Volatility Returns

November 10, 2025

Market Roundup for the Week

Please find here a list of highlights / news clips that potentially drove markets all week long.

- The US economy is showing signs of a growing divide, with low-income consumers being hit hardest by inflation and rising prices.

- The Fed carried out its largest liquidity injection since the pandemic, pumping $29.4 billion into the banking system through repo operations.

- Cardboard box sales sank to their lowest third-quarter level since 2015, hinting at a slow holiday shopping season.

- Trump negotiated a deal with Eli Lilly and Novo Nordisk to lower the price of obesity drugs, aiming to offer some treatments for as low as $149 per month. Eli Lilly and Novo Nordisk agreed to cut the prices of their weight-loss drugs in exchange for tariff relief and access to Medicare patients.

- Not all layoffs are being driven by AI—some companies are using the narrative to mask missteps and good old-fashioned cost cutting.

- US companies have announced nearly 950,000 job cuts through September, marking the highest YTD total since 2020.

- Starbucks sold a 60% stake in its China business to private equity firm Boyu Capital in a deal valued at $4 billion, handing over operational control in its second-largest market.

- Instacart is leaning into AI, launching a new tool that offers personalized meal planning, budgeting, and product recommendations for grocery shoppers.

- Norway's $2 trillion sovereign wealth fund, which holds a 1.14% stake in Tesla, said it will vote against Elon Musk's proposed $1 trillion pay package.

- Digital asset treasuries, aka public companies that buy and hold crypto, were a great investment – until they weren't.

- The services sector showed stronger growth than expected last month, buoying hopes that the US economy remains strong.

- Some talk of Google building a mega-data center in outer space.

- The FAA reduced flight traffic by 10% at 40 airports due to the government shutdown.

- Google is going toe-to-toe with Nvidia with Ironwood, the company's most powerful chip ever.

- Meta Platforms reportedly projected that 10% of sales in 2024, or $16 billion, came from running ads for scams.

- Consumer sentiment fell to its lowest level in three years, nearly its lowest level ever, due to fears surrounding the government shutdown.

- Tesla is considering building a "gigantic" semiconductor fabrication plant to meet its AI and robotics needs, and could potentially partner with Intel.

- Over 75% of the companies that reported earnings this week beat EPS expectations.

- Restaurant chains are starting to feel the pain of consumers closing up their wallets.

- The widespread selloff among digital assets wiped out almost all of crypto's gains in 2025.

