Are Market Signals Mixed

November 17, 2025

Market Roundup for the Week

This past week was probably the most topsy-turvy, up-and-down market in a very, very long time. Major cross-currents of news could be the ruling factors.

The government shutdown ended and the markets seemed to like it. But then, later in the week, ome hawkish news from the FED knocked the futures down big overnight. Then, of course, the buy-the-dip mentality returned and the markets saw a reversal.

When was the last time the S&P 500 made new highs while the vast majority of stocks went absolutely nowhere? The headline numbers are telling us one story while the market structure is yelling something entirely different. What's happening beneath the surface? Making decisions based only on what the S&P and tech are doing, we may be seeing only a small part of the picture.

The true story of the market may be told by equal-weighted counterparts, and the relative under performance is pretty large. The Equal-Weighted S&P 500 has spent six months trapped in consolidation near its breakout point. Despite the powerful AI tailwind driving headline indices higher, the Equal-Weighted Nasdaq has managed just 4% gains over the same period. These numbers may be saying that market gains are flowing to a handful of names while the broad market trails far behind, posting 0% and 8% annualized returns respectively.

For a sustainable broad market rally, we may need capital flowing into the market as a whole, not just the AI theme. Until equal-weighted indices find legs, and small caps start breaking out, this market may be considered a concentration story masquerading as a bull market.

Strategy Corner

Based on last week's market movements, here are some trading ideas and option strategies for the readers' consideration. The strategies can be scaled bigger (or smaller), according to individual account size.

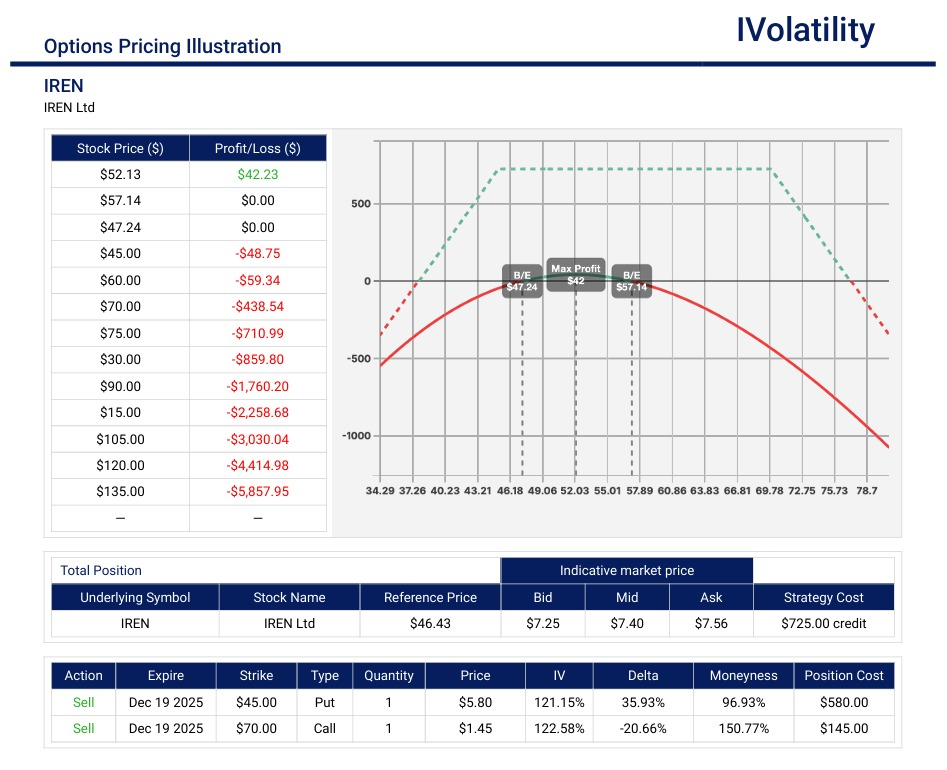

- IREN (closed at 46.36 on Friday, Nov 14th)

If a trader would like to lean a bit bullish at these levels, then selling the Dec19 45/70 strangle could be profitable

