Will the Markets Take a Breather?

August 4, 2025

Market Roundup for the Week

The week delivered the latest quarterly numbers from four of the Magnificent 7 stocks, as well as a reading of the PCE index, the monthly US employment report, and Jerome Powell's latest interest rate decision.

In the end though, sweeping new global tariffs, constant waffling on deadline dates and an unpleasant jobs report, put an end to the exuberance of the past weeks. All three major market indices ended down.

Strategy Corner

Based on last week's market movements, here are some trading ideas and option strategies for the readers' consideration. The positions can be scaled bigger if suitable for larger accounts.

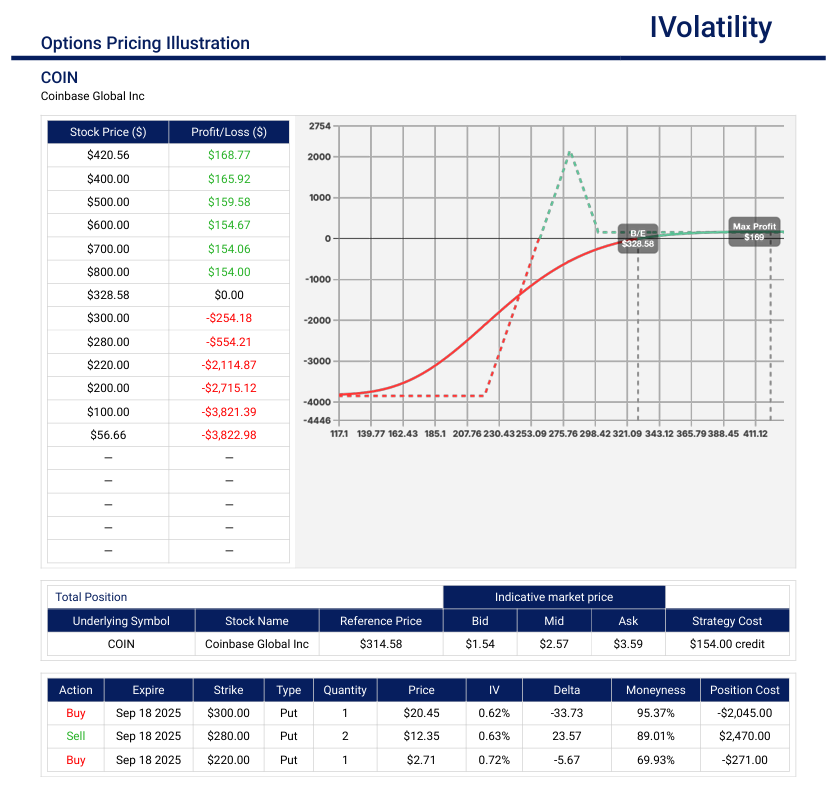

- COIN (closed at around 315 on Friday, Aug 1st)

Sell a Sep19 broken-wing butterfly: buy one 300put / sell two 280puts / buy one 220put

