Inflation Still Matters

September 1, 2025

Market Roundup for the Week

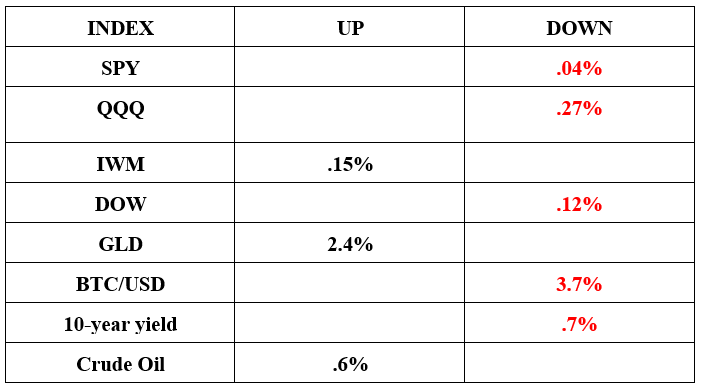

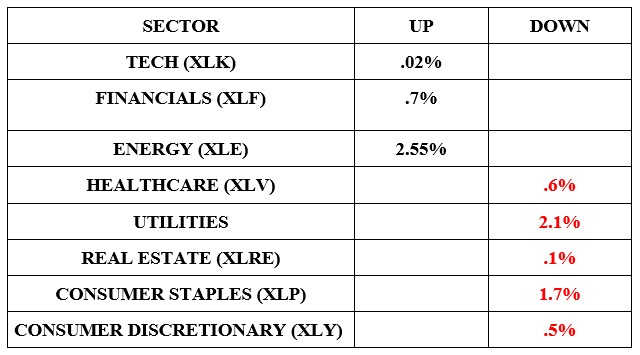

There was a lot of push pull between the major averages AND the individual sectors, but, by week's end there were small changes though the SPY hit an all-time high. Similarly, there was rotation among the S&P sectors with some up and some down.

Just when the market was settling on a newfound optimism over coming rate cuts, a fresh dose of inflation worries dampened the mood. A new reading on the Federal Reserve's preferred inflation gauge inched up for July, but the report also showed that consumer spending picked up last month. The latest inflation data, alongside a host of corporate earnings, which were largely eclipsed by the legal battle unfolding at the Federal Reserve, appears to reinforce a longstanding narrative on Wall Street. American consumers, despite it all, are still shopping through it.

11 of the 15 S&P 500 companies that reported earnings this week beat revenue estimates. But corporate earnings, while revealing a mixed picture of shifting behaviors and withheld spending, also showcased a consumer resilience that has bucked expectations.

Strategy Corner

Based on this week's market movements, here are some trading ideas and option strategies for the readers' consideration. The positions can be scaled bigger if suitable for larger accounts.

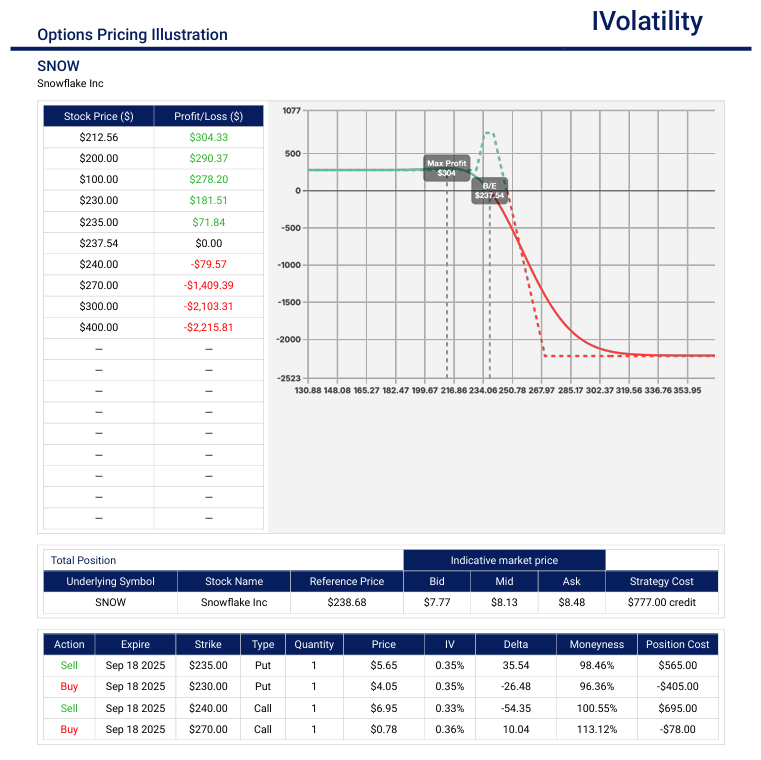

- SNWO (closed around 37.80 on Friday, Aug 29th)

This underlying rose over 20% following earnings on August 27th. If a trader might think that SNOW will settle a bit or even go down over the next few weeks, then a Reverse Jade Lizard strategy would be profitable.