Net position delta about +18

Net premium collected about $740

Buying power about $2600

Probability of profit about 60%

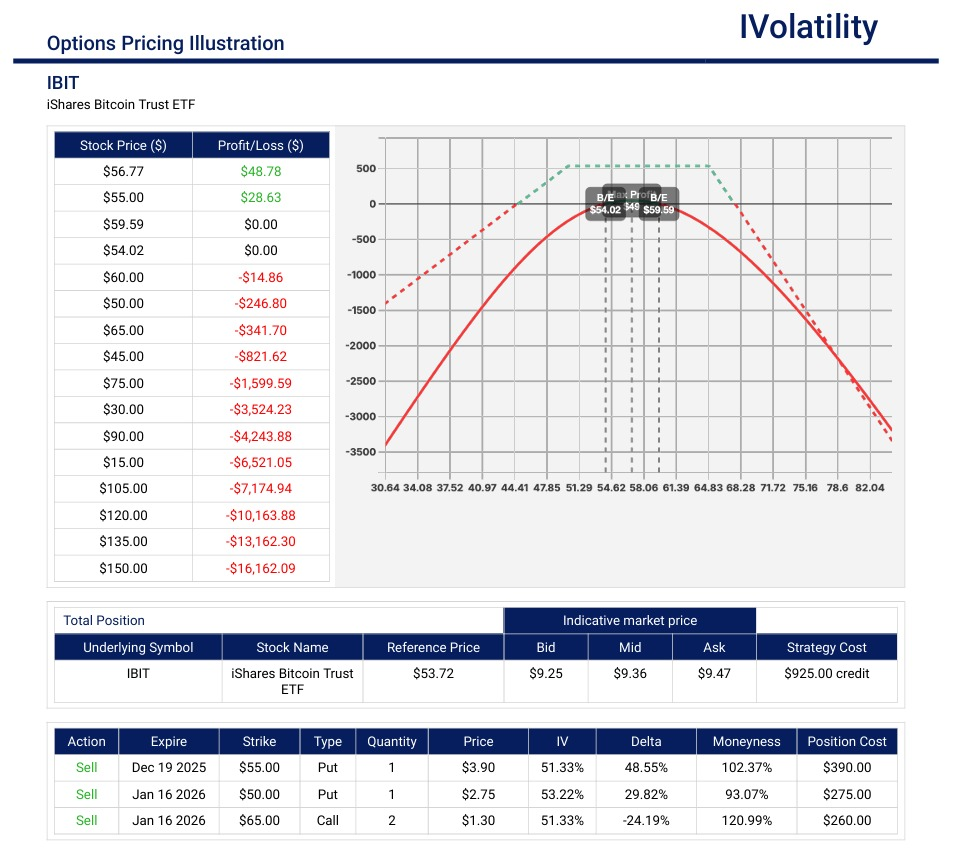

PnL Calculator from the IVolLive Web - IBIT (closed at 53.47 on Friday, Nov 14th)

If a trader would like to lean a bit bullish at these levels, then consider selling staggered strangles in this UL.

Sell one Dec19 55put / Sell one Jan16 50put / Sell two Jan16 65calls

Net position delta about +40

Net premium collected about $930

Buying power about $3900

PnL Calculator from the IVolLive Web

Movement of the Major Indices:

These numbers are reporting the tradable activity from the opening on Monday, Nov 10th to the closing on Friday, Nov 14th (any gaps over the weekend are not included). Again, more sector rotation was observed.

