Shadows Beneath the Rally

September 8, 2025

Market Roundup for the Week

Wall Street finished the holiday-shortened week mixed, as optimism over deeper Fed rate cuts was offset by mounting recession fears tied to labor market weakness.

Markets eked out modest gains by week's end, with the S&P 500 edging higher despite a mix of uneasy signals. Labor market data pointed to cooling momentum, raising questions about the strength of the economy. At the same time, Federal Reserve officials urged patience on rate cuts. Mega-cap tech once again carried the indices, but volume remained low and small caps and cyclicals lagged. Narrow leadership and a slowing economy cast long shadows that investors might not ignore. The rally looked impressive on the outside, but revealed growing shadows underneath. Should it be considered market resilience or growing complacency?

The economy appeared to be treading a fine line, with investors hoping for a goldilocks scenario – will the economy stay good enough to keep up the growth, but bad enough to get the interest rate cut. Wall Street's gains are fundamentally about earnings and positive earnings are harder to come by when the economy is struggling.

Is the market strength sustainable or simply running on borrowed time? Was this week a summer stall-out?

Strategy Corner

Based on this week's market movements, here are some trading ideas and option strategies for the readers' consideration. The positions can be scaled bigger if suitable for larger accounts.

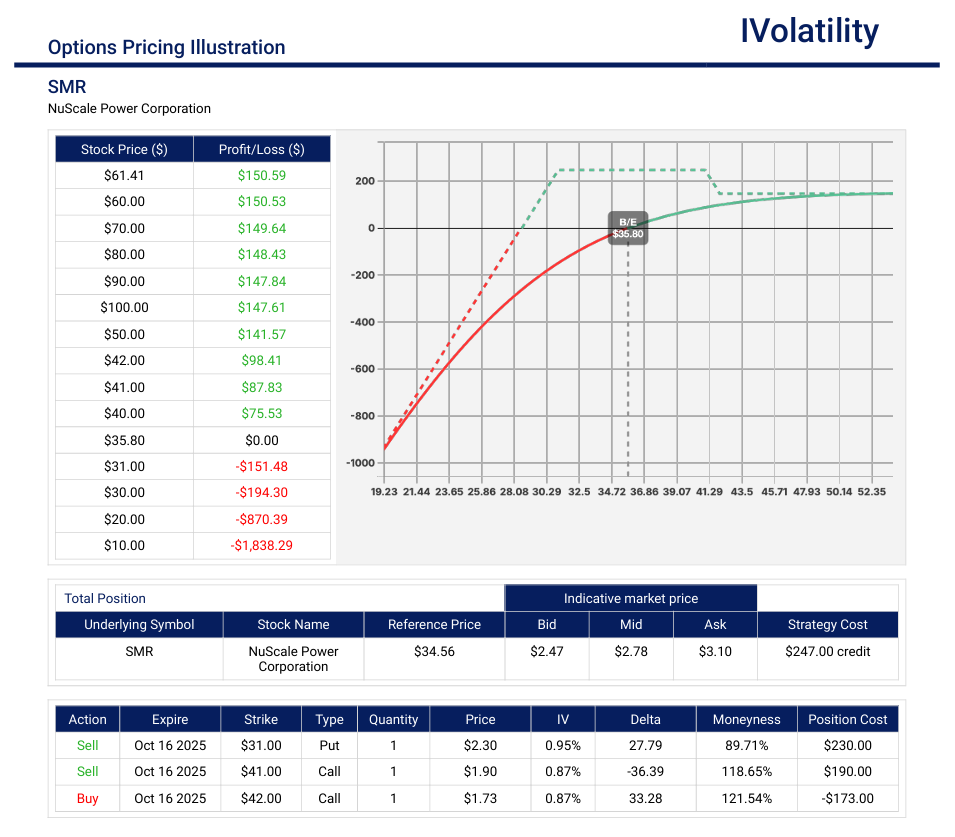

- SMR (closed around 34.52 on Friday, Sep 5th)

If a trader is bullish on SMR, then a Jade Lizard strategy could be a profitable trade.

For Oct 17 expiration, sell the 31put AND sell the 41/42 call spread.