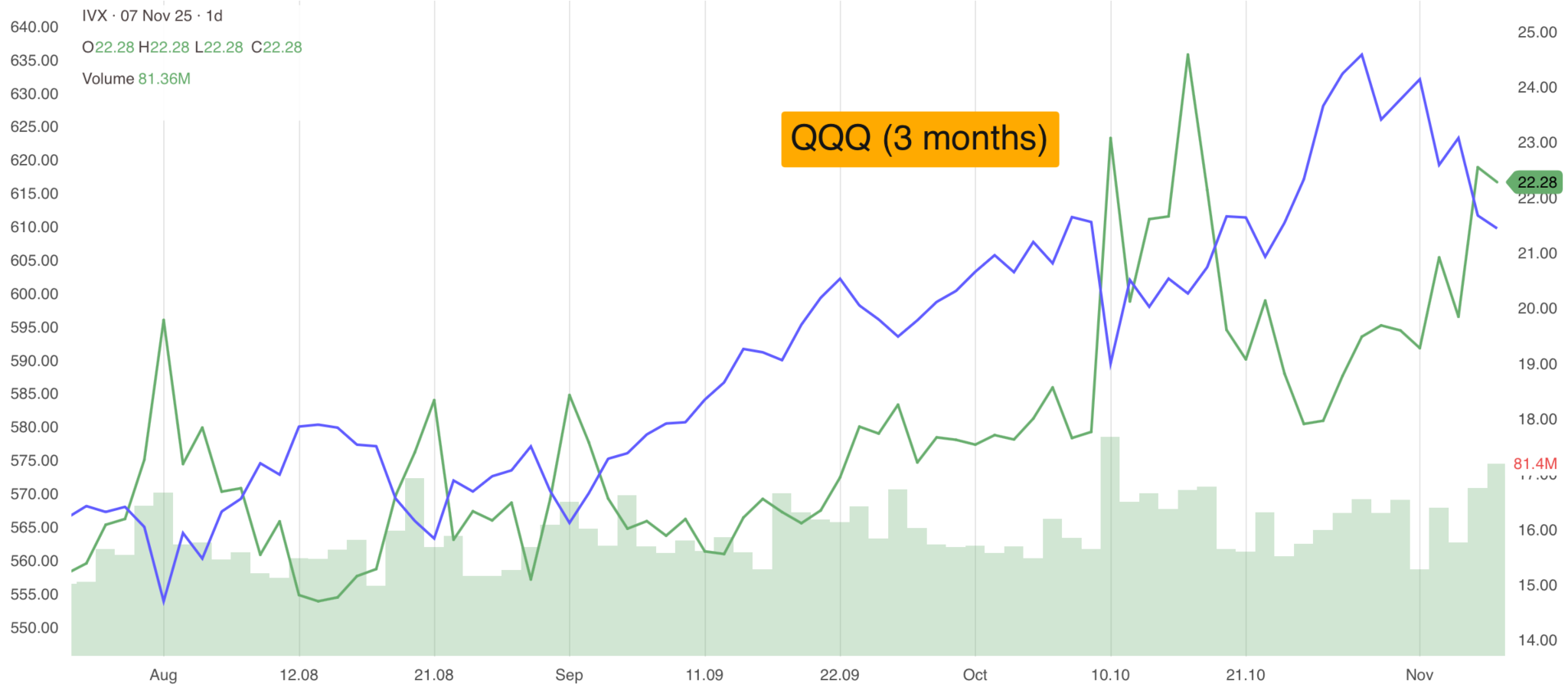

In summary, major indices slipped for the week ending November 7th. The heavy tech/growth segment (especially companies tied to AI or "momentum" themes) under-performed. Sentiment took a hit: concerns around stretched valuations (especially in AI/tech), the ongoing U.S. government shutdown, and weaker private-sector job cut data weighed.

Volatility ticked up: implied volatility rose as market participants showed more caution.

Strategy Corner

Based on this week's market movements, here are some trading ideas and option strategies for the readers' consideration. The positions can be scaled bigger if suitable for larger accounts.

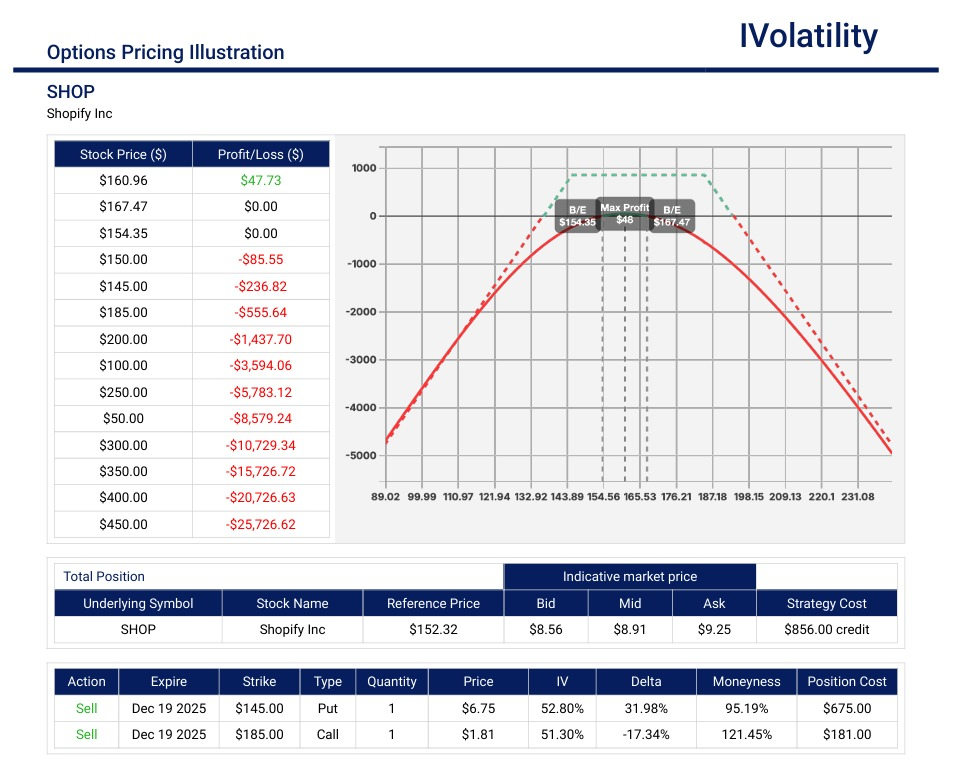

- SHOP (closed around 152 on Friday, Nov 7th)

If a trader would like to lean bullish for the next 40 days, then a strangle with slightly positive deltas could be a productive strategy.

