The Bulls Are Back in Control

August 25, 2025

Market Roundup for the Week

For months now, investors have lived in fear that the stocks propelling the entire market higher could stumble – and bring the whole S&P 500 down with them.

This week, it felt like the dominos had started to fall, and the anxiety about an AI bubble was reaching a fever pitch. Investors were starting to get anxious and wanted to see some tangible results from big tech's AI spending bonanza, in which Google, Amazon, Microsoft, and Meta will dole out a combined $340 billion on AI datacenters just this year.

The hope was that this spending will result in huge profits for these companies – but with actual returns remaining in limbo, this AI-fueled bull market started to fizzle.

The announcement that Meta Platforms is freezing its gigantic AI hiring spree was not the latest in a series of body blows for the AI industry.

Fears of a bubble forming in the AI space began after OpenAI CEO Sam Altman admitted that startup valuations are "insane". The bad news kept coming when MIT published a study showing that 95% of generative AI pilots are flopping.

In the days following, some of the highest-flying AI stocks on the market dropped hard. Palantir sold off for six days straight on the heels of a short seller report from Citron Research questioning its high valuation, calling it "detached from fundamentals and analysis."

Nobody knows for sure whether AI stocks are in a dot-com era bubble but FT editor John Thornhill makes a good point: There will probably be multiple cycles of hype and crash as the AI revolution continues on. Bubbles can serve a purpose resulting in the buildout of infrastructure that eventually leads to widespread adoption of the technology.

The US government has taken the highly unusual step of owning a piece of the beleaguered chipmaker, Intel, with a 10% stake.

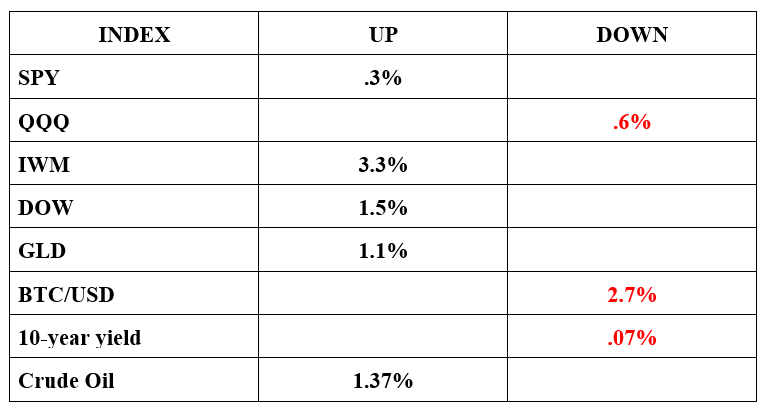

Wall Street this week was headed for a solid loss, weighed down by a rout in technology stocks and disappointing retail earnings. However, a dovish signal from Federal Reserve chair Jerome Powell on Friday at the annual Jackson Hole Economic Policy Symposium sparked a big rally, helping the benchmark S&P 500 index eke out gains for the week.

While the S&P and also the blue-chip Dow notched weekly gains, the tech-focused Nasdaq Composite posted a decline, as cautious investors sold off pricey megacap tech stocks ahead of Jackson Hole Meanwhile, retail giants Walmart (WMT) and Target (TGT) slid after their quarterly results.

Anticipation ahead of Powell's speech was high, with market participants hoping for comments on easing monetary policy. Though Powell did not fully commit to cutting interest rates, he noted that the downside risks to the labor market were increasing and that the "baseline outlook and the shifting balance of risks may warrant adjusting our policy stance."