| INDEX | UP | DOWN |

| SPY | -.76% | |

| QQQ | -1.6% | |

| IWM | -2.59% | |

| DIA | 0,41% | |

| GLD | 1.90% | |

| BTC/USD | -9.67% | |

| TLT | -0.69% | |

| Crude Oil | -2.33% | |

| VIX | 6.67% |

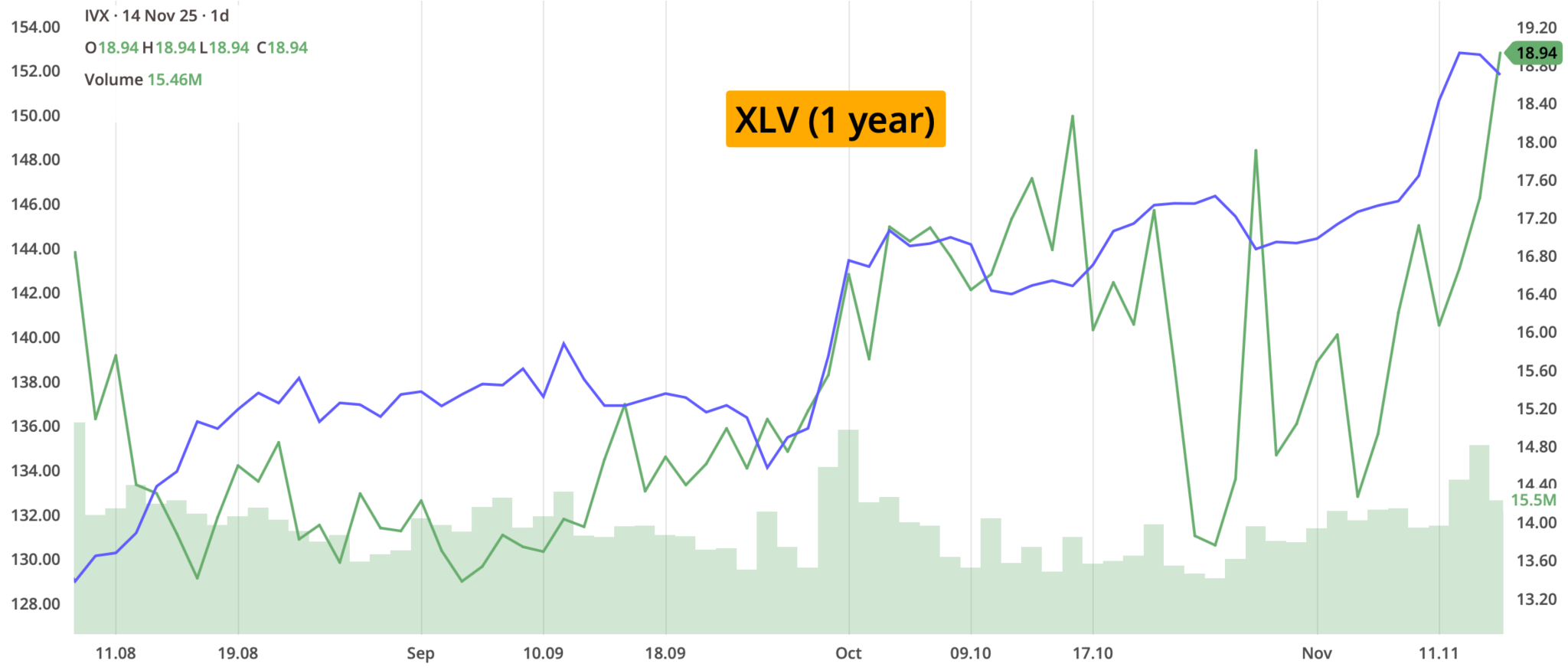

Movement of the Major Sectors:

| INDEX | UP | DOWN |

| XLK | -1.76% | |

| XLF | -.91% | |

| XLV | 4.14% | |

| XLY | -3.06% | |

| XLI | -1.29% | |

| XLP | 1.02% | |

| XLE | 2.51% | |

| XLU | -1.32% | |

| XLB | 0.44% | |

| XLRE | -0.58% |

Notable S&P gainers for the week of Nov 10th - 14th:

The week was a mixed but ultimately positive one for the major market indices, characterized by a sharp Monday rebound followed by mixed trading for the rest of the week due to sector rotation. The most significant gains were often triggered by M&A, analyst upgrades, or sharp reversals from a prior week's decline.

Viatris (VTRS) jumped following positive sentiment and strategic growth initiatives presented at a major healthcare conference.

Palantir Technologies (PLTR) rebounded sharply after a significant sell-off the prior week. This was probably due to optimism regarding an end to the U.S. government (a major company client) shutdown.

Micron Technology (MU) rebounded strongly at the start of the week on bullish analyst commentary regarding sustained demand for its AI-related high-bandwidth memory (HBM) chips.

FedEx (FDX) climbed significantly after favorable guidance was provided for its fiscal second-quarter earnings per share, boosting confidence in the logistics and holiday season outlook.

Eli Lilly (LLY) gained after a positive rating upgrade from a major analyst, contributing to the overall strength in the pharmaceutical/weight-loss drug space.

Notable S&P losers for the week of Nov 10th - 14th:

The week was marked by a significant rotation of capital, leading to substantial losses in sectors that had previously been major gainers, particularly high-flying technology and AI stocks.

Anavex Life Sciences (AVXL) tumbled sharply (over 40%) after advisors to the European Medicines Agency issued a "negative trend vote" on its key Alzheimer's drug candidate.