Sell the Dec19 145/185 strangle with net position delta of about 17 and collect about $900 in premium.

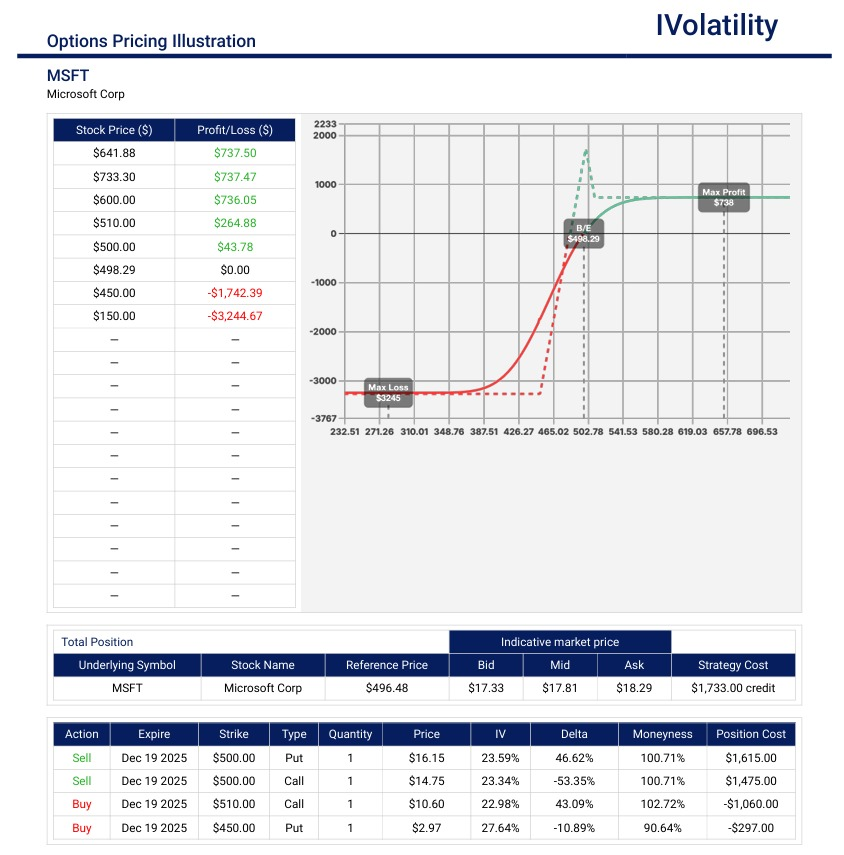

PnL Calculator from the IVolLive Web - MSFT (closed around 496 on Friday, Nov 7th)

If a trader would like to be bullish at these levels, a big lizard strategy could be something to consider.

For the Dec19 expiration, sell the ATM 500 straddle, buy the 510 call to remove any risk to the upside and buy the 450 put to limit buying power requirement.

BP required is about $3200

Credit collected is about $1800

No risk to the upside (since the 500/510 call spread is covered by the credit collected) and downside breakeven is around 482.

PnL Calculator from the IVolLive Web

Movement of the Major Indices:

These numbers are reporting the tradable activity from the opening on Monday, Nov 3rd to the closing on Friday, Nov 7th (any gaps over the weekend are not included).

| INDEX | UP | DOWN |

| SPY | -2.23% | |

| QQQ | -4.04% | |

| IWM | -1.94% | |

| DIA | -1.32% | |

| GLD | 0.26% | |

| BTC/USD | -6.12% | |

| TLT | -0.06% | |

| Crude Oil | -2.52% | |

| VIX | 5.98% |

Movement of the Major Sectors:

| INDEX | UP | DOWN |

| XLK | -5.07% | |

| XLF | 0.86% | |

| XLV | 1.44% | |

| XLY | -2.69% | |

| XLI | -1.11% | |

| XLP | 0.78% | |

| XLE | 1.58% | |

| XLU | 0.74% | |

| XLB | -0.54% | |

| XLRE | 1.95% |

Notable S&P gainers for the week of Nov 3rd - 7th:

Expedia Group (EXPE) soared over 17% on Friday, November 7th, after reporting quarterly earnings that topped analyst expectations and raising its full-year revenue guidance.