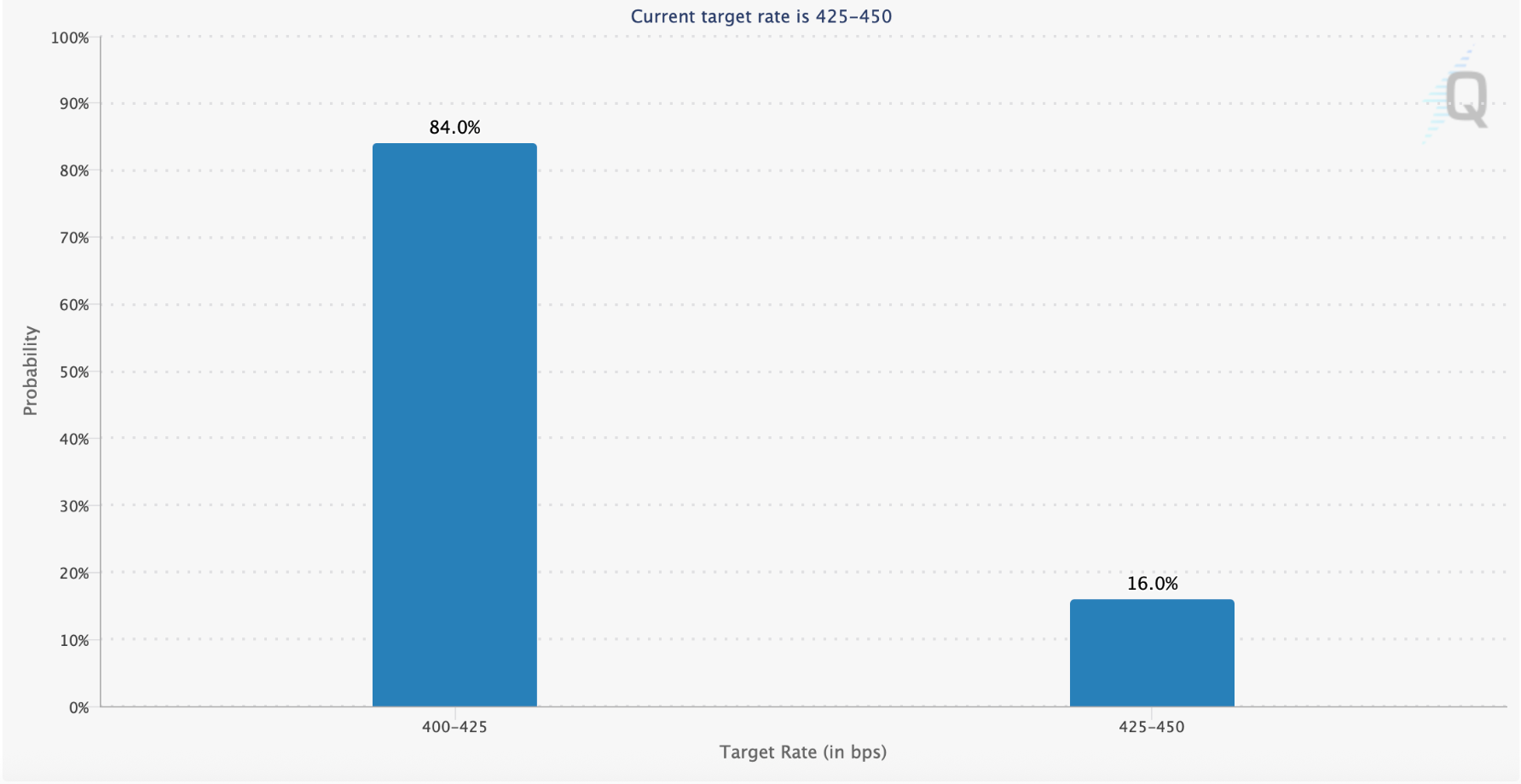

After Powell spoke on Friday, the odds of a rate cut at the Fed's next meeting on Sept. 16-17 rose to just above 84%, per CME FedWatch and the bears were nowhere to be seen, the bulls came out in full force and the markets rallied!!!

Strategy Corner

Based on this week's market movements, here are some trading ideas and option strategies for the readers' consideration. The positions can be scaled bigger if suitable for larger accounts.