NVIDIA Corp (NVDA) suffered a significant weekly loss (despite a Monday rebound) after SoftBank announced it had sold its entire stake in the chip giant on Tuesday, fueling concerns about AI valuations and profit-taking at the top of the market.

Advanced Micro Devices (AMD) fell in tandem with NVIDIA and the broader semiconductor sector on concerns about AI valuation and future growth prospects.

AppLoving (APP) fell sharply during the week, weighed down by an SEC investigation into its data-collection practices, despite a relatively strong earnings report.

Metsera Inc (MTSR) sank about 15% after its primary suitor, Novo Nordisk (NVO), pulled out of a bidding war, leaving Pfizer (PFE) to acquire the obesity drugmaker at a lower price than initially hoped.

Monday.com (MNDY) dropped over 10% for the week after the software company guided its fourth-quarter sales below Wall Street consensus estimates, despite beating on Q3 revenue and EPS.

Review selected market indices below:

Daily Notable Market Action

Monday's Markets:

On optimism of the government re-opening, there was a large true gap opening adding to the previous Friday's strength.

High hopes that the government shutdown may be coming to an end put investors in a cheerful mood as they bought the dip on tech stocks, helping the Nasdaq enjoy its best day since May.

Gold bounced to its highest price in two weeks as traders banked on a rate cut from the Fed next month. Fellow hot commodities silver and platinum popped as well.

Visa and Mastercard settled a 20-year old lawsuit and will lower the fees that stores pay for swiping credit cards.

President Trump floated the idea of $2,000 checks for every American ("not including high income people!") using revenue from tariffs.

Gen Z isn't buying the recent market dip, though older generations have been happy to dive in.

Monday's Movers to the Upside:

- Nvidia (NVDA) popped nearly 6% on hopes of an end to the US government shutdown and reports of a good meeting between CEO Jenson Huang and TSMC executives.

- Cogent Biosciences (COGT) exploded over 100% thanks to positive trial results for the pharma company's investigative cancer treatment.

- Coinbase (COIN) gained nearly 3% on the news that it will allow retail investors to purchase digital tokens before they are listed on its exchange.

- Penn Entertainment (PENN) rose over 7% after CEO Jay Snowden revealed that he bought $500,000 worth of shares of the casino operator.

- Diageo (DEO) gained nearly 5% on the news that it's bringing aboard former Tesco chief Dave Lewis to turn things around.

- Rumble (RUM) rallied over 11% thanks to its acquisition of German AI infrastructure company Northern Data.

Monday's Movers to the Downside:

- Metsera (MTSR) plunged nearly 15% after the weight-loss drug startup accepted Pfizer's acquisition offer, which management deemed to be a safer bet than Novo Nordisk's higher offer.

- Monday.com (MNDY) may have beaten analyst estimates last quarter, but the company fell over 12% after issuing lower-than-expected fiscal guidance for its fourth quarter.

- Six Flags Entertainment (FUN) stumbled over 9% after Morgan Stanley analysts downgraded the company from overweight to equal weight, citing diminished spending from lower-income consumers.

Tuesday's Markets:

The market saw a strong rotation into value and defensive sectors, while the Nasdaq lagged due to pressure on high-flying tech stocks like NVIDIA.The main theme of the day was a shift away from the expensive, momentum-driven technology stocks (which saw the largest losses) and into established companies with strong financial outlooks.

Tuesday's Movers to the Upside:

- Viatris (VTRS) surged over 10.0% making it the top S&P performer for the day. The company presented its strategic growth initiatives at the UBS Global Healthcare Conference and investors were pleased.

- Paramount Skydance (PSKY) surged nearly 10% following the release of its first quarterly earnings report since the completion of the merger between Paramount Global and Skydance Media, indicating investor optimism.

- FedEx (FDX) rose 5.5% after its CFO provided a favorable forecast for fiscal second-quarter earnings per share, suggesting strong performance ahead of the critical holiday season.

- Merck (MRK), benefitting from rotation into healthcare, led the DOW advancers by rising 5.0%.

- Amgen (AMGN) rose 5%, mirroring Merck's strength as investors moved into defensive, large-cap healthcare names.

- Nike (NKE) was up 4.0%, benefitting from a rotation into the consumer discretionary sector.

- Apple (AAPL) was up about 2.0%, (along with Microsoft, Alphabet, and Amazon) contributing to the overall market strength despite the Nasdaq's mild decline.

