"Buy America" Days Are Back

July 21, 2025

Market Roundup for the Week

A slew of corporate giants kicked off the first week of Q2 earnings season, particularly heavyweights like Netflix, JPMorgan Chase, and BlackRock. Last quarter's earnings were earned before the tariffs had fully dropped – this quarter, however, encapsulates Liberation Day, the TACO trade, and everything in between. But companies may still not have absorbed the full impact of tariffs, given that the White House is still negotiating the final tariffs.

Analysts project S&P 500 corporate profits will jump about 5% in Q2, which would probably be its lowest YOY growth since 2023.

It doesn't help that the S&P 500 is trading near a record high and at 22.4 times 12-month forward earnings, its highest valuation in three years, according to Barron's. But analysts believe traders could push the index even higher if companies manage to beat the relatively low expectations.

Remember that whole "sell America" trade that swept through markets earlier this year? As President Trump's trade war heated up, enthusiasm for US assets – particularly Treasuries – noticeably cooled. The thinking was that international traders were bailing on domestic investments like stocks and bonds, pulling key support for both assets.

Well, things didn't turn out that way after all. The Treasury Department reported late yesterday that foreign investor holdings of US Treasuries rose $32.4 billion in May to $9.05 trillion – the second-highest level ever, according to Bloomberg, and a surge that almost completely erased April's decline.

Zooming out, the picture gets even better. International investors poured over $310 billion in net inflows into long-term US securities, a category that includes both stocks and bonds. Compared to net outflows of just over $14 billion in April, it's clear that foreign investors got a lot more bullish on US assets after the initial tariff shock had passed.