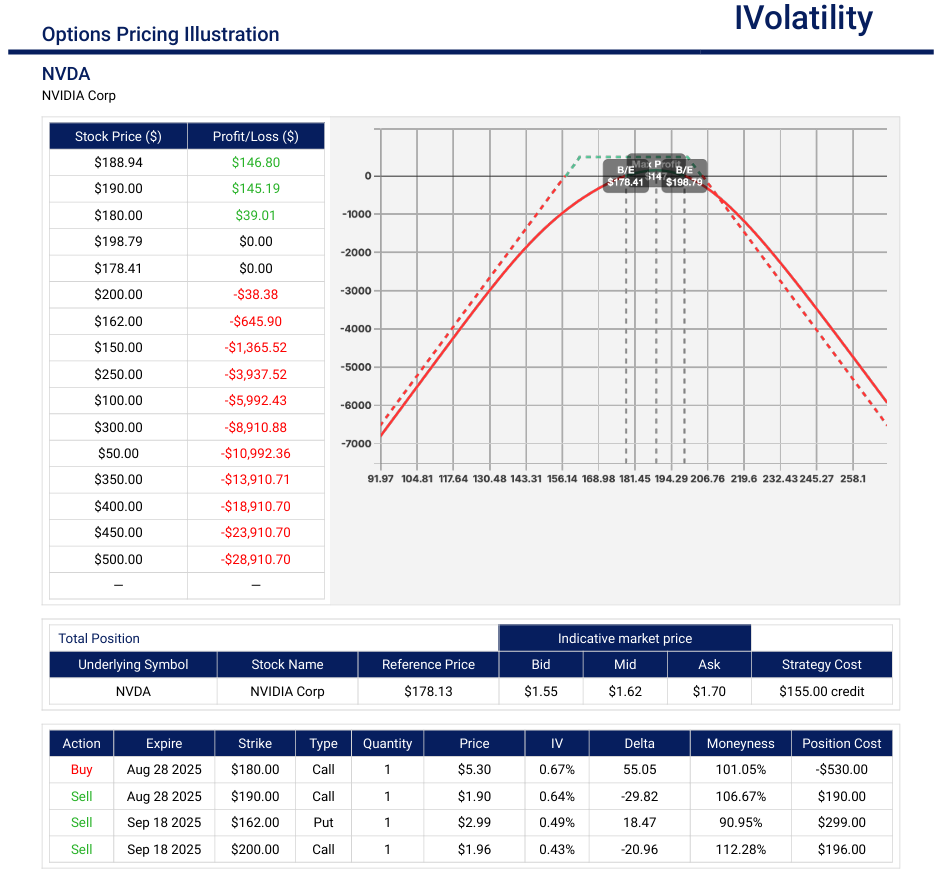

- NVDA (closed around 178 on Friday, Aug 22nd)

This UL will report earnings on Aug 27th. If an investor is bullish on NVDA, then the following trade could be considered:

Buy the aug29 ATM long call spread and finance the purchase with the sale of the sep19th 162/200 strangle

Net position delta: 26

Premium collected: $165 with buying power of $4500

Max potential profit: width of the weekly long call spread + premium collected

PnL Calculator from the IVolLive Web - WMT (closed around 97 on Friday, Aug 22nd)

