The Week That Stocks Roared

September 22, 2025

Market Roundup for the Week

For the first time since December 2024, the Federal Reserve cut interest rates by .25% bringing the target range to 4-4.25%. The decision appears to have been largely driven by concerns over a weakening labor market.

The rate cut led to a decline in 30-year fixed mortgage rates to 6.39%, the lowest since October 2024. This development boosted housing-related stocks, with the PHLX Housing Index rising 15% this quarter, outperforming the S&P 500's 7% gain. Companies like D.R. Horton, KB Home, and Toll Brothers saw significant gains.

The cut sparked optimism about further easing, perhaps in October and December.

Year-to-Date, the S&P is up over 13%, the Nasdaq is up over 17% and the Russell is up nearly 10%.

Strategy Corner

Based on this week's market movements, here are some trading ideas and option strategies for the readers' consideration. The positions can be scaled bigger if suitable for larger accounts.

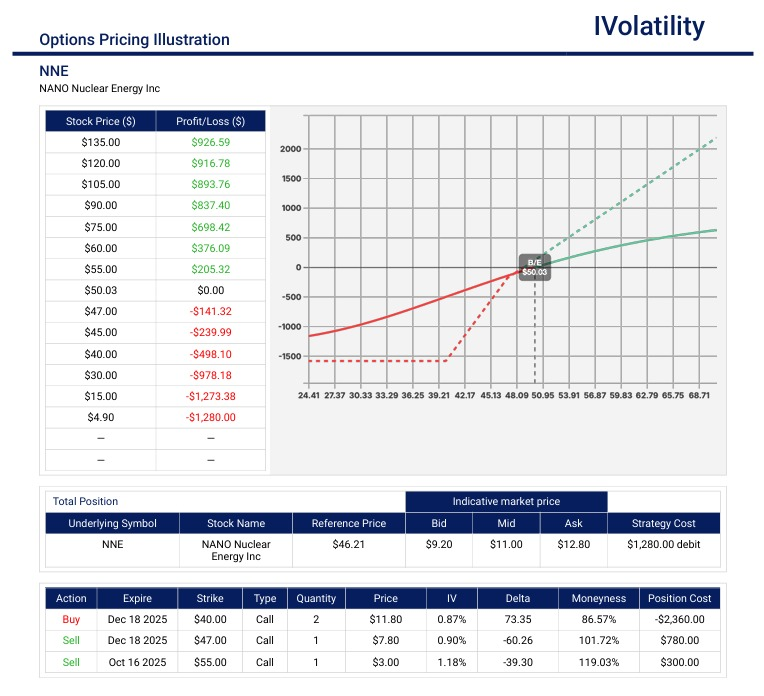

- NNE (closed around 46.27 on Friday, Sep 19th)

NNE is in the business of commercializing compact, next-gen nuclear technology as an alternative to building large, traditional nuclear power plants. The growing demand for always-on, high-power infrastructure (like AI training/data centers) is stressing grids. Nuclear is being seen as a cleaner, more reliable baseload power source relative to many renewables. This has been frequently cited as a key tailwind.

So, if an investor would like to be bullish, a covered call zebra could be used.

For Dec19 expiration, buy two 40calls and sell one 47call creating a position with 83positive deltas. This is a synthetic way to emulate a long stock position using a lot less capital.

Cover the long stock position by selling one Oct17 55call.

Debit paid about $1130; max potential value about $2200.