Premium collected: $277 / Buying power deployed: $387

Probability of profit: 74%

No risk to the upside; downside breakeven just below 29

If SMR expires:

– above 42, profit would be $177

– anywhere between 31 and 41, profit would be $277

– below 31, the position would need to be closed or managed by rolling out in time or rolling down the call spread

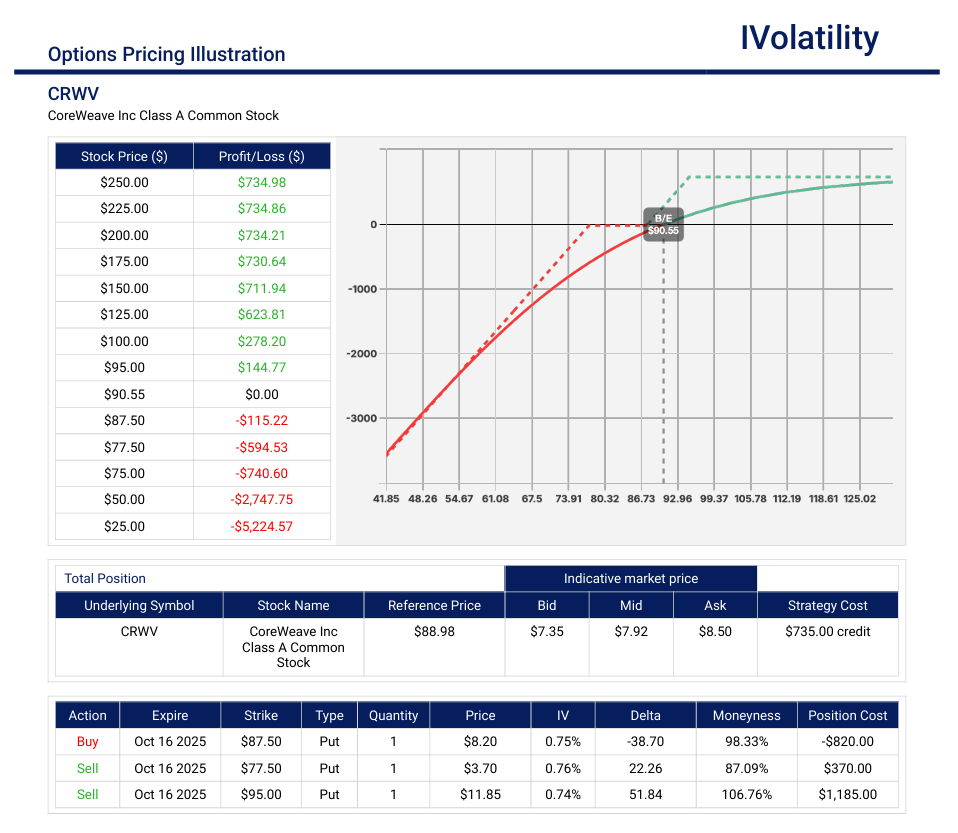

PnL Calculator from the IVolLive Web - CRWV (closed around 89.10 on Friday, Sep 5th)

If a trader is bullish on CRWV, then a Buffer strategy could be a profitable trade.

For Oct 17 expiration, buy the 77.5/87.5 put spread AND sell the 95put

Premium collected: $787 / Buying power deployed: $1110

No risk to the upside; downside breakeven just below 77.5

If CRWV expires:

