Optimism or Irrational Exuberance

July 28, 2025

Market Roundup for the Week

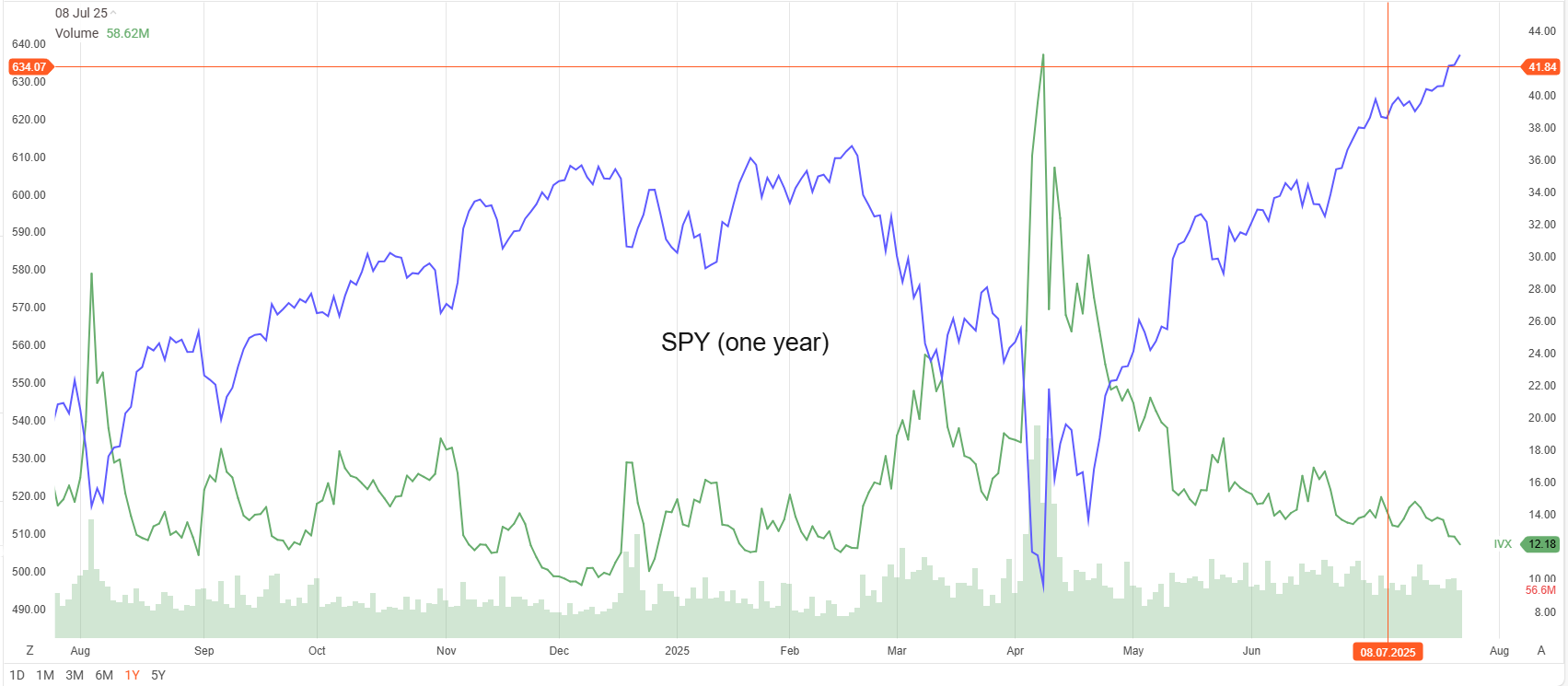

Barclays' "equity euphoria" index is warning of a bubble. Goldman Sachs' "speculative trading indicator" is at an all-time high. Deutsche Bank warns that US margin debt is rising at an unprecedented rate, and that the market is getting "too hot to handle".

Everywhere we look, Wall Street analysts are warning that there's some serious froth in equities at the moment. Analysts think the music is about to stop, but retail investors just keep on dancing.

Everyone is confused, and perhaps concerned, about why stocks are up so much...

Strategy Corner

Based on last week's market movements, here are some trading ideas and option strategies for the readers' consideration. The positions can be scaled bigger if suitable for larger accounts.