Credit collected: $300; Buying power held: $3700

Probability of profit: 86%

No risk to the upside; downside breakeven just below 260

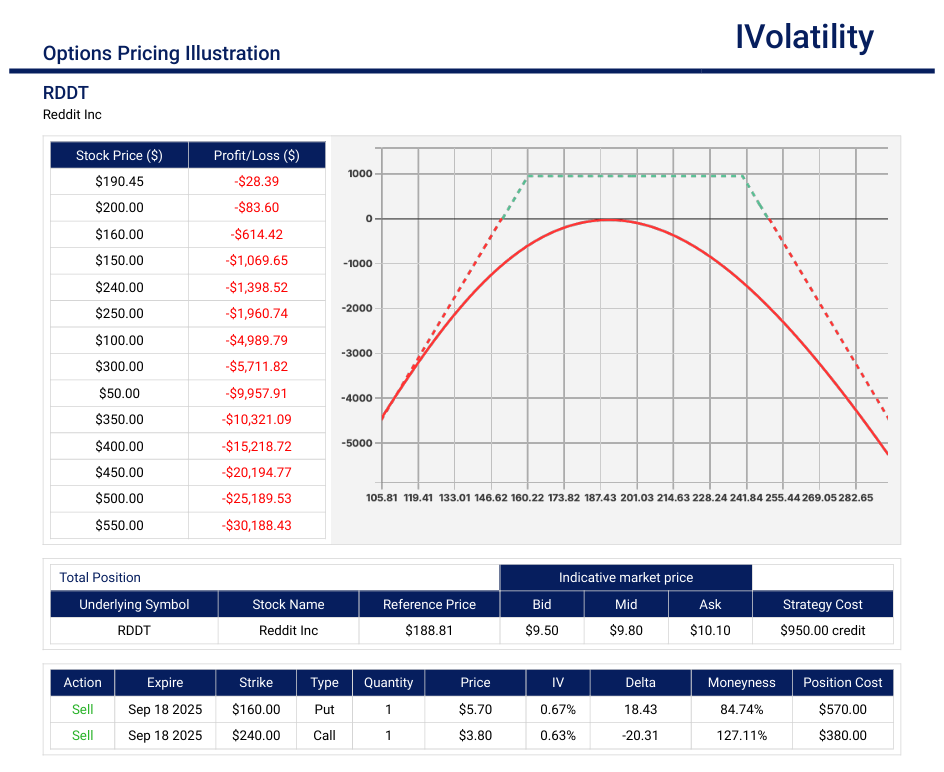

PnL Calculator from the IVolLive Web - RDDT (closed at around 188.81 on Friday, Aug 1st)

With IVR still elevated, sell a Sep19 strangle: Sell the 160put AND Sell the 240 call