– above 95, profit would be $787

– anywhere between 87.5 and 95, profit would be between $0-$277

– below 77.5, the position would need to be closed or managed by adding duration

PnL Calculator from the IVolLive Web

Weekly changes in Major Indices

| INDEX | UP | DOWN |

| SPY | .3% | |

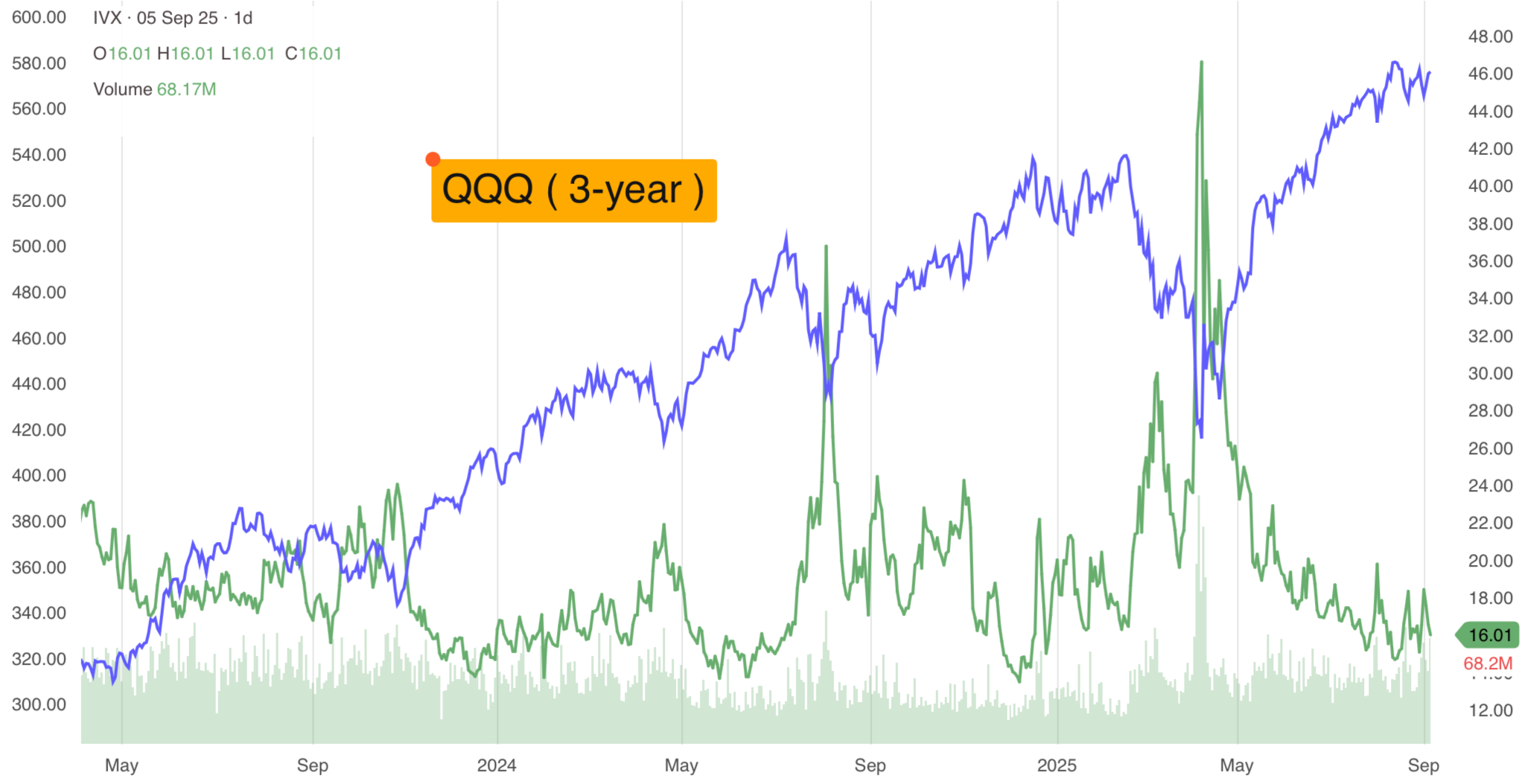

| QQQ | 1.1% | |

| IWM | 1% | |