Tuesday's Movers to the Downside:

- AppLovin (APP) dropped nearly 9%, despite topping sales and profit estimates in a recent report, the stock was reportedly weighed down by an SEC investigation into its data-collection practices.

- Vistra (VST) slumped nearly 5% following lower-than-expected revenue in its recent earnings report.

- Micron Technology (MU) shed nearly 5% perhaps as part of a broader tech/semiconductor pullback and/or selling off after a strong recent run.

- Coinbase Global (COIN) shed nearly 4.5% probably due to a broader pullback and riskoff sentiment in cryptocurrency prices.

- Lam Research (LRCX) declined over 4% as part of the broader selling pressure in the semiconductor equipment sector.

- Hewlett Packard Enterprise (HPE) dropped over 4%, probably moving lower with the rest of the Nasdaq.

- NVIDIA Corp (NVDA) dropped 3.0%, led by the decline in the chip sector after SoftBank announced the sale of its entire stake in the AI chip giant. This news contributed to caution about high AI valuations.

Wednesday's Markets:

A light at the end of the shutdown tunnel helped lift the Dow to a new record closing high above 48,000 for the first time ever, bumped gold up, and pushed Treasury yields lower.

Oil took a turn for the worse after OPEC announced that it now anticipates that crude supply will rise to meet demand in 2026.

AMD energized the AI trade with growth projections at Investor Day conference.

Waymo launched driverless robotaxis on highways for the first time ever in Los Angeles, San Francisco, and Phoenix.

The White House said that key October jobs and inflation data won't just be late, but might never be released at all due to the government shutdown.

Wednesday's Movers to the Upside:

- BigBear.ai (BBAI) jumped over 18% after beating Q3 estimates and announcing a $250 million deal to acquire Ask Sage, a generative-AI platform serving defense and national agencies.

- Bill Holdings (BILL) popped nearly 11.5% following reports it's exploring a potential sale.

- On Holding AG (ONON) surged nearly 18% after topping both revenue and earnings expectations and raising guidance for the third straight quarter.

- Oklo (OKLO) climbed over 6.5% despite posting steeper-than-expected losses as investors cheered news that the Energy Department approved its nuclear-fuel facility design, keeping it on track to deploy its first reactor.

Wednesday's Movers to the Downside:

- Circle (CRCL) shares plunged over 12% despite strong Q3 results after the company raised its full-year expense outlook, signaling higher costs ahead.

- Although Alkermes (ALKS) reported success in a narcolepsy drug trial, but investors were displeased when the company clarified that the positive results relied on statistical adjustments that could inflate false positives. Shares tumbled over 7%.

- Solar-tracking firm Nextracker (NXT) announced a rebrand to "Nextpower" to reflect its move into a full power-tech platform—but investors weren't impressed, and shares sank nearly 9%.

- USA Rare Earth (USAR) shares initially rose after announcing UK approval for its acquisition of Less Common Metals, a key supplier of rare-earth alloys—but the early gains reversed, and the stock fell nearly 5%.

- Eledon Pharmaceuticals (ELDN) lost over 11% following its $50 million public offering, which will increase share count and dilute existing investors' ownership stakes.

Thursday's Markets:

The government shutdown officially ended but one of the FOMC members declared that it is "appropriate to hold rates" where they are.

The S&P 500 closed yesterday up some 2% since the beginning of the shutdown. While shutdowns don't necessarily wreck the economy, the downstream effects could sneak up on investors over the next few months. While the US government likely to reopen imminently, markets are hoping for the resumption of official data to solidify their assessment of the Fed's future rate decisions. Historically, the S&P 500 tends to make a full recovery after the government reopens. The index has risen an average of 11.5% one full year after a government shutdown.

Just a month ago, markets pegged the odds of the Fed cutting interest rates at its December meeting at 95%. Today, it's closer to 50-50.

Oil recovered from yesterday's steep losses, and although gold rose to its highest level in over three weeks, the safe haven investment still ended the day lower.

Bitcoin fell below $100,000 once again, dropping to its lowest level since May.

Profits may be surging for the Magnificent Seven, but AI startups like OpenAI are posting staggering losses.

MSTR's Michael Saylor said there's "no doubt in my mind" that bitcoin will overtake gold within a decade while the "Big Short" investor Michael Burry has deregistered his hedge fund, Scion Asset Management.