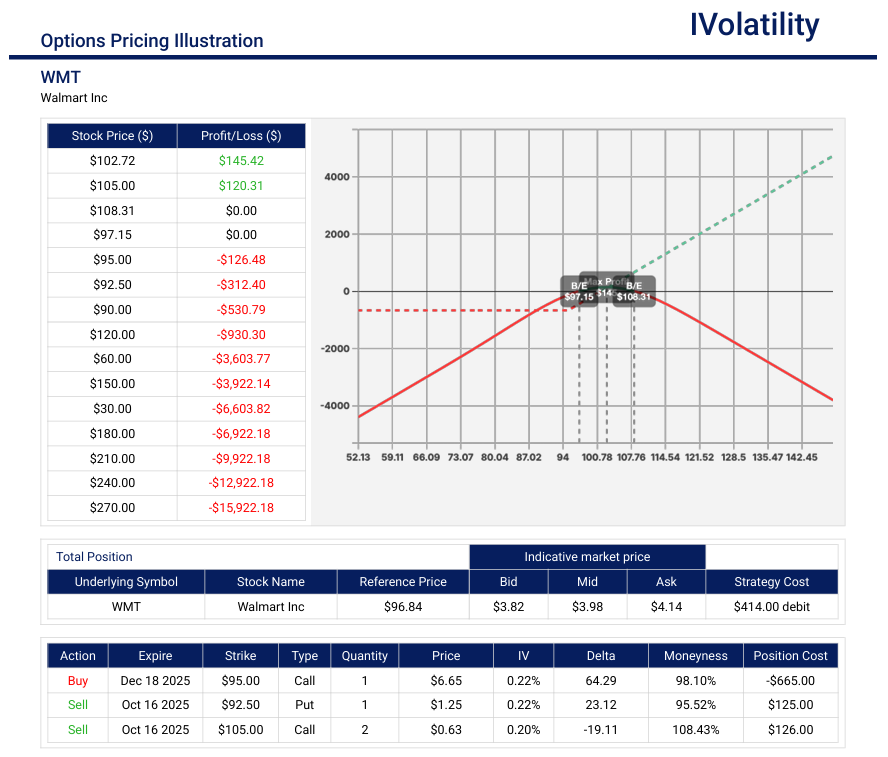

This UL reported earnings on Thursday, Aug 21st. It missed analyst EPS consensus but revenues were up and the company raised full year outlook. The stock dropped anyway. But, if an investor sees this as a place to get bullish for the next few months, then buying a long diagonal and financing it with the sale of a strangle could be considered.

