Caution to the Wind, Continue to Buy

October 6, 2025

Market Roundup for the Week

Federal Reserve has no jobs data, farmers are in need of bailouts, valuations are stretched. but none of this appeared to matter.

The 3 market indices hit record highs while the government stayed shut down. Traders appeared to shrug off concerns over the shutdown and its effect on economic data. Historical data shows that stocks largely take shutdowns in stride.

The nonfarm payrolls report was due out on Friday but got cancelled after the U.S. Bureau of Labor Statistics was left with just one employee. Without this report, traders can only look through job opening figures, private employment updates and job cut data.

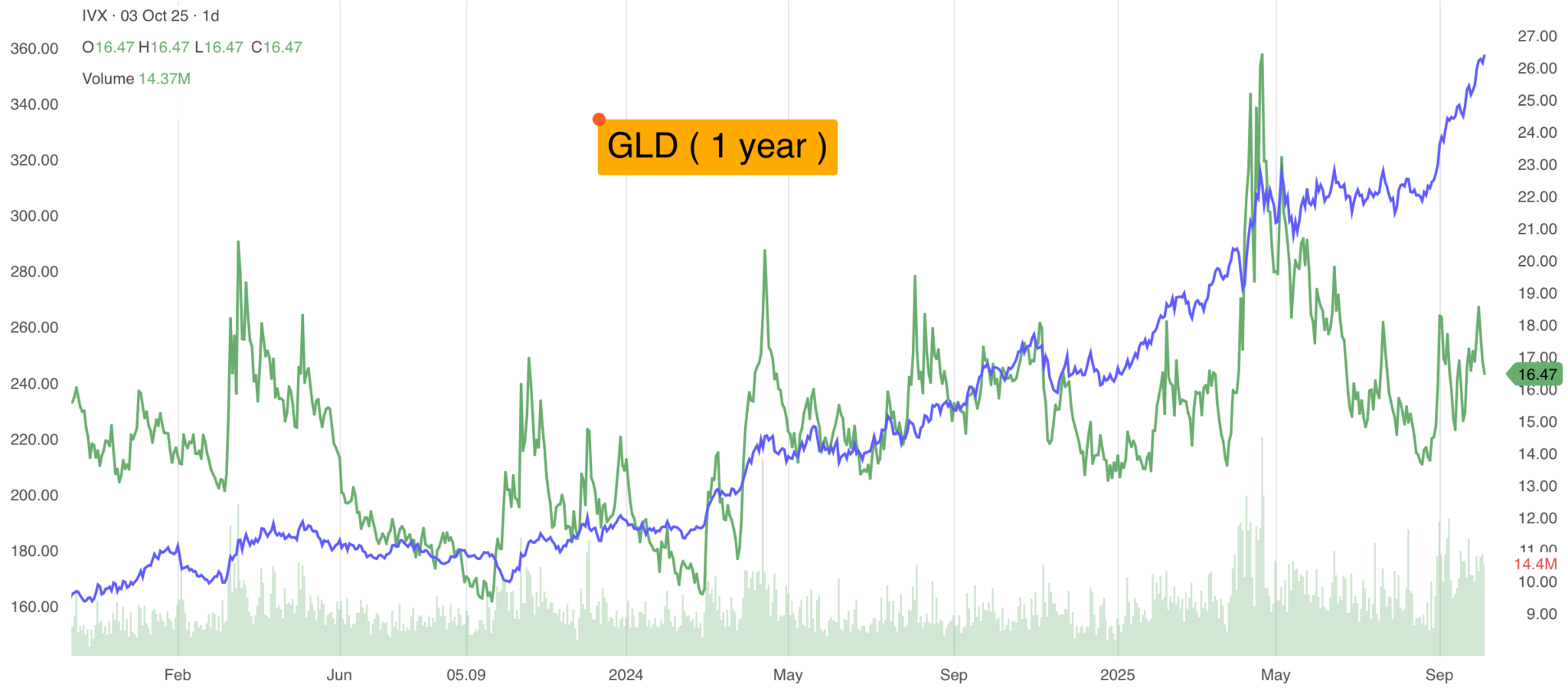

Gold popped above $3,800 an ounce to a new record. Bitcoin briefly popped above $123,000 to reach within 1% of its record high. The world's biggest crypto appears to be getting a "safe haven" boost from the government shutdown, similar to its older cousin, gold.