Thursday's Movers to the Upside:

- TKO Group Holdings (TKO) rose over .5% as the parent company of UFC signed a multiyear deal with Polymarket to integrate real-time prediction markets into live events.

- Sweetgreen (SG) climbed over 10% after co-founder Nicolas Jammet purchased about $1 million worth of shares, a move seen as a vote of confidence in the salad chain.

- Planet Fitness (PLNT) popped over 3% after the company outlined new two-year fiscal targets, calling for 6% to 7% annual club growth and mid-teens adjusted EBITDA expansion.

- Firefly Aerospace (FLY) jumped nearly 17% after posting strong Q3 earnings and raising its full-year guidance, citing momentum from new government and NASA contracts.

Thursday's Movers to the Downside:

- Robinhood (HOOD) fell over 8.5% following a Wall Street Journal report that the brokerage will soon deliver cash to your doorstep.

- Flutter Entertainment (FLUT) slipped nearly 15% despite beating revenue and earnings expectations as the company cut its full-year guidance.

- Ibotta (IBTA) topped revenue estimates, but still dropped nearly 25% mostly due to a drop in sales.

- Webtoon Entertainment (WBTN) fell over 25% following a revenue miss and weak forecasts, raising concerns about slowing user engagement.

- Kodiak AI (KDK) declined over 18% after the autonomous-driving startup reported a significantly wider loss than expected, citing one-time merger-related charges.

Friday's Markets:

Additional hawkish commentary from the FED resulted in December rate cut expectations down-shifting to below 50%. Markets gapped down in a big way but, again the buy-the-dip mentality overcame the markets and the day ended with a big rally.

Indices looked set to extend their losses at the beginning of the day, but the Nasdaq managed to pull off an impressive turnaround.

The US and Switzerland have "essentially" reached a deal, according to trade representative Jamieson Greer. Meanwhile, President Trump is reportedly preparing tariff cuts to address concerns over the rising cost of goods.

Bitcoin fell to a six-month low today, and remains deep in bear market territory as ETF investors continue to abandon ship.

Paramount, Comcast, and Netflix are a few of the bidders making a play for Warner Bros. Discovery. Amazon and Microsoft are among those companies supporting legislation that would restrict Nvidia's exports to China.

The holiday shopping season is in peril as high income shoppers turn into bargain hunters.

Friday's Movers to the Upside:

- Cidara Therapeutics (CDTX), with its experimental flu-prevention therapy, surged over 100% after Merck agreed to buy the company for $9.2 billion.

- Scholar Rock (SRRK) skyrocketed nearly 25% following a “constructive” meeting with the FDA about its biologics license application for its treatment for spinal muscular atrophy.

- Figure Technology Solutions (FIGR) jumped over 16% after the lending platform reported better-than-expected Q3 revenue in its first quarter as a public company.

- Whirlpool (WHR) climbed nearly 7% after hedge-fund titan David Tepper's Appaloosa disclosed a major expansion of its stake in the appliance maker.

- Topgolf Callaway (MODG) advanced nearly 7% amid reports it's in talks to sell its Topgolf unit to a private-equity firm

Friday's Movers to the Downside:

- Strategy (MSTR) market value fell below the value of its bitcoin holdings after short seller Jim Chanos closed his hedged position. Shares fell over 4%.

- Under Armour (UA) slipped nearly 3% following Steph Curry's decision to end his decade-long partnership with the brand to launch his own independent label.

- Gauzy (GAUZ) shed over ⅓ of its value as the vision and light-control technology company delayed the release of its third-quarter 2025 results scheduled for November 14.

- Anavex (AVXL) shed over ⅓ of its value after a European Medicines Agency (EMA) expert panel rejected its Alzheimer's therapy.

- Baidu (BIDU) sank nearly 4% after investors were unimpressedby its new Ernie 5.0 AI model.

Notable Earnings due week of Nov 17th - 21st

The actual day may vary, so do consult with your broker to confirm the actual date.

As for earnings, there are plenty of companies reporting next week but perhaps only one that every investor in the world will be watching.

Monday: XPEV / XP /

Tuesday: HD / BIDU / PDD / MDT / TCOM

Wednesday: NVDA / PANW / NIO / TGT / LOW / TJX / WSM

Thursday: WMT / RST / M / INTU / GPS / ISRG /

Friday: BJ / BKE / /

Notable Economic Data due week of Nov 17th - 21st

The government shutdown ended (bullish) but a rate cut in December is now uncertain. Will there be a deluge of pent up economic data... or perhaps some, not all, data will be released?