Akamai Technologies (AKAM) climbed close to 15% after reporting better-than-expected quarterly earnings and boosting its outlook, driven by strong demand for its security and cloud infrastructure services.

Kenvue (KVUE) jumped over 12% following the announcement of a proposed acquisition deal by Kimberly-Clark.

IDEXX Laboratories (IDXX) rose over 15% after reporting better-than-expected quarterly sales and profit and raising its 2025 guidance.

Notable S&P losers for the week of Nov 3rd - 7th:

Several companies experienced sharp drops, often related to earnings reports, guidance, or other specific news:

- e.l.f. Beauty (ELF) tumbled approximately 35-40% for the week. The drop was attributed to missing Q2 revenue expectations, cautious forecasts for the next fiscal year (FY26), and a sharp P/E multiple contraction.

- Intellia Therapeutics (NTLA) saw a weekly decline of over 31% mainly due to a Clinical Hold by the FDA triggered by safety concerns and a patient death./li>

- Celsius Holdings (CELH) saw a price decline of approximately nearly 25% for the week. While the company posted strong headline numbers, the details revealed several concerning factors that worried investors. There was a significant one-time net loss related to termination of distribution agreements.

- DoorDash (DASH) sank about 17% after warning of significantly higher spending on product development for the next year.

- Duolingo (DUOL) nosedived over 25% following its post-earnings move despite excellent current-quarter results. The plunge was probably due to disappointing forward-looking guidance.

- Pinterest (PINS) dropped almost 22% after its earnings release. The significant drop was primarily due to the company's disappointing guidance for the crucial holiday quarter (Q4 2025), which overshadowed its decent third-quarter earnings results.

- Super Micro Computer (SMCI) sank 11%. The sharp drop was primarily triggered by the release of its fiscal first-quarter 2026 earnings report which revealed a significant miss on key financial metrics and a concerning trend in its profit margins.

- Arista Networks (ANET) declined about 8.5% primarily due to investor disappointment over the company's forward guidance, despite its strong third-quarter 2025 financial results.

- Block (XYZ) slumped about 8% after missing third-quarter earnings estimates.

- Take-Two Interactive Software (TTWO) plunged 8% after announcing another delay for the release of Grand Theft Auto VI.

Review selected market indices below:

Daily Notable Price Action

Monday's Markets:

A big AI deal for Amazon pulled tech stocks higher today, which helped carry the S&P 500 and Nasdaq into the green. But below the surface, most of the market wasn't in the mood for a rally – seven of the S&P 500's 11 sectors ended the day lower.

Over the weekend, OPEC+ decided to press pause on raising oil output for three months beginning in January 2026 in response to rising fears of a supply glut.

Digital assets dropped across the board after a $100 million hack hit a protocol on Ethereum's native network.

Monday's Movers to the Upside:

- Micron Technology jumped nearly 5% after rival SK Hynix illustrated strong demand for memory and storage hardware.

- Data center construction company Cipher Mining soared over 22% as the company signed a $5.5 billion lease agreement with Amazon Web Services.

- Veterinary product maker Idexx Laboratories skyrocketed nearly 15% after beating revenue estimates, despite a decline in clinic visits.

- Amkor Technology rose over 17% on solid Q3 results, fueled by growing demand for advanced chip packaging.

- Ares Management popped over 4.5% thanks to a 167% YoY jump in earnings, driven by strong performance in its secondary's business.

Monday's Movers to the Downside:

- UniQure plummeted nearly 50% following an FDA statement that its Phase I/II data for gene therapy may be insufficient for a Biologics License Application.

- Beyond Meat fell over 16%, delaying its third-quarter results until Nov. 11 as it works to finalize a material noncash impairment charge.

- Adeia dropped over 16% after slashing its full-year outlook and filing patent infringement lawsuits against AMD over 10 semiconductor patents.

- Kontoor Brands lost over 9% due to a revenue miss and weak Q4 guidance overshadowing an earnings beat.

- Shutterstock fell nearly 10% as the UK's antitrust regulator launched an in-depth probe into its proposed $3.7 billion merger with Getty Images.

Tuesday's Markets:

Palantir became the poster child for overhyped AI stocks today and tech stocks sold off in a hurry, yanking the Nasdaq lower and pulling the other major indices down with it.