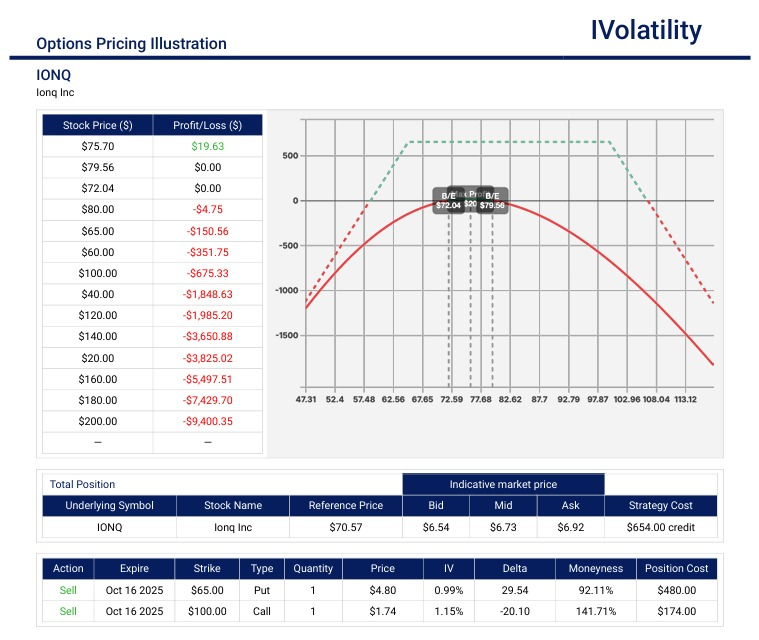

PnL Calculator from the IVolLive Web - IONQ (closed around 70.44 on Friday, Sep 19th)

This is a quantum computing hardware and software company and has recently moved off its YTD lows. If an investor would like to open a neutral to slightly bullish position, a strangle with positive delta might be a strategy to consider.

For Oct 17 expiration, sell the 65/100 strangle.

Probability of profit around 64% / Premium collected about $672 / Buying power deployed about $870.

Risk to both sides with breakevens around 58 and 107.

If IONQ expires anywhere between 65 and 100, max profit would be equal to premium collected.

If IONQ expires beyond the breakevens, the position would need to be closed or managed by adding duration.

PnL Calculator from the IVolLive Web

Weekly changes in Major Indices

| INDEX | UP | DOWN |

| SPY | .96% | |

| QQQ | 2.13% | |

| IWM | 1.93% | |

| DIA | .78% | |

| GLD | 1.06% | |

| BTC/USD | -.39% | |

| 30-year US treasury bond | 1.50% | |

| Crude Oil | -0.02% | |

| VIX | 4.66% |

Top S&P 500 Gainers:

Oklo (OKLO) up about 64% for the week.

A recent between the U.S. and U.K. is accelerating deployment of advanced reactors. This sort of policy support suggests faster licensing and more government & private sector collaboration, which benefits companies like Oklo.

Intel (INTC) up almost 23% for the week.

The catalyst was Nvidia's announcement that it will invest $5 billion in Intel, acquiring common stock at $23.28 per share, along with a collaboration to jointly develop custom chips for PCs and data centers. The deal signals a strong vote of confidence from one of the leaders in AI hardware.

Tesla (TSLA) rose just over 7.5% for the week.

Elon Musk disclosed a purchase of 2.57 million Tesla shares, his first open-market acquisition since 2020. This move was perceived by investors as a strong vote of confidence in Tesla's future prospects.

Tesla received approval from the Arizona Department of Transportation to test autonomous robotaxi vehicles in the Phoenix Metropolitan area.

Top S&P 500 Losers:

Dexcom (DXCM) dropped about 11% probably due to a short-seller report raising some concerns about the company's glucose monitors and financials.

DR Horton (DRI) reported weaker than expected Q3 financial results and cited challenges in the housing market and elevated mortgage rates.

KB Homes (KBH) fell 2.5%, again citing headwinds from the housing market slowdown and elevated mortgage rates.

Lennar (LEN) fell about 4% reporting weaker than expected Q3 financials and citing challenges in the housing market and elevated mortgage rates.

Texas Instruments (TXN) declined about 2% probably due to China's anti-dumping investigation into US semi-conductor companies.

Analog Devices (ANI) declined about 2% probably due to China’s anti-dumping investigation into US semi-conductor companies.

Review selected market profiles below:

Top Daily Movers

Monday: Notable movers to the upside

Tesla Inc. (TSLA) surged over 3.5%, driven by positive developments including a favorable legal settlement and insider stock purchases.

Alphabet Inc. (GOOGL) gained 4.5%, surpassing a $3 trillion market cap. the gain could be attributed to growing investor enthusiasm for AI-driven demand.

Apple Inc. (AAPL) rose over 3% following the global launch of the iPhone 17, with analysts raising price targets amid strong demand forecasts.with analysts raising price targets amid strong demand forecasts.

Microsoft Corporation (MSFT) increased by nearly 2%, supported by continued growth in cloud services and AI applications.

Monday: Notable movers to the downside

DexCom Inc. (DXCM) plummeted nearly 11% following a short-seller report that raised concerns about the company's glucose monitoring systems and financial practices.

Hess Midstream Partners (HESM) declined over 8%, likely due to broader market pressures affecting energy infrastructure stocks.

Corteva Inc. (CTVA) dropped over 5.5% despite reports of potential corporate breakups, indicating investor skepticism about the company's strategic direction.