For Sep19 expiration, sell the 230/235 put spread AND the 240/270 call spread.

Premium collected: $830 / Buying power deployed: $2170

No risk to the downside; upside breakeven just above 248

If SNOW expires:

– below 230, profit would be $330

– anywhere between 230 and 248, profit would be some fraction of the premium collected

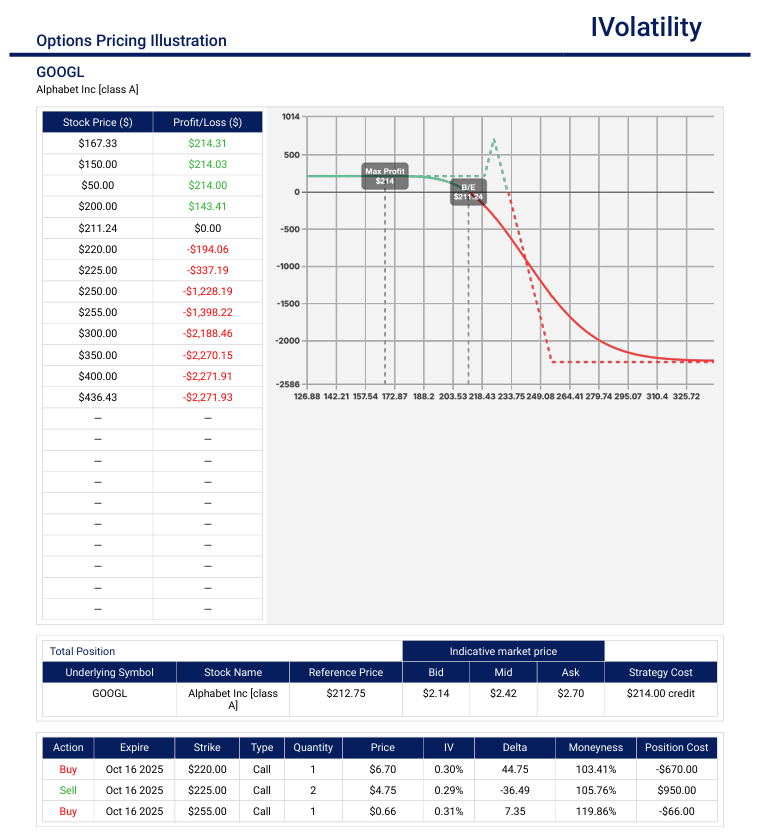

PnL Calculator from the IVolLive Web - GOOGL (closed around 213 on Friday, Aug 29th)

This underlying appears fairly extended. So a Call Broken-wing Butterfly might be in order. This is a uni-directional position and benefits if the underlying goes down but can, to a limited degree, also capture further upside moves.

Buy ONE oct17 220call / Sell TWO oct17 225calls / Buy ONE oct17 255call

Premium collected: $250 / Buying Power deployed: $2250

No risk to the downside; upside breakeven around 232

PnL Calculator from the IVolLive Web

Weekly changes in Major Indices

S&P 500 Sector Changes

Top S&P 500 Gainers:

Autodesk Inc. (ADSK)

- Performance: +7.5%

- Catalyst: Strong earnings report that exceeded expectations

Affirm Holdings Inc. (AFRM)

- Performance: +13%

- Catalyst: Positive quarterly results and optimistic forward guidance

Ambarella Inc. (AMBA)

- Performance: +20%

- Catalyst: Better-than-expected earnings and strong demand for its AI-powered video processing chips

Alibaba Group Holding Ltd. (BABA)

- Performance: +12%

- Catalyst: Strong earnings report and advancements in artificial intelligence initiatives

Berkshire Hathaway Inc. (BRK.B)

