Are These Normal Market Moves?

August 11, 2025

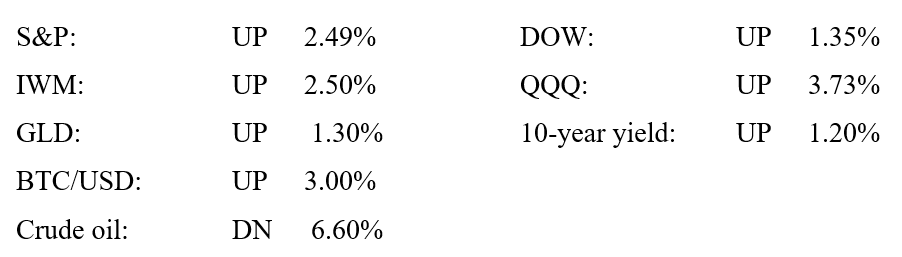

Market Roundup for the Week

Wall Street logged its best week since late June, rebounding from a weak July jobs report on Monday and boosted by strong tech gains, upbeat earnings, and optimism over potential Russia-Ukraine peace talks. Markets wrapped the week on a high note, buoyed by solid earnings and strong gains from the Magnificent 7. The Nasdaq closed at a fresh record high, while the S&P 500 just barely missed a new record of its own.

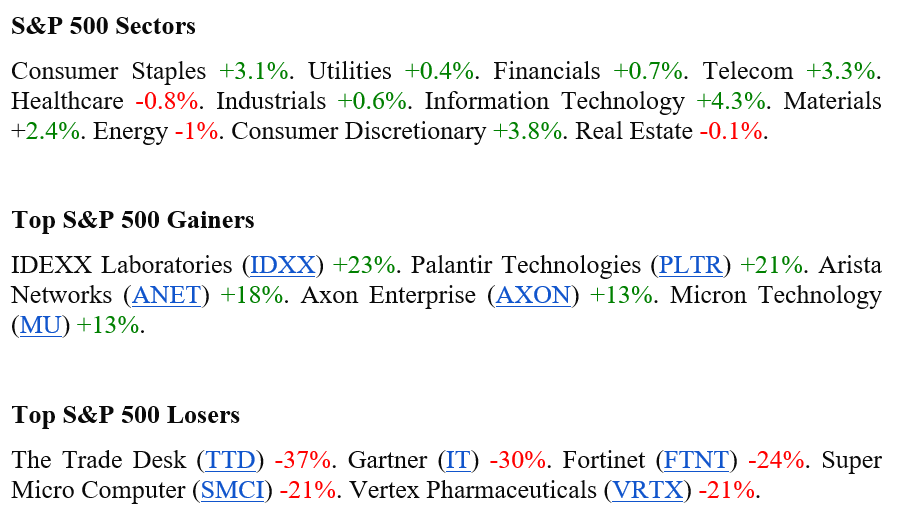

The S&P has gained 8% year-to-date, but a closer look reveals significant disparities within the broader equity market, according to a recent report by David Kostin, strategist at Goldman Sachs. While the index itself is within 1% of its record high, the median stock remains 12% below its 52-week peak. This divergence highlights a market marked by substantial stock-level dispersion, with investors gravitating towards certain themes and sectors, such as artificial intelligence, large-cap stocks and industrials, while largely avoiding others, including small-caps and most defensive sectors. The dispersion of stock returns in the S&P 500 has reached historically high levels, according to Goldman’s August 8 report. The three-month return dispersion for the index has surged to 36 percentage points, placing it in the 82nd percentile compared with the past 30 years. This wide variation in returns is seen across nine of the 11 sectors, where return dispersion ranks above the 70th percentile.

Experts analyzing recent government data say that tech giants splurging on AI data centers packed with the latest computer chips are propping up an otherwise sluggish economy. Meanwhile, consumer spending, the typical engine of the economy, has weakened. AI spending contributed more to GDP growth than consumer spending did last quarter, according to the head of economic research at Renaissance Macro Research, Neil Dutta.

Today marks President Trump's deadline for Russia to agree to a ceasefire with Ukraine, and while there was no news on that front, all eyes are on a meeting between Trump and President Putin in the coming days. Meanwhile, Japan got a reprieve after US negotiators agreed not to stack tariffs on top of each other.

Bitcoin continued to climb on the news that investors may soon be able to utilize the crypto king in their 401(k) accounts, while ethereum rose to $4,000 for the first time in three years.