Buy ONE dec19 95call / Sell ONE oct17 92.5put / Sell TWO oct17 105calls

Net Position Delta: 50

Debit paid: $400

PnL Calculator from the IVolLive Web

Weekly changes in Major Indices

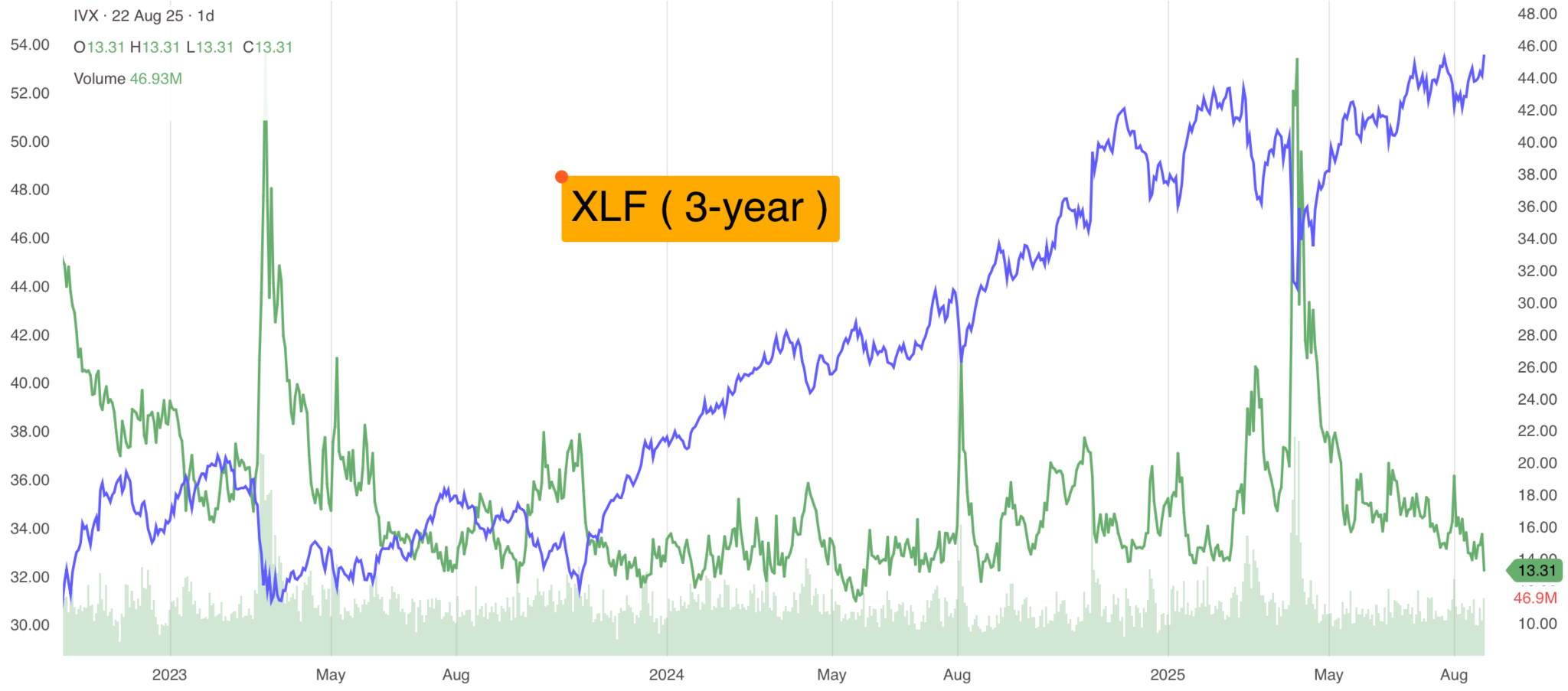

S&P 500 Sectors: Consumer Staples -0.48%, Utilities -0.54%. Financials +1.49%, Telecom +2.1%, Healthcare +4.89%, Industrials -0.09%, Info Tech -0.18%, Materials +2.04%, Energy +2.04%, Consumer Discretionary +2.42%, Real Estate +0.39%.

Top S&P 500 Gainers: Dayforce (DAY) +31%. Paramount Skydance (PSKY) +17%. EPAM Systems (EPAM) +11%. LyondellBasell Industries N.V. (LYB) +10%. Packaging Corporation of America (PKG) +10%.

Top S&P 500 Losers: Palantir Technologies (PLTR) -8%-10%. Intuit (INTU) . Advanced Micro Devices (AMD) -5%. Dell Technologies (DELL) -5%. Oracle (ORCL) -5%.

Review selected market profiles below:

Top Daily Headlines

Monday's Recap:

It was a slow start to the week as investors focused on a few major meetings that could shake markets – the summit with President Trump, President Zelenskiy, and several EU leaders; and Jerome Powell's forthcoming speech at the Jackson Hole Symposium on Friday.

After soaring to a new record last week, concerns that higher wholesale inflation could mean a Fed rate cut isn't immediately forthcoming pushed bitcoin lower.

Markets enjoyed a snoozefest! Normally, the SPY shares have an average daily volume of 72 million but today that number was just slightly over half. Investors were basically waiting for Powell's highly anticipated speech to be delivered later this week at the Jackson Hole symposium.

Notable movers to the upside:

- SunRun (RUN) continued its hot streak, gaining another 11.35% after RBC Capital Markets upgraded the solar power provider following last week's new renewable energy guidance

- Solar tracking tech maker Nextracker (NXT) rose nearly 12% and solar panel maker First Solar (FSLR) rose nearly 10% on the renewable energy guidance as well

- Terawulf (WULF), a bitcoin miner and AI computing provider popped nearly 5% on the news that it's expanding its data center campus in New York with the help of a $1.4 billion backstop from Alphabet

- Duolingo added nearly 13% after several Wall Street analysts gave the language learning app a boost and Citigroup initiated coverage with a BUY rating

- Starbucks rose over 2% after the coffee giant announced a 2% raise for all North American salaried employees

- GoodRx Holdings (GDRX), a telemedicine platform, soared nearly 40% on the news that Novo Nordisk will be offering its discounted Ozempic on the platform

- Target, climbed 3% after being added to a Wall Street firm's tactical outperform list

- Antero Resources (AR), a natural gas provider, dropped 6% after a downgrade to neutral from buy. It appears that there may be a threat of oversupply in the gas market that's likely to create challenges throughout the sector