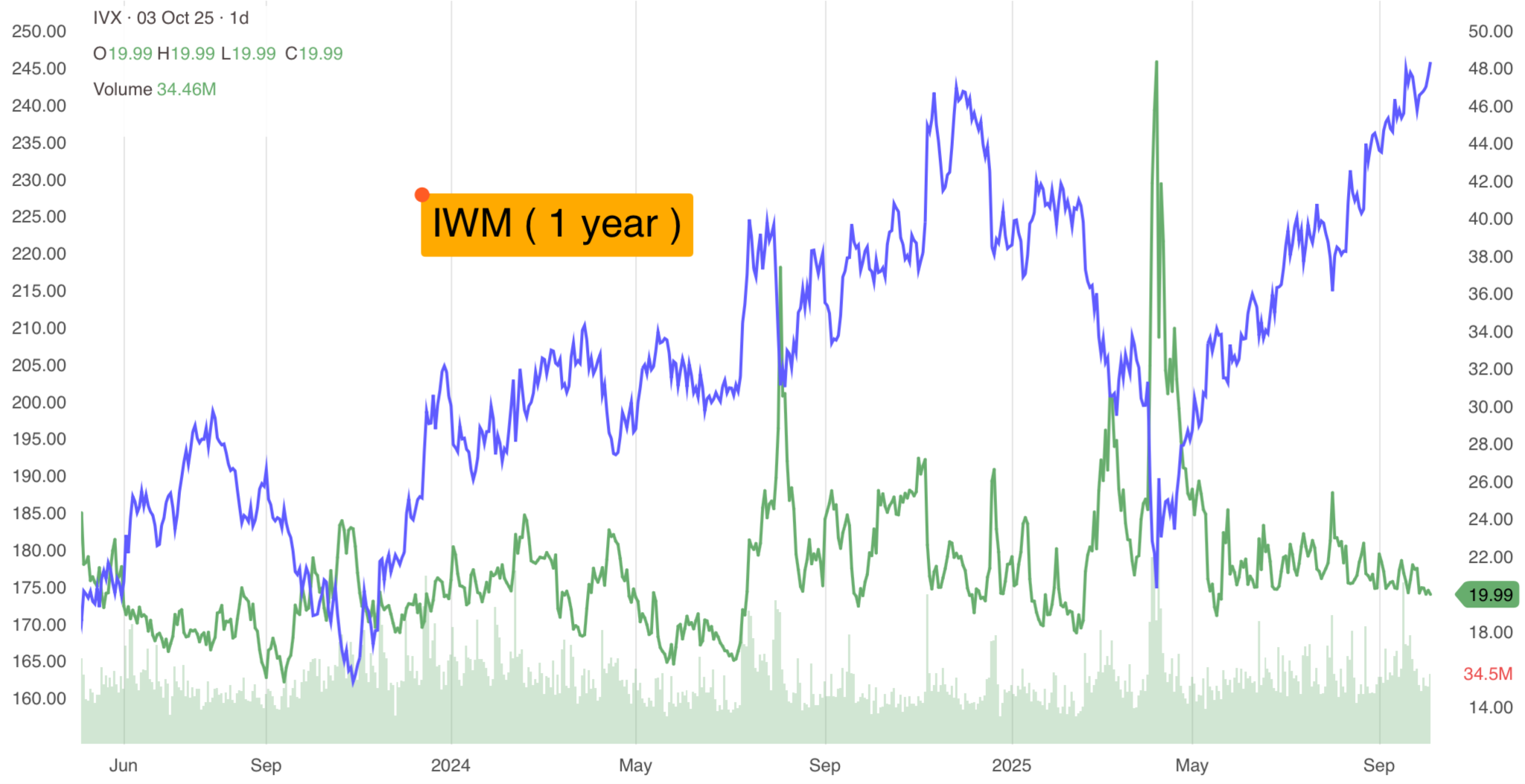

If seasonal patterns are any indication, the rally could continue through New Year's because the fourth quarter has historically been the stock market's best-performing stretch of the year. Keep in mind though, October has historically been the most volatile month of the year for the markets.

Strategy Corner

Based on this week's market movements, here are some trading ideas and option strategies for the readers' consideration. The positions can be scaled bigger if suitable for larger accounts.