Wall Street's attention will be on any further fallout from the July jobs report. A much weaker than anticipated nonfarm payrolls reading, coupled with significant revisions in jobs growth from May and June, has rocked market sentiment. Trump's subsequent firing of Bureau of Labor Statistics (BLS) Commissioner Erika McEntarfer has been met with widespread reactions of concern.

The services sector is slowing, the labor market took a hit after a shockingly bad July jobs report, and now the pros think that reciprocal tariffs are about to add more fuel to the inflation fire. The combination of high inflation, high unemployment, and slow economic growth equals stagflation – all could be bad news for the economy.

So, what does that mean for investors? Right now, the market thinks there's a 89.4% chance the Federal Reserve cuts rates in September. But central bankers are aware of the growing stagflation risks, as St. Louis Fed President Alberto Musalem noted today, and that may mean the Fed stays put.

Strategy Corner

Based on last week's market movements, here are some trading ideas and option strategies for the readers' consideration. The positions can be scaled bigger if suitable for larger accounts.

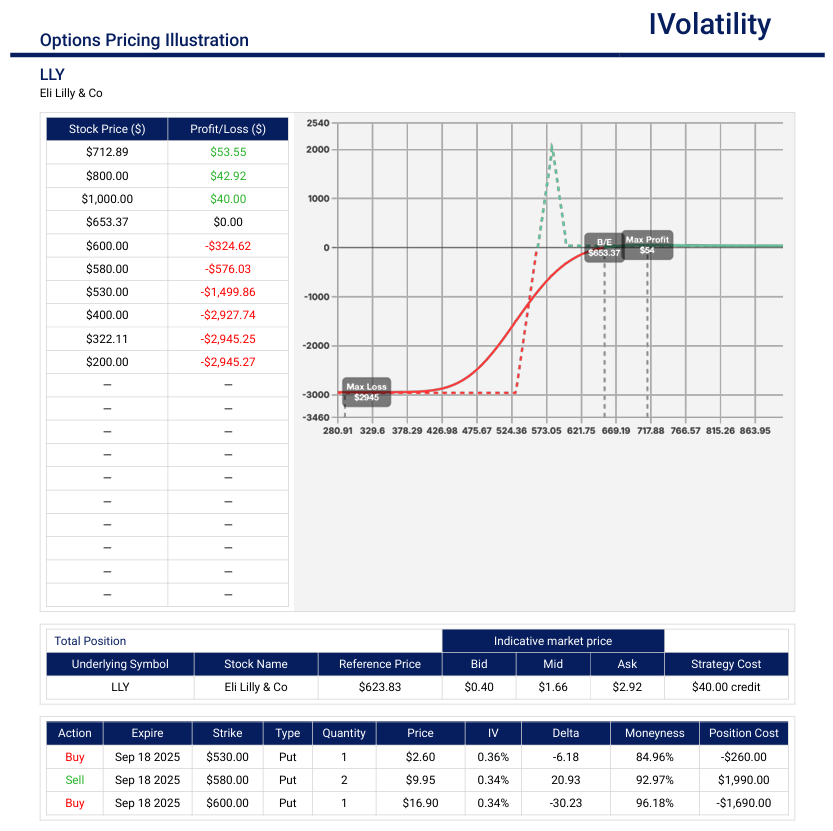

- LLY (closed around 625 on Friday, Aug 8th)

If you think that the stock might recover from here or not sink much lower, then selling a put broken-wing butterfly could be a productive strategy.

For Sep19, BUY ONE 600put / SELL TWO 580puts / BUY ONE 530put

Credit received: $1.70 / Downside BE below 560 / no risk to the upside

Buying power used: $2800 / Net Position Delta: +6

Probability of profit: 84%

PnL Calculator from the IVolLive Web - TLT (closed around 87.25 on Friday, Aug 8th)