- ServiceTitan, (TTAN), a cloud-based residential and commercial building software provider climbed 4% after being upgraded to a Buy from a hold and its 12-month price target was raised to $140 from $100

Notable movers to the downside:

- Hims & Hers Health (HIMS), dropped over 6% primarily due to a downgrade to HOLD from STRONG BUY. The company has seen significant growth in 2025, with its stock price increasing by over 66% year-to-date, though it remains below its 52-week high of $68.74

- Meta Platforms (META) sank over 2% on the news that the tech giant is overhauling its AI operations for the fourth time in six months

- Joby Aviation (JOBY) lost nearly 3.5% only a few days after the air taxi company conducted its first piloted flight between two airports. A few analysts downgraded the stock from "Buy" to "Neutral," citing concerns over the company's high valuation

- Tonix Pharmaceuticals (TNXP) tumbled over 20% despite the FDA giving its drug Tonmya the green light to treat fibromyalgia. Despite the regulatory success, the stock's volatility and investor concerns may have led to the downturn

Tuesday:

What was hot yesterday, seems cold today. Some sector rotation was apparent, away from technology and into more "stable" sections of the markets. Investors took some profits off the table ahead of Friday's pivotal speech from Jerome Powell. Tech in particular took a beating, dragging the Nasdaq lower, though the Dow hit an all-time high at one point today before giving back some gains.

The White House expanded steel and aluminum tariffs to include 407 additional consumer products that contain the metals, such as air conditioning units and motorcycles.

UBS believes gold demand will hit its highest point since 2011 later this year, and upped its 2026 price targets for the precious metal. Oil sank as the chance of peace talks between Russia and Ukraine opened the door to easing Russian energy sanctions.

Wyoming has become the first US state to debut its own stablecoin, the Frontier Stable Token.

Notable movers to the upside:

- Intel shares rose almost 7% on reports that Softbank will invest in the company. The company fell amost 4% on Monday on news that the Trump administration may take a 10% stake in the chip maker

- Palo Alto Networks popped over 3% after crushing its earnings report, raising its guidance, and touting huge revenue gains in its next-gen security offerings

- Home Depot fell just shy of earnings expectations this quarter, but shares still rose over 3% after the home improvement retailer stuck to its fiscal forecast

- Chinese EV maker XPeng gained 4.22% after posting a smaller-than-expected loss last quarter and beating revenue expectations

Notable movers to the downside:

- Profit-taking swept through some of the hottest stocks on the market today: Palantir fell 9.35%, Nvidia lost 3.50%, and Bullish dropped 6.08%

- Crypto stocks crumbled with Strategy sinking 7.43%, MaraHoldings lost nearly 6%, and Riot Platforms gave up nearly 3%

- Viking Therapeutics plummeted over 42% after trial results for its new daily weight-loss pill were worse than expected

- Robinhood Markets lost over 6.5% after the online brokerage announced it will roll out prediction markets for college and professional football games this season

- Medical device maker Medtronic (MDT) beat on both lines, but shares fell over 3%. Analysts considered the results "solid, but not stellar" and the recent involvement of activist investor, Elliot Management, cast a shadow on further upside

- Electronics manufacturer Fabrinet (FN) posted a solid beat-and-raise quarterly report, but tumbled nearly 13%. The earnings results were mixed and the stock has had a giant up move since the beginning of the year so investors may not be wanting to sustain the momentum

Wednesday:

Fears of an AI bubble continue to climb after MIT published a report that 95% of companies using generative AI programs have nothing to show for it, despite pouring billions of dollars into this space.

Another day of tech stocks selling off pulled the S&P 500 and Nasdaq lower, with investors rotating out of some of the hottest names on the market.

President Trump demanded the resignation of Fed Governor Lisa Cook for allegations of mortgage fraud. Meanwhile, the minutes from the July FOMC meeting revealed a growing divide between central bankers.

It was revealed that President Trump has spent over $100 million buying bonds while in office.