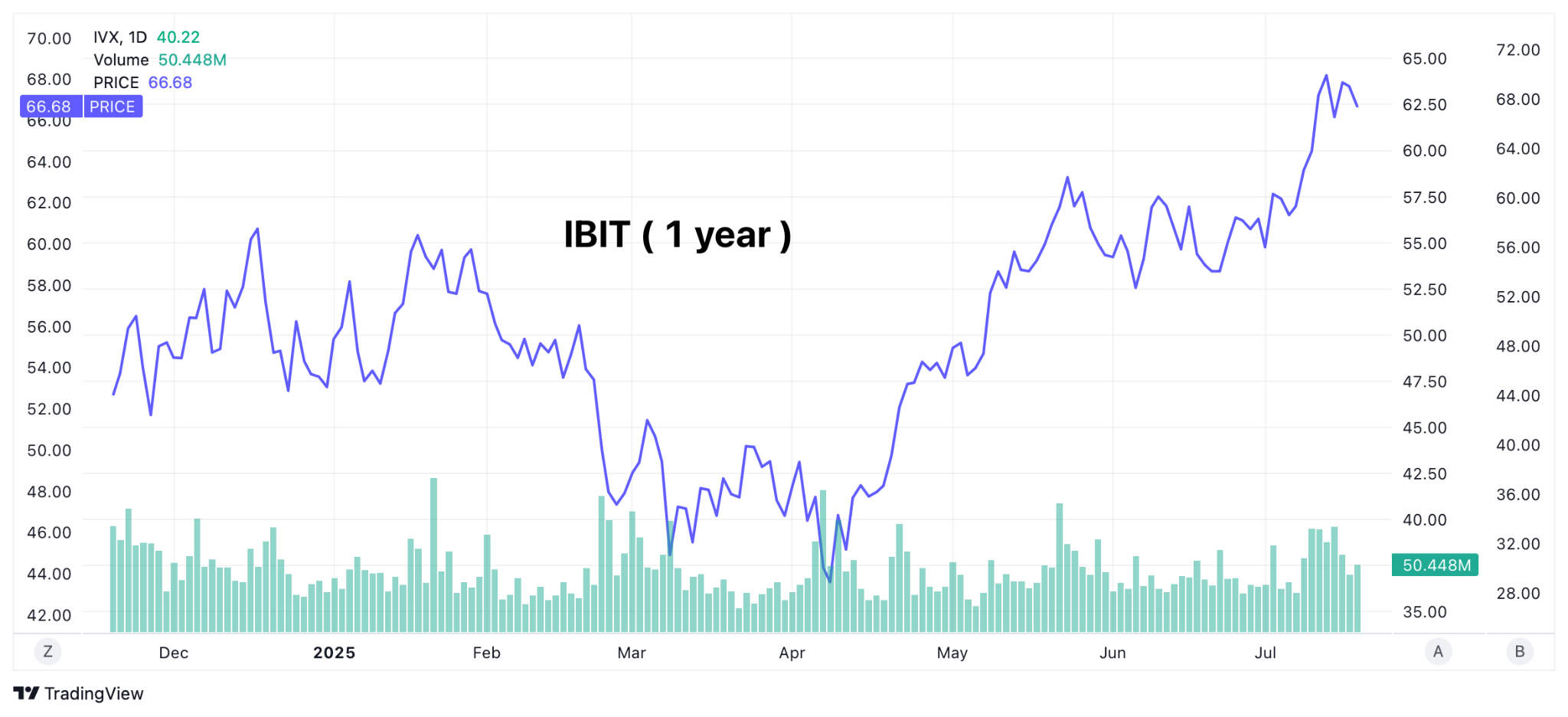

"Crypto week" is an actual legislative agenda in the House of Representatives. Bitcoin briefly surged above $123,000 to a new record in anticipation of all the various pro-crypto bills before the legislative body, including the GENIUS Act, the Digital Asset Market Clarity Act, and the anti-CBDC Surveillance State Act. These bills will define regulatory roles for the SEC and Commodity Futures Trading Commission, create a legal path for stablecoins and other tokens. All of these efforts are aimed at bringing regulatory clarity to crypto markets, which industry bulls say will foster more mainstream adoption.

As an aside...according to Bloomberg, hackers have already stolen $2.17 billion in crypto through June, or more than in all of 2024.

In other market developments:

- Elon Musk's rocket company SpaceX has invested $2 billion into his artificial intelligence company xAI

- The crypto tsunami continues

- It is expected that Meta's first AI supercluster will come online next year

- Some of the biggest names on Wall Street are getting louder about the importance of an independent Federal Reserve as the White House pressure on Jerome Powell intensifies. Arguments are being presented about how critical it is for the capital markets to have an autonomous central bank

Strategy Corner

Based on last week's market movements, here are some trading ideas and option strategies for the readers' consideration. The positions can be scaled bigger if suitable for larger accounts.