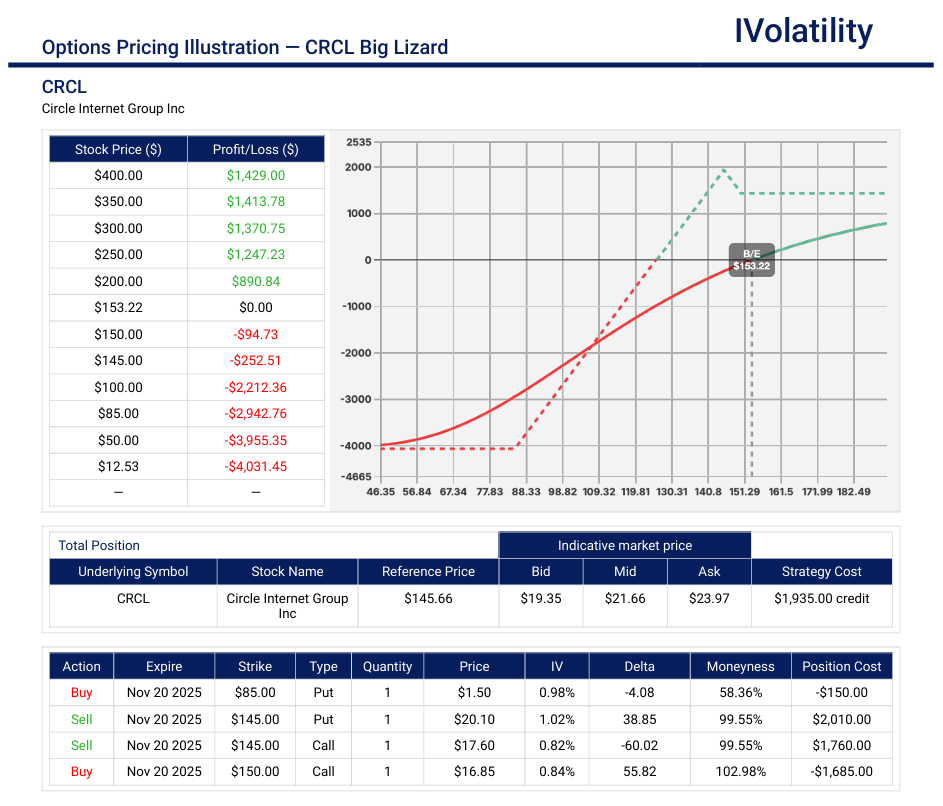

- CRCL (closed around 145.76 on Friday, Oct 3rd)

Circle operates a platform and network for stablecoins (digital tokens pegged to fiat currencies, like the US dollar). They offer products including tokenized funds, payments, liquidity services, developer tools, and other applications around the internet financial system.

So, if an investor would like to be bullish, a Big Lizard strategy could be employed.

For November 21st expiration, sell the 145 straddle and buy the 150call.The premium collected exceeds the width of the $5 short call spread and hence removes risk to the upside.

Reduce the buying power required by buying the 85 put.

Probability of profit around 62% / Premium collected about $2200 / Buying power deployed about $3800 / downside breakeven around 123 (short put less premium collected).

If CRCL expires above 150, then the maximum potential profit is $1700 (2200-500).

If CRCL expires below its downside breakeven of 123, the position would need to be closed or managed in other ways.

If CRCL expires between 123 and 150, a certain portion of the premium collected may be retained.