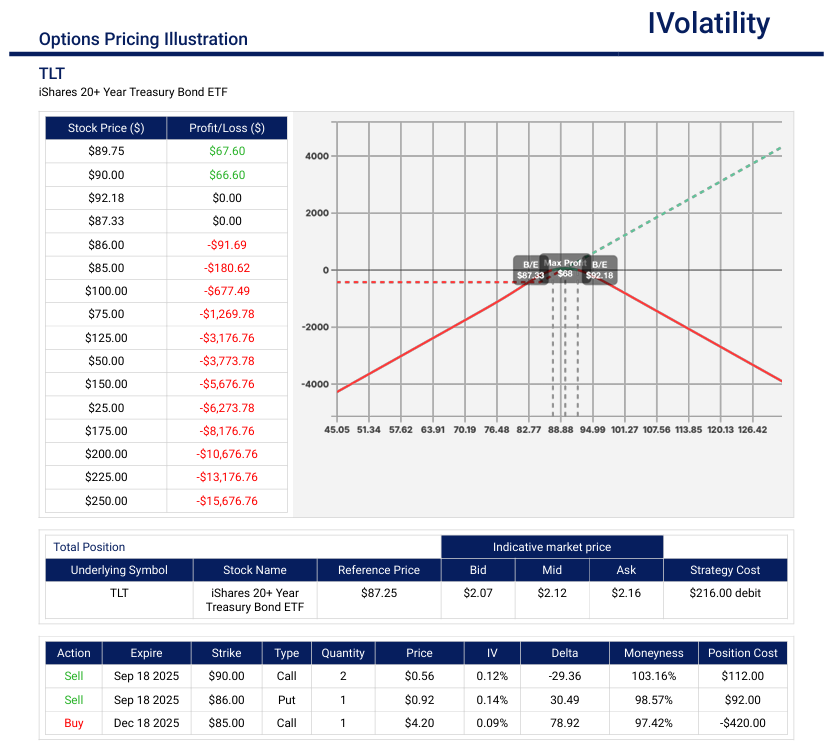

If bullish on long-term bonds (given interest rate drops over the coming months), then buying a call diagonal and financing the purchase with the sale of a strangle could be a productive trade

Buy one Dec19 85call / Sell two Sep19 90calls / Sell one Sep19 86put

Debit paid: $2.11 / Buying power used: $1975

Net Position Delta: +48

PnL Calculator from the IVolLive Web

Weekly changes in Major Indices

Review selected market profiles below:

Top Daily Headlines

Monday's Recap:

On Monday, the major averages bounced back strongly from the fallout of the July nonfarm payrolls report last week.

Was this a gap fill or a one-day V-shaped recovery? Perhaps as the week rolls out, investors will get a better idea.

Notable movers to the upside:

- Palantir Technologies rose nearly 18% in the week after Q2 results and outlook beat expectations reporting a 48% year over year increase in sales that pushed its revenue above $1 billion for the first time ever – two quarters earlier than Wall Street analysts expected. Shares rose nearly 8% today to a new all-time high, drawing positive commentary from Wall Street analysts. "We believe in the next few years Palantir has the potential to be a trillion-dollar market cap as the AI Revolution takes hold," said analysts from Wedbush. While a high valuation may give investors pause, it's not stopping Jim Cramer. He declared this morning that Palantir is "dramatically undervalued", and that the stock will hit $200 any day now

- AXON Enterprise popped 16% based on beating earnings and raising full year guidance

- Mercado Libre missed earnings estimates but stock price increased by over 2%, reflecting investor confidence in the company's long-term growth prospects

Notable movers to the downside:

- Vertex Pharmaceuticals fell over 20% even though the earnings report beat estimates. The stock decline may be attributed to the halting of the development of its next-gen pain drug, VX-993, due to underwhelming trial results

- ON Semiconductor plummeted nearly 16% after the company reported a slight revenue decline year-over-year and pointed to cautious behavior by its customers and high levels of uncertainty in its key automotive market

Tuesday:

The biggest part of the US economy is services-based businesses, and after today's ISM services report revealed the sector barely grew last month, stocks tanked at the open. The Dow was able to recover for a short while, but ultimately all three major indexes wound up lower than where they started.

Multiple countries face new trade barriers this week, resulting in the President of Switzerland flying to Washington DC to try and secure exemptions.

The US trade deficit contracted 16% to $60.2 billion in June, its narrowest since September 2023, thanks largely to a steep drop in imports.

Tesla's sales fell 60% in Britain and 55% in Germany, while rival BYD enjoyed soaring vehicle registrations in both markets.

12.9% of student loan debt is in serious delinquency, the highest percentage in 21 years.