Credit collected: $980; Buying power held: $4770

Probability of profit: 72%

Breakevens around 150 and 250

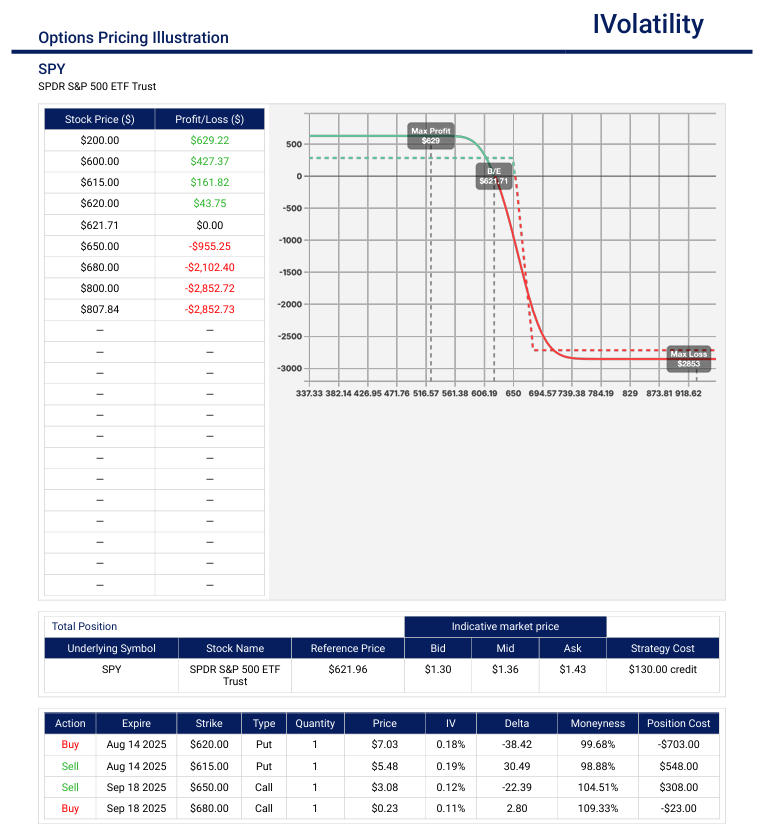

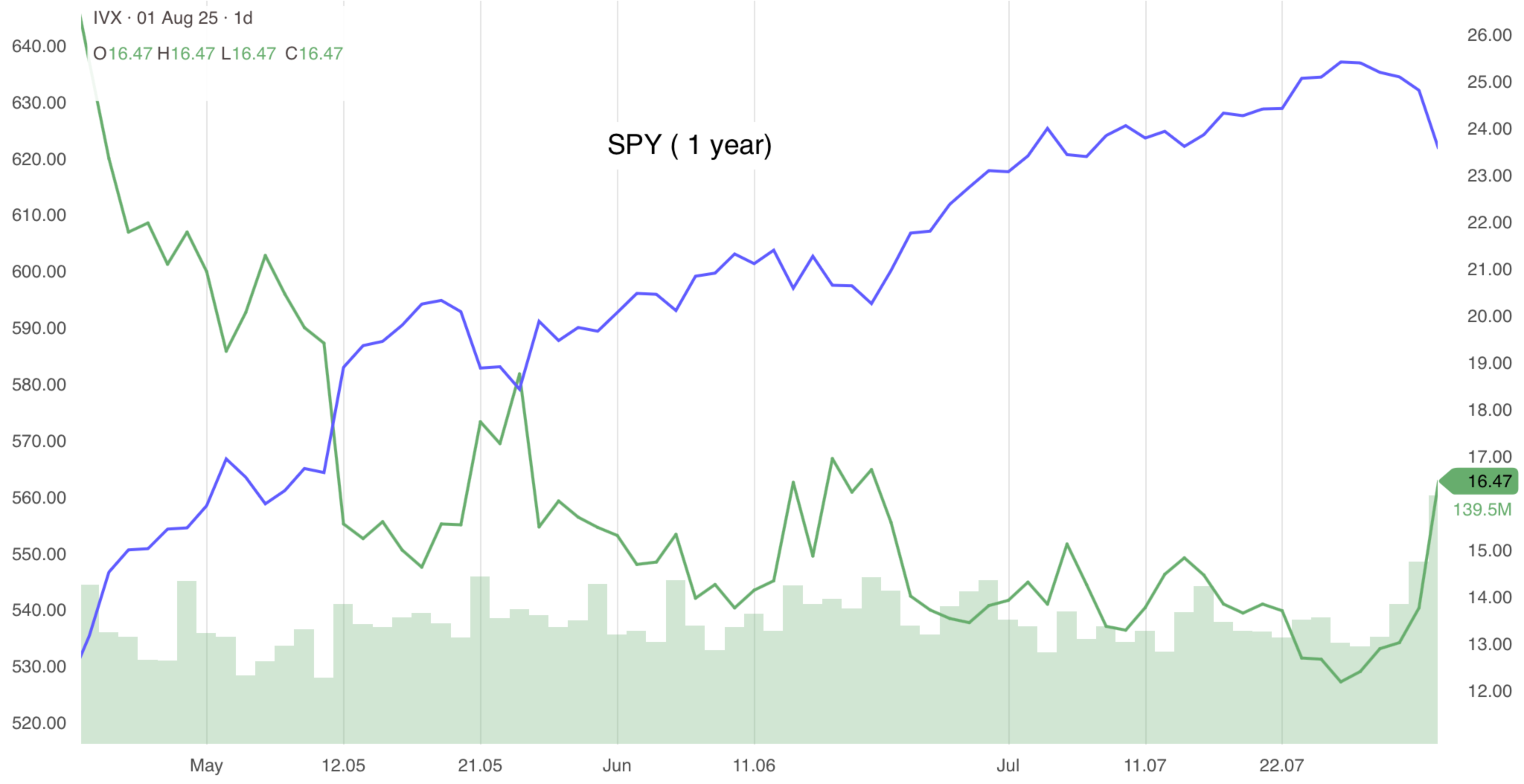

PnL Calculator from the IVolLive Web - SPY (closed at 621.75 on Friday, Aug 1st)

Setting up a hedge against further downside in the markets, buy a long put spread in the Aug15 expiration and finance the purchase with the sale of a call spread in the Sep 19 expiration.