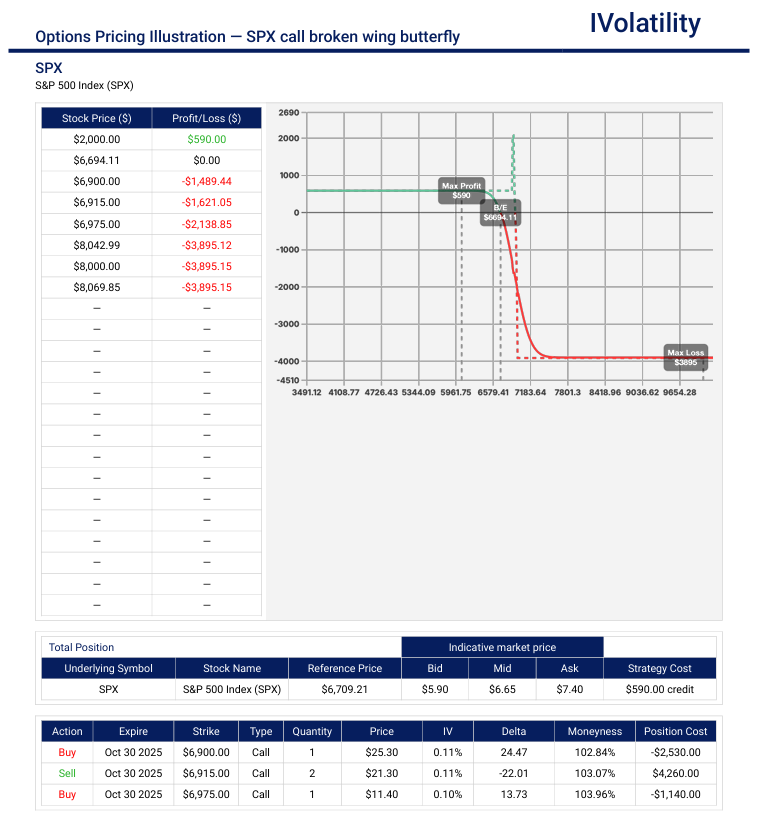

PnL Calculator from the IVolLive Web - SPX (closed around 6715 on Friday, Oct 3rd)

SPX represents the S&P 500 Index — a stock market index that tracks the performance of 500 of the largest publicly traded companies in the United States. It has enjoyed a very good run up for the year and, if an investor would like to establish an upside limit, then a Call Broken-Wing Butterfly could be a productive strategy.

For Oct 31 expiration, Buy one 6900call / Sell two 6915calls / Buy one 6975 call.

Probability of profit around 75% / Premium collected about $700 / Buying power deployed about $3800.

No risk to the downside / Upside breakeven around 6937.

If SPX expires below 6900, max profit would be equal to premium collected.

If SPX expires beyond the upside breakeven of 6937, the position would need to be closed or managed by adding duration.

If SPX expires between 6900 and 6937, an additional premium can be collected (due to the characteristics of a butterfly).

PnL Calculator from the IVolLive Web

Weekly changes in Major Indices

| INDEX | UP | DOWN |

| SPY | 1.12% | |

| QQQ | 1.21% | |

| IWM | 1.86% | |

| DIA | 1.35% | |

| GLD | 3.14% | |

| BTC/USD | 11.46% | |

| 30-year US treasury bond | -.08% | |

| Crude Oil | -7.36% | |

| VIX | 8.89% |

Top S&P 500 Gainers:

Western Digital (WDC) surged approximately 23% following a Morgan Stanley significant price target increase, citing a spike in hard disk drive demand tied to cloud infrastructure.

Bio-Techne (TECH) rose around 21% upon news of advancements in spatial biology technology that bolstered investor confidence.

Coinbase (COIN) jumped over 20% being positively impacted by a rebound in Bitcoin prices to two-month highs above $120,000.

Charles River Laboratories (CRL) increased about 19% following an analyst upgrade and a breakout past technical buy points.

Fair Isaac (FICO) gained around 22% after revelation of a shift to offer FICO scores directly to vendors.

Top S&P 500 Losers:

Palantir Technologies (PLTR) dropped about 5% following a US Army memo flagging vulnerabilities in a communications network involving PLTR.

Las Vegas Sands (LVS) declined over 7% over concerns of a tropical cyclone hitting Macau during the busy Golden Week and impacting casino stocks.

Wynn Resorts (WYNN) declined over 7% as well over fears of a tropical storm impacting tourism and gaming revenues.

Nike (NKE) declined about 3.5% despite an earnings beat. NKE initially rose modestly after the earnings beat but the stock pulled back because the guidance suggested potential headwinds, and some investors interpreted it as a cautionary signal for the next quarter.

Applied Materials (AMAT) dropped nearly 3% due to US export restrictions.

Review selected market profiles below:

Substantial Movers on a Daily Basis

Monday: Notable movers to the upside

Etsy (ETSY) jumped over 15% after OpenAI announced a new feature that lets buyers use ChatGPT to buy from Etsy sellers in the US.

Tilray (TLRY) spiked over 60% and Canopy Growth (CGC) nearly 20% spiked after a video was posted hyping up CBD's potential health benefits for seniors.

Merus (MRUS), a Dutch drugmaker, rallied over 35% after agreeing to be acquired by larger rival Genmab for $8 billion.