| DIA | -.24% | |

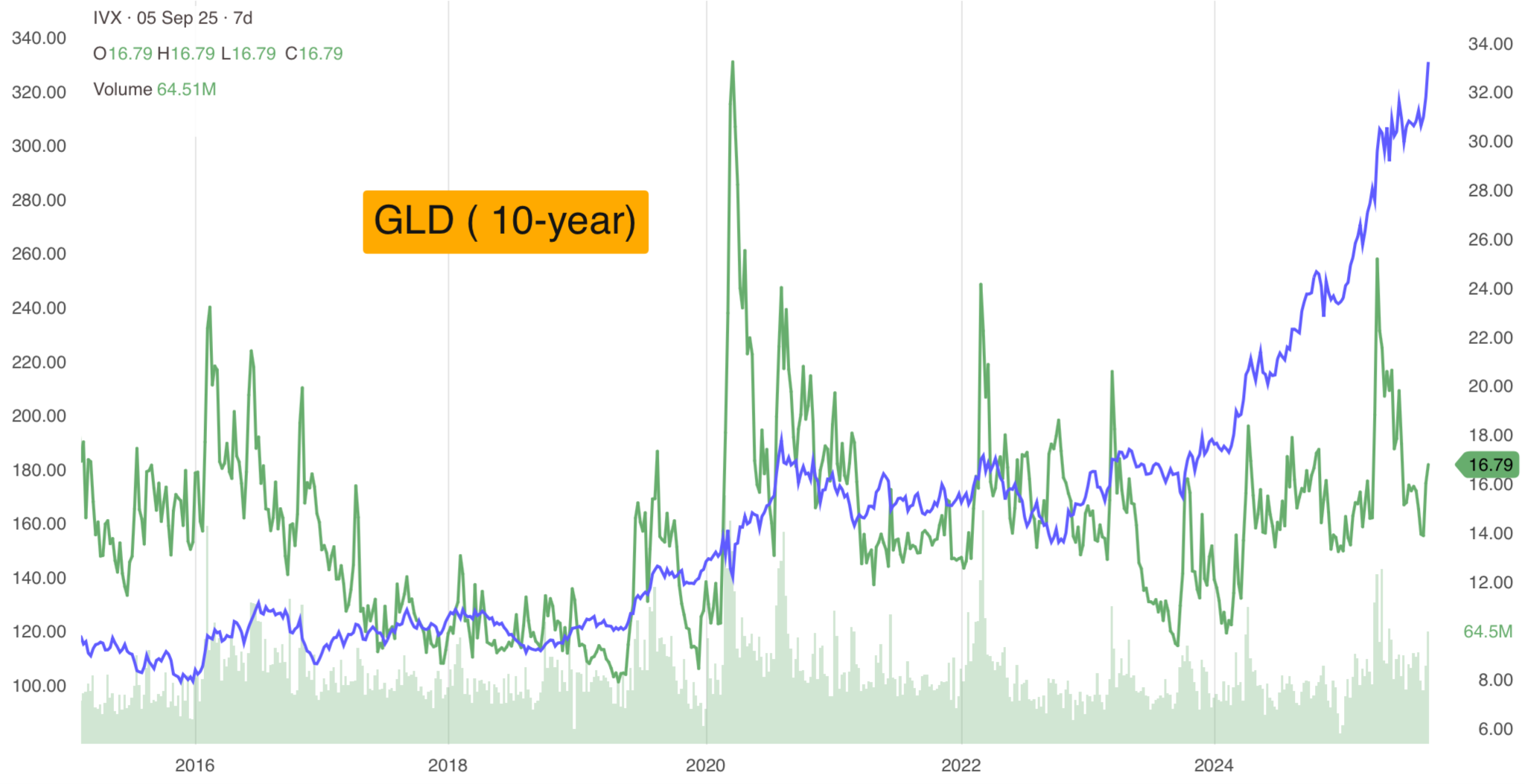

| GLD | 3.9% | |

| BTC/USD | 1.71% | |

| 10-year yield | -1.92% | |

| Crude Oil | -3.3% | |

| VIX | -1.2% |

S&P 500 Sector Changes

| SECTOR | UP | DOWN |

| TECH (XLK) | .2% | |

| FINANCIAL (XLF) | -1.7% | |

| INDUSTRIALS (XLI) | -.9% | |

| ENERGY (XLE) | -3.5% | |

| HEALTHCARE (XLV) | .4% | |