Gold dropped below $4,000 per ounce at the same time that the US dollar hit a four-month high.

Bitcoin briefly dipped below $100,000 for the first time since June and remained at a four-month low amid investor concerns over inflated AI valuations, as well as broader tech sector volatility.

Tuesday's Movers to the Upside:

- The bidding war for Metsera isn't cooling down: Novo Nordisk raised its offer to $10 billion, well above Pfizer's $8.1 billion. Metsera soared oer 20%, though Novo fell over 1.5%.

- iHeartMedia jumped over 37% to a two-year high following reports of a potential video podcast partnership with Netflix.

- Wingstop gained nearly 11% on earnings that beat expectations, despite a revenue miss and a decline in same-store sales.

- Nintendo climbed over 2.5% after raising sales forecasts for the Switch 2, with analysts saying it could mark the strongest Year 1 performance for any console in gaming history.

- Hertz reported its first profit in two years, driven by lower depreciation costs on its rental fleet and results that far exceeded expectations. Shares exploded over 36%.

- Electronics manufacturer Sanmina popped over 16.5% after beating revenue and EPS estimates, with shares further boosted by its acquisition of ZT Systems, strengthening its position in the cloud and AI server markets.

Tuesday's Movers to the Downside:

- Norwegian Cruise Line Holdings reported record high revenue, but investors were not impressed as the company missed expectations for the third straight quarter and lowering of its full-year guidance. Shares sank over 15%.

- Sarepta Therapeutics plummeted over 33% following disappointing trial results for its Duchenne muscular dystrophy treatments, which may delay the regulatory approval process.

- Harley-Davidson fell nearly 6.5% despite beating on both EPS and revenue, weighed down by a drop in motorcycle retail sales and operating income.

- Lattice Semiconductor tumbled over 13% as investors looked past its top- and bottom-line beat, focusing instead on a drop in GAAP profit and weak Q4 guidance.

- Papa John's fell nearly 10% after reports that Apollo Global withdrew its offer to take the pizza chain private.

Wednesday's Markets:

A better-than-expected private payroll report from ADP gave investors hopes about the labor market, helping push indices higher across the board.

Treasury yields popped as Supreme Court justices indicated skepticism about the legality of President Trump's tariff policies, raising the possibility that the White House will lose its case – and all the tariff revenue it has collected.

Gold recovered a bit of its past "energy", getting back to within striking distance of $4,000. But oil continued to flounder as traders worried about oversupply.

Wednesday's Movers to the Upside:

- EV maker Rivian popped over 23% thanks to a 78% increase in revenue that helped propel sales and profits past Wall Street's forecasts.

- Advanced Micro Devices gained over 2.5% after beating analyst expectations, though the chipmaker has some investors worried about its margins.

- Teradata rallied over 32% thanks to a blowout quarter for the cloud networking company.

- Lumentum maker of photonic products like optical amplifiers and massive data center buildouts. The company posted a beat-and-raise earnings report that pushed shares 23% higher.

- Auto service chain Monro popped over 15% on the news that Carl Icahn has taken a 15% stake in the company.

Wednesday's Movers to the Downside:

- Super Micro Computer dropped over 11.5% after the AI server maker missed Wall Street expectations on both the top and bottom lines.

- Toyota fell nearly 2.5% after the car maker reported a $3 billion hit from tariffs, though it did still raise its fiscal guidance.

- Cava dropped over 2.5% after the fast casual chain revised its full-year same-store sales outlook lower.

- Cloud services provider Arista Networks lost over 8.5% due mostly to sky-high investor expectations.

- Kratos Defense & Security Solutions sank over 14% even though the drone maker absolutely crushed revenue forecasts.

- Speaking of defense, Taser maker Axon Enterprise plunged nearly 9.5% although it posted record revenue.

- Trex, plummeted over 31% after cutting both its fiscal 2025 and 2026 revenue guidance due to low demand.

Thursday's Markets:

AI stocks were back under the microscope today as investors fretted about valuations. Rising anxiety that tech stocks have gotten out over their skis was enough to pull all three major indexes lower, punishing the Nasdaq in particular.

Treasury yields dropped following a surprise pop in October layoffs.

Thursday's Movers to the Upside:

- Moderna is selling fewer Covid vaccines, but shares still rose over 3% after the company revealed that cost-cutting measures helped make up the difference.

- Datadog jumped over 23% after the cloud cybersecurity company posted a beat-and-raise earnings report.