- Performance: +0.9%

- Catalyst: General market rally and investor confidence in Buffett's diversified portfolio

Cracker Barrel Old Country Store Inc. (CBRL)

- Performance: +8%

- Catalyst: Reversal of a controversial logo change and improved customer sentiment

Kohl's Corporation (KSS)

- Performance: +20%

- Catalyst: Better-than-expected quarterly earnings and strategic initiatives

Top S&P 500 Losers:

Marvell Technology Inc. (MRVL)

- Performance: -14%

- Catalyst: The stock plummeted following a weak Q3 revenue forecast and a downgrade by Bank of America, raising concerns about AI infrastructure demand

Dell Technologies Inc. (DELL)

- Performance: -6.4%

- Catalyst: Dell's stock fell after projecting Q3 earnings slightly below analyst expectations, despite beating Q2 earnings and revenue estimates

Nvidia Corporation (NVDA)

- Performance: -3.3%

- Catalyst: Nvidia's stock declined due to slower-than-expected AI chip sales and concerns over the China market, despite strong overall results

Hormel Foods Corporation (HRL)

- Performance: -13%

- Catalyst: Despite reporting a 6% increase in sales, Hormel missed earnings expectations due to rising commodity costs and warned of ongoing financial pressures

Review selected market profiles below:

Top Daily Headlines

Monday's Recap:

The S&P 500 and Dow both took a turn for the worse today after last week's late-breaking rally fizzled. The tech-heavy Nasdaq hung on for longer as investors prepared for Nvidia's earnings due this Wednesday, but it, too, fell into the red just before the end of the session.

Ether surged to an all-time high on Sunday just below $5,000, its first new record since 2021, only to collapse today alongside bitcoin.

Notable movers to the upside:

- PDD Holdings (PDD) eked out a 0.87% gain after the parent company of Chinese online retailer Temu posted solid earnings in spite of tariff turmoil

- Puma (PUMG) popped over 15% on reports that the Pinault family is considering selling its 29% stake in the footwear brand

- Vital Energy (VTLE) jumped over 14% on the news that it will be acquired by Crescent Energy for $3.1 billion

Notable movers to the downside:

- Furniture companies that import most of their goods took a beating on President Trump's promise to hit them with tariffs in the next 50 days. Restoration Hardware (RH) fell 5.33%, Wayfair (W) dropped over 6%, and Williams-Sonoma (WS) dropped nearly 3%.

- Figma (FIG), the design software maker had a red-hot IPO, but now that the quiet period is over, it fell nearly 9% after receiving less-than-favorable analyst ratings

- Crypto stocks crumbled with Mara Holdings (MARA) down nearly 5.5% and Coinbase (COIN) fell over 4%

- Railroad operators sank after Warren Buffett declared that Berkshire Hathaway is not in the market for another train company. CSX lost over 5%, Union Pacific fell nearly 2%, and Norfolk Southern dropped over 2.5%

Tuesday:

Long-term Treasury yields rose and short-term yields fell, opening the gap between 5-year and 30-year yields to its widest point in three years. This resulted from President Trump putting out an announcement on social media to fire Fed Governor Lisa Cook.

Equities barely budged on this Fed drama, with investors' attention fully focused on Nvidia earnings tomorrow afternoon.

Notable movers to the upside:

- Eli Lily (LLY) gained 5.85% thanks to late-stage clinical trial data showing strong results for its new weight-loss pill

- Semiconductor maker Semtech (SMTC) popped over 15% on stronger-than-expected earnings and a boost to its fiscal guidance

- Cracker Barrel (CBRL) recovered 6% after seven straight days of losses apparently fueled by its decision to change its logo

- Oklo (OKLO) gained over 4% after Bank of America analysts initiated their coverage of the nuclear power provider with a "buy" rating, citing rising AI demand

- Starbucks (SBUX) rose nearly 1% on its first day of selling the very popular Pumpkin Spice Latte

Notable movers to the downside:

- Constellation Brands (STZ) dropped over 3% thanks to a downgrade from Bank of America analysts, who predict that beer consumption will continue to drop

- Kohl's (KSS) lost over 6% on reports that the retailer has asked vendors for more time to settle its invoices

- Newegg Commerce (NEGG) fell over 20% after investor, Martin Shkrel, revealed he's bearish on the tech retailer.Beware that Shkreli often engages in controversial and provocative online behavior and his actions continue to fuel public debate about ethics in the pharmaceutical industry and corporate governance

Wednesday:

Markets meandered higher all day long as investors waited for the make-or-break earnings report from Nvidia after the markets close today.