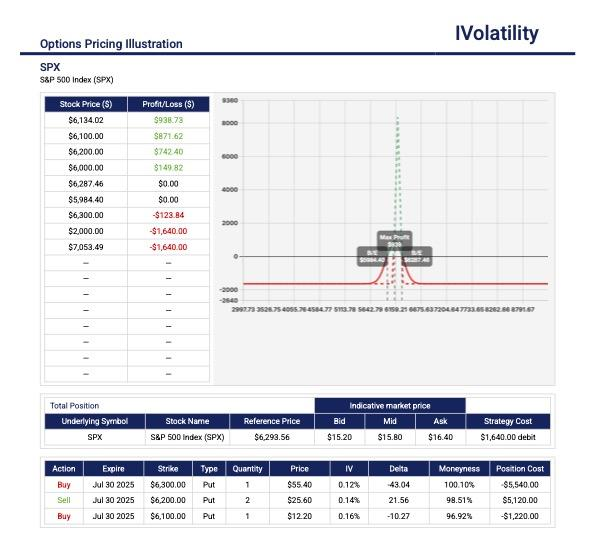

- Strategy: put butterfly in SPX

With SPX near all-time highs, buy a put butterfly in the July 31st expiration

Buy ONE 6300put / Sell TWO 6200puts / Buy ONE 6100put

Total cost = $1570

Probability of Profit = 32%

Max potential profit (a pin at 6200 on expiration) = 10000-1570 = $8430

Max possible loss = $1570

PnL Calculator from the IVolLive Web - Strategy: covered stock with strangle

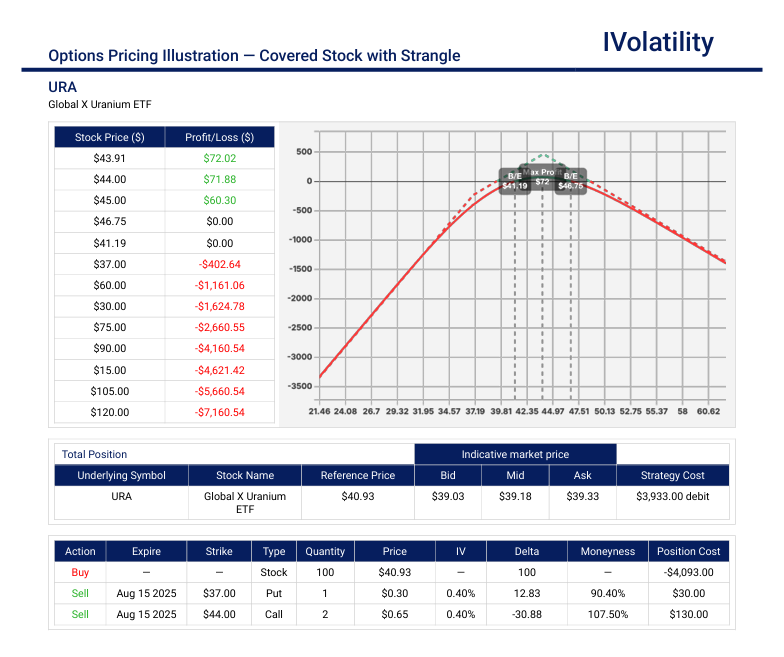

URA (closed around $40 on Friday) is the most highly traded uranium-focused ETF, offering the greatest liquidity and trading volume among its peers

Buy 100 shares of URA / Sell ONE Aug15 37put / Sell TWO Aug15 44calls

Net position delta = 68

Total Cost = $3670 / Buying power withheld = $2300

Probability of Profit = 65%

PnL Calculator from the IVolLive Web

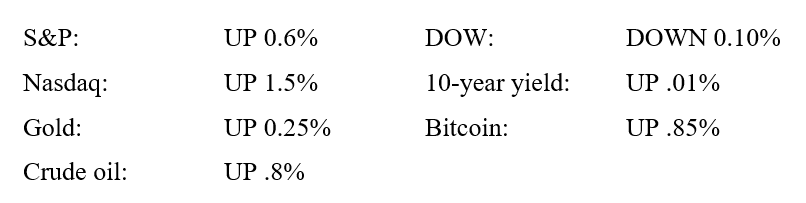

Major Indices for week ending 7/11/2025

Review selected market profiles below:

Top Headlines Each Day of the Week

Monday's Recap:

Everyone is spending the summer...spending.

It is reported that online spending between July 8 and July 11 rose over 30% compared to last year, as shoppers poured over $24 billion into big summer sales run by the likes of Amazon, Walmart, and Target. That's more than double the $10.8 billion they spent on Black Friday in 2024.

Markets largely shrugged off President Trump's weekend threat of 30% levies against the EU and Mexico, as well as his proposed 100% secondary tariffs against Russia today. Stocks eked out a win across the board, with the Nasdaq climbing to a new record close.

Notable movers to the upside:

- Bitcoin continued to boom and crypto-related stocks such as MicroStrategy, Robinhood Markets and Coinbase climbed along with it

- Boeing rose nearly 2% on preliminary reports that investigators have found no evidence of malfunction in the plane that crashed in India last month. Engine-maker GE Aerospace also gained nearly 3%. on the same report

- PayPal climbed over 3.5% even though it is reported that JPMorgan will start charging the company fees for access to customer data

Notable movers to the downside:

- Starbucks sank over 1.5% on news that employees will have to return to the office four days a week

- Rivian Automotive lost over 2% when an analyst forecast softer sales for the automaker's latest models

Tuesday:

The S&P 500 and Dow tumbled on a mixed bag of bank earnings, while the Nasdaq was buoyed by big news for Nvidia.

Oil experienced a slight drop as traders wondered how serious Trump is about his 50-day deadline for Russia.

The biggest news was from the name MP Materials (MP). The company operates the only rare earth mine in the US, which is why its share price has quadrupled since the start of the year, nearly doubled this month alone, and shot up another 20% after it announced a $500 million deal with Apple. Just last week, MP soared 50% in one day following a $400 million stake in the miner by the Pentagon.

The analyst consensus on the stock is "overweight", according to the WSJ. Research analysts have highlighted several economic tailwinds for critical mineral producers last week, including tighter supply for magnets produced in China and higher demand from Western governments trying to build their strategic stockpiles. And today's deal with Apple should keep its "commercial momentum" going.

A potential blow to TSLA could be the departure of its VP of Sales.