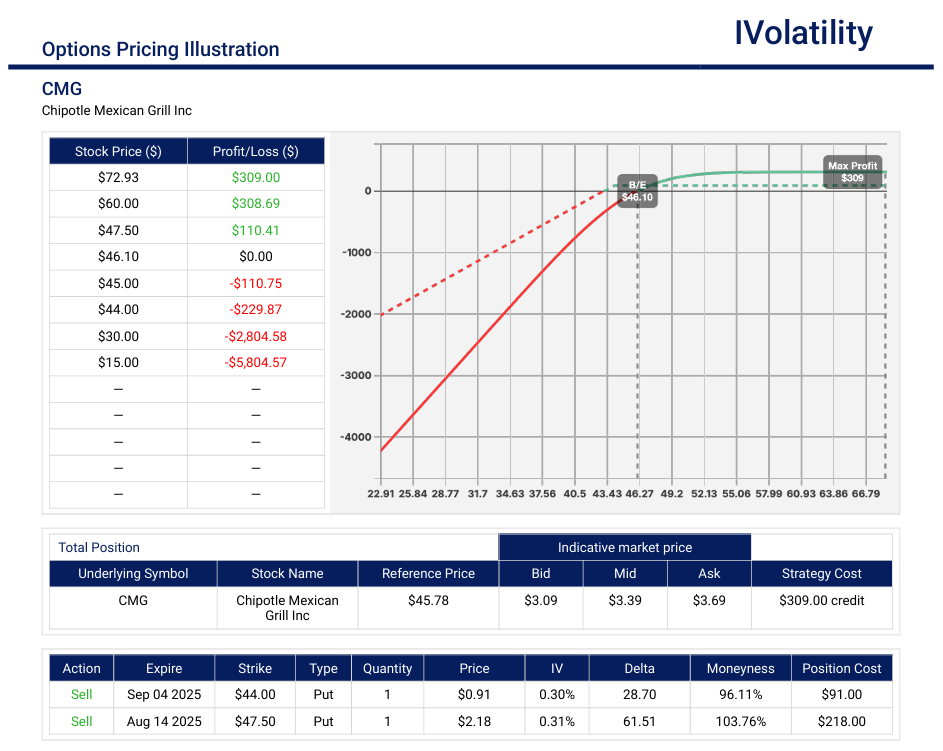

- CMG – post earnings (closed at 45 on Jul24)

Even though the stock fell post-earnings, Morgan Stanley and Wells Fargo both reiterated their overweight ratings and UBS kept its buy rating. Analysts largely appear to be bullish for Chipotle heading into the back half of the year.