Buy one aug15 620put / Sell one aug15 615put

Sell one sep19 650call / Buy one sep19 680call

Credit collected: $145; buying power held: $2850

No downside breakeven; upside breakeven around 650

PnL Calculator from the IVolLive Web

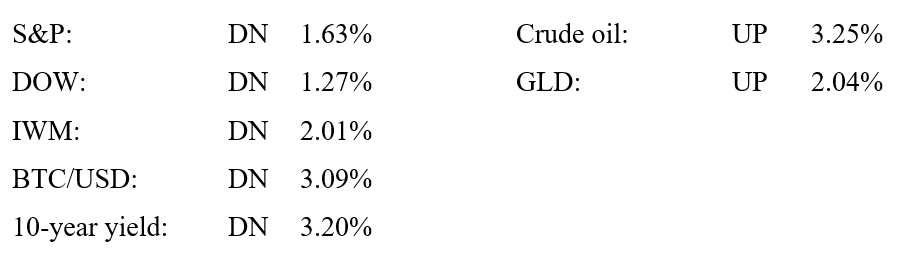

Weekly changes in Major Indices

Review selected market profiles below:

Top Daily Headlines

Monday's Recap:

Investors cheered the news of an EU & US trade deal over the weekend, pushing the S&P 500 above 6,400 for the first time ever. But the index gave up most of its gains late in the day as attention turned to a huge week of data ahead.

Today was the first day of discussions between US and Chinese negotiators in Stockholm to keep the trade war truce alive. Elsewhere, President Trump foresees a baseline 15% to 20% tariff rate for the rest of the world.