Notable movers to the upside:

- Citigroup gained nearly 4% after the big bank reported better-than-expected earnings

- CoreWeave climbed over 6% on the news that it will build a $6 billion AI data center in Pennsylvania

- Trade Desk jumped over 6.5% thanks to its inclusion in the S&P 500

Notable movers to the downside:

- BlackRock fell almost 6% after the world's largest asset manager reported that a single client pulled $52 billion last quarter

- It wasn't a great day for other big banks: Wells Fargo sank nearly 5.5% after cutting its 2025 net interest income guidance, while JPMorgan Chase lost almost 1% despite beating sales and profit estimates

Wednesday:

The stock market does not want Donald Trump to fire Jerome Powell. This much became clear from the S&P's reaction after several reports came out that Trump was ready to fire Powell and even had a letter drafted to do so. The markets immediately dropped nearly 1% and the 30-year treasury yield surged above 5%. Not more than a few minutes later, Trump denied those reports, saying that firing Powell was "highly unlikely". Immediately after those comments, the S&P 500 responded with a sharp 0.6% rally, and the 30-year yield slipped back to 5.0%.

The Core CPI numbers released today showed that inflation hasn't drastically accelerated. However, peeking below the surface reveals that certain corners of the market have seen steep, sudden increases. Examples are egg and coffee prices, video subscriptions and cost of motor vehicle repairs.

Although investors shrugged off any inflation negativity today, analysts noted that goods prices rose 0.7% annually in June thanks in no small part to tariffs – an early indication that we're not totally in the clear just yet. Inflation pressure may likely remain acute for the rest of the summer because tariffs may not have materially impacted inflation metrics yet.

Trading desks across Wall Street are certainly profiting from the Liberation Day market mayhem. Citigroup's equity traders reported their best quarter in five years and Goldman Sachs posted the best quarter of trading in Wall Street history. Traders at JPM Chase enjoyed their best Q2 ever. JPMorgan's market cap is now larger than the combined market cap of its next three biggest competitors – Bank of America, Citigroup, and Wells Fargo.

Notable movers to the upside:

- Johnson & Johnson rose over 6% after the consumer goods giant reported impressive earnings last quarter and raised its forward guidance. More importantly, the company raised full-year guidance and cut their estimate on potential tariff hits

- Tesla gained 3.50% after the EV maker revealed the new six-seat Model Y it will begin selling in China this fall

- Nvidia received an analyst price target bump to $200

- VC powerhouse Peter Thiel revealed a 9% stake in bitcoin miner BitMine Immersion Technologies. Shares popped over 12%, while fellow miners soared in tandem. SharpLink Gaming added 29%, and Bit Digital gained nearly 20%

Notable movers to the downside:

- ASML dropped over 8% after the chipmaker warned that growth might be completely flat next year

- Ford fell nearly 3% on the news that the automaker is recalling nearly 700,000 crossover SUVs due to fuel leaks

- GrabAGun Digital Holdings, the online gun seller backed by Donald Trump, Jr., made its market debut today. Investor reception was scathing, and the stock slid nearly 25%

Thursday:

Markets started the day on a high note thanks to a fifth straight decline in weekly initial jobless claims and surprisingly strong monthly retail sales. The Nasdaq hit its 10th record closing high of 2025 and the S&P 500 hit its ninth.

Retail sales rebounded in June, perhaps an indication that the tariffs have not significantly impacted consumer spending habits. This reading serves as another snapshot of the health of the US consumer. Data from the Department of Labor showed weekly filings for unemployment claims are now at their lowest level in three months.

These economic data releases are lending credibility to the belief that the US economy may avoid recession and increasing trader appetite for risk. Strong breadth in equities, led by small- and mid-cap stocks, underscores the optimism. Fed rate cut odds for July appear to be zeroed out, while odds of a September cut are now at their lowest point of the cycle. The US dollar is bouncing back while long-end US yields drop, all while precious metals dip. It appears to be another "buy America" kind of day.

Notable movers to the upside:

- Lucid exploded over 36% on news that the EV maker is partnering with Uber to roll out the ridesharing company's new robotaxis

- United Airlines missed Wall Street's revenue forecast but its profits were enough to impress investors and shares rose over 3%

- Sarepta Therapeutics soared nearly 20% after the biotech announced it will restructure its business, including layoffs

- Quantumscape continued its hot streak, rising nearly 20% thanks to its recent battery breakthrough in manufacturing throughput and tech efficiency

- Taiwan Semiconductor rose over 3% after announcing Q2 profits that rose 60%. The company said that while AI demand was growing, the impact of tariffs was still unmeasurable

- Shares of the real estate platform, "OPEN", soared 40% premarket as retail traders piled into the stock. A post on Reddit's WallStreetBets forum titled "Opendoor is the next Carvana" might have provided the impetus

- Pepsi shares rose more than 3% after the company said it expected a smaller drop in annual profit. Pepsi's shift to cater to consumers' preferences for healthier soda brands appeared to have paid off this quarter

Notable movers to the downside:

- Abbott Laboratories beat on both top and bottom line guidance, but still fell over 8% after the pharma company narrowed its fiscal forecasts

Friday:

Stocks slid lower today even as a preliminary survey revealed that consumer sentiment hit its highest point since February, while inflation expectations fell to pre-tariff levels. The selloff deepened on reports that President Trump wants 15% to 20% tariffs against the EU, though the Nasdaq managed to eke out a win.