The FOMC Minutes on Wednesday is the most likely release to generate significant market volatility. This is when comments from the various Fed speakers are fleshed out.

Monday:

- Empire State Manufacturing Index: Provides an early read on the health of the manufacturing sector in the New York region, often a leading indicator for broader national factory activity.

Tuesday:

- U.S. Import and Export Prices: Measures changes in the prices of imported and exported goods, offering insight into trade-related inflation and global price pressures.

- Industrial Production & Capacity Utilization: A key measure of the physical output of the nation's factories, mines, and utilities, indicating the health and spare capacity of the industrial sector.

Wednesday:

- Housing Starts & Building Permits: Critical data for the housing market, measuring the number of new homes on which construction has begun (Starts) and the number of future projects authorized (Permits).

- FOMC Meeting Minutes: The detailed record of the last Federal Open Market Committee meeting. Traders scrutinize this for clues on the Fed's stance on inflation, economic outlook, and future interest rate policy.

Thursday:

- Philadelphia Fed Manufacturing Survey: This index provides an early look at manufacturing activity in the mid-Atlantic region.

- Initial Jobless Claims: Tracks the number of people filing for unemployment benefits for the first time, serving as a real-time indicator of labor market health.

- Existing Home Sales: Measures the number of previously constructed homes sold, offering a deeper look into the residential real estate market's volume and pricing trends.

Friday:

- S&P Global Flash US Manufacturing PMI: A preliminary survey estimate of business conditions in the manufacturing sector for the current month.

- S&P Global Flash US Services PMI: A preliminary survey estimate of business conditions in the critical service sector, which makes up the largest part of the U.S. economy.

- U. of Michigan Consumer Sentiment: The final reading of a widely followed survey that measures consumer confidence and spending intentions, which drives a large portion of economic activity.

Closing Thoughts

The famed short seller who called Enron's collapse back in 2001 just closed his short bet against Strategy (MSTR), the world's largest corporate holder of bitcoin. Chanos wagered that the stock was wildly overvalued compared to the bitcoin it actually owned, and after a 50% plunge in Strategy's share price from its 2025 peak, that bet has paid off.

In 2020, Michael Saylor turned MSTR into the first "digital asset treasury" (DAT) after deciding the struggling software firm should just buy and hold bitcoin indefinitely. It appeared to be a brilliant move – with no spot bitcoin ETF at the time, investors desperate for crypto exposure piled in, happily paying a premium just to own a stock that held bitcoin. Last November, investors were paying $2.50 for every $1 of bitcoin the company kept in its coffers.

That trade could only work as long as crypto kept climbing—and for most of the year, it did. Fueled by friendlier regulations under a pro-crypto Trump administration and growing institutional demand, digital assets soared. MSTR rode the wave, rising more than 1,000% over the past five years, roughly double bitcoin's gain over the same period.

But momentum can reverse fast in the world of crypto. Bitcoin just had its worst week since March, tumbled below $100,000 for the first time since June, and wiped out nearly $300 billion in market value by Friday afternoon. Other major tokens followed suit, dragging the broader crypto market sharply lower.

The sell-off hit DATs especially hard: since their business models are effectively leveraged bets on crypto prices, they sink even faster when bitcoin falls. MSTR, once valued at about $128 billion in July, is now worth roughly $70 billion, erasing nearly half its market cap in a matter of months.

Still, opinions on what comes next for DATs is split. After a 20% slide from its peak in October, bitcoin is still up about 13% in 2025. Analysts warn the pain might not be over yet, with some saying there's a "high probability" bitcoin could fall below $60,000 if it stays under key support levels.

Many others see the October sell-off as a needed cooldown that cleared out excess leverage while leaving fundamentals in place. Cathie Wood, for one, is sticking to her call that bitcoin will hit $1 million, assisted by the rapid growth of stablecoins, which recently topped $300 billion in total market value. She also argued bitcoin could mirror gold's rise and eventually capture a meaningful share of its market cap.

What happens next will hinge on whether or not bitcoin finds its footing. For now, DAT investors might want to tread lightly.

Questions / Comments

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use support@ivolatility.com.

Previous issues are located under the News tab on our website.