Notable movers to the upside:

- Pfizer surged over 5% after the pharma giant not only handily beat top and bottom line expectations for its second quarter, but also raised its forward-looking guidance

- BP jumped over 3% after the company reported its turnaround plan is kicking off after years of underperforming. The oil giant promised investors a wide-ranging portfolio review, including cost cuts demanded by activist investor Elliot Investment Management. In a continuation of its pivot back toward fossil fuels and away from renewable energy, BP said it made its biggest oil discovery in 25 years off the coast of Brazil just the other day

- Axon Enterprise jumped over 16% after strong demand for security solutions propelled it to a beat-and-raise earnings report

- Lemonade soared nearly 30% after the insurance company reported a smaller-than-expected earnings loss and an impressive revenue beat

- BWX technologies, a nuclear components manufacturer, soared over 17% as the US announced plans to build a nuclear reactor on the moon by 2030. BWX would benefit from resulting space contracts

- Syndax Pharmaceuticals popped over 20% thanks to strong sales for its leukemia drug, pushing revenue higher than expected last quarter

- DigitalOcean gained nearly 30% thanks to an impressive quarter, beating top and bottom line estimates and raising its forward guidance

- Lattice Semiconductor added over 15% after the semi stock beat revenue forecastsand matched Wall Street's profit expectations

- Palantir, a defense technology company, crossed the billion-dollar quarterly threshold for the first time with 48% y-o-y growth. The company raised full year guidance and expects the next quarter to represent the highest sequential growth in company history

- Astera Labs surged nearly over 30% in the week after an impressive Q2 report card featured a Y/Y revenue gain of 150%. The company develops semiconductor connectivity solutions for cloud and artificial intelligence data centers

Notable movers to the downside:

- Financial stocks took a tumble today on reports that a new executive order is in the works that punishes banks that discriminate against customers for political reasons. It would appear that JPM and BAC rejected Mr. Trump as a customer. JPMorgan lost nearly 1%, Bank of America fell over 0.5%, and Citigroup lost 0.60%

- Hims & Hers Health may have beaten earnings estimates last quarter, but it fell over 12% after sales came in much lower than expected and forward guidance was weak

- Yum Brands fell over 5% after the fast-food giant missed on top and bottom line expectations thanks to lower same-store sales from KFC and Pizza Hut

- Snap shares tanked more than 15% when it reported second-quarter earnings in which global average revenue per user missed expectations

- Firefly Aerospace fell just over 22% in the first week of trading. Shares jumped to as high as $73.85 within the first hour of its IPO debut Thursday on the Nasdaq Global Market but cooled off in afternoon trading on Friday

- Super Micro Computer dropped over 20% as the data storage and server solutions company missed Q4 estimates amid continued low gross margins – due in part to tariff and inventory reserve pressure – and its outlook for Q1 of fiscal 2026 also fell short of market expectations

- Lucid Group declined around over 14% after the electric automaker issued a weak quarterly report and trimmed its production outlook

Wednesday:

Notable movers to the upside:

- Shopify surged over 20%, thanks to earnings that beat expectations and strong guidance into Q3

- Arista Networks popped over 17% after reporting 30% revenue growth, 35% earnings growth, and raising its revenue outlook

- Apple jumped roughly 5.1%, on investor optimism tied to a $100 billion U.S. manufacturing investment pledge

- McDonald's gained around 3%, driven by strong performance of its affordable menu bundles and rising global same-store sales

- Match Group rose about 10.5%, buoyed by strong user growth and revenue beats

Notable movers to the downside:

- Joby Aviation dropped nearly 10% on lower-than-expected losses, but reaffirmed guidance for full-year 2025

- Fortinet fell nearly 24% and faced multiple analyst downgrades this week after its Q2 results and outlook as well as disappointing management comments on its firewall refresh cycle

Thursday:

The announcement that President Trump and Russian President Putin may meet as soon as next week to discuss tariffs and peace in Ukraine propelled stocks higher at the open. The markets basically shrugged off the chip tariff drama but remained subdued through the course of the day. At the end, the major indexes largely gave up their gains as so-so earnings announcements and rising bond yields weighed markets down.

Federal Reserve Governor Christopher Waller has reportedly emerged as the top candidate to replace Jerome Powell.

Trump's reciprocal tariffs took effect at midnight on Thursday, and traders will keep a watch on the impact the trade policies have going ahead. Part of the reason that the market isn't tanking is a phenomenon we've seen play out with increasing frequency: Investors just don't believe Trump is serious.

