesday.

- Thursday will bring miscellaneous reports on initial jobless claims, durable goods orders, US trade balance, a second revision to GDP, and pending home sales.

- The week with wrap up with the PCE, the FED's favorite inflation barometer.

Earnings Reports:

The season will wrap up with some notables: KB / FDX / MU / NKE / WBA / GIS.

Closing Thoughts

The entire world got a little bit wealthier last year. In fact, it is reported that the total wealth around the globe has risen at a compound annual growth rate of 3.4% since 2000, net of inflation.

But the biggest gains last year were centered squarely on the US. Nearly 40% of the world's wealth resides in the United States, as do nearly 40% of the world's millionaires. In absolute growth terms, the millionaire population increased the most in the United States in 2024, averaging over a thousand people every single day.

$1,000 invested in the stock market 70 years ago would be worth about $2 million today. However, think about this: if an investor stayed in the markets only under Democratic administrations, that number would be $72,000 while the investor would have only $28,000 if invested only under Republican presidents.

Analysts at Deutsche Bank took a look at market sell offs following geopolitical events going all the way back to 1939. The results show that the S&P 500 fell about 6% in the three weeks following a geopolitical shock, only to completely recover over the next three weeks. Six weeks to get back to even? So it may be a good idea for traders to stick with their investment plans and not let short-term political chaos interfere with their long-term goals.

Questions / Comments

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use support@ivolatility.com.

Previous issues are located under the News tab on our website.