Strategy: sell staggered puts

Sell one Aug15 47.5put AND sell one Sep5 44put

Net Credit = $330 / Buying power withheld = $1650

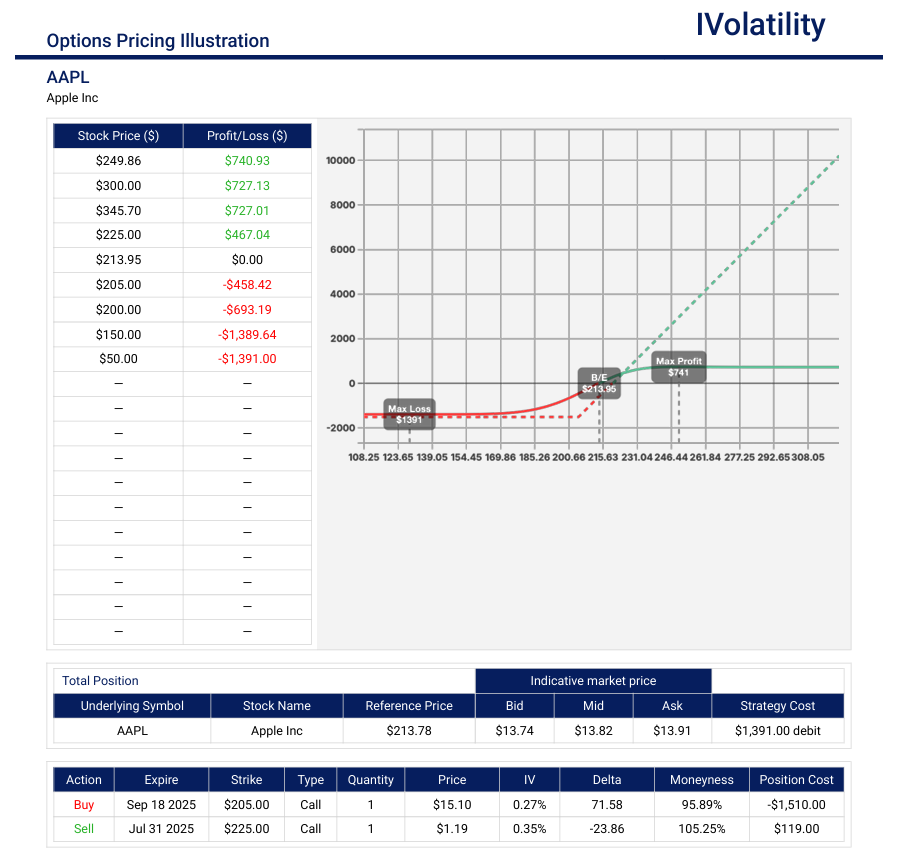

PnL Calculator from the IVolLive Web - AAPL pre-earnings (closed at 213.88 on July 25th)

Strategy: bullish call diagonal for earnings

Buy one Sep19 205 call / Sell one Aug1 225 call

Net position delta: 47

Debit paid: $1380

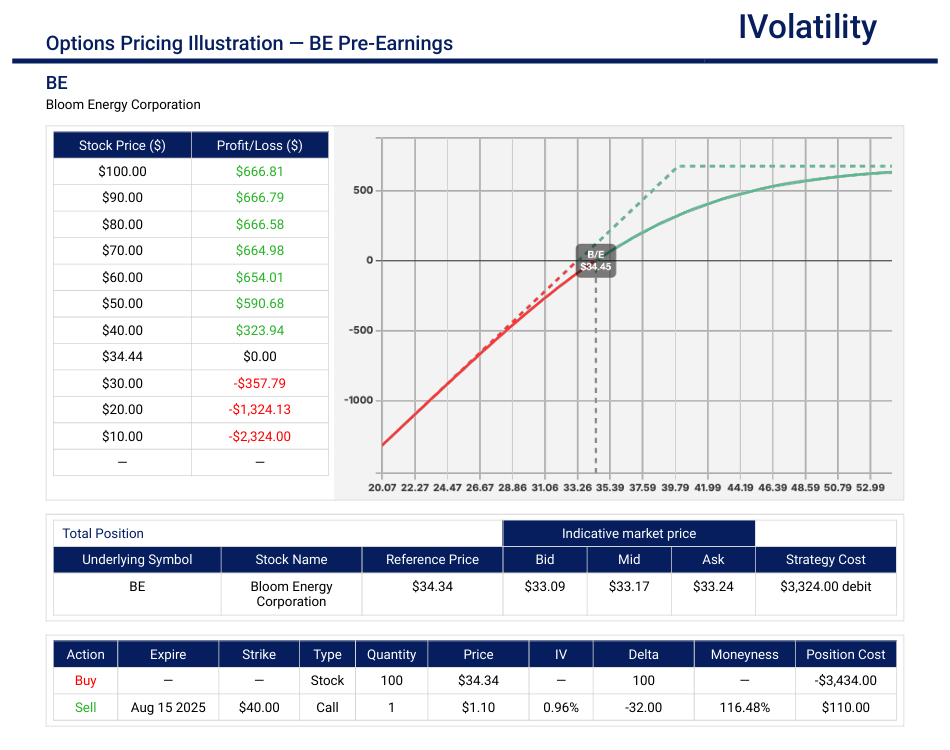

PnL Calculator from the IVolLive Web - BE pre-earnings (closed at 34.33 on July 25th)

Strategy: bullish covered stock position for earnings

Buy 100 shares of BE / Sell one Aug15 40 call

Net position delta: 71

Cost basis = Debit paid = $3317

Max potential profit = $700 (if BE expires above 40 on Aug15)