| UTILITIES | -1.1% | |

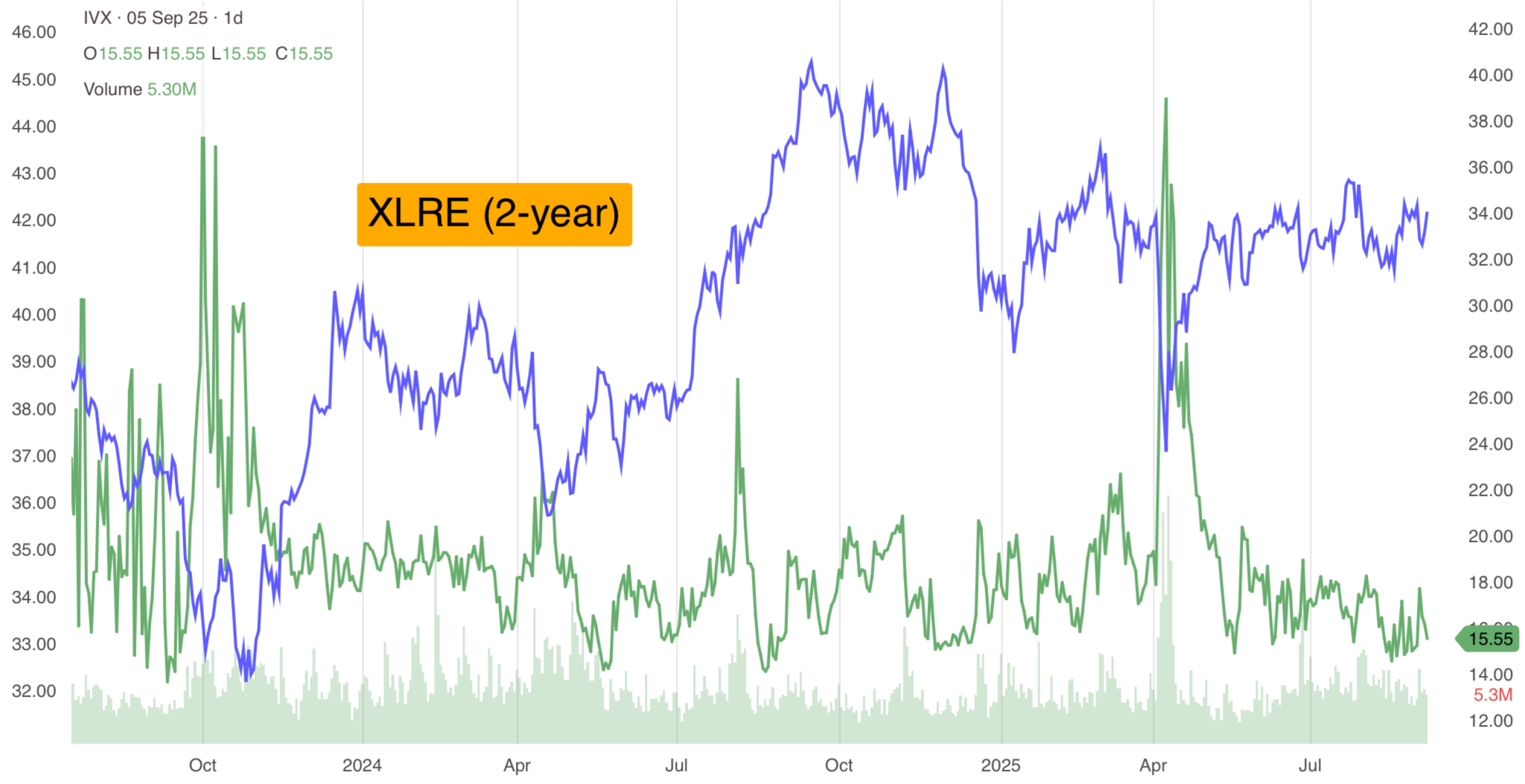

| REAL ESTATE (XLRE) | -.3% | |

| CONSUMER STAPLES (XLP) | .3% | |

| CONSUMER DISCRETIONARY (XLY) | 1.6% |

Top S&P 500 Gainers:

Seagate Technology (STX)

- Performance: +12,5%

- Catalyst: strong quarterly results and favorable outlooks and price targets from various analysts

Alphabet (GOOGL)