50% tariffs on imports from India kick into effect today. Meanwhile, the EU may cut all tariffs on US industrial goods by the end of the week.

Oil rose on the idea that high tariffs against India could persuade the country to stop buying Russian crude.

The DOJ expanded its probe into United Health, looking into how the insurance giant reimburses doctors.

Apple Music will arrive on radio stations near you as the tech giant tries to compete with Spotify.

The CEO of Pop Mart is now richer than Peter Thiel thanks to Labubus. The toys have become a cultural phenomenon, particularly among young adults aged 15 to 40, who are drawn to their nostalgic and emotional appeal. This trend has been fueled by social media, celebrity endorsements, and the gamification of the consumer experience.

Notable movers to the upside:

- Canada Goose (GOOS) jumped over 16% on reports that the luxury clothing maker has received a bid to take it private valued at $1.4 billion

- MongoDB (MDB) exploded nearly 40% after the database developer crushed Wall Street's forecasts

- American Eagle (AEO) rose over 8.5% after the retailer enlisted Travis Kelce in a new partnership

- Cloud solutions company nCino (NCNO) gained nearly 14% after crushing Wall Street expectations and raising its fiscal forecast

- Cracker Barrel (CBRL) popped over 8% after the restaurant chain retracted its new logo design amid intense public pressure

Notable movers to the downside:

- JM Smucker (SJM) fell over 4% thanks to a tough quarter for the snack foods seller

- PayPal (PYPL) sank nearly 1% on reports that German banks are blocking transactions with the payment company due to a technical glitch

- Abercrombie & Fitch (ANF) barely beat Wall Street forecasts last quarter thanks to exceptional growth from its Hollister brand, but shares still fell over 1%

- Krispy Kreme (DNUT) fell nearly 3.5% after analysts lowered their rating on the stock to “underweight,” citing the end of its partnership with McDonald's

Thursday:

The US Department of Labor reported that initial jobless claims for the week ending August 23, 2025, decreased by 5,000 to 229,000, aligning with Wall Street expectations. This gauge is considered vital for assessing labor market strength. The Federal Reserve is closely monitoring labor market conditions, with Chair Jerome Powell acknowledging that a cooling labor market could influence decisions on potential interest rate cuts as early as September.

The EU made a formal proposal to remove tariffs on US industrial goods, setting the stage for reconciliation between the two powers.

Fertilizer prices have soared to their highest point since 2016 thanks to tariff uncertainty, leaving American farmers under immense strain. Gold climbed to a five-week high as traders stash their cash ahead of tomorrow's big PCE report.

Nvidia's earnings were good-but-not-great, but investors were happy enough that they pushed the S&P 500 above 6,500 for the first time ever.

Notable movers to the upside:

- Pure Storage (PSTG) soared over 30% on an excellent quarter and strong forward guidance due to its ties with META

- Snowflake (SNOW) climbed over 20% thanks to a great quarter, including a 32% increase in revenue year over year

- Burlington Stores (BURL) popped over 5% on a solid beat-and-raise earnings report

- Dollar General (DG) gained under 0.5% after reporting higher foot traffic and increased spending per customer last quarter

- Five Below (FIVE) rose nearly 4% after it raised its full-year fiscal guidance as shoppers search for deals heading into the holidays

Notable movers to the downside:

- Tesla (TSLA) sank over 1% on the news that the company's sales in Europe fell 40% year over year in July, while Chinese EV rival BYD's European sales skyrocketed 225%

- Crowdstrike (CRWD) had a good quarter but the stock dropped over 4.5% due to possible drop in sales in the coming quarters

- Urban Outfitters (URBN) tumbled over 10% after issuing a warning about tariffs hurting margins and resulting in possible price increases in the futures

- Dick's Sporting Goods (DKS) reported a solid quarter, but shares still slipped nearly 5%, probably due to the forthcoming merger with Foot Locker

- Hormel (HRL) sank over 13% after the food company missed EPS estimates and hinted at price increases ahead to offset tariff costs

- Best Buy (BBY) announced its best quarter of same-store-sales in years, but investors pushed the shares down nearly 4%, probably due to disappointment over the retailer not raising its fiscal guidance

Friday:

PCE (personal consumption expenditure) is the Federal Reserve's preferred gauge of inflation and, if it runs hot, September rate cuts might be harder to justify.