PnL Calculator from the IVolLive Web

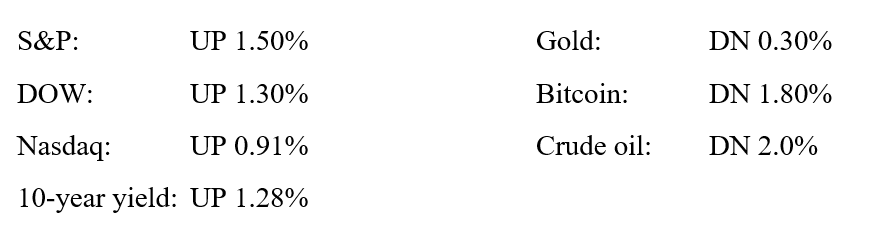

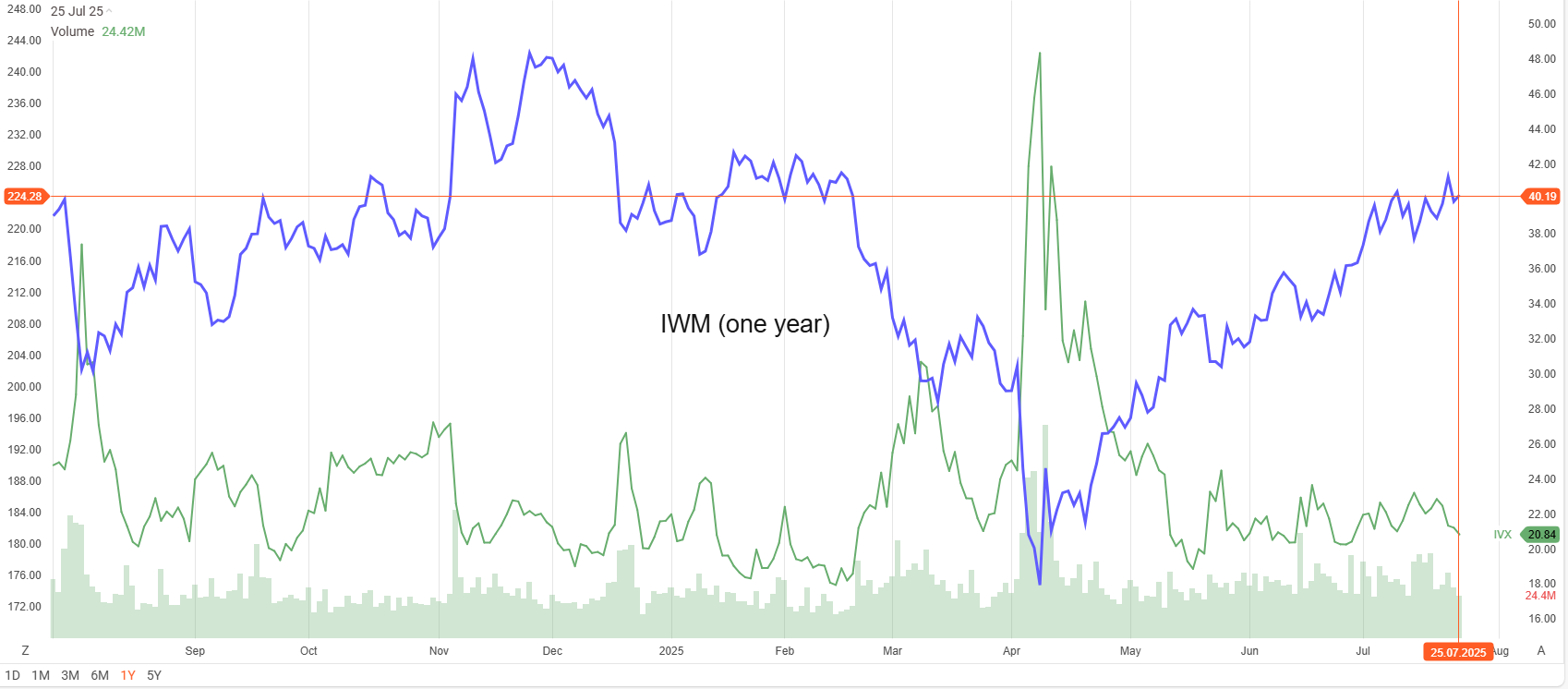

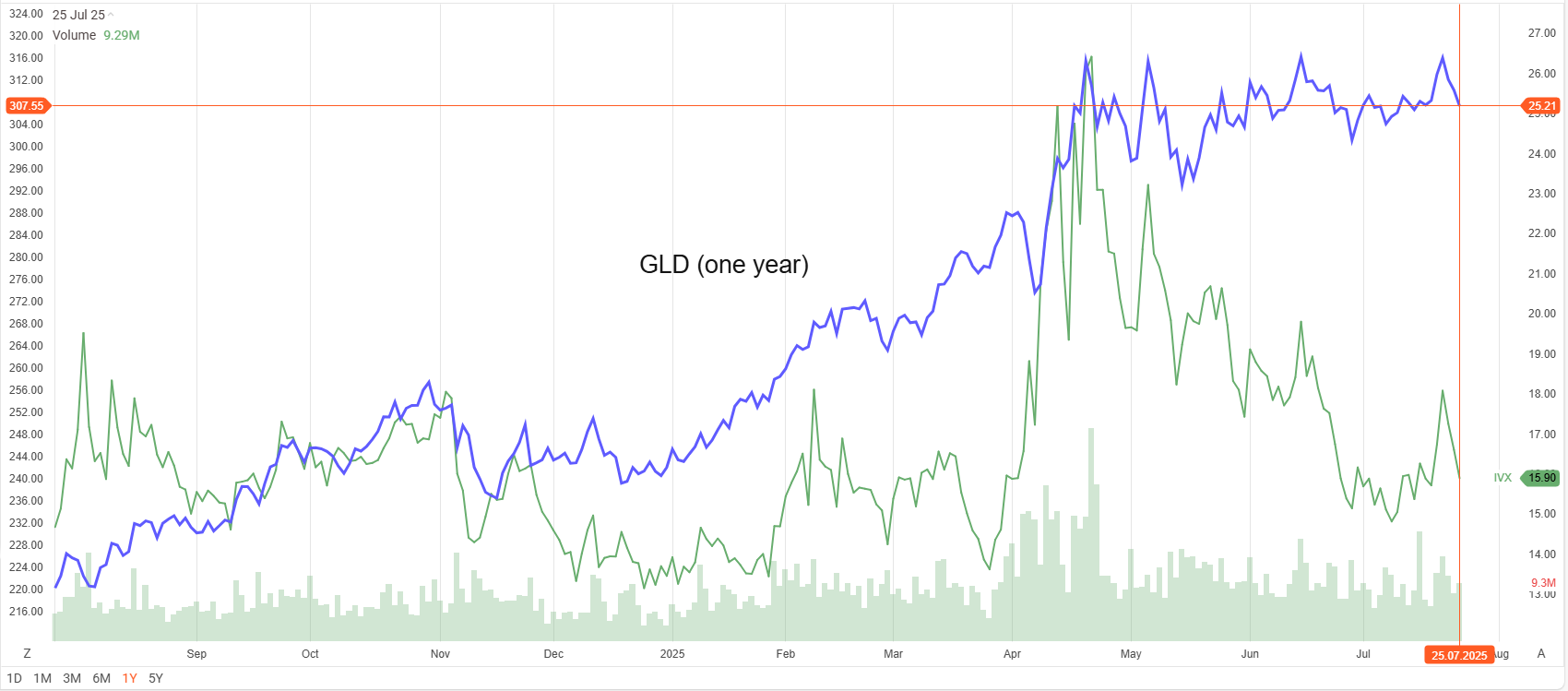

Weekly changes in Major Indices

Review selected market profiles below:

Top Daily Headlines

Monday's Recap:

Markets lost steam late in the trading session as investors awaited more earnings announcements, with the Dow tumbling into the red. But the S&P 500 managed to end the day above 6,300 for the first time ever, while the Nasdaq enjoyed its sixth consecutive record close.

Over the weekend, President Trump disputed reports that Treasury Secretary Scott Bessent talked him out of firing Jerome Powell. Commerce Secretary Howard Lutnick reiterated that August 1 will be the "hard deadline" for countries to make a deal with the US. Both negotiations and tensions with the EU were ramping up as Trump threatened to slap the bloc with 30% levies.