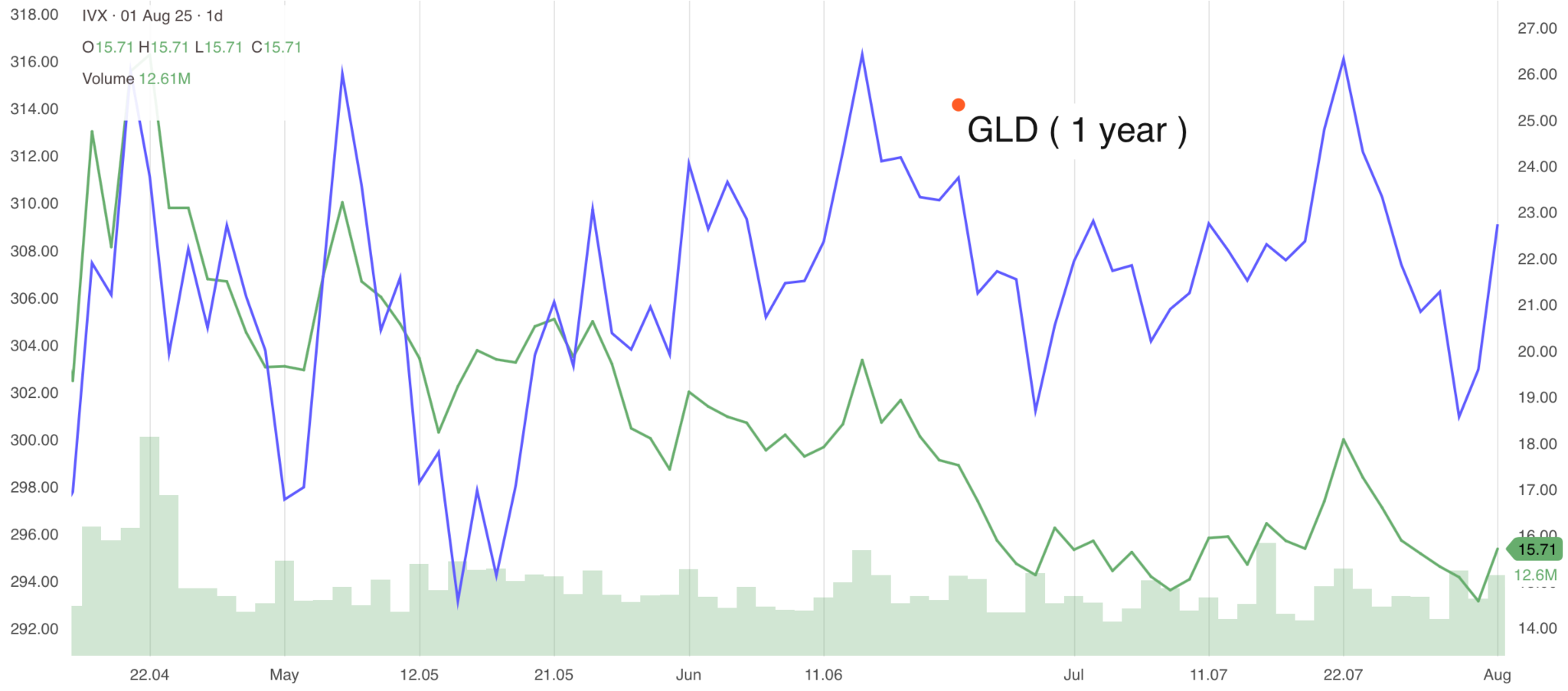

Gold fell as trade deal hopes heightened investors' risk appetite, while oil spiked higher after Trump gave Russia a 10- to 12-day deadline to sign a truce with Ukraine.

Oppenheimer's Chief Investment Strategist John Stoltzfus raised his price target on the S&P 500 from 5,950 to 7,100 today, 11% above today's close. That makes him the biggest bull on Wall Street.

Morgan Stanley Chief US Equity Strategist Mike Wilson sounded a bit more optimistic. He is leaning toward his bull case of the S&P 500 hitting 7,200 by the middle of 2026, citing strong earnings growth, a weak dollar, and pent-up demand from investors.

"Of course, the near-term set up is not without risks—back-end rates, tariff-related inflation and softening seasonals", Wilson wrote. "Thus, we do expect some consolidation tactically, but we would reiterate that we expect pull-backs to be shallow (mid-to-high single digit percent range), and we're buyers of dips."

In other news, the US housing market just posted its worst spring selling season since 2012, PayPal will now allow merchants to accept payment in the form of over 100 cryptocurrencies and the next hot IPO on deck is web designer Figma, aiming for a valuation of nearly $20 billion.

Notable movers to the upside:

- Tesla jumped 3% after the company signed a $16.5 billion deal with Samsung to produce AI chips

- Nike surged nearly 4% after the athletic apparel brand got an upgrade from JP Morgan, which now gives the stock an "overweight" rating due to the company's turnaround plan

- Advanced Micro Devices raised the price of its chip, signaling strong demand for AI hardware and pulling the rest of the sector up with it. AMD rose over 4%, Super Micro Computer jumped over 10% and Nvidia rose nearly 2%

- Celcuity skyrocketed 167.18% after the biotech firm reported encouraging results in a Phase 3 breast cancer trial

Notable movers to the downside:

- Albemarle fell over 10% as investors took profits from the lithium producer, which popped 30% last week

- Centene Corp dropped over 5%, continuing its downward trend after the health insurer posted worse-than-expected earnings last Friday

- Cisco Systems fell 1.12% after getting hit with a downgrade from analysts regarding its valuation

Tuesday:

The major indexes dropped from record highs on a day that kept investors glued to their screens. Earnings came in fast and furious, the US and China agreed to continue discussions over extending their tariff pause, and consumer confidence rose in July.

The US dollar continued to climb and hit a one-month high against the euro following the US – EU trade pact. The greenback is on pace for its first monthly gain since January.

Oil prices rose due to optimism the trade war is thawing and President Trump's escalating threats of sanctions against Russia over its war in Ukraine.

Railroad giant Union Pacific officially announced its plans to buy Norfolk Southern in a massive $85 billion merger. The acquisition would create the US' first coast-to-coast freight network, running across 50,000 miles in 43 states. The railroads argue that one joint company operating the entire route would streamline shipments. If approved by antitrust regulators, the tie-up would be the biggest M&A deal of the year and biggest rail merger ever. The two companies are likely hoping the business-friendly Trump administration will authorize the deal.

JPMorgan Chase is nearing a deal to take over Apple's credit card program, which used to have Goldman Sachs as a partner, the WSJ reports. Apple is closing a retail store in China for the first time ever.