- Performance: +9,3%

- Catalyst: a favorable antitrust ruling that allowed it to retain its Chrome browser and continue its search deal with Apple

Broadcom (AVGO)

- Performance: +9,41%

- Catalyst: strong earnings beat and profit growth reported with a 63% surge in AI chip revenue

Apple (AAPL)

- Performance: +4,21%

- Catalyst: benefits from ruling for Alphabet that positively impacts its search deal prospects

Enphase Energy (ENPH)

- Performance: +8,57%

- Catalyst: continuing upward trend perhaps due to a recovery in solar demand and company's expansion into new markets. The stock is currently trading at a valuation below its historical averages, suggesting potential upside for investors

Micron Technology (MU)

- Performance: +5,76%

- Catalyst: positive sentiment in the semi-conductor space

Oracle (ORCL)

- Performance: +4,39%

- Catalyst: strong performance in cloud services

Stanley Black & Decker (SWK)

- Performance: +4,92%

- Catalyst: robust demand in its tools and storage segment

Top S&P 500 Losers:

Lululemon Athletica (LULU)

- Performance: -17,7%

- Catalyst: significant decline attributed to a weaker-than-expected earnings report and concerns over the impact of higher tariffs on its products

Dollar Tree (DLTR)

- Performance: -10%

- Catalyst: management's guidance for Q3 was underwhelming—earnings forecast to be flat year-over-year, well below analyst estimates

Kenvue (KVUE)

- Performance: -6,9%

- Catalyst: influenced by broader market trends affecting consumer goods companies

Advanced Micro Devices (AMD)

- Performance: -6,6%

- Catalyst: reflecting investor caution amid the tech sector's volatility

Interactive Brokers Group (IBKR)

- Performance: -6,4%

- Catalyst: impacted by market fluctuations affecting brokerage firms

Charles Schwab Corporation (SCHW)

- Performance: -5,8%

- Catalyst: broader financial sector trends

Review selected market profiles below:

Top Daily Headlines

Monday's Recap:

Markets were closed for the Labor Day holiday.

Tuesday:

September has historically been the weakest month for US stocks, including a much-awaited and consequential Federal Reserve meeting looming in mid-September.

Treasury yields popped today as investors digested a Federal appeals court ruling late last Friday declaring most of President Trump's tariffs as illegal. The 30-year yield closed in on the key 5% level.

Equities tumbled across the board as tech stocks sold off and pulled the rest of the market down with them.

Gold hit a new record high as traders hedged against tariff uncertainty and braced themselves for an extremely important US jobs report due on Friday that could make or break the case for the Fed to start cutting rates.

Notable movers to the upside:

- Cytokinetics (CYTK) soared over 40% after early results from its new heart disease treatment met with much approval at a recent cardiology conference

- Biogen (BGEN) rose over 5% due to the FDA's approval of its new once-weekly injectable version of its Alzheimer's treatment Leqembi

- Frontier Group Holdings (ULCC) popped 14.49% after Deutsche Bank said the low-cost airline is the biggest beneficiary of Spirit Airlines's second bankruptcy filing in a year

- Miners climbed across the board thanks to yet another new record high for gold. Newmont (NEM) rose nearly 2%, Barrick Mining (B) gained over 1%, and AngloGold Ashanti (AU) rallied over 2.5%

Notable movers to the downside:

- Paramount Skydance (PSKY) and Activision (now part of Microsoft after a 2023 acquisition) are joining forces to produce a live-action Call of Duty movie. However, investors were unimpressed and the company fell over 1.5%

- Target (TGT) fell over 3.5% after the American Federation of Teachers joined a boycott against the retailer. Many educators view the rollback of DEI initiatives as yielding to political pressure rather than standing firm on equity principles

- Nvidia (NVDA) continued to tumble another nearly 2% following its underwhelming earnings report last week

- Taiwan SemiConductor (TSMC) dropped over 1% after the US pulled its authorization to send key semiconductor parts to its China-based production facility

- Constellation Brands (STZ) sank nearly 7% after the international alcohol maker warned that weak demand means it's cutting its forward guidance

Wednesday:

In one of the biggest antitrust cases in decades, US District Judge Amit Mehta ruled against many of the Department of Justice's harshest proposals for Alphabet – including breaking the company up. It seems that the emergence of GenAI changed the course of this case.