Notable movers to the upside:

- Opendoor Technologies (a real-estate technology company) exploded nearly 50% higher as the meme stock added to its 188% gain from the previous week

- Block (formerly known as Square, is a fintech company) surged over 7% on the news that it will be added to the S&P 500 this week

- Verizon Communications, the largest wireless carrier in the US, gained over 4% thanks to a strong quarter for the telecom giant despite losing more wireless prepaid net phone subscribers than Wall Street anticipated

- Cleveland-Cliffs, the largest vertically integrated steel producer in North America, soared over 12% after the steelmaker posted a smaller-than-expected loss last quarter

Notable movers to the downside:

- Domino's Pizza, a global quick-service restaurant chain, fell nearly 1% despite same-store sales beating Wall Street's forecasts. Shareholders were disappointed by lower-than-expected EPS

- EQT Corp, a US-based energy company, tumbled over 9% on a warning from its CEO. He asked that the US streamline permitting and judicial review processes for natural gas infrastructure – such as pipelines, power plants, and export terminals – to remain competitive globally, especially in the context of rising energy demand from AI data centers

Tuesday:

A major win for small account holders subject to Pattern Day Trading (PDT) rules. The account limit is set to be lowered by FINRA from $25,000 to $2000. The "pattern day trading rule" currently requires investors making more than four day trades in a five-day period to have at least $25,000 in their margin account. FINRA is looking to drop that number down to $2,000 – lowering the bar for investors with small accounts to make leveraged bets on equity underlyings.

The multi-day rally wavered as investors turned their attention to big tech earnings coming on Tuesday. The S&P 500 closed at a record high, while the Nasdaq finally broke its hot streak.

Bessent said China may get an extension to make a true trade deal, while promising a "rash of trade deals" in the coming days, including a deal with the Phillipines that capped levies at 19%.

Notable movers to the upside:

- Medpace, a global, full-service contract research organization, soared nearly 55% thanks to an impressive beat-and-raise earnings reports. It was all thanks to a seriously impressive beat-and-raise earnings report

- DR Horton, the largest homebuilder in the US by volume, popped over 17% after crushing Q3 earnings expectations

- Pultegroup, another US home builder, rose nearly 12% based on management optimism that sales will bounce back next quarter

- Northrop Grumman, a leading US defense and aerospace company, popped nearly 10% after a strong quarter, including an 18% increase in international sales

Notable movers to the downside:

- Lockheed Martin, a leading US aerospace company, dropped over 10% after suffering big losses in its classified aeronautics program

- General Motors, a dominant multinational automotive manufacturer, beat earnings expectations last quarter and kept its fiscal forecast intact. However, investors didn't like to hear about the $1.1 billion in projected tariff costs and shares of the automaker dropped over 8%

- Coca-Cola, a global beverage company, lost over .5% after strong European sales helped the soft drink titan beat earnings estimates though sales were soft everywhere else

- Equifax, a global data, analytics and technology company, tumbled over 8% owing to disappointing guidance

Wednesday:

Notable movers to the upside:

- Krispy Kreme and GoPro got caught up in the new meme stock craze – the donut maker jumped nearly 5%, while the wearable camera company leaped over 12%

- GE Vernova, an energy technology company spun off from GE, gained nearly 15% thanks to an impressive beat-and-raise earnings report

- USANA Health Sciences soared nearly 13% after the nutritional supplement maker crushed earnings estimates

- Cal-Maine Foods, the biggest egg producer in the US, popped nearly 14% after profiting from the high cost of eggs

- Lamb Weston, a global food processing company, sizzled over 16% higher as shareholders applauded a strong earnings report and new cost-cutting programs

Notable movers to the downside:

- Texas Instruments tumbled over 13% after the semiconductor company revealed a disappointing third-quarter earnings forecast

- Enphase Energy, a global energy technology company, plummeted over 14% thanks to weak earnings guidance, with tariffs being blamed for squeezed margins

- SAP, an enterprise software company missed Q2 revenue estimates and dropped over 5%

- Fiserv, a fintech company, sank nearly 14% mainly due to weaker-than-expected financial guidance

- Otis Worldwide dropped nearly 13% after the elevator manufacturer lowered its fiscal guidance due to weak demand

Thursday:

Strong earnings from Alphabet pulled the Nasdaq higher while the latest sign of labor market strength kept the rally going through day's end and helped the Nasdaq and S&P 500 hit new closing records.