Notable movers to the upside:

- SoFi revenue is surging at the fastest pace in more than two years, which sent its stock 6.57% higher. The fintech also raised its full-year outlook

- Sarepta jumped 14.21% because it's going to resume shipments of its gene therapy Elevidys

- CyberArk Software jumped nearly 14% after the WSJ reported it was in talks to be acquired by Palo Alto Networks in a mega cybersecurity deal worth over $20 billion

- Materials science legend Corning popped 11.87% on an earnings beat and better-than-expected guidance. CEO Wendell Weeks said the company is "seeing remarkable customer response to both our new Gen AI and U.S.-made solar products."

Notable movers to the downside:

- UnitedHealth Group's profits are getting squeezed by the persistent problem of higher costs. Shares of the health conglomerate declined nearly 8% after reporting a drop in Q2 earnings

- Boeing shares dipped 4.37% despite its recovery moving along. The company lowered its cash burn to just $200 million (vs. $1.8 billion expected) and recorded its highest quarterly revenue in six years

- UPS dropped nearly 11% on a profit miss. For the second straight quarter, the parcel delivery giant refused to issue guidance, citing the uncertain economic backdrop

- Whirlpool is getting beat up by Asian rivals stockpiling imports in the US ahead of tariffs. The appliance maker tumbled nearly 14% after it lowered its dividend and slashed its full-year profit guidance

- Spotify fell nearly 12% after posting a Q2 loss and issuing softer guidance. It has been up 120% over the past year, and continues to add more subscribers

- PayPal dropped nearly 9% despite Venmo revenue growing over 20% from the previous year. Investors had a problem with slowing growth in transaction margin dollars, a gauge of profitability

- Novo's stock plunged over 21% today after the Danish pharma giant slashed its full year guidance: It now projects full-year sales growth between 8% and 14%, a steep drop from its prior estimate of 16% to 24%. The company also lowered its operating profit growth forecast to between 10% and 16%, below the previous target of 16% to 24%

Wednesday:

Markets started the day strong but fell off a cliff after Jerome Powell indicated that there aren't any interest rate cuts ahead just yet (more on that in a moment).

President Trump unveiled a 25% tariff on imports from India today, and warned that India will also pay an unspecified "penalty" for buying Russian military equipment and energy.

Copper prices plunged after the White House announced a universal 50% tariff on imports of the metal and on semi-finished products like copper pipes and wires, but exempted input materials like ore and concentrates.

Although pressure on the Federal Reserve to cut interest rates has been building to Category 5 levels, the Federal Open Market Committee stood strong and held interest rates steady at between 4.25% and 4.50% for its fifth straight meeting.

This news surprised no one, although all eyes and ears were glued on chair Jerome Powell's every word for hints about whether the Fed will cut rates at its next meeting September 16-17.

"We have made no decisions about September", he said at the afternoon press conference. "We don't do that in advance. We'll be taking that information into consideration and all the other information we get as we make our decision."

But now, Powell may be facing dissent in his own ranks. Two Fed governors voted to cut rates by 25 basis points, the first time more than one sitting governor has diverged from the typical near-unanimous 12-member committee since 1993. They've also pushed for rate cuts publicly, arguing that tariffs haven't fanned inflation as much as feared and that the job market is showing signs of losing steam.

CME's FedWatch tool, which attempts to predict Fed moves based on futures prices, currently puts the odds of a September rate cut at 45%. While that's much lower than the 63.3% reading as of yesterday, two rate cuts are still expected before the end of the year.

Notable movers to the upside:

- META rose over 11% following a stellar earnings report. Its advertising business is still booming and the venture into AI is alive and well

- MSFT scored big with its earnings announcement. The company reported such great numbers that investors sent its market cap past $4 trillion for the first time ever. The biggest headline was perhaps in its Azure cloud revenue, which surged a staggering 39%. Shares climbed nearly 4% today

- Sarepta Therapeutics popped nearly 6% on the news that its treatment for Duchenne muscular dystrophy will return to the market after the FDA placed a hold on shipments following the deaths of several patients

- Wingstop flew nearly 30% higher after the chicken chain posted its most profitable quarter ever and promised to open even more restaurants than expected this year

- Peloton added nearly 20% after UBS analysts upgraded the home fitness company, believing that shares could double thanks to its cost cutting and improvements to operational efficiency