Notable movers to the upside:

- McDonald's (MCD) rose nearly 1% on the news that franchise owners have agreed to lower the price of Big Mac meals in order to lure in more cash-conscious customers

- Analog Devices (ADI) climbed over 6% after the chipmaker posted a solid beat-and-raise earnings report

- Dayforce (CDAY) gained nearly 3% on reports that the HR software firm may be bought out for $70 per share

- Discount retailer TJX Companies profited from consumers hunting for a bargain last quarter, rising nearly 3% on strong earnings

Notable movers to the downside:

- Target (TGT) beat sales and earnings expectations, and even doubled down on its forward-looking guidance. But foot traffic at its stores declined over 3% over the quarter resulting in lower comparable sales – the 11th straight quarter of flat or falling sales, according to the Wall Street Journal

- Some of the biggest names in tech continued to tumble today as animal spirits turned against them: Apple fell nearly 2%, Tesla lost over 1.5%, and Palantir was pulled into bear market territory after it sank 1.10%

- Chip stocks crashed on a Reuters report that the Trump administration is considering taking a stake in all companies that received CHIPS Act funding. Intel lost nearly 7%, Micron fell nearly 4%, and TSMC dropped nearly 2%

- Estee Lauder (EL) sank over 3.5% after the beauty retailer warned that tariffs will take a $100 million bite out of the company's profits

- La-Z-Boy (LZB) plunged over 12%. The blame can be placed on lower foot traffic, lower sales of its key brand, and lower hopes that the recliner maker will turn things around anytime soon

- Building materials maker James Hardie Industries (JHX) plummeted nearly 35% after warning that demand in the US remains challenging

Thursday:

Stocks fell yet again today, bond yields rose, and commodities wavered as all eyes now turn to Jackson Hole, where Jerome Powell will be delivering his final big speech as Fed Chair on Friday, Aug 22nd, at 10 am ET.

The US and EU issued a joint statement outlining the next phase of their trade deal, including a 15% baseline tariff on most imports from Europe. The White House also launched a probe into imported wind turbine parts, likely foreshadowing more tariffs for the clean energy sector.

Weekly jobless claims rose to their highest level since June – the same day Kansas City Fed President Jeffrey Schmid and Cleveland Fed President Beth Hammack made it clear there's no rush to cut interest rates. Meanwhile, US manufacturing expanded at its fastest rate in over three years.

Notable movers to the upside:

- Nordson (NDSN) climbed 3% after the adhesive coating company announced better-than-expected earnings and revenue last quarter

- Paramount Skydance (PSKY) soared nearly 15%. There was no news on the stock so it may still be gripped by meme stock madness. House Democrats have launched a probe into its recent merger

- Chinese EV maker XPeng (XPEV) popped nearly 12% after its CEO purchased over 3 million shares of the company just days after an impressive earnings report

- Hewlett Packard Enterprise (HPE) climbed over 3.5% after Morgan Stanley analysts upgraded the tech stock and upped their price target, giving AI and networking demands as the driving force

Notable movers to the downside:

- Walmart (WMT) sank nearly 4.5% after earnings. But, if an investor looks under the hood at how things are really going, the retail giant is performing well. The company raised its full-year guidance on top of upping forecasts for the current quarter, with management crediting a "resilient" consumer amid a broader economic slowdown and threats of tariffs. Overall, the vast majority of analysts covering Walmart have a "buy" rating on the stock

- Coty (COTY) plummeted over 20% after the beauty brand reported a larger EPS loss than Wall Street expected, though it promised a turnaround in the next few months

- Instacart (CART) sank over 2% after Wedbush analysts downgraded the grocery delivery company, citing rising competition

- Renewable energy stocks tumbled after President Trump said via Truth Social that he will not approve any new solar or wind power projects. SolarEdgeTechnologies fell 5.77%, SunRun lost 4.72%, and First Solar dropped 6.99%

Friday:

In a tepid speech at the central bank's annual conclave in Jackson Hole, Powell said that "the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance". The Fed chief added that "the balance of risks appears to be shifting" between the central bank's dual mandate of full employment and stable prices. He cited "sweeping changes" in tax, trade and immigration policies.