Across the pond, the ECB kept interest rates steady today after seven straight cuts.

During Thursday's trading session, 38 stocks in the S&P traded at new 52-week highs. The list included:

- Citigroup, trading at levels not seen since November 2008

- JPM, trading at all-time highs back to its IPO in 1983

- Blackrock, trading at all-time high levels back to its IPO in December 1999

- Ulta Beauty trading at levels not seen since April 2024

- Dollar Tree, trading at levels not seen since June 2024

- Broadcom, trading at all-time high levels back to its IPO in August 2009

- Ebay, trading at all-time high levels back to its IPO in September 1998

- Caterpillar, trading at all-time high levels back to when it first began trading on the NYSE in 1929

- Northrop Grumman, trading at all-time highs back to the merger between Northrop Aircraft and Grumman Aerospace in 1994

- General Dynamics, trading at all-time high levels back to 1952 when it was incorporated and listed on the NYSE

- Warner Bros. Discovery, trading at levels not seen since August 2023

Notable movers to the upside:

- Alphabet, parent company of Google, rose over 1.65%. The search giant also upped its capital expenditures forecast by $10 billion, and now plans to shell out $85 billion this year. Google appears to remain the AI infrastructure king. Revenue of $96.43B crushed estimates, but the real story was the capex increase to ~$85B. This massive bet on AI infrastructure benefits the entire semiconductor supply chain. Google Cloud revenue jumped with operating income more than doubling year-over-year

- Las Vegas Sands, a strategic leisure-and-business tourism powerhouse with high-end integrated resorts in Macau and Singapore, rose over 4% after crushing analyst estimates last quarter

- Deutsche Bank, a major global financial services firm, rose nearly 8% to a decade high. It seems that investors are appreciating the financial firm's turnaround efforts

- T-Mobile US, second largest wireless carrier in the US, gained nearly 6% thanks to a better-than-expected earnings quarter

- Bloom Energy, in the business of solid fuel cells used primarily for powering data centers, popped over 20% on the news that it made a deal with Oracle to provide the tech company's AI data centers with power

- ServiceNow, an enterprise software company, jumped over 4% on management's promise of more AI growth ahead

- West Pharmaceutical Services, a global leader in designing and manufacturing integrated containment and delivery systems for injectable medicines, soared over 22% on news that demand for GLP-1 products remains strong

Notable movers to the downside:

- IBM, an enterprise IT solutions company, dropped nearly 8% despite beating analysts' expectations on the top and bottom lines last quarter. The announcement of slowing software sales pulled down the stock

- UnitedHealth Group, the largest health insurer in the US, fell nearly 5% on reports that the health insurer is cooperating with the DOJ's investigation into its Medicare billing practices

- American Airlines sank nearly 10% after lowering its forward guidance

- Southwest Airlines lost over 11% after missing analyst earnings estimates

- OPEN, a digital real-estate company, jumped another 8.5%. This stock is now included in the meme stock carousel which continues to spin

- Chipotle, a leading fast-casual restaurant chain, tumbled over 13% after the company reported its second straight quarter of slowing sales, and Q2 same-store sales dropped 4%

- Tesla had a tough quarter, and not just because the cloud of Elon Musk's political fallout with President Trump is still hanging over the company. Shares sank over 8% after the EV company reported that auto sales fell 16%, the second straight quarter the metric has declined and Tesla's worst quarterly sales drop in over a decade. The company pointed to headwinds like cutthroat competition from China, but promised a cheaper car was on its way later this year to eventually boost sales. Perhaps even more concerning to investors was Musk's warning that Tesla's losing streak could continue for "a few rough quarters" due to the expiration of federal EV credits in the big, beautiful bill that was just passed by Congress

Friday:

US stocks rose Friday, pushing the S&P 500 to its fifth-straight record this week and lifting the Nasdaq to a new all-time high. Earnings and trade optimism boosted investor sentiment, while President Trump eased market nerves by downplaying talk of firing Federal Reserve Chair Jerome Powell.

As an aside, trade talks with Brazil have reportedly stalled and oil fell to a three-week low as Iran signaled a willingness to come to the negotiating table with European powers for nuclear talks.