Alaska Air Group (ALK): Fell 6.7% amid concerns over rising fuel costs and operational challenges impacting the airline industry.

Seagate Technology (STX) gained nearly 8%, fueled by optimism over data center construction and AI infrastructure.

Tuesday: Notable movers to the upside

Oracle Corporation (ORCL) rose 4% following reports that the company may be involved in a consortium enabling TikTok's continued U.S. operations. This speculation, coupled with a strong earnings report, boosted investor confidence.

Alphabet (GOOGL) rose over 1% when its AI chatbot, Gemini, received top rank in the US App Store. Strong investor sentiment led to the company surpassing a $3 trillion market cap.

Chipotle Mexican Grill (CMG) announced a $500 million stock buyback and the stock rose nearly 2%.

Ferguson Enterprises (FERG) surged nearly 8% after reporting better-than-expected earnings, pointing to a strong performance in the building materials sector.

QMMM Holdings (QMMM) rose over 22% after an announcement about a strategic expansion into cryptocurrency and blockchain AI solutions.

Tuesday: Notable movers to the downside

Nvidia Corporation (NVDA) fell nearly 2% after China's antitrust regulator accused the company of violating antimonopoly laws related to its 2020 acquisition of Mellanox Technologies. This raised concerns about Nvidia's ability to resume sales of its H20 chips and introduce its advanced Blackwell processors in China, a significant market for the company.

Dave & Buster's Entertainment, Inc. (PLAY) plummeted 17% following disappointing earnings and revenue reports.

L'Oréal S.A. (OR) declined nearly 2% after receiving an analyst downgrade to “underperform” based on concerns about the company's growth trajectory and valuation.

Alphabet Inc. (GOOGL) dipped nearly .2% after reaching a record high and surpassing a $3 trillion market cap. The slight decline was attributed to profit-taking following strong performance and concerns over potential regulatory scrutiny.

Wednesday: Notable movers to the upside

Oklo (OKLO) surged probably due to the announcement of the Atlantic Partnership for Advanced Nuclear Energy between the United States and the United Kingdom. This agreement aims to expedite the development and deployment of next-generation nuclear technologies, including small modular reactors (SMRs) and microreactors.

Brighthouse Financial (BHF) rose over 5%, primarily driven by reports that a consortium is in advanced discussions to acquire Brighthouse Financial for $65 to $70 per share. The proposed acquisition price represents a significant premium over Brighthouse's recent trading levels, reflecting investor optimism about the potential deal.

Wednesday: Notable movers to the downside

Nvidia (NVDA) declined almost 1.5% after reports emerged that China's internet regulators had banned the company's AI chips.

Oracle (ORCL) dipped nearly 2% amid broader market fluctuations and investor reactions to recent developments in the technology sector.

Thursday: Notable movers to the upside

Intel Corporation (INTC) surged nearly 30% upwards following Nvidia's announcement of a $5 billion investment in the company. The collaboration aims to co-develop advanced chips for data centers and PCs, signaling a strong vote of confidence from a key industry player.

Nvidia Corporation (NVDA) rose over 10% following an investment in INTC that boosted investor sentiment about the partnership's potential to drive innovation in semi-conductor technologies.

Synopsys Inc. (SNPS) rose over 10% in anticipation of increased demand for its electronic design automation software, benefiting from the Intel-Nvidia collaboration./p>

CrowdStrike Holdings Inc. (CRWD) shares gained after the cybersecurity firm provided an improved forecast for annual recurring revenue, signaling strong business growth.

Netskope (NTSK), a cybersecurity company, surged 18% in its Nasdaq debut.

Thursday: Notable movers to the downside

Darden Restaurants (DRI) dropped nearly 8% after reporting weaker-than-expected earnings, citing challenges in the housing market and elevated mortgage rates.

Cognizant Technology Solutions (CTSH) dropped nearly 5% with the technology sector facing headwinds.

Harley-Davidson Inc. (HOG) dropped nearly 5% after reporting a 21% drop in global retail motorcycle sales for the first quarter, leading to a 23% decline in quarterly revenue. These figures reflect weak consumer confidence and high interest rates, which have negatively impacted demand for discretionary products.

Scholastic Corporation (SCHL) dropped nearly 11% after reporting disappointing earnings. There are concerns over potential new US visa fees and regulations that could impact future business operations.