Coal companies Peabody Energy (BTU) and Ramaco Resources (METC) rose over 9% and 4% respectively after news that the US administration announced plans to increase coal use in the country.

Monday: Notable movers to the downside

Carnival (CCL) fell nearly 4% despite a good earnings report and being a top analyst pick in the leisure industry. It has rallied sharply earlier in the year and perhaps investors are locking in gains causing "a harsh reaction" on the stock.

MoonLake Immunotherapeutics (MLTX) tanked nearly 90% after a trial for its antibody-based therapy for a skin condition appeared to flop in results last week.

Intel (INTC) dropped nearly 3% after the stock apparently took a breather following its 20% gain the prior week.

Tuesday: Notable movers to the upside

Oracle Corporation (ORCL) rose 4% following reports that the company may be involved in a consortium enabling TikTok's continued U.S. operations. This speculation, coupled with a strong earnings report boosted investor confidence.

Alphabet (GOOGL) rose over 1% when its AI chatbot, Gemini, received top rank in the US App Store. Strong investor sentiment led to the company surpassing a $3 trillion market cap.

Chipotle Mexican Grill (CMG) announced a $500 million stock buyback and the stock rose nearly 2%.

Ferguson Enterprises (FERG) surged nearly 8% after reporting better-than-expected earnings, pointing to a strong performance in the building materials sector.

QMMM Holdings (QMMM) rose over 22% after an announcement about a strategic expansion into cryptocurrency and blockchain AI solutions.

Tuesday: Notable movers to the downside

Nvidia Corporation (NVDA) fell nearly 2% after China's antitrust regulator accused the company of violating antimonopoly laws related to its 2020 acquisition of Mellanox Technologies. This raised concerns about Nvidia's ability to resume sales of its H20 chips and introduce its advanced Blackwell processors in China, a significant market for the company.

Dave & Buster's Entertainment, Inc. (PLAY) plummeted 17% following disappointing earnings and revenue reports.

L'Oréal S.A. (OR) declined nearly 2% after receiving an analyst downgrade to "underperform" based on concerns about the company's growth trajectory and valuation.

Alphabet Inc. (GOOGL) dipped nearly .2% after reaching a record high and surpassing a $3 trillion market cap. The slight decline was attributed to profit-taking following strong performance and concerns over potential regulatory scrutiny.

Wednesday: Notable movers to the upside

Nike (NKE) gained nearly 6.5% after reporting more progress in its turnaround business efforts. The company had been losing market share to competitors like Hoka and On in its running shoes business but seems to be finding a groove again.

Intel (INTC) spiked over 7% on a report that the company is in talks to add AMD as a foundry customer, in what would be a big advantage for a struggling side of its business.

Pharma stocks such as Pfizer (PFE), Moderna (MRNA), Eli Lilly (LLY), Regeneron (REGN) and Merck (MRK) rose nearly 10% in tandem a day after Pfizer avoided tariffs by making a deal with President Trump.

Lithium Americas (LAC) soared over 20% following a Bloomberg report that the US government is taking a 5% equity stake in the Canadian miner and a 5% stake in its Thacker Pass project in Nevada.

AES rose over 16% on a report that BlackRock's Global Infrastructure Partners was looking to buy it for $38 billion.

Wednesday: Notable movers to the downside

Reddit (RDDT) sank nearly 12% on reports that ChatGPT is sourcing less content from the social media company.

Grocery stocks including Walmart (WMT), Target (TGT) and Kroger (KR) ticked lower on the news that Amazon is rolling out a private-label food brand with most products costing under $5.

Peloton (PTON) slid nearly 4% after the company announced it was overhauling its product lineup and raising prices.

Thursday: Notable movers to the upside

Fair Isaac (FICO) surged over 17% after saying it would sell its credit scores directly to mortgage resellers. That was not good news for intermediary credit reporting giants Experian, Equifax and TransUnion, whose shares all tumbled on the announcement.

Stellantis (STLA), a global automaker whose brands include Jeep, Dodge, Peugeot, Fiat, Chrysler jumped nearly 8% after reporting a 6.4% increase in US sales, its first quarterly sales growth this year.

Intel (INTC) rose another 3.78% to put its monthly gain at more than 50%. The US government's 10% stake in the chipmaker is now worth $16 billion, up from an initial investment of $8.9 billion.