The PCE rose 2.6% from a year ago, while core inflation rose 2.9% annually. This suggests that Americans are still opening their wallets, despite tariff-induced higher prices – though some analysts note that consumers bought a lot of cars and not much else last month, skewing spending data.

Still, the odds that shoppers will continue spreading their money around seem to be dwindling: US consumer confidence dropped in August from July. That's the first drop in four months, and the lowest reading in three months – a sign that Americans are starting to flinch at the price creep they're seeing in stores.

The final trading day of the summer took a turn for the worse as a selloff in tech stocks yanked indexes down from recent all-time highs.

Gold hit a new all-time high as traders fretted about the possibility of the Federal Reserve losing its independence.

Notable movers to the upside:

- Alibaba (BABA) surged nearly 13% following its earnings announcement, as investors responded to the cloud growth and AI initiative, despite the revenue miss

- Autodesk (ADSK) rallied over 9% following strong earnings and a big bump in its fiscal guidance

- Petco Health & Wellness (WOOF) soared almost 24% as the company's turnaround efforts begin to show good results

- Affirm Holdings (AFRM) popped over 10% after revenue rose substantially and EPS nearly doubled Wall Street forecasts last quarter

- Celsius Holdings (CELH) rose over 5% after PepsiCo said it is increasing its stake in the energy drink maker

- SentinelOne (S) gained over 7% after a strong earnings report following increasing demand for the company's cybersecurity products

- Ambarella (AMBA) soared over 16% after the chip designer boosted its fiscal year revenue guidance by over 30%

Notable movers to the downside:

- Nvidia (NVDA) lost over3% as investors took profits following a so-so earnings report from the chipmaker

- Caterpillar (CAT) fell over 3.5% after the heavy machinery maker warned that tariffs will cost the company between $1.5 and $1.8 billion this year

- Dell Technologies (DELL) sank nearly 9% after its EPS guidance for the current quarter came in low

- Ulta Beauty (ULTA) tumbled over 7% despite the cosmetics retailer posting solid earnings and raising its full-year fiscal forecast

- Marvell Technology (MRVL) plunged nearly 20% after the chipmaker's lackluster quarter for its data center business and weaker-than-expected earnings guidance

Considerations for the coming week

Economic Data Releases:

Monday: Markets are closed

Tuesday: ISM manufacturing index

Wednesday: Job Openings and Labor Turnover Survey (JOLTS) for July 2025 / Factory Orders (July) / Durable Goods Orders

Thursday: ADP National Employment Report (private-sector payrolls) / Initial Jobless Claims / ISM Non-Manufacturing (Services) Index

Friday: Nonfarm Payrolls / Unemployment Rate (are cracks in the labor market healing or deepening?

Earnings Reports:

Monday: US markets are closed for Labor Day

Tuesday: Nio (NIO), Zscaler (ZS) and Signet Jewelers (SIG)

Wednesday: Macy's (M), Dollar Tree (DLTR), Campbell Co (CPB), Salesforce (CRM), Hewlett-Packard Enterprises (HPE), Figma (FIG), Gitlab, and C3.ai (AI)

Thursday: Broadcom (AVGO), Lululemon (LULU) and Docusign (DOCU)

Closing Thoughts

Many investors may not have realized that the best returns can actually be found outside the US. Emerging markets and international stocks have been outpacing domestic equities in 2025.The MSCI Emerging Markets Index has gained 31% this year, while the Vanguard Total International Stock Index has surged 21.5% – both outpacing the S&P 500's return of 9.93%.

The biggest reason that international markets have universally popped is that the dollar has weakened, declining nearly 9.5% this year when compared to a basket of international currencies. That makes foreign companies more valuable when compared to American ones. Emerging markets (EM) in particular have been on a serious tear.

"International equities could help diversify investment portfolios given the prominence of sectors such as financials and industrials (i.e., not tech) outside the US", explained strategist Julian McManus. However, selecting a random country probably isn't the best way to start.

Analysts strongly emphasize country-specific opportunities and currently have a preference for local bonds in Brazil, Colombia, Hungary, and Turkey and like stances on select sovereign credits including Chile, Colombia, Guatemala, Mexico, Morocco, South Africa, and Zambia.

Questions / Comments

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use support@ivolatility.com.

Previous issues are located under the News tab on our website.