Although bitcoin fell after the president signed the GENIUS Act into law, ether rose to its highest price in six months today, while enthusiasm for the new legislation pushed total crypto assets above $4 trillion.

Trains are back on track...Union Pacific, the biggest freight railroad operator in the country is in talks to purchase Norfolk, the smallest operator. Once the two are merged, it would create the only transcontinental rail route operated by a single company in the US. Considered the biggest corporate deal of this year, a big benefit of this merger would be a more streamlined shipping process.

Fed Governor Christopher Waller announced that he may vote for a rate cut this month. Adding to the drama surrounding the Fed, Jerome Powell wrote a letter addressing allegations of wrongdoing about the Federal Reserve's recent renovations.

Speaking of using AI, Delta Airlines revealed AI is helping it maximize the prices customers are willing to pay.

Notable movers to the upside:

- Interactive Brokers surged nearly 8% after the broker reported an increase of over 30% in number of customer accounts by 32%

- Charles Schwab gained almost 3% after opening more than 1 million new brokerage accounts last quarter

- Quantumscape continued to climb yet again, rising another 8% as investors pour money into the next-generation solid state battery maker

- Crypto companies continued to have a great week as key legislation passed its final barrier in Congress. Coinbase climbed 2.2%, Robinhood Markets rose 4.07%, and Galaxy Digital gained 4.19%

Notable movers to the downside:

- Netflix fell over 5% after the streaming company reported a strong quarter but warned that its operating margin will take a hit in the second half of the year. The company did raise its full-year guidance and said that it was on track to double its ad revenue and revealed that it began to use generative AI in its programming last quarter...still the markets sold off the stock. Can that be interpreted as the markets getting pickier about what deserves a celebration?

- Sarepta Therapeutics plunged over 35% after the biotech reported a third patient death during its Phase 1 study of its new gene therapy

- American Express sank over 2% despite a strong quarter of spending among cardholders that helped the credit card company notch record quarterly revenue

- 3M also fell nearly 4% in spite of beating Wall Street's forecasts and raising its earnings guidance. Shares were already up nearly 50 % year-to-date, and perhaps some investors opted to lock in profits. Overall market jitters – namely renewed tariff uncertainty from U.S. political news – may have also contributed to a pullback

Considerations for the coming week

Economic Data Releases:

Monday: leading economic indicators

Wednesday: existing home sales

Thursday: new home sales / initial jobless claims

Friday: durable goods orders

Earnings Reports:

Some notable earnings reports are listed below:

Monday: Verizon, Domino's Pizza, Cleveland-Cliffs, and NXP Semiconductors

Tuesday: Coca-Cola, Lockheed Martin, RTX, Northrop Grumman, DR Horton, MSCI, GM, Philip Morris International, Intuitive Surgical, Texas Instruments, Paccar, Capital One, Enphase Energy, Chubb, and Sherwin Williams

Wednesday: Tesla, Alphabet, Chipotle, NextEra Energy, IBM, AT&T, T-Mobile, ServiceNow, Hilton Worldwide, O'Reilly Automotive, Las Vegas Sands, and Mattel

Thursday: Intel, Blackstone, Honeywell, Deckers Outdoor, Southwest Airlines, American Airlines, Union Pacific, Mobileye Global, Digital Realty Trust, Imax, and Nokia

Friday: HCA Holdings, Charter Communications, Philips 66, Centene, Booz Allen Hamilton, and AutoNation

Closing Thoughts

So what is the big deal about Rare Earth Materials? Rare earths are the raw materials used to make powerful magnets that are vital to building military weapons and other tech. They have also become a flashpoint of the ongoing trade war between the US and China.

China has a monopoly on the industry, mining roughly 70% of the world's rare earths and refining 90%. After China imposed export restrictions on the material in response to President Trump's steep tariffs, the US government decided to give the rare earth industry a domestic boost. Check out the boom in MP.

Questions / Comments

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use support@ivolatility.com.

Previous issues are located under the News tab on our website.