Kodiak AI (KDK) increased 14.60% today after Soros Fund Management bought a 5.7% passive stake in the newly public maker of driverless trucking technology.

Thursday: Notable movers to the downside

Rivian (RIVN) surprised with upside Q3 sales, but the stock dropped over 7% due to lower full-year guidance.

Netflix (NFLX) dropped nearly 1% amid boycott calls by Elon Musk pointing to unwelcome contents in one of its programs.

Friday: Notable movers to the upside

Quantum stocks that included Rigetti Computing (RGTI), D-Wave Quantum (QBTS) and Quantum Computing (QUBT) soared on a series of optimistic headlines about the sector. These were a combination of commercial milestones, institutional endorsements, and sector-wide optimism.

Plug Power (PLUG) popped nearly 35% to close out a huge week that saw it deliver a new electrolyzer array to a company in Portugal and snag a price-target boost from a prominent analyst.

Rumble (RUM), a video-sharing platform, gained nearly 16% on an announcement about a partnership with AI startup Perplexity.

USA Rare Earth (USAR), a rare earth miner, rose over 14% after the CEO said the company is "in close communication" with the White House.

Shopify (SHOP) rose over 6.5% on an announcement about an upcoming integration into ChatGPT.

Friday: Notable movers to the downside

Palantir (PLTR) tumbled nearly 7.5% on a report that its battlefield communications system may have significant flaws. The company did push back, claiming that those issues had been resolved.

GameStop (GME) dropped nearly 7% after filing paperwork about future sale of stock and other securities that would dilute shareholders.

Applied Materials (AMAT), a maker of chip equipment, fell nearly 3% after it warned that US export curbs might result in a dent in future sales.

Roblox (RBLX) dropped over 8% after reporting a deceleration in its bookings growth. Growth dropped to the low 30% range in the US markets and this slowdown raised concerns among investors about the company's growth trajectory.

Notable Economic Data due week of Oct 6th-10th:

Please note that the ongoing federal government shutdown which began on October 1st, 2025 may delay or cancel some of these reports. The shutdown has led to the furlough of approximately 800,000 federal employees and the suspension of various government services. As a result, several key economic data releases, including the monthly jobs report from the Bureau of Labor Statistics, may be delayed or canceled. These data points can be crucial for assessing the current economic landscape and can influence market sentiment and Federal Reserve policy decisions.

This disruption hampers policymakers' ability to assess the economy accurately, especially as signs of a weakening labor market emerge. With the potential delay or absence of crucial economic data, markets may also experience increased volatility.

Wednesday: The Federal Reserve is expected to release the minutes from its September meeting, where it implemented a 0.25% rate cut. Markets will be closely analyzing these minutes for insights into the Fed's future policy direction.

Thursday: Chair Jerome Powell is scheduled to speak at 2:30pm EST. His remarks will be studied for any indications of the Fed's stance on economic conditions and monetary policy.

Friday:University of Michigan Consumer Sentiment Index (Preliminary) will be released. This report provides insights into consumer confidence, which is a critical indicator of future consumer spending and overall economic health.

In addition, the Treasury Department is expected to release the federal budget data for September, offering a snapshot of the government's fiscal position.

Notable Earnings Reports due week of Oct 6th-10th:

The actual day may vary, so do consult with your broker to confirm the actual date.

With economic data releases dried up because of the government shutdown, investors will focus on the new earnings season that's right around the corner. A trickle of reports should show up, leading up to all the big banks in the following week.

Monday: Constellation Brands (STZ)

Tuesday: McCormick & Co. (MKC)

Wednesday: No significant earnings announcements are due

Thursday: PepsiCo (PEP) / Delta Air Lines (DAL) / Tilray Brands / Levi Strauss (LEVI)

Friday: Diageo (DEO) / BlackRock (BLK) / British American Tobacco (BTI)

Closing Thoughts

There was some concern expressed about the current surge in AI stocks that could lead to a market correction, similar to the dot-com bubble burst of the late 1990s. While AI has much potential, there appears to be significant overvaluations in certain AI stocks that could lead to a "drawdown" as these valuations are eventually noticed. Cyclical behavior of this type is common in markets along with the fact that only a few individual underlyings actually survive the surge.

Questions / Comments

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use support@ivolatility.com.

Previous issues are located under the News tab on our website.