Risk Is Off

July 7, 2025

Market Roundup for the Week

Wall Street closed out a holiday-shortened week on a positive note with back-to-back record closes before the July 4th holiday weekend.

The first half of the year is officially in the books. The gain of 5.5% in the first two quarters may appear lackluster relative to 15% in the same period last year. However, the good news is that the upswing in 2025 – after dropping 4.6% in Q1, the S&P climbed over 10.5% in Q2.

A trade deal with Vietnam and a surprisingly strong June jobs report drove the market sentiment.

Another notable development was the passage of President Trump's "One Big Beautiful Bill Act", considered his biggest legislative victory.

Strategy Corner

Based on last week's market movements, here are some trading ideas and option strategies for the readers' consideration. The positions can be scaled bigger if suitable for larger accounts.

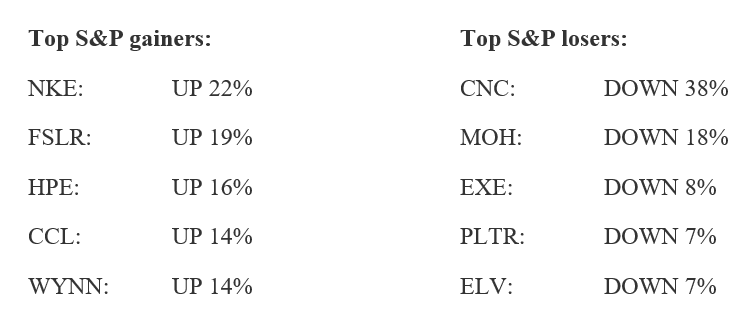

- Call Calendar for XYZ (closed at 69.21 on Thursday)

Buy the Sep19 70call / Sell the Aug15 80call

Net position delta = 29 / Debit paid = $445

Max loss = $445; Max potential value around $1000

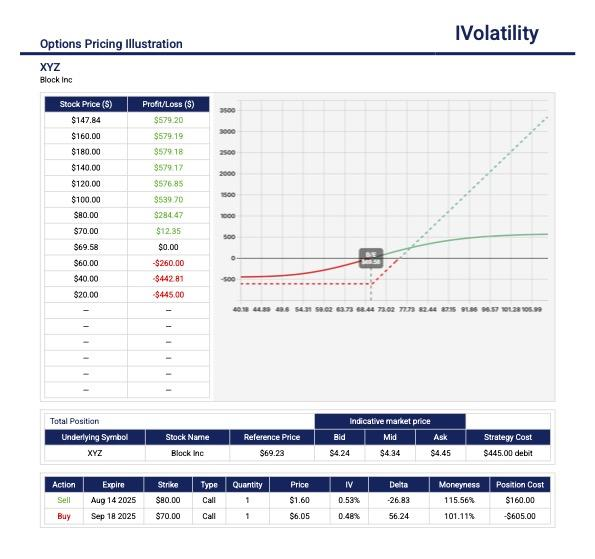

PnL Calculator from the IVolLive Web - Staggered puts for BBAI (closed at 7.74 on Thursday)

Sell one Aug15 8put / Sell one Sep19 7put

Net position delta = 74 / Credit collected = $325

Buying Power withheld = 1171 / Probability of profit = 64%

PnL Calculator from the IVolLive Web

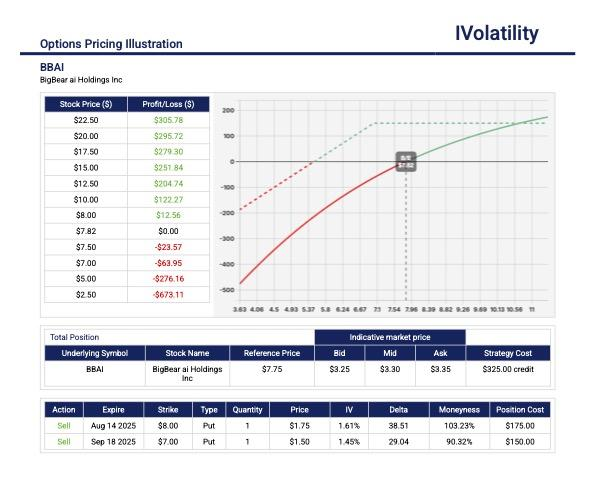

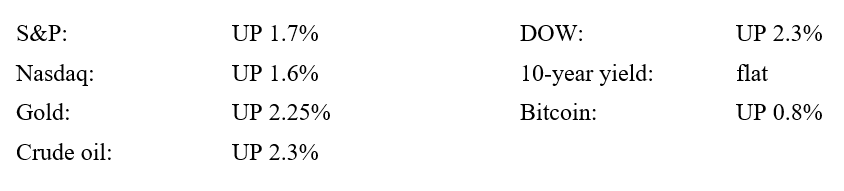

Major Indices for week ending 7/4/2025

Review selected market profiles below:

Top Headlines Each Day of the Week

Monday's Recap:

Canada folded on its digital tax and the White House confirmed that trade talks are back on.

Markets pushed up to record highs as the trade talks appeared to be thawing. With inflation stable, interest rates range bound and earnings trending higher, investors might be seeing the walls of worry crumbling and perhaps more upside in the S&P for the second half of the year.