Expectations for a quarter-point rate cut in September surged to roughly 83% following the speed from about 75% earlier in the week, according to the CME Group's FedWatch tool.

The markets rallied after Federal Reserve Chair Jerome Powell signaled the central bank could begin easing monetary policy next month.

The Dow reached a fresh high and the S&P came within three points of its record.

Shares of megacap technology stocks soared on Powell's comments. Today's market performance came in sharp contrast to much more downbeat market action earlier in the week. The major averages entered the session lower week-to-date due to pressure in megacap tech. Today's rally helped investors claw back most of the losses from earlier in the week.

Gold rose on rate cut hopes while oil fell as peace talks between Ukraine and Russia stalled. But the biggest winner is coffee: prices have risen for six straight days to cap off its biggest weekly gain since 2021.

Notable movers to the upside:

- Nvidia (NVDA) rose nearly 2% on reports that the chipmaker is having conversations with the US government about shipping more advanced chips to China

- Intel (INTC) climbed over 5.5% on reports that the US government is poised to take a 10% stake in the chipmaker. This will be the first direct US government ownership in a tech company

- META (META) rose over 2% on news of a 6-year, 10B cloud contract with GOOGL. This deal underscores massive infrastructure spending considered necessary for AI leadership

- Apple (AAPL)gained nearly 1.5% on reports that the company is in talks with GOOGL about using Gemini for Siri overhaul, conceivably accelerating AAPL's AI timeline

- Ubiquiti (UI), a network technology provider exploded over 30% after unveiling strong earnings, a higher dividend, and a new share buyback program

- OpenDoor (OPEN) soared nearly 40% on a combination of meme stock enthusiasm and hopes of a rate cut

- Zoom Communications (ZM) popped 12.71% after the communications company announced a beat-and-raise earnings report

- Tesla (TSLA) climbed nearly 6%. There was no company-related news, perhaps just renewed appetite for high-beta tech names?

Notable movers to the downside:

- Intuit (INTU) sank over 5% after the company reported a lower fiscal forecast than expected

- Workday (WDAY) fell nearly 3% on weaker forward forecasts, despite the HR software maker beating expectations last quarter

Considerations for the coming week

Economic Data Releases:

Monday: Durable goods orders are an indication of whether businesses are spending money on equipment. Weak numbers would support a view that the economy needs help.

Thursday: Initial Jobless Claims (Weekly) is a gauge of new unemployment filings and is considered vital for assessing labor market strength.

Friday: PCE (personal consumption expenditure) is the Federal Reserve's preferred gauge of inflation. If it runs hot, September rate cuts might be harder to justify.

Earnings Reports:

Some notable earnings reports due out during the week of Aug 25th – 29th are:

Monday: PDD Holdings (PDD)

Wednesday: Five Below (FIVE), Urban Outfitters (URBN), Guess (GES), CrowdStrike(CRWD), Nvidia (NVDA), Snowflake (SNOW), NetApp (NTAP)

Thursday: Affirm (AFRM), Dollar General (DG), Best Buy (BBY), Autodesk (ADSK), Marvell Technology (MRVL), Dell (DELL), Dick’s Sporting Goods (DKS), Toronto Dominion Bank (TD)

Closing Thoughts

Altcoins (cryptocurrencies other than Bitcoin) have traditionally trailed Bitcoin itself in terms of market value, recognition, and adoption by the financial world. But that has changed dramatically this year as investors seem to have embraced all things crypto, and nowhere is that more apparent than in the price of ethereum.

Ethereum is up around 40% this year compared to Bitcoin's 24% gain. It's partly due to the crypto's more affordable price point and mostly because more companies transforming into crypto treasuries are adopting the token en masse.

Ethereum is fast becoming a popular platform for building new fintech tools, a key consideration as traditional financial firms move into the crypto market.

Questions / Comments

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use support@ivolatility.com.

Previous issues are located under the News tab on our website.