Friday: Notable movers to the upside

Apple Inc. (AAPL) rose over 3% following the global launch of the iPhone 17 and strong demand forecasts. This prompted analysts to raise their price targets, boosting investor confidence.

FedEx Corporation (FDX) reported quarterly earnings that exceeded analyst expectations and the company provided a positive outlook for fiscal 2026.

Newmont Corporation (NEM) rose nearly 3% after announcing its aim to reduce debt and streamline operations.

Uber Technologies (UBER) rose over 2.5% after reporting increased demand and higher-than-expected revenues.

Fortinet Inc. (FTNT) rose nearly 3% after the cybersecurity company reported increased investor interest amid rising concerns over digital security threats.

Friday: Notable movers to the downside

Intel Corporation (INTC) dropped over 3%, Following a significant 23% surge the previous day due to a $5 billion share purchase by Nvidia. Citi downgraded Intel to "Sell" over high valuation concerns, leading to the decline.

Micron Technology, Inc. (MU) experienced a nearly 4% pullback after a 12-day winning streak and hitting a record high. The decline was attributed to profit-taking and a short-seller report raising concerns about its financials.

Lennar Corporation (LEN) dropped over 4% after reporting weaker-than-expected Q3 financial results, citing challenges in the housing market and elevated mortgage rates.

Notable Economic Data due week of Sep 15th-19th:

These data points can be crucial for assessing the current economic landscape and can influence market sentiment and Federal Reserve policy decisions.

Monday:

Chicago Fed National Activity Index (Aug)

A composite index measuring overall economic activity and inflationary pressures. A sharp deviation from the neutral value of zero could influence expectations for future Fed actions.

Treasury Bill Auctions

The U.S. Department of the Treasury will auction 13-week and 26-week bills. These auctions provide insights into investor demand for short-term government debt and can impact short-term interest rates.

Tuesday:

S&P Global Flash PMIs (Sep)

Preliminary readings for manufacturing and services sectors. A reading above 50 indicates expansion, while below 50 signals contraction. These indices offer early insights into economic momentum.

New Home Sales (Aug)

Data on the number of newly constructed homes sold. A key indicator of housing market health and consumer confidence.

Wednesday:

Durable Goods Orders (Aug)

Measures new orders placed with manufacturers for durable goods. A rise suggests business investment confidence, while a decline may indicate economic slowdown concerns.

Revised Q2 GDP Growth

An updated estimate of the economy's growth rate for the second quarter. Significant revisions can alter perceptions of economic strength.

Initial Jobless Claims

The number of individuals filing for unemployment benefits for the first time. A decrease suggests a strengthening labor market.

Wholesale Inventories (Aug)

Data on the stock of goods held by wholesalers. A rise may indicate slowing sales, while a drop could point to strong demand.

Thursday:

Existing Home Sales (Aug)

Measures the number of previously owned homes sold. Reflects consumer confidence and housing market trends.

Core PCE Price Index (Aug)

The Federal Reserve's preferred inflation gauge, excluding food and energy. A key indicator for future monetary policy decisions.

Friday:

University of Michigan Consumer Sentiment Index (Final, Sep)

A measure of consumer confidence. A higher index suggests optimism about the economy, potentially leading to increased spending.

Notable Earnings Reports due week of Sep 15th-19th:

The actual day may vary, so do consult with your broker to confirm the actual date.

Monday: SPIR / FEAM

Tuesday: MU / SFIX / MLKN / ACUT / AZO / AIR

Wednesday: CTAS / KB / UEC

Thursday: KMX / ACN / JBL / SNX / BB / COST / LUXE

Friday: IPX / NEOV / TAYD / FONR

Closing Thoughts

"Macro can move the tide, but micro decides which boats float."

Macro factors include interest rates, inflation, unemployment, GDP growth, geopolitical tensions, and overall market liquidity.

Micro factors are company-specific fundamentals such as earnings growth, profit margins, balance sheet strength, management quality, competitive advantages, and innovation. Even in a rising tide, poorly managed or financially weak companies can underperform or fail, while strong companies can thrive even in adverse macro conditions.

Macro factors can lift or sink the market as a whole. But individual companies respond differently: strong fundamentals, resilient business models, and smart management determine which stocks thrive and which lag, regardless of market trends.

Are investors just reacting to headlines, or are they digging into the companies that will weather the waves? Remember: macro sets the conditions, micro decides the outcome.

Questions / Comments

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use support@ivolatility.com.

Previous issues are located under the News tab on our website.