Notable movers to the upside:

- AAPL jumped over 2% with news that OpenAI might be integrated into Siri

- Palantir rose 4.27% after announcing that Accenture will help federal government clients implement the defense tech company’s AI offerings

- JOBY climbed almost 12% higher after the eVTOL (electric vertical takeoff and landing aircraft) company delivered its first flying taxi to the UAE

- ORCL jumped nearly 4% thanks to regulatory filings that revealed a new $30 billion annual cloud deal

- HPE popped over 11% after the Department of Justice settled its lawsuit with the server maker

- HOOD rose over 12% as the company announced the launch of blockchain-based token trading to be made available commission-free for European investors around the clock

- DIS, received an upgrade to BUY and a new price target of 144. Some reasons given were 2 new cruise ships, booming theme parks and strong momentum in streaming services

- CRCL, initiated with a BUY rating by Barclay and a $215 price target

Notable movers to the downside:

- TSLA tumbled 1.84% on the news that the Senate version of the tax bill will end credits for EV purchases by September

- BA fell over 2% on news that its acquisition of Spirit AeroSystems faces antitrust scrutiny in the UK

Tuesday:

While the second quarter saw an impressive recovery in the technology sector, today was a day of rotation. Technology stocks took a breather with profit taking in several big caps. Investors flocked to cyclicals in the healthcare, energy and materials sectors.

Notable movers to the upside:

- Solar stocks got a reprieve after the Senate dropped the excise tax on clean energy projects. Sunrun, Enphase Energy, SolarEdge Technologies and Array Technologies were the notable beneficiaries

- Apple rose 1.29% on the news that the company may pivot to using Anthropic or OpenAI in iPhones instead of building something in-house

- Hasbro bumped up over 4% following a Goldman Sachs upgrade from neutral to buy

- Ford popped over 4% after the company reported an impressive 14% increase in sales last quarter

- Casino stocks, like WYNN, LVS and MGM soared on the news that gaming revenue in Macau rose about 19% in June

Notable movers to the downside:

- TSLA continued to slide amid the clash between Elon Musk and Trump over EV subsidies

- NVDA, COIN, AMD and PLTR fell substantially weighed down by general tech profit-taking

Wednesday:

The US President announced a trade deal with Vietnam and the risk on mentality of the S&P rose

Notable movers to the upside:

- HOOD climbed about 7% amidst speculation that it could be added to the S&P index

- BBAI surged nearly 60%. The company secured a large AI defense contract from the US Army and, earlier, reported better than expected Q1 revenue and improved operational momentum

Notable movers to the downside:

- CNC, a managed healthcare provider, withdrew its full year guidance based largely on lower enrollment rates in several states. The stock sank almost 40% and traded at prices not seen since March 2017

- Other health insurers like UNH, MOH and HUM fell substantially following CNC's announcement

Thursday:

The markets were open half a day in anticipation of the July 4th holiday.

Surprisingly strong jobs report drove the markets to new highs. Bonds responded by pointing to a lower likelihood of a rate cut in July. The Russell 2000 rallied nearly 24% from its April low and finally closed green for 2025.

25 S&P companies reached new all-time highs. Among them were RCL / GS / AXP / COF / JPM / LOW / MS / NDAQ / CRWD / NVDA and ORCL.

The US government reversed policy on blocking chip-design software exports to China. This would result in opening up the world's largest chip market to US semiconductor companies.

On the other hand, trade war tensions and volatile weather patterns appear to have contributed to a wild year for agricultural commodities. In fact, prices are expected to decrease about 12% in 2025.

Notable movers to the upside:

- DDOG, a cloud monitoring company in the AI space, joins the S&P on July 9th

- SNPS and CDNS (among other semiconductor companies) rose due to possible removal of export restrictions to China

- FSLR and ENPH rose substantially as the regulatory overhang of a proposed tax on solar and wind projects appeared to be deleted from the new tax bill

Notable movers to the downside:

- Despite the broader U.S. market rally, some sectors – especially homebuilders (LEN, DHI) agriculture/commodity stocks (corn, beans and wheat) and pharma (MRK) – experienced softness and even notable pullbacks.

Friday:

Markets were closed in observance of the July 4th Independence Day celebrations.

Considerations for the coming week

Economic Data Releases:

The WH confirmed that new tariffs will be established next week for countries "not negotiating in good faith". A hard deadline of July 9th was confirmed. Thus far, only UK and Vietnam deals appear to be finalized. The EU may be looking for an "agreement in principal only".

What's for sure is that nothing is absolutely sure! Extension of tariff pauses beyond July 9th may not be out of the question either. Remember the label TACO?

Earnings Reports:

The coming week's focus is on Delta, Conagra, and Levi, with Delta being the most closely watched.

Closing Thoughts

Crypto continues to make inroads into everyday life, whether that means helping Walmart create its own currency or helping Americans buy a home.

In the latest sign of widespread adoption, stablecoin hotshot Circle has submitted a bank charter application to the Office of the Comptroller of the Currency. If granted, it would allow Circle to establish the First National Digital Currency Bank.

Questions / Comments

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use support@ivolatility.com.

Previous issues are located under the News tab on our website.