- LendingClub climbed over 20% thanks to a great quarter for the online lender, buoyed by a 32% increase in the value of loan originations

Notable movers to the downside:

- Starbucks may be turning things around, but not quickly enough for shareholders – a sixth straight quarter of declining same-store sales pushed the stock down 0.22%

- Avis Budget Group sank over 15% after profits fell 71%

- Novo Nordisk fell another 7.25%, as the pharma giant's tumble continued after it slashed its full-year guidance

- Mondelez may have beaten analyst forecasts last quarter, but the snack food conglomerate still fell nearly 7% after posting slower organic growth and slimmer margins last quarter

Thursday:

The fate of the global economy is being decided via Truth Social posts. With a self-imposed midnight deadline looming for the end of the tariff pause, President Trump rolled out new tariffs to be imposed on imports from dozens of countries—but pushed off their implementation until Aug. 7.

Over the past few days, the White House announced a slew of last-minute tariff deals before the reciprocal tariff deadline hits on Friday – for real this time.

Recall that Liberation Day posterboard where President Trump unveiled his massive tariffs on major trading partners on April 2. But he delayed implementing them first until July 9, and then again until August 1, in order to give the White House time to make deals and avert complete global chaos.

Now, Trump is already waffling on the Friday deadline, announcing that Mexico will get another 90-day extension to the deadline, during which the US will leave its trading partner's tariff rate at 25%.

Markets started the day strong thanks to positive PCE data and impressive big tech earnings (more on that in a second). But the rally lost steam in the afternoon after President Trump sent letters to 17 major pharmaceutical companies asking them to cut prices in the next 60 days.

Notable movers to the upside:

- AAPL blew past Wall Street's expectations when it reported its Q3 earnings. Though tariffs cost Apple $800 million, they also helped spur sales as consumers raced to buy new tech before higher prices kick in

- AMZN didn't leave investors impressed. Amazon also reported better-than-expected numbers, with revenue and profit both up. But the e-commerce giant's stock fell in after-hours trading because its cloud business wasn't growing as rapidly as its rivals', leaving investors worried its AI investments weren't paying off enough

- Figma made its market debut today, with shares nearly 40 times oversubscribed. The stock began trading at more than double its IPO price, and ended the day up 256.33%

Notable movers to the downside:

- Cigna posted a solid quarter thanks to growth in its pharmacy benefits management business, but shares of the health insurer still fell over 10%

- Bristol-Myers Squibb also beat top and bottom line estimates last quarter, but shares sank 5.81% as the pharma giant faces a series of patent expirations

- Shake Shack plummeted nearly 15% after the burger chain cut its third-quarter revenue forecast, warning of slower consumer spending

- Align Technology plunged nearly 40% after the orthodontics maker missed top and bottom line forecasts and cut its fiscal guidance

- Qualcomm dropped nearly 8% despite beating analyst estimates

- Arm Holdings lost over 13% after missing revenue forecasts

Friday:

Markets dipped (all three major averages were down) as President Trump laid out sweeping new global tariffs and a jobs report that showed the labor market has been cooling down more than was realized earlier. The dip left all three major averages down for the week.

The Bureau of Labor Statistics (BLS) said that the US added just 73,000 jobs in July, and those gains were almost entirely in just two industries: healthcare and social assistance. Additionally, the BLS also made some significant downward revisions to previous months' data and said the revisions were mostly due to routine recalculations of seasonal factors. The unemployment rate rose over 4%.

Friday's data provided more clarity that many tariff-sensitive industries either lost jobs or showed little growth in July. Also, the labor force also shrank for the third straight month, dragged down by an exodus of foreign-born workers in the face of strict immigration policies.

Gold jumped as the likelihood of a rate cut rose due to the latest jobs report.