- Brighthouse Financial soared over 26% on confirmation that the insurer will be bought by Aquarian Capital for $4.1 billion.

- Snap soared nearly 10% after the social media company announced a new $400 million deal with AI startup Perplexity.

Thursday's Movers to the Downside:

- CarMax plunged nearly 25% on the news that the car seller has terminated its CEO, and a dreary forecast that car sales will sink next quarter.

- Peloton slid nearly 6% thanks to a recall of 833,000 units due to an issue with the seat post that injured two people.

- Qualcomm beat Wall Street forecasts last quarter, but still sank 3.63% thanks to sky-high investor expectations.

- Duolingo is focusing on user growth instead of making money, and shareholders plummeted the stock over 25%.

- e.l.f. Beauty beat on profit, missed on revenue, and lowered its full-year fiscal guidance, pushing shares down over 34%.

- Airline stocks tumbled on the news that the FAA is canceling thousands of flights amidst the ongoing government shutdown. United Airlines lost 1%, AmericanAirlines fell 2%, and Delta Airlines dropped 1.21%.

Friday's Markets:

Investors remain worried that the AI bubble is getting close to popping and all three indices sank at the open, but hopes of a deal in Congress helped spark a late-day recovery – though it wasn't enough to prevent the Nasdaq from having its worst week since April.

Friday's Movers to the Upside:

- Expedia jumped over 17% after the travel booking company raised its full-year revenue guidance, touting strong demand.

- Peloton Interactive recovered over 14% following yesterday's selloff thanks to a surprisingly strong earnings report and high hopes of big holiday spending.

- Buy now, pay later company Affirm reported EPS of $0.23 last quarter, far better than the $0.31 loss it reported in the same quarter last year. Shares rallied nearly 12%.

- Globus Medical soared over 36% due to a strong beat-and-raise earnings report for the medical device maker, followed by analyst upgrades from Truist and Bank of America.

- MP Materials gained 12.8% following a strong quarter for the largest rare-earth miner in the US, including predictions that it will earn a profit next quarter.

Friday's Movers to the Downside:

- Tesla fell almost 4% after shareholders voted to approve Elon Musk's $1 trillion pay package.

- Air taxi maker Archer Aviation plunged nearly 8% thanks to the announcement of a $650 million share sale.

- Block tumbled nearly 8% on weak third-quarter results that missed analyst estimates across the board.

- Sweetgreen reported lower same-store sales, cut its fiscal guidance, and sold its robo-kitchen business. Shares sank nearly 7.5%.

Notable Earnings due week of Nov 10th - 14th:

The actual day may vary, so do consult with your broker to confirm the actual date.

The earnings season will be slower but here are a few big names reporting in the coming week.

Monday: OXY / TSN / GETY / PLUG / RKT / WULF / RGTI

Tuesday: OKLO / CRWV (Tuesday is Veteran's Day in the US. The stock market is open, but the bond market is closed)

Wednesday: CSCO / CRCL / ONON / TME / HBM / FLUT /

Thursday: DIS / AMAT / JD / NU / BILI / BN / FF

Friday: QUBT /

Notable Economic Data due week of Nov 10th - 14th:

Please note that the ongoing federal government shutdown which began on October 1st, 2025 has resulted in cancellation of some (or all) economic reports.

Here are the most notable economic data points due this coming week. The primary focus will be on inflation and consumer spending in the US.

Thursday, Nov. 13:

- Consumer Price Index (CPI) is a highly significant report on inflation. Markets will closely watch the year-over-year change, especially for the "Core CPI" (excluding food and energy), as it heavily influences Federal Reserve interest rate decisions.

- Weekly Initial Jobless Claims report provides a timely gauge of the health of the labor market and new layoffs.

Friday, Nov. 14:

- Advance Retail Sales is a key report on consumer spending, which accounts for a large portion of US economic activity. It shows the change in the total value of sales at the retail level.

- Producer Price Index (PPI) is a measure of wholesale inflation – the prices that producers receive for their goods and services and can signal future consumer price trends.

Closing Thoughts

The good times could keep going: November has been the best month for stocks over the last seven decades. As a matter of fact, the S&P 500 has risen 59% of the time during November since all the way back in 1927, according to Bank of America.

October kicks things off, and December gets all the attention, but maybe it's time to finally give the middle child of the holiday season the respect it deserves.

Questions / Comments

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use support@ivolatility.com.

Previous issues are located under the News tab on our website.