After five years of legal battles, this victory sent Alphabet shares soaring 9.01% to a new all-time high.

Markets muddled along today, with the S&P 500 and Nasdaq buoyed after a pivotal antitrust ruling for Alphabet pushed big tech stocks higher across the board.

The 30-year Treasury brushed 5% today as traders fret about the Fed's independence and the odds of interest rate cuts (more on all that later).

Oil sank on reports that OPEC+ is contemplating increasing its crude output next month, while gold reached yet another new record high as uncertainty swirling around the future of tariffs continued to rise. Some analysts predict a high value of $4250 by year's end for gold.

Notable movers to the upside:

- American Bitcoin (ABTC), a bitcoin miner and treasury company backed by Eric and Donald Trump, Jr., soared over 16% on its first day of trading

- Campbell Co (CPB) rose over 7% on solid earnings

- NuScale Power Corp (SMR) jumped over 8.5% thanks to its new partnership with the Tennessee Valley Authority to develop several modular nuclear reactors

- TG Therapeutics (TGTX) climbed over 6.5% after the company declared a $100 million share repurchase program

Notable movers to the downside:

- Dollar Tree (DLTR) sank over 8% despite beating top- and bottom-line expectations last quarter and raising its guidance

- ConocoPhillips (COP) fell over 4% on the news that it will cut 20% to 25% of its workforce

- United Therapeutics (UTHR) took a breather from its wild rally, dropping over 3% as shareholders took profits following strong trial results for its lung disease treatment

- Skillz (SKLZ) dropped almost 17% after a key customer terminated its contract with the online multiplayer gaming platform

Thursday:

Equities climbed slowly but steadily throughout the day as investors braced themselves for Friday's all-important jobs report.

Gold remained in the spotlight as traders bulked up on bullion to protect their portfolios in case the Federal Reserve loses its independence. If that does happen, Goldman Sachs analysts think gold could climb to $5,000.

Bitcoin fell as a selloff in cryptocurrencies associated with the Trump family pulled the entire crypto market lower.

Notable movers to the upside:

- American Eagle (AEO) soared % over 37% after reporting impressive earnings attributed to its recent Sydney Sweeney advertisement

- Hewlett Packard Enterprise (HPE) rose over 1% after reporting record quarterly revenue and raising its fiscal guidance

- Ciena (CIEN) jumped over 23% thanks to a beat-and-raise earnings report, as well as the announcement it will cut 4% to 5% of its workforce to reduce expenses

- T. Rowe Price (TROW) rose nearly 6% on the news that Goldman Sachs will buy up to $1 billion of the asset managers' shares as part of a new partnership

- Gap (GAP) popped nearly 6% after investors seemed to like the idea of the company selling makeup

Notable movers to the downside:

- Salesforce (CRM) sank nearly 5% though the company beat top and bottom-line estimates. The disappointing revenue guidance for the current quarter could be held responsible for the stock dropping

- C3.ai (AI) dropped over 7% thanks to a serious decline in revenue, a large EPS loss, and the appointment of a new CEO

- Gitlab (GTLB), a software developer tool maker, fell nearly 7.5% after lowering current quarter and full-year fiscal guidance

- Figma (FIG) sank 20% following its first earnings report since its IPO. Revenue was up 41% but marginally below Wall Street expectations and guidance was slightly above forecasts. Given the company's hefty valuation and upcoming share unlock potential, investors hit the stock quite hard

Friday:

Stocks started the day on a high note after a weak jobs report raised hopes that the Fed will cut interest rates this month. But the rally faded as the afternoon wore on, while 10-year bond yields tumbled to their lowest level since April.

President Trump said "fairly substantial" tariffs for semiconductors are coming "very shortly", but hinted that companies like Apple will be spared. He also clapped back at EU regulators for fines against Google.

With or without revisions, the labor market appears to be cracking under pressure.