Notable movers to the upside:

- Firefly Aerospace made its public debut today and shares of the rocket maker exploded over 30%

- Duolingo soared nearly 14% higher after the language learning app reported stellar earnings. It appears that its embrace of AI is working well

- Celsius popped over 17% on the back of a whopping 84% increase in revenue last quarter as customers continued to consume energy drinks

- DoorDash topped analyst estimates last quarter thanks to a 20% increase in total orders. Shares climbed over 5%

- Dutch Bros. climbed over 20% after revenue rose 28% last quarter even as the drive-thru coffee chain continues to expand rapidly

- SunRun zoomed over 30% higher on record battery installations, strong profits, and hopes that the solar industry is seeing a revival

- COIN jumped nearly 2% when Trump announced plans to allow the $43 trillion retirement industry to invest in crypto assets

- AMD recovered over 5.5% from recent earnings miss on speculation that US-based operations could benefit from tariff exemptions

- AAPL went up over 3% after announcing an additional US investment of $100 billion. This could exempt AAPL from the 100% chip tariffs

Notable movers to the downside:

- Ralph Lauren beat analyst expectations on both the top and bottom lines and also raised its earnings guidance. However, the retailer still sank nearly 7% when management issued a warning that tariff-driven cost pressures could compress margins and potentially weigh on consumer sentiment later in the year

- Crocs plummeted nearly 30% after the shoe maker declined to provide full-year fiscal guidance

- Airbnb beat earnings forecasts, but slid 8% after the short-term rental company warned of a slowdown in the second half of the year

- Eli Lilly fell nearly 18% in the week, with a better-than-expected Q2 report and raised 2025 outlook being overshadowed by concerns over late-stage trial data for the company's oral weight loss drug Orforglipron

Friday:

Today, Wall Street posted its best week since late June, driven by a combination of a rebound from a weak July jobs report, a surge in tech stocks, a largely solid batch of quarterly earnings, and hopes of a truce between Russia and Ukraine.

Notable movers to the upside:

- LegalZoom soared over 30% higher after analysts upgraded it from "underperform" to "buy" and raised it price target by 43%

- MP Materials, the rare-earth miner that's gotten millions of dollars in support from the US government, rose nearly 5% thanks to a smaller-than-expected loss last quarter

- Expedia jumped over 4% after beating earnings estimates and raising its sales and profit forecast

- TripAdvisor gained nearly 12% after it beat EPS expectations and bumped up its revenue forecast

- Doximity (LinkedIn for doctors) rose over 13% on news that it will acquire AI startup Pathway Medical

- Monster Beverage climbed over 6% after the energy drink maker beat earnings and reported record revenue last quarter and received an analyst upgrade

Notable movers to the downside:

- Under Armour sank over 18% on news that tariffs will take a serious toll on the retailer's profits and sales this year

- Trade Desk reported good, but tepid, earnings but the stock plunged nearly 40%. It appears that several analysts downgraded the company citing disappointing forecast, valuation risks and growing competitive threats

- Sweetgreen plummeted over 23% after management cut its fiscal guidance for the second time in two quarters

- Yelp stumbled 9.45% after it lowered its revenue estimates for the current quarter

- Block crushed analyst estimates last quarter and raised its full-year guidance, but the fintech company fell 4.50% anyway. It seems that the stock's valuation already reflects most of the expected growth from its core business

- Pinterest beat revenue forecasts but missed profit expectations, pushing the social media site over 10% lower

Considerations for the coming week

Economic Data Releases:

Wall Street's focus this week will be on key inflation data and on any further developments around trade and Russia and Ukraine.

A busy economic calendar will take center stage, with the July consumer price index and producer price index reports due on Tuesday and Thursday, respectively. Market participants and monetary policymakers will be keeping a close eye on the data for any effects of U.S. President Donald Trump's tariffs on consumer and producer prices. Friday will see the retail sales reading for July.

Earnings Reports:

The earnings season will continue to chug along this week, though the pace will ease up considerably. Some notable earnings reports due out in the Aug 11th-15th week are:

Monday: Oklo, Plug Power, AMC Entertainment, Barrick Mining, Sphere Entertainment, and AST Spacemobile

Tuesday: ON Holdings, CoreWeave, Circle Internet Group, eToro, and H&R Block

Wednesday: Cisco, D-Local, Brinker International, Sketchers and Venture Global

Thursday: JD.com, AliBaba, Applied Materials, Advance Auto Parts, Deere & Co., and Birkenstock

Friday: No notable announcements on deck

Closing Thoughts

President Trump is set to sign an executive order allowing alternative assets such as cryptocurrency, private equity investments, and real estate in retirement accounts. Those accounts are a veritable gold mine – Americans have stashed approximately $12.5 trillion away for retirement, and alternative asset managers would certainly enjoy some of those assets. This latest move expands beyond private equity, coinciding with Trump's push to bring crypto mainstream.

Supporters argue that alternative assets in retirement accounts will add to investment diversification and potentially greater profits. Detractors note that these assets are less liquid, less transparent, and generally more risky than investing into publicly traded stocks and bonds.

Questions / Comments

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use support@ivolatility.com.

Previous issues are located under the News tab on our website.