Gold sank lower since hopes of trade deals reduce the need for a safe haven investment such as gold.

Notable movers to the upside:

- Coursera, a global online learning platform, surged nearly 40% today after a stellar Q2 earnings report. The company not only beat top and bottom line earnings expectations, but raised its revenue outlook for the full year to between $738 million and $746 million, above previous estimates of $720 million and $730 million

- Tesla, a leading manufacturer of all-electric vehicles, arrested its latest decline and gained over 3.5% on the news that it will roll out its new robotaxi program in San Francisco very very soon

- Deckers Outdoor, the maker of Hoka and Ugg footwear, soared 11.35% on the back of stronger-than-expected earnings thanks to impressive international sales

- Newmont, a gold mining company, climbed nearly 7% after a quarter of surging gold prices helped propel earnings

- Boston Beer, the fourth largest brewer in the US and most widely recognized, rose over 6.5% as shareholders raised a toast to management's effort to keep tariff costs low

Notable movers to the downside:

- Intel, a multinational semiconductor company, fell 8.5% on the news that it's cutting costs by laying off 15% of its workforce and scaling back its chip foundry plans

- Puma, a Germany-based global athletic and lifestyle brand, plummeted over 15% after the company warned of the high cost of tariffs

- Charter Communications, a major US telecom company, plunged nearly 20% after reporting that it lost 117,000 broadband subscribers last quarter. Other cable stocks like Comcast lost market value as well

- Lyft, a US-based ride-sharing company, announced a roll-out of autonomous shuttles. Investors were unimpressed and shares still fell over 0.5%

Considerations for the coming week

Economic Data Releases:

This coming week will deliver the latest quarterly numbers from four of the Magnificent 7 stocks, as well as a reading of the PCE index, the monthly US employment report, and Jerome Powell's latest interest rate decision.

The economic calendar is stacked with big announcements, particularly when it comes to the labor market. It all starts on Tuesday with the S&P Case-Shiller home price index, a look at consumer confidence, and the JOLTS report.

On Wednesday, the ADP employment report, Q2 GDP, and pending home sales reports will be released. Most important event on this day, will be the end of the FOMC two-day meeting followed by the Federal Reserve making its latest interest rate decision.

Thursday will deliver the latest look at inflation with the PCE Index, as well as weekly jobless claims.

Friday will wrap up with monthly US nonfarm employment report, but, most importantly, it is also the deadline for the many, many trade deals the US is still negotiating.

Earnings Reports:

Some notable earnings reports due out next week are listed below:

Monday: Waste Management, Western Union, Nucor and Cadence Design Systems

Tuesday: UPS, PayPal, Visa, Starbucks, Procter & Gamble, United Health, Spotify, SoFi Technologies, Boeing, Merck, Royal Caribbean, JetBlue Airways, AstraZeneca, Marathon Digital, Electronic Arts, Mondelez International and The Cheesecake Factory

Wednesday: Microsoft, Meta Platforms, Qualcomm, HSBC, ARM Holdings, ADP, UBS, Rio Tinto, Robinhood Markets, Altria, Ford, eBay, Carvana, Humana, and The Hershey Co.

Thursday: Apple, Amazon, Mastercard, Coinbase, MicroStrategy, AbbVie, Shell, Sanofi, British American Tobacco, Bristol-Myers Squibb, Roblox, CVS Health, Cloudflare

Friday: Exxon Mobil, Chevron, Dominion Energy, Regeneron Pharmaceuticals, Kimberly-Clark, Moderna, Franklin Resources and AMC Entertainment

Closing Thoughts

Michael Saylor, CEO of MicroStrategy, is probably pretty pleased. After buying 6,220 bitcoins for $739.8 million last week, the company now owns 3.05% of all 19.9 million bitcoins currently in circulation.

MicroStrategy pioneered the crypto treasury model, which entails a publicly traded company purchasing a large amount of bitcoin (or any other digital asset) and riding the market's enthusiasm for all things crypto higher. Many have tried to copy this model to varying degrees of success, including Trump Media & Technology Group, which rose 3.11% on the news that the company just bought $2 billion worth of bitcoin.

Questions / Comments

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use support@ivolatility.com.

Previous issues are located under the News tab on our website.