Notable movers to the upside:

- Reddit soared nearly 20% following better-than-expected quarterly earnings results

- Figma, a software design firm, continued its upward move another 5% after its explosive market debut a day ago

- First Solar gained over 5% on a solid quarter for the solar panel maker and management's cautious optimism that new regulations won't hurt business as badly as previously thought

- Rocket Companies, parent company of Rocket Mortgages, jumped nearly 12% thanks to a better-than-expected quarter

Notable movers to the downside:

- Coinbase crumbled over 16% after revenue missed estimates last quarter and trading volume fell due to a relatively tame quarter for crypto

- Moderna may have beaten top and bottom line estimates last quarter, but shares of the vaccine maker still fell nearly 7% after it cut its fiscal guidance

- MicroStrategy beat earnings estimates, but the stock sank over 8% after shareholders disapproved of an accounting change that could skew numbers in a positive direction

- Eastman Chemical Co. dropped 19.03% after not only missing analyst forecasts for both sales and profits this quarter, but also cutting its earnings guidance for the current quarter

- Fluor plunged nearly 30% after the construction company missed analyst estimates last quarter and cut its fiscal 2025 outlook

- Apple sank 2.50% despite reporting a record-high Q3 revenue surpassing analysts' expectations

- Amazon stock slid over 8%, despite beating top and bottom line estimates in Q2. Although online shopping remained robust, the company has been struggling to maintain its lead in cloud computing. Amazon Web Services (AWS) revenue grew by 18% year over year, and while this was in line with expectations, it trails the gains made by rivals Microsoft and Alphabet, which posted cloud growth of 39% and 32% last quarter, respectively

Considerations for the coming week

Wall Street's attention will be on any further fallout from the July jobs report. A much weaker than anticipated nonfarm payrolls reading, coupled with significant revisions in jobs growth from May and June, has rocked market sentiment. Trump's subsequent firing of Bureau of Labor Statistics (BLS) Commissioner Erika McEntarfer has been met with widespread reactions of concern.

Economic Data Releases:

The economic calendar will be fairly light compared to last week's largely packed affair. Market participants will receive services PMI readings.

Earnings Reports:

The earnings season will continue to chug along this week, though the pace will ease up considerably.

Some notable earnings reports due out the coming week are:

Monday, August 4: Palantir, MercadoLibre, Hims & Hers Health, Vertex, Williams Cos, Wayfair, and Tyson Foods

Tuesday, August 5: AMD, Caterpillar, Amgen, Eaton, Arista Networks, Pfizer, BP, Apollo, Marriott, Zoetis, Diageo, Coupang, Yum! Brands, Infineon, Super Micro Computer, DuPont de Nemours, Rivian Automotive, and Snap

Wednesday, August 6: Novo Nordisk, McDonald's, Walt Disney, Uber, Shopify, AppLovin, DoorDash, Siemens Energy, Airbnb, Emerson Electric, Fortinet, CRH, Honda Motor, Glencore, Occidental Petroleum, Rockwell Automation, Bayer, NRG Energy, DraftKings, Duolingo, and Lyft

Thursday, August 7: Eli Lilly, Toyota, Siemens, Allianz, Sony, Gilead Sciences, ConocoPhillips, SoftBank, DBS, Constellation Energy, Rheinmetall, Vistra, Flutter Entertainment, Atlassian, Cheniere, Datadog, Block, Kenvue, Take-Two Interactive Software, Warner Bros. Discovery, Pinterest, Expedia, Rocket Lab, Twilio, NuScale Power, Maplebear, Monster Beverage, Wynn Resorts, and Peloton

Friday, August 8: Wendy's, Under Armour, and FuboTV

Closing Thoughts

MicroStrategy pioneered the idea that a publicly traded company could enjoy a tremendous boost to its share price simply by purchasing bitcoin, and a wave of stocks have followed in its footsteps. The Wall Street Journal reported late last week that 98 companies have raised over $43 billion to buy cryptocurrencies since June 1 alone.

While bitcoin is the crypto king, nowadays companies are searching further afield for cryptocurrencies to acquire as their treasury asset of choice. Analysts are concerned that publicly traded companies pouring hundreds of millions of dollars into obscure cryptos may raise serious market volatility.

And can we safely presume that when a company decides to use Fartcoin as its treasury asset, a market top is nearby?

Questions / Comments

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use support@ivolatility.com.

Previous issues are located under the News tab on our website.