22,000 in August, far below projections of 75,000 and a steep backtrack from the revised 79,000 increase in July. Meanwhile, the unemployment rate officially climbed to 4.3%, its highest level since 2021.

The JOLTS survey showed that the number of new job openings dropped by 176,000 in July, its worst reading since the pandemic in 2020. Plus, ADP reported that US private employers added just 54,000 jobs in August, far below estimates of 75,000.

The carnage isn't expected to stop anytime soon, but the upside is that the Federal Reserve now has good reason to cut interest rates later this month. Traders now put the chance of a September rate cut at 90%.

"Tariffs and AI are weighing on job growth this year", explained Chief Economist for Comerica Bank Bill Adams in a note today. "Economic growth will likely remain modest through year-end, then regain traction in 2026 as fiscal and monetary policy turn more accommodative."

The markets seem to have fully priced in a September Fed rate cut of 25 bps, with a 10% chance the FOMC drops rate by 50bps.

Gold benefited from the drop in rates, powering above $3,500/oz. and gaining over 4% for the week.

Notable movers to the upside:

- Broadcom (AVGO) jumped on Friday after the chipmaker unveiled a $10 billion AI chip order from a new customer, fueling optimism around its ability to benefit from the generative AI race

- Alphabet (GOOG and GOOGL) shares rose after a U.S. antitrust ruling was not as severe as feared. Judge Amit Mehta has ruled that Google will be required to share online search data with rivals while avoiding harsher penalties, including the forced sale of its Chrome business

- Tesla (TSLA) board proposed a performance-based pay package for CEO Elon Musk, potentially worth around $1 trillion. The 10-year plan ties Musk's payout to ambitious targets, including scaling Tesla's robotaxi business and boosting the company's market value from about $1 trillion to $8.5 trillion

- T. Rowe Price (TROW) rallied after Goldman Sachs said it plans to acquire a stake of up to 3.5%, as part of a collaboration agreement. The alliance will focus on offering investment products for retirement

- American Eagle (AEO) gained after the clothing retailer reported better-than-expected Q2 revenue, boosted by demand following its Sydney Sweeney ad campaign

- Lumen Technologies (LUMN) shares rose after the company announced a partnership with Palantir (PLTR) to integrate its Foundry and AI Platform, supporting Lumen's transition from a traditional telecom to a next-gen tech infrastructure provider

Notable movers to the downside:

- GitLab (GTLB) shares fell Thursday after a weaker-than-expected sales outlook for the third quarter, a conservative revenue guide for the full year, and a sudden CFO exit rattled investors

- Lululemon (LULU) fell after the athletic clothing retailer cut its earnings guidance for the full year

- Figma (FIG) fell after the software design company forecast annual sales that failed to impress Wall Street's expectations. This was the company's first report since it went public in late July

- Texas Instruments (TXN) shares fell after CFO Rafael Lizardi said the recovery is progressing more slowly than some expected, noting that while four of its five end-markets are improving, the automotive market remains weak

Notable Economic Data due week of Sep 8th-12th:

Tuesday: preliminary jobs revision will be released. This could indicate weaker labor market conditions than previously reported, potentially influencing the Federal Reserve's approach to interest rates.

Thursday: Consumer Price Index will be released. This will be closely watched for signs of inflationary pressures.

Notable Earnings Reports due week of Sep 8th-12th:

The actual day may vary, so do consult with your broker to confirm the actual date.

Monday: CASY

Tuesday: ORCL / SNPS / MOMO /

Wednesday: CHWY / GME /

Thursday: ADBE / KR /

Closing Thoughts

A research internship usually entails taking coffee orders and making copies. XTX Markets, a high-frequency trading (HFT) firm, just posted a new open position for an AI Research Internship at $35,000 per month (not including the signing bonus).

AI has proven to be an incredible force multiplier in the dog-eat-dog HFT industry. Demand is high for knowledgeable employees who are capable of creating money-making machines. However, when interns are potentially being paid near $1/2million per year, could it be a sign that the AI bubble is getting larger and larger and perhaps on the brink of bursting?

Questions / Comments

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use support@ivolatility.com.

Previous issues